I have a vivid recollection of the period following the Great Financial Crisis: I spent March to September of 2008 writing Bailout...

I have a vivid recollection of the period following the Great Financial Crisis: I spent March to September of 2008 writing Bailout...

Read More

This week, we speak with Peter Atwater, president of Financial Insyghts and an adjunct professor at William & Mary and...

Read More

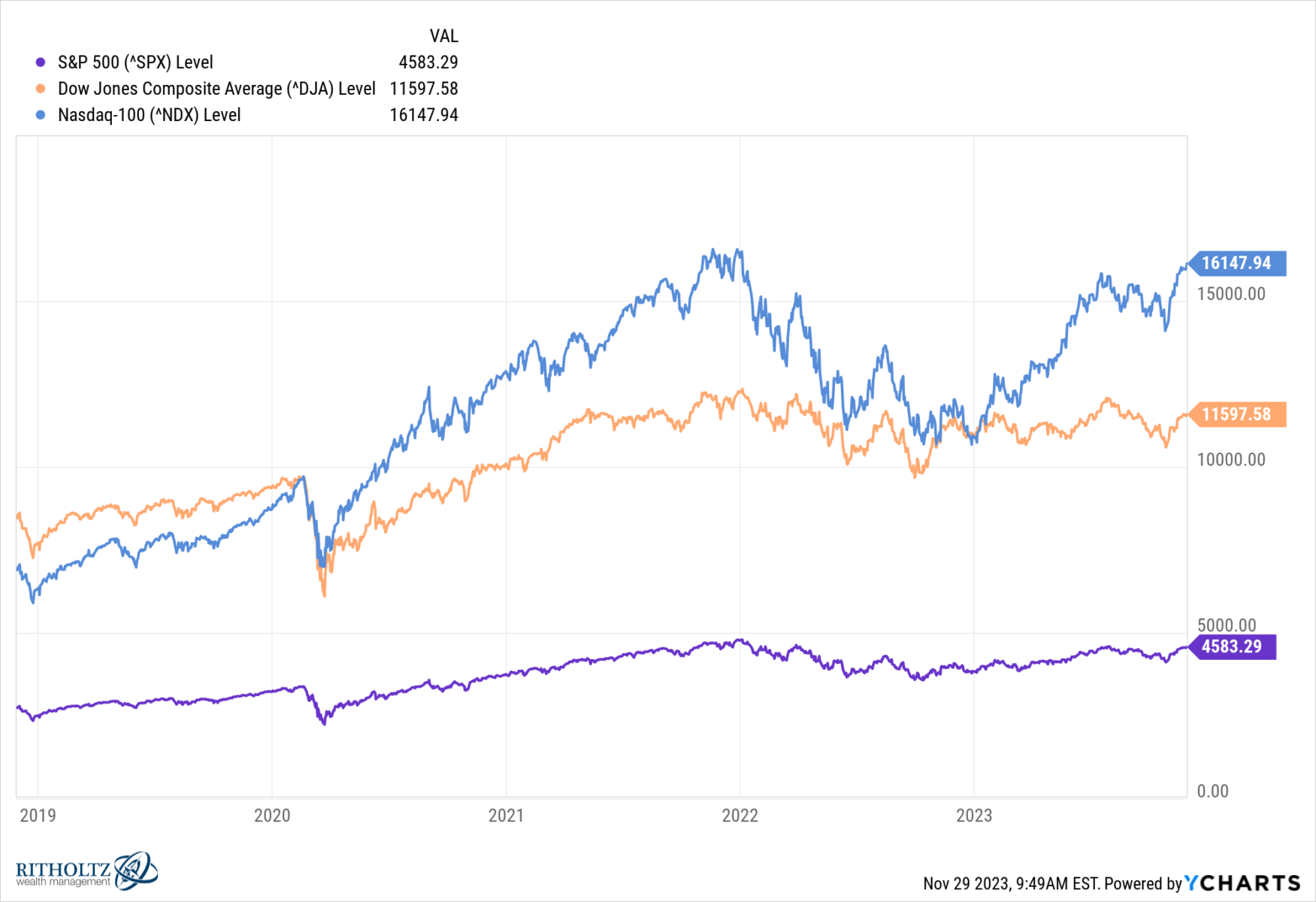

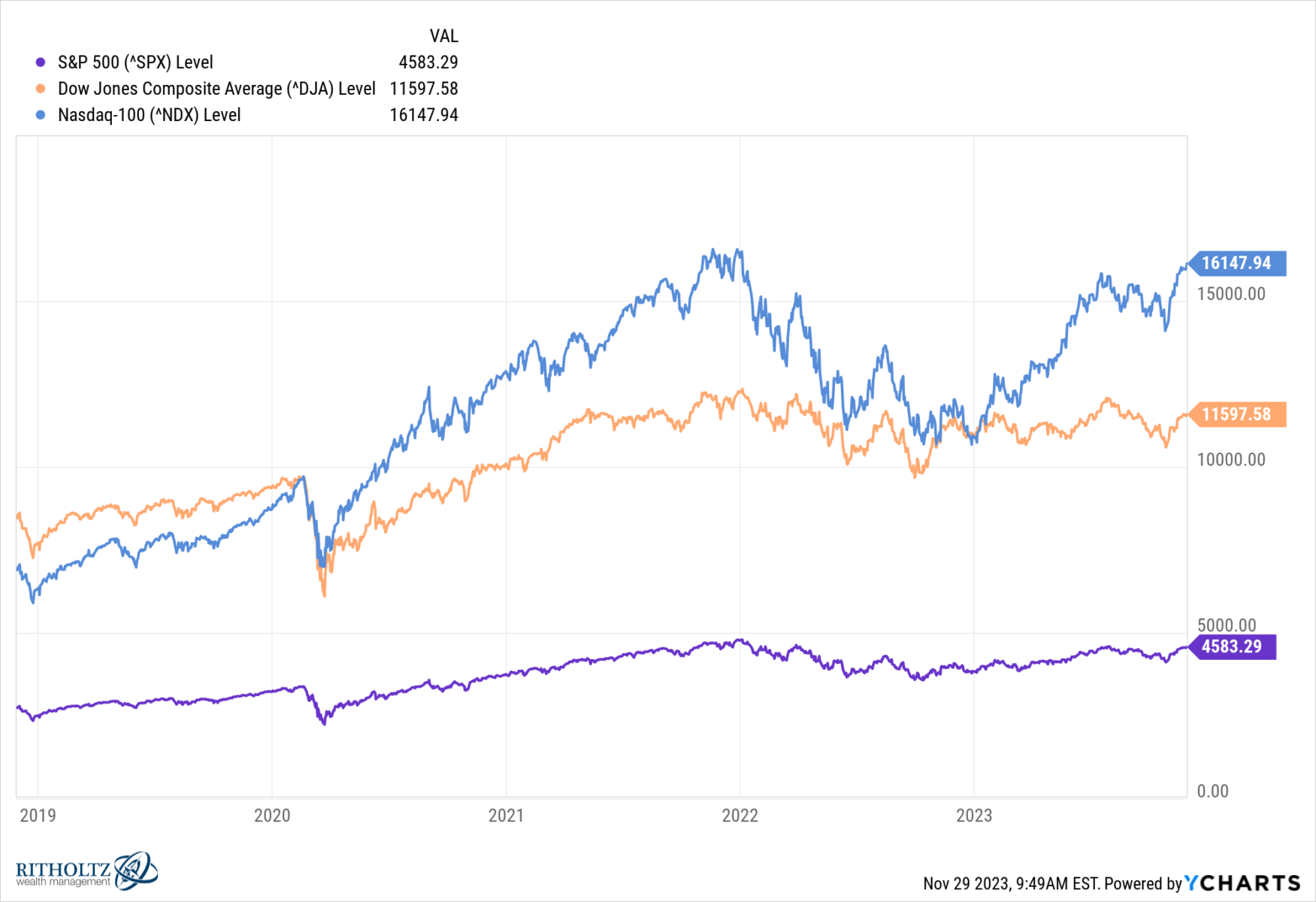

One of my favorite responsibilities as chief investment officer at Ritholtz Wealth Management is the quarterly conference call I do for...

One of my favorite responsibilities as chief investment officer at Ritholtz Wealth Management is the quarterly conference call I do for...

