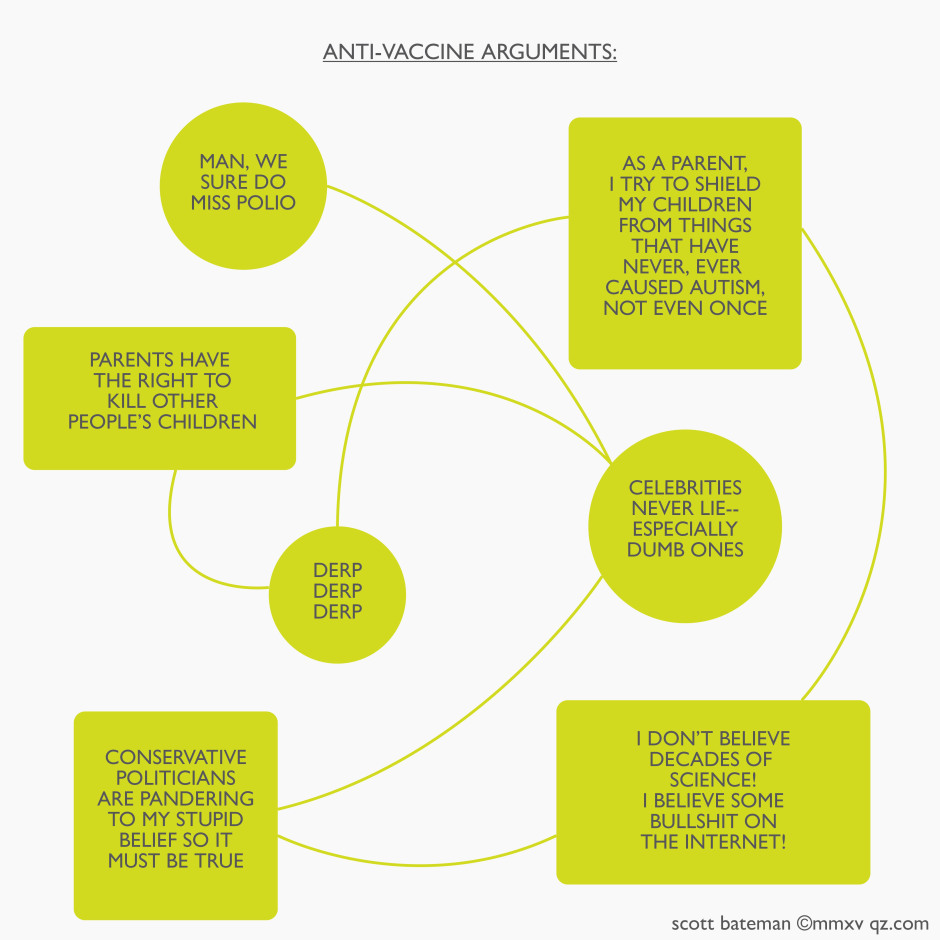

Source: Quartz

Source: Quartz

TDS: Guardians of the Veracity

The Daily ShowGet More: Daily Show Full Episodes,Indecision Political Humor,The Daily Show on Facebook

Pharmaceutical Companies’ Marketing to Doctors

Pharmaceutical companies spend billions of dollars marketing drugs to doctors. We have a few issues with that. Last Week Tonight with...

More Dumb Economic Conspiracy Nonsense

Friday’s jobs numbers were big, and the revisions below the surface were huge. Yet even before the release, the...

Adventures in Banking: Responsibility & Blame

Morgan Housel makes the delightful if infuriating observation that bank execs take credit — along with fat paychecks and even...

Don’t Play Probalities Like the Seahawks in Investing

Don’t Invest Like the Seahawks There are lessons for investors in the Seattle Seahawks’ Super Bowl loss. Bloomberg, February...

Love Letters to Richard Dawkins (NSFW)

A little counter-programming for those of you not watching the big game: In a candid moment, filmmaker Eric Preston, founder and producer...

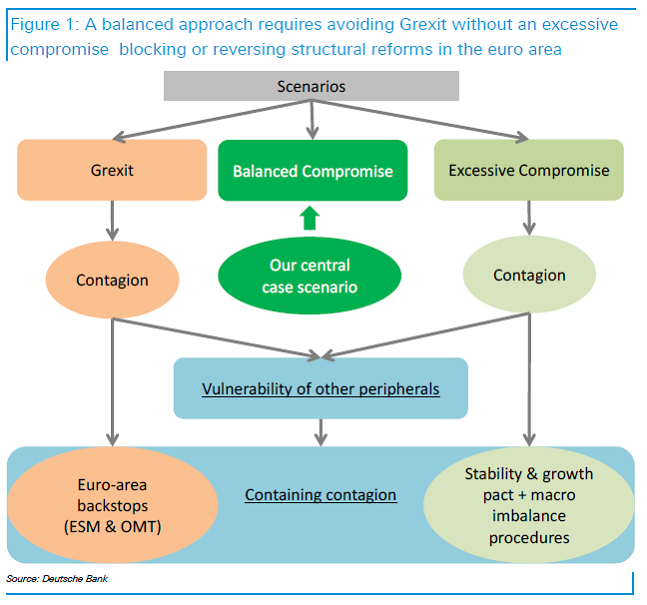

The “Greek Issue”

Fascinating flowchart from Deutsche Bank: It is wrong to think that contagion stems only from Grexit. An excessive compromise with...

Fascinating flowchart from Deutsche Bank: It is wrong to think that contagion stems only from Grexit. An excessive compromise with...