How the TLC & Medallion Owners Created Uber

Taxi Cab Owners and Regulators Created Uber The number of cars for hire didn’t rise with demand. What would you expect? Bloomberg, May...

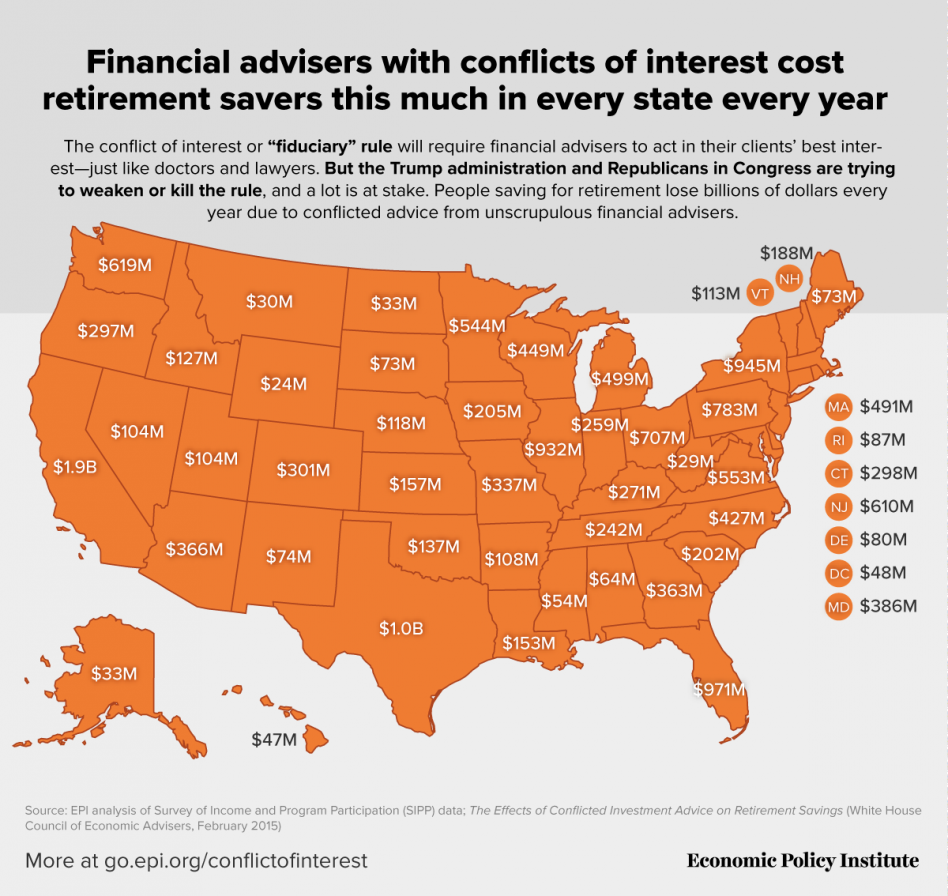

Costs of Advisor Conflict of Interest, State by State

Source: Economic Policy Institute We have been discussing the fiduciary standard of care owed to investors for some time...

Source: Economic Policy Institute We have been discussing the fiduciary standard of care owed to investors for some time...

JPM Buys Bear Stearns for $2 Share

Bear Stearns global headquarters on New York, March 17, 2008. This photo is seared into my memory — it was a decade...

Bear Stearns global headquarters on New York, March 17, 2008. This photo is seared into my memory — it was a decade...

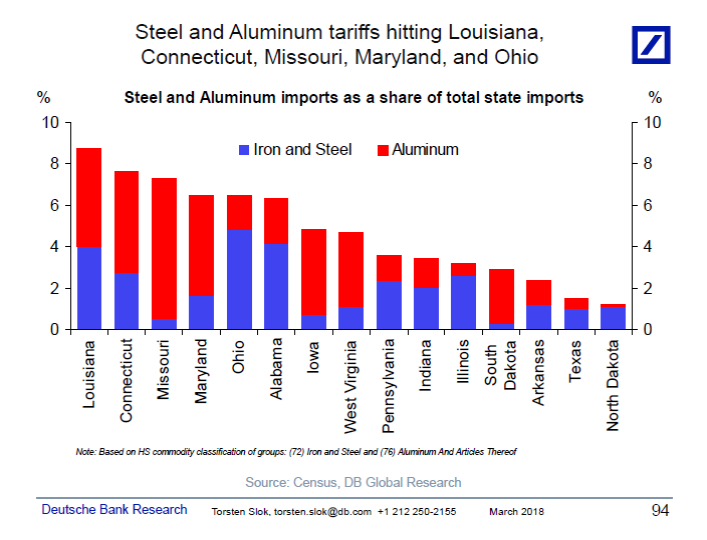

Top 15 Tariff Impacts on US States

click for bigger graphic Source: Torsten Sløk, Ph.D., Deutsche Bank Securities Torsten Sløk of Deutsche Bank shares...

click for bigger graphic Source: Torsten Sløk, Ph.D., Deutsche Bank Securities Torsten Sløk of Deutsche Bank shares...

How Safe Are We From the Next Ponzi Scheme?

“Bernie is the poster boy for a world where deregulation is the rule…” -Steve Fishman, Ponzi Supernova ...

Financial Regulation: Fit for New Technologies?

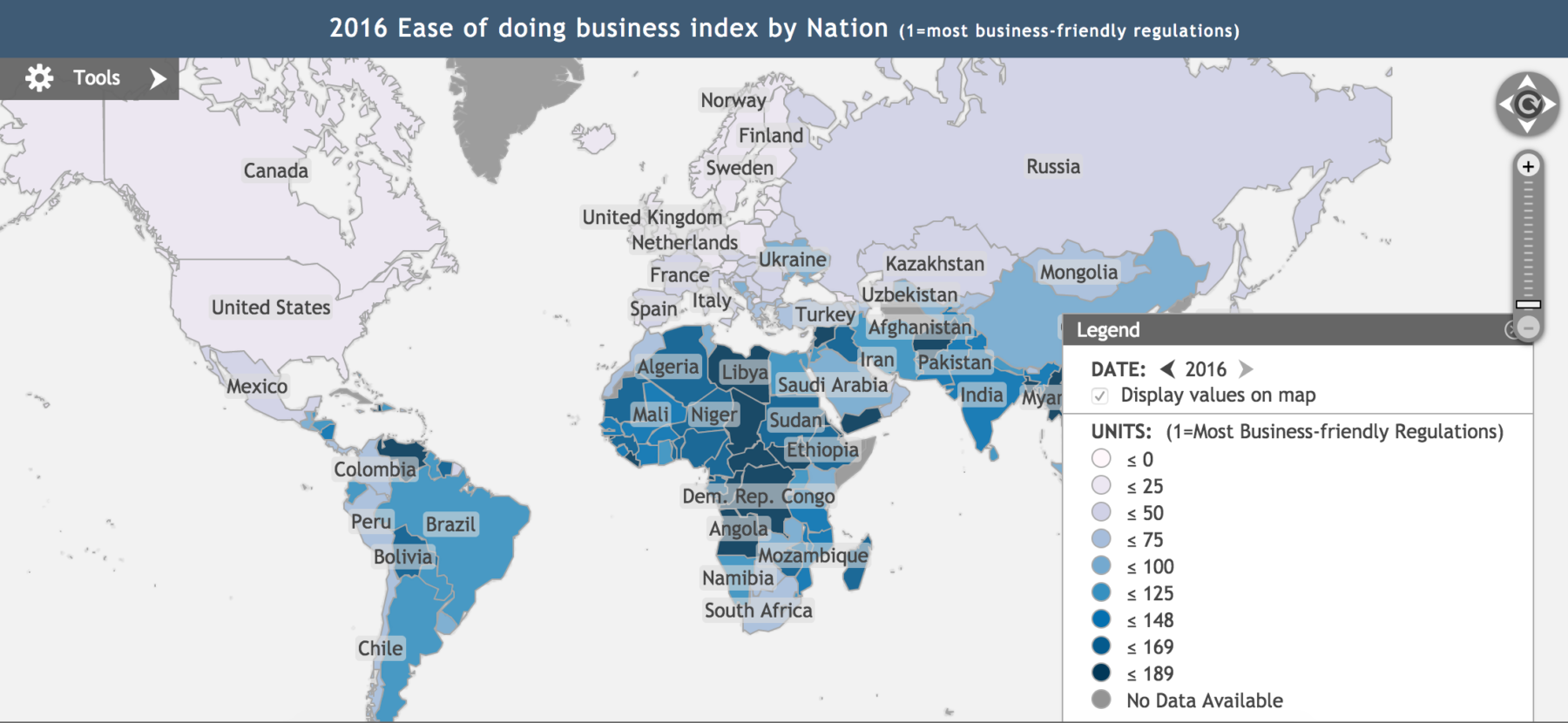

The Ease of Doing Business Index

Take it easy! The Ease of Doing Business Index click for interactive map Source: FRED How this map was created: In GeoFRED, select...

Take it easy! The Ease of Doing Business Index click for interactive map Source: FRED How this map was created: In GeoFRED, select...

Coal’s Last Stand

Nothing Trump Does Can Save Coal Don’t blame liberals and regulations; blame capitalism and technology. Bloomberg, November 15,...

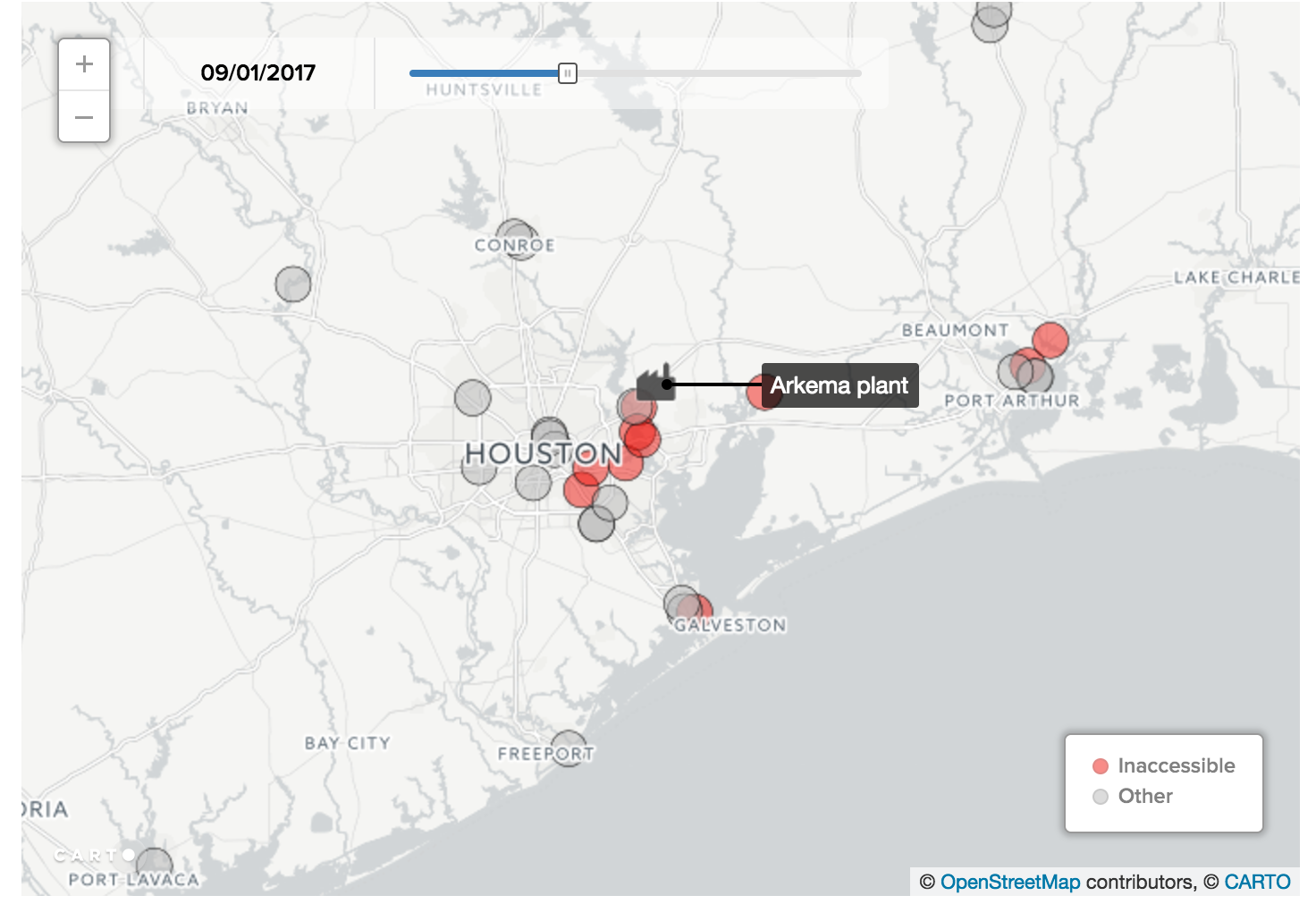

Harvey Unleashed Toxic Waste from 13 Superfund Sites…

Via Buzzfeed: Tropical storm Harvey damaged at least 13 dump sites for thousands of tons of industrial waste, but flooding has prevented...

Via Buzzfeed: Tropical storm Harvey damaged at least 13 dump sites for thousands of tons of industrial waste, but flooding has prevented...