Black Friday is a Comin’ !

It’s become a favorite holiday tradition around these parts: wait for the National Retail Federation annual holiday spending...

The rise of the email, internet and mobile computing has changed the landscape for how traditional retailers and other companies...

The rise of the email, internet and mobile computing has changed the landscape for how traditional retailers and other companies...

Check out this awesome and well researched discussion of one of my pet peeves. click for full article Source: The Atlantic...

Check out this awesome and well researched discussion of one of my pet peeves. click for full article Source: The Atlantic...

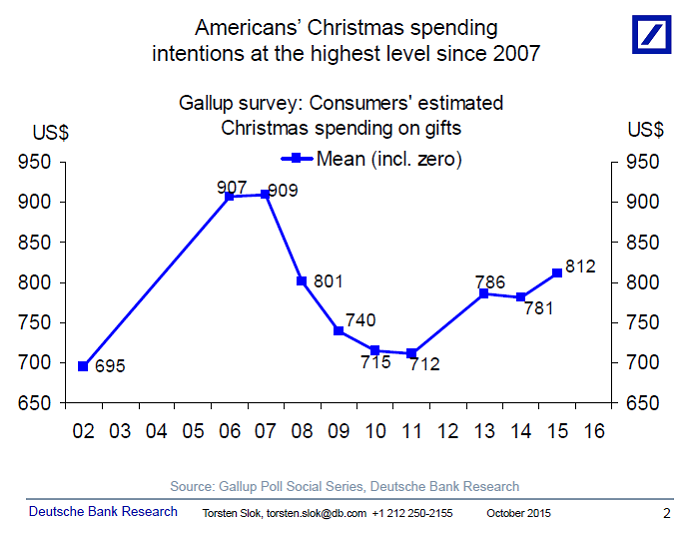

Source: Torsten Sløk, Ph.D., Deutsche Bank Research The Gallup survey (above) was carried out from October 7 to October...

Source: Torsten Sløk, Ph.D., Deutsche Bank Research The Gallup survey (above) was carried out from October 7 to October...

Get subscriber-only insights and news delivered by Barry every two weeks.