Read More

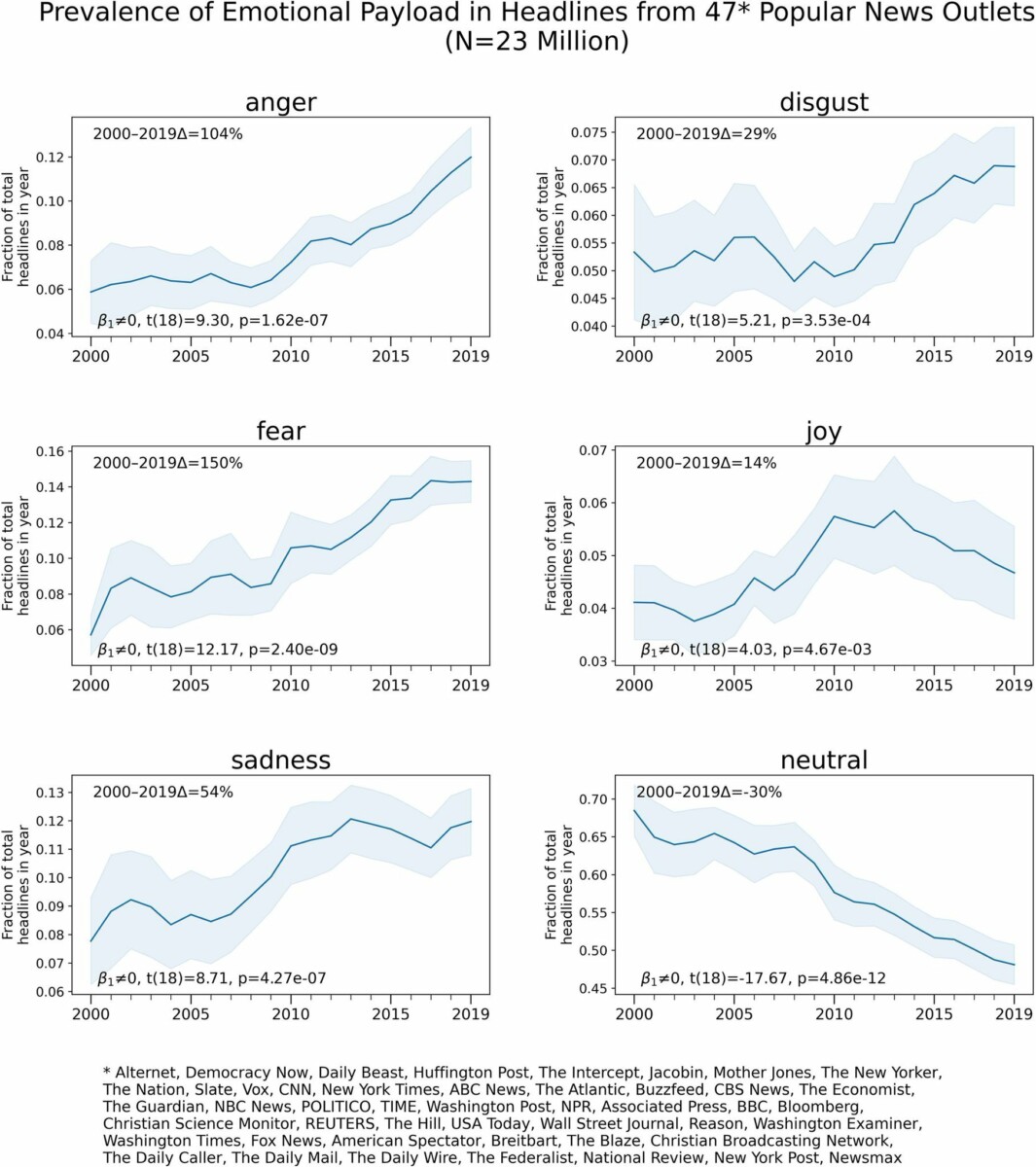

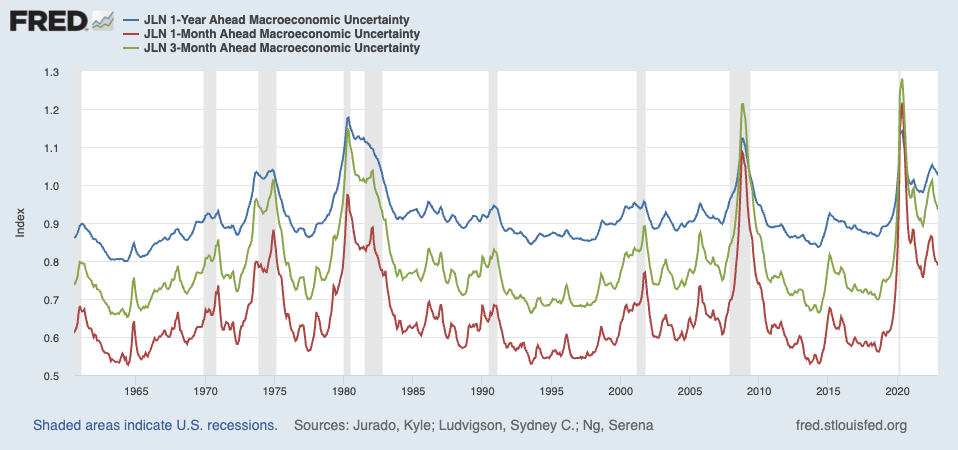

I love FRED — I am a big user of their charts and data (and even their swag). Where I go full heterodox are in things like...

I love FRED — I am a big user of their charts and data (and even their swag). Where I go full heterodox are in things like...

Read More

It’s a summer Friday and nobody has the patience for a long rant about whatever foolishness is bothering me today. So instead, a...

It’s a summer Friday and nobody has the patience for a long rant about whatever foolishness is bothering me today. So instead, a...

Read More

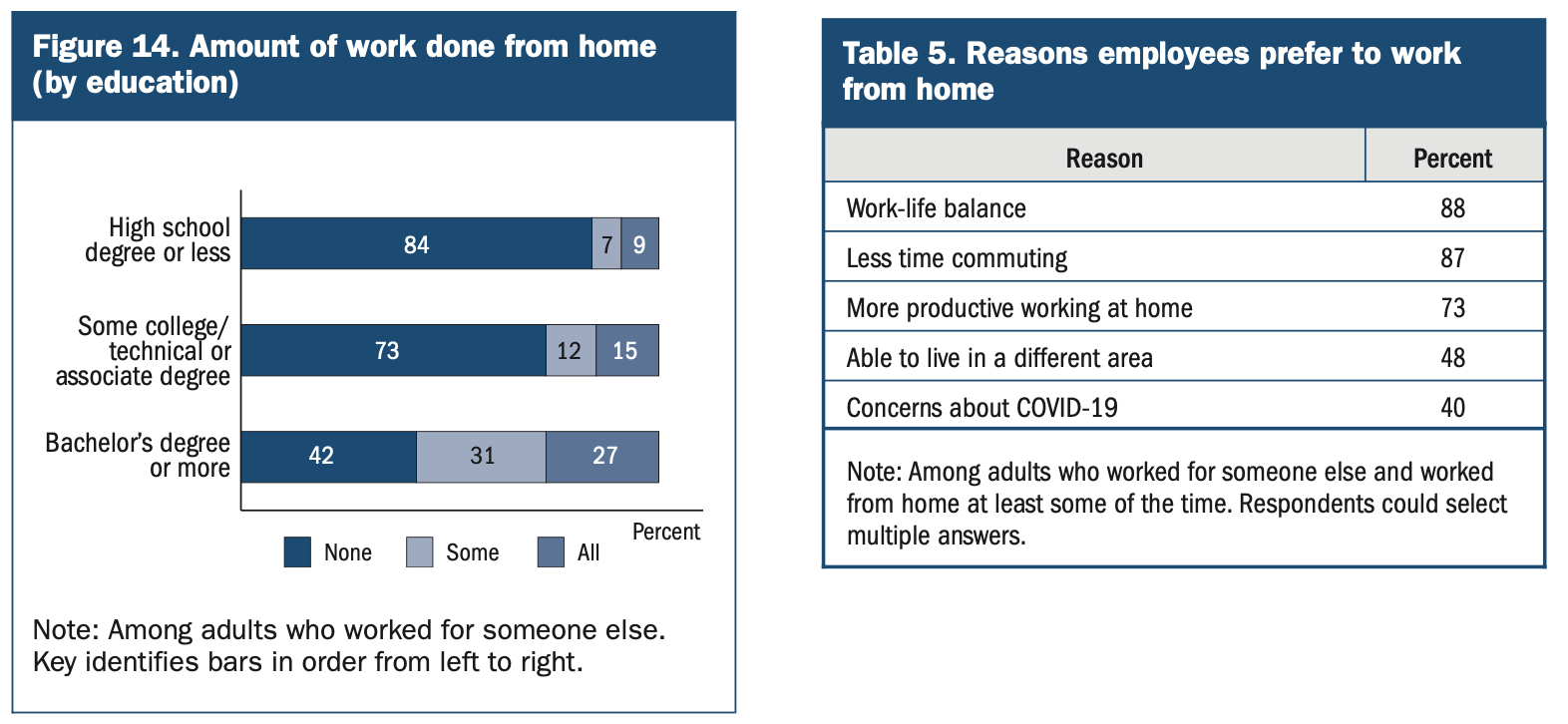

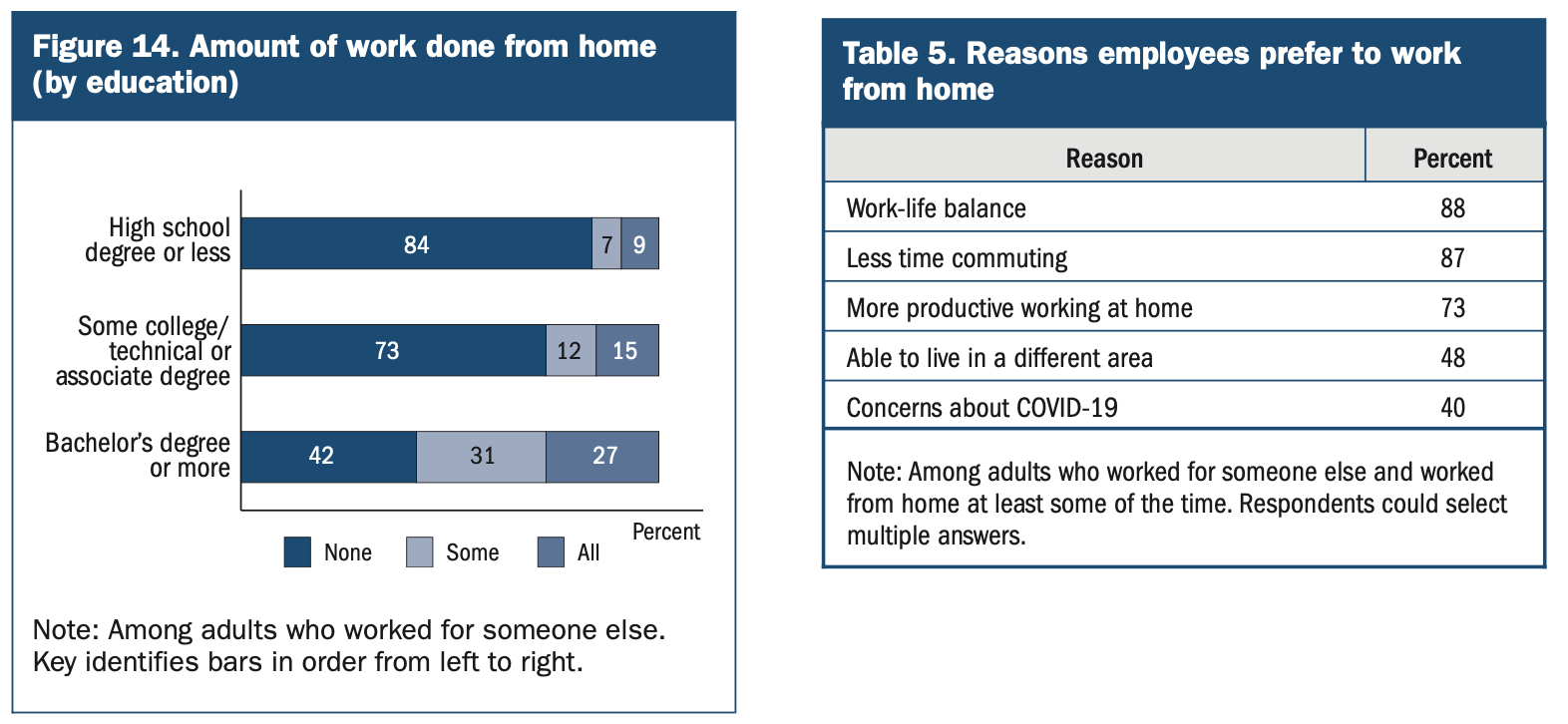

This week saw the release of the Fed’s big annual research report, Economic Well-Being of U.S. Households in 2022....

This week saw the release of the Fed’s big annual research report, Economic Well-Being of U.S. Households in 2022....

Read More

