Ritholtz Wealth Management Chairman Barry Ritholtz discusses the markets and his investment ideas on “In The Loop Bloomberg, March 3 2015

Read More

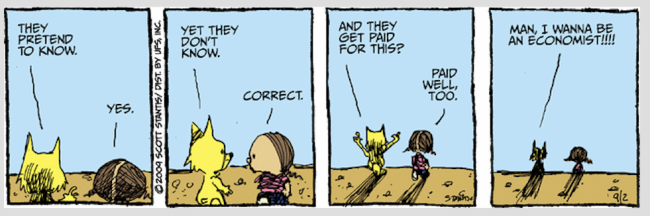

Source: Real-World Economics Review Blog

Source: Real-World Economics Review Blog

Read More

America’s crumbling infrastructure: It’s not a sexy problem, but it is a scary one. Follow us on Twitter for news about jokes and...

Read More

Jimmy feels that all of this anti-vaccination silliness is starting to snowball, so he invited some real doctors to address it. These are...

Read More

Today’s discussion is aimed at the individual investor, though certainly the professionals might take something from our philosophical...

Read More

Fed Gives Cover to Bumbling Congress By helping to prevent a depression after the financial crisis, the Federal Reserve gave the...

Read More

Fiscal Hawks Should Love Cheaper Retirement Plans Changes in rules governing retirement-plan managers and advisers will lower their fees,...

Read More

Wal-Mart’s Minimum Wage Breakdown Wal-Mart plans to raise the wages of hourly workers because it didn’t have much choice as...

Read More

To outsiders, Wall Street is a manic, dangerous and ridiculous republic unto itself – a sort of bizarro world where nothing adds up and...

Read More

Last week, we had the announcement of the end of Jon Stewart’s run on The Daily Show. I had been saving this column for the next...

Read More