Transcript: Anat Admati

Transcript: Anat Admati The transcript from this week’s, MiB: Anat Admati on Regulations and Techlash, is...

White House NEC Director Brian Deese Says Mergers Have Cost Families The White House estimates that consolidation across industries means...

White House NEC Director Brian Deese Says Mergers Have Cost Families The White House estimates that consolidation across industries means...

White House NEC Director Brian Deese Says Mergers Have Cost Families The White House estimates that consolidation across...

White House NEC Director Brian Deese Says Mergers Have Cost Families The White House estimates that consolidation across...

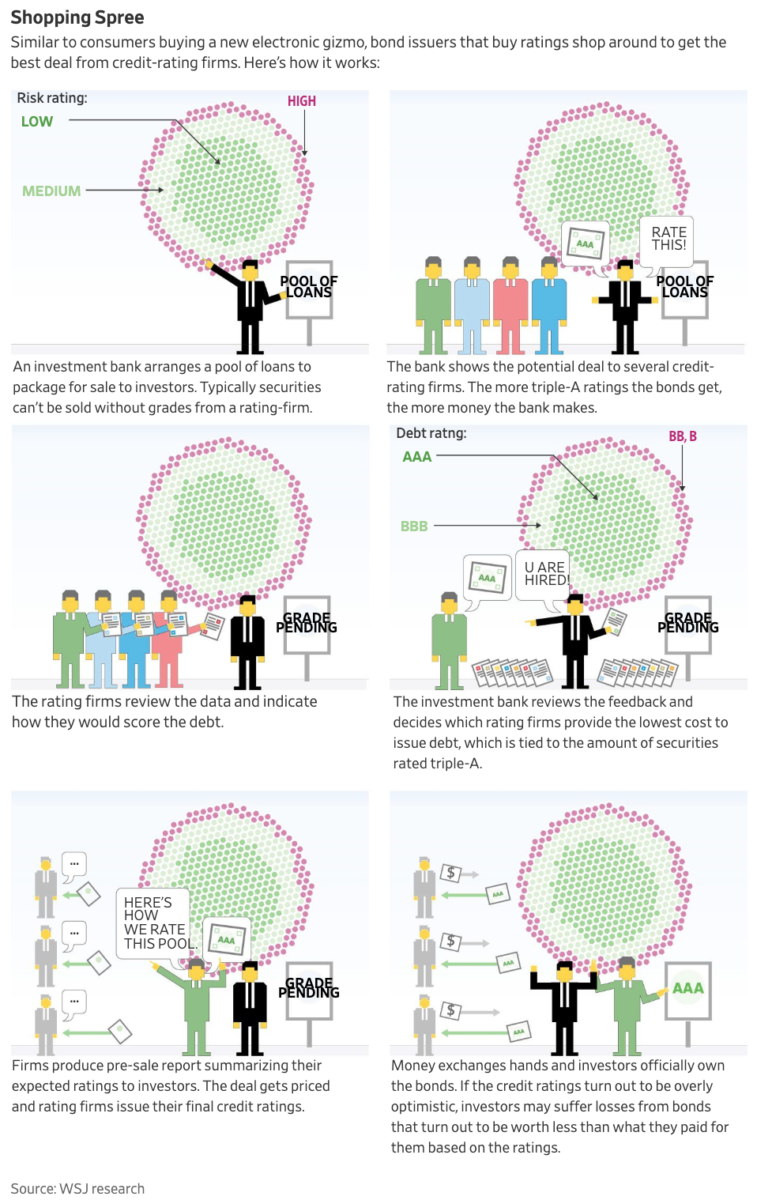

I was away last week when this monster piece came out in the WSJ. This issue has intrigued me since 2007, but for those of you not up to...

I was away last week when this monster piece came out in the WSJ. This issue has intrigued me since 2007, but for those of you not up to...

Get subscriber-only insights and news delivered by Barry every two weeks.