As big tech becomes an increasingly important part of our daily lives, it is crucial that we allow innovation to flourish. This means...

Read More

From Dave Wilson: Proposals to limit or bar U.S. stock repurchases may amount to kicking businesses when they’re down. Comparing the...

From Dave Wilson: Proposals to limit or bar U.S. stock repurchases may amount to kicking businesses when they’re down. Comparing the...

Read More

10 Things People Still Get Wrong About the Financial Crisis All are the result of bias, ignorance, laziness or bad faith. Bloomberg,...

Read More

Reporting Profits Daily Would End Corporate Short-Termism Think there’s too much hoopla about quarterly earnings? Imagine if the circus...

Read More

Reporting Profits Daily Would End Corporate Short-Termism Think there’s too much hoopla about quarterly earnings? Imagine if the circus...

Read More

Uber Is Blamed for the Mistakes of New York’s Leaders Failing to understand market forces will make matters worse. Bloomberg, August 6,...

Read More

Uber Is Blamed for the Mistakes of New York’s Leaders Failing to understand market forces will make matters worse. Bloomberg, August 6,...

Read More

Last month, , I ranted about the TLC and Yellow Cab Medallion owners: How the TLC & Medallion Owners Created Uber. That column...

Read More

Have the Biggest U.S. Banks Become Less Complex? Linda S. Goldberg and April Meehl Liberty Street Economics, May 07, 2018 ...

Have the Biggest U.S. Banks Become Less Complex? Linda S. Goldberg and April Meehl Liberty Street Economics, May 07, 2018 ...

Read More

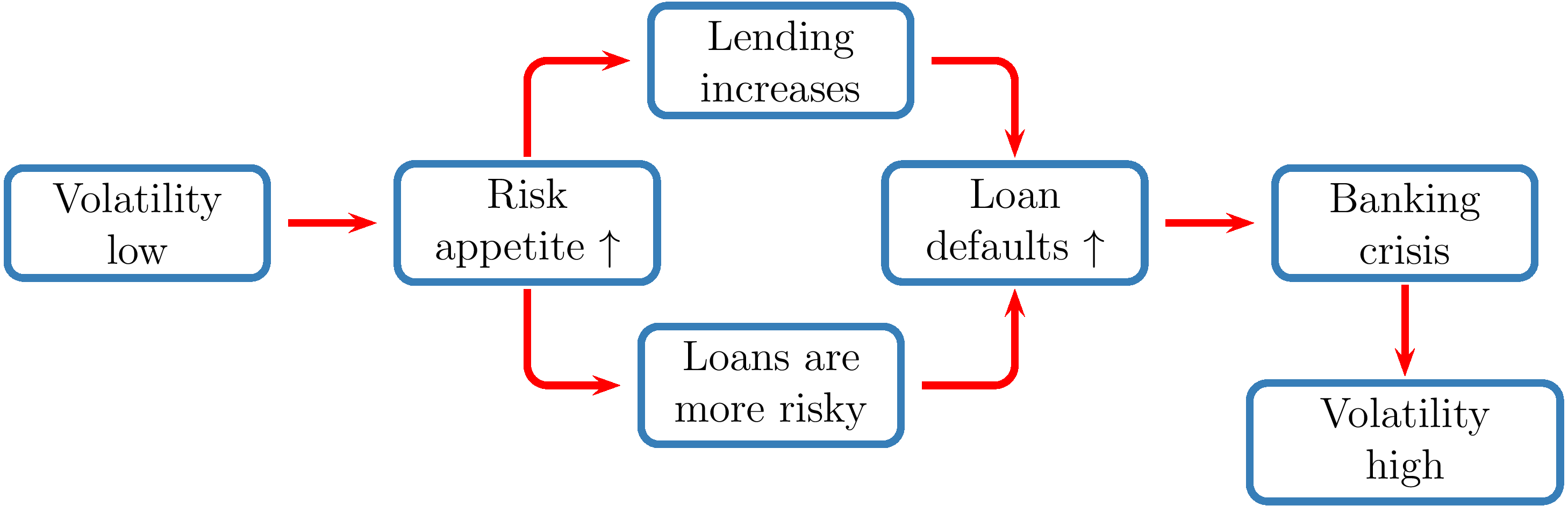

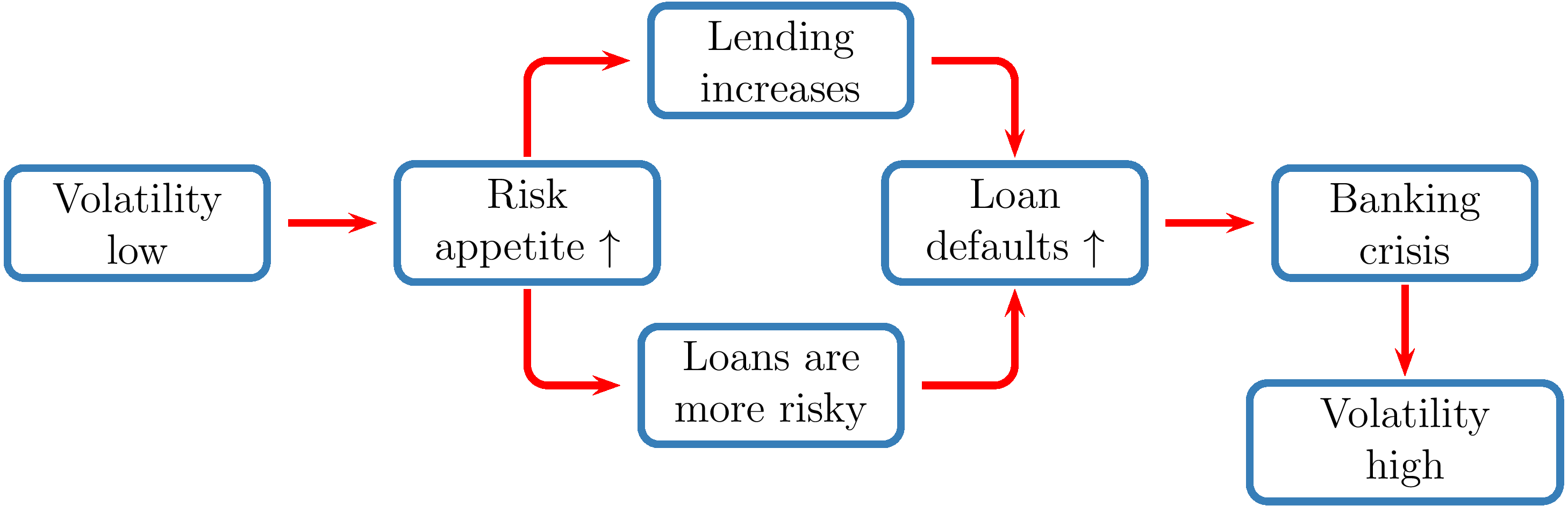

Low risk as a predictor of financial crises Jon Danielsson (London School of Economics), Marcela Valenzuela (University of Chile),...

Low risk as a predictor of financial crises Jon Danielsson (London School of Economics), Marcela Valenzuela (University of Chile),...

Read More

From Dave Wilson: Proposals to limit or bar U.S. stock repurchases may amount to kicking businesses when they’re down. Comparing the...

From Dave Wilson: Proposals to limit or bar U.S. stock repurchases may amount to kicking businesses when they’re down. Comparing the...

Low risk as a predictor of financial crises Jon Danielsson (London School of Economics), Marcela Valenzuela (University of Chile),...

Low risk as a predictor of financial crises Jon Danielsson (London School of Economics), Marcela Valenzuela (University of Chile),...