What Is Ailing Retail?

It’s Not Just Retail That’s Changing. It’s Us. Technology keeps people too busy to go to the mall, and gives them an...

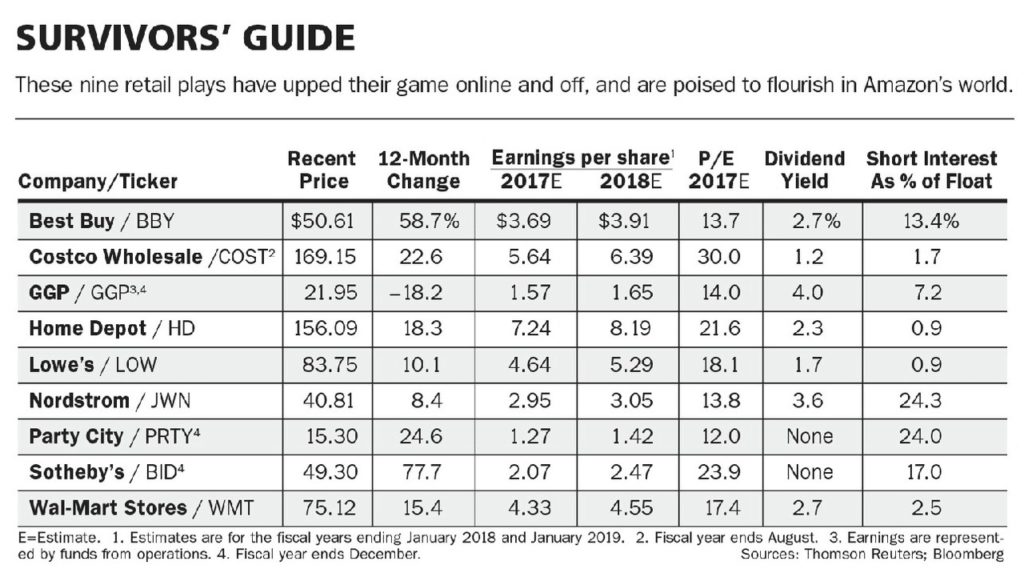

Interesting, from Barron’s: Creative destruction has defined the retailing business since the moment after its birth. Today it...

Interesting, from Barron’s: Creative destruction has defined the retailing business since the moment after its birth. Today it...

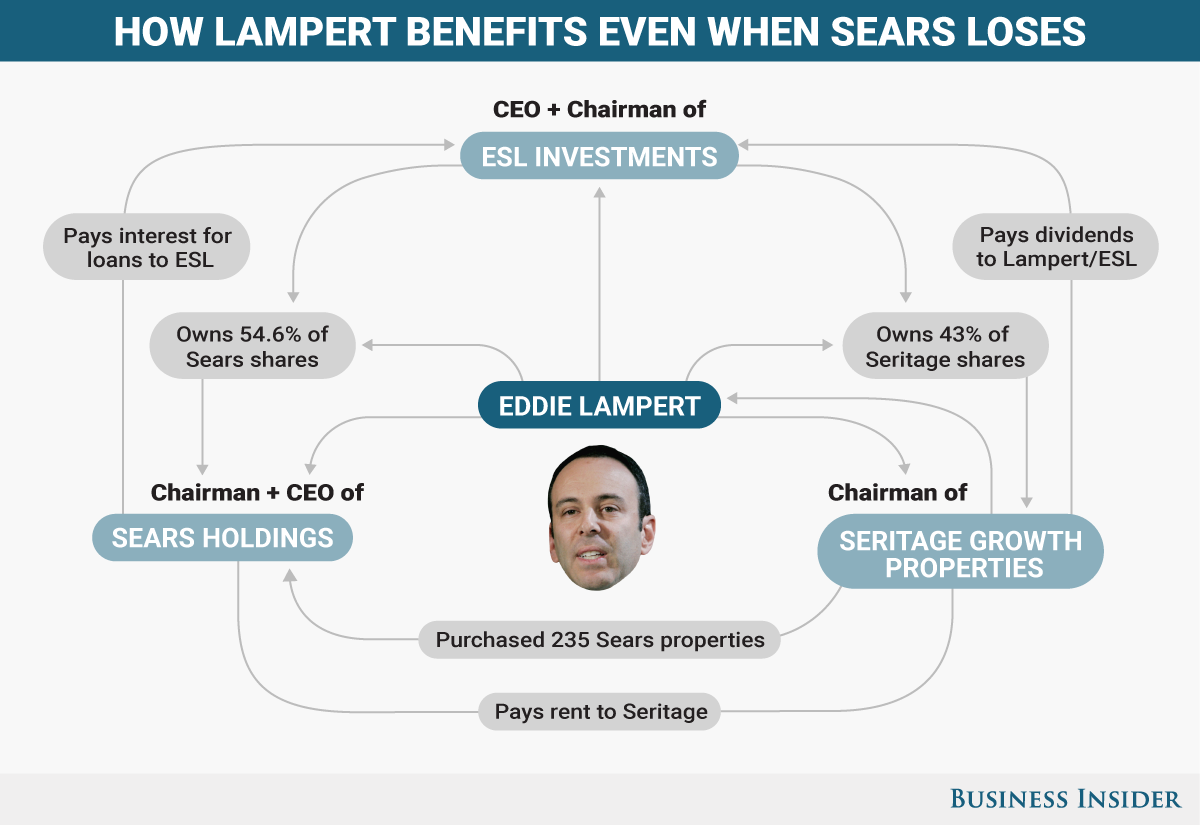

click for ginormous graphic Today’s must read is a monster piece from Business Insider (again) headlined Inside Sears’ death...

click for ginormous graphic Today’s must read is a monster piece from Business Insider (again) headlined Inside Sears’ death...

Get subscriber-only insights and news delivered by Barry every two weeks.