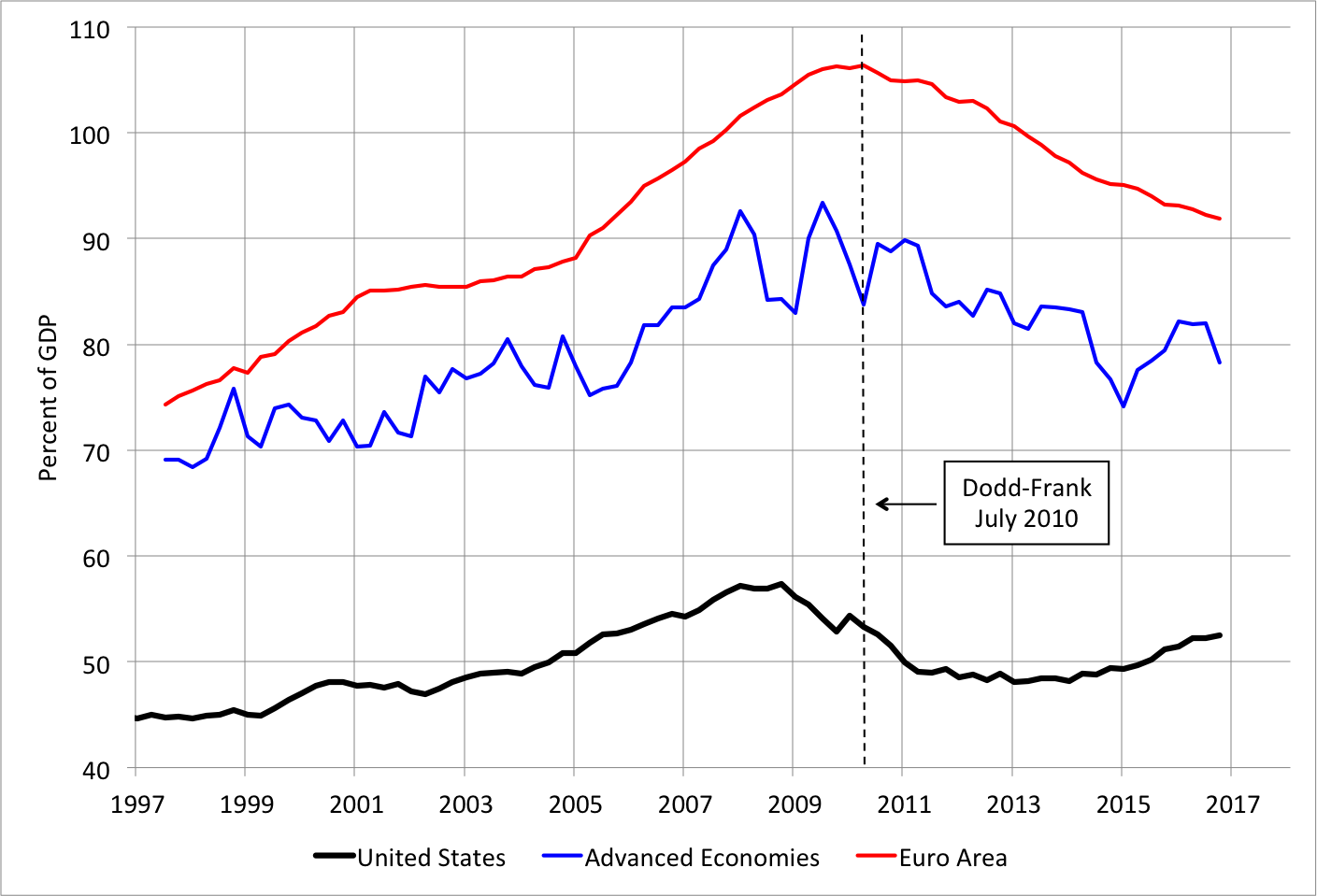

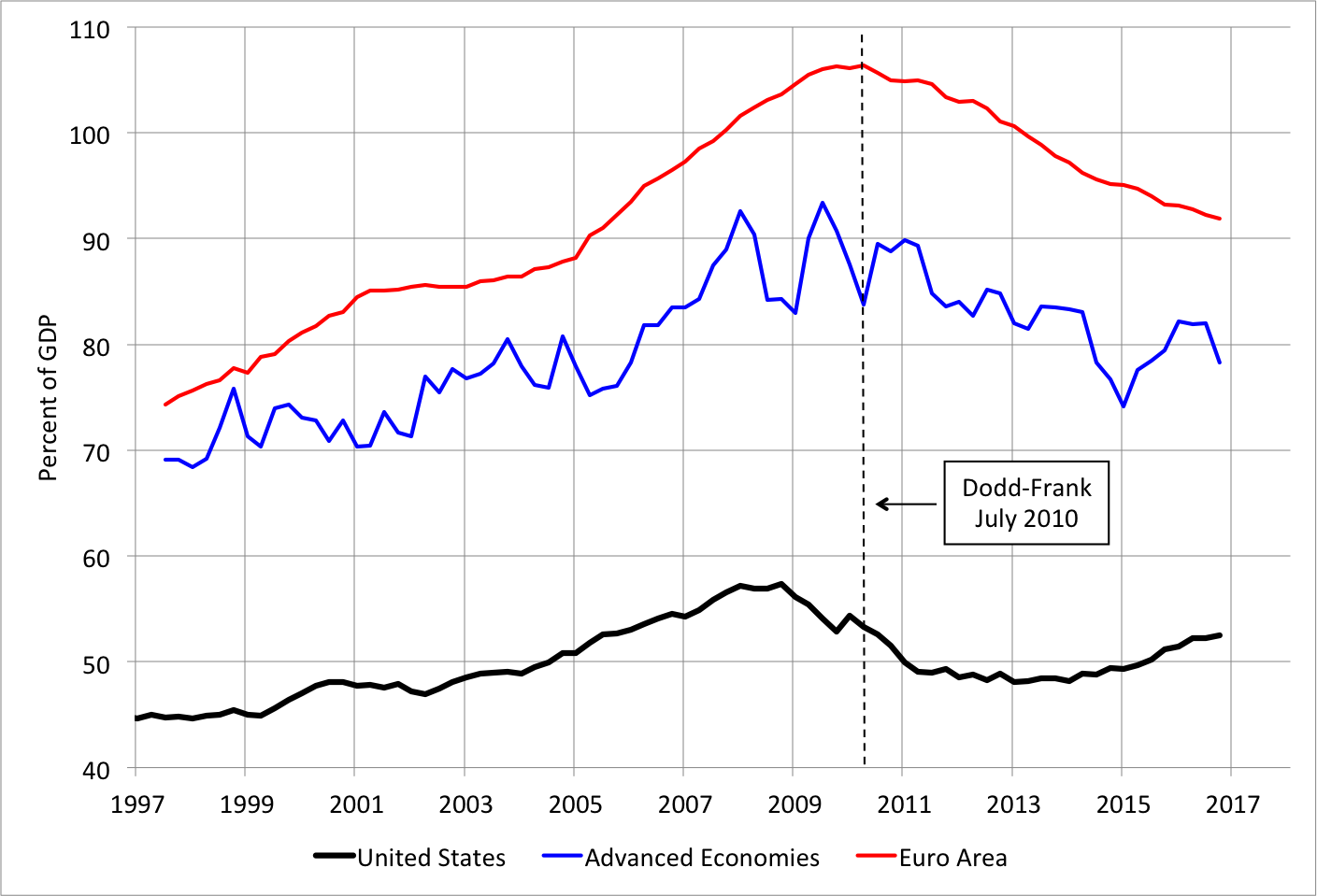

Sizing Up Systemic Risk Joseph G. Haubrich, Charlotte DeKoning Federal Reserve Bank of Cleveland Regulators now use...

Sizing Up Systemic Risk Joseph G. Haubrich, Charlotte DeKoning Federal Reserve Bank of Cleveland Regulators now use...

Read More

Were Banks ‘Boring’ before the Repeal of Glass-Steagall? Nicola Cetorelli Liberty Street Economics, July 31, 2017 Since...

Were Banks ‘Boring’ before the Repeal of Glass-Steagall? Nicola Cetorelli Liberty Street Economics, July 31, 2017 Since...

Read More

Sinclair Broadcast Group is the largest owner of local TV stations in the country. That’s alarming considering that they often...

Read More

Treasury’s Missed Opportunity Money and Banking, June 19, 2017 “…we expect to be cutting a lot out of...

Treasury’s Missed Opportunity Money and Banking, June 19, 2017 “…we expect to be cutting a lot out of...

Read More

This is your must read column of the day: Via Reuters, Wall Street’s self-regulator blocks public scrutiny of firms with tainted...

Read More

Retirement Savers Really Do Need Government Help The Trump administration will let a rule to go into effect requiring financial advisers...

Read More

The ride-hailing giant is using data science to engineer a more sustainable business model, but it’s cutting drivers out from some...

Read More

Has there been a sea change in the way banks respond to capital requirements? Sebastian J A de-Ramon, William Francis and Qun Harris...

Has there been a sea change in the way banks respond to capital requirements? Sebastian J A de-Ramon, William Francis and Qun Harris...

Read More

Be Smart When You Compare Reagan’s Economy to Obama’s Some partisans act as if we can run a controlled experiment to see...

Read More

Sizing Up Systemic Risk Joseph G. Haubrich, Charlotte DeKoning Federal Reserve Bank of Cleveland Regulators now use...

Sizing Up Systemic Risk Joseph G. Haubrich, Charlotte DeKoning Federal Reserve Bank of Cleveland Regulators now use...

Sizing Up Systemic Risk Joseph G. Haubrich, Charlotte DeKoning Federal Reserve Bank of Cleveland Regulators now use...

Sizing Up Systemic Risk Joseph G. Haubrich, Charlotte DeKoning Federal Reserve Bank of Cleveland Regulators now use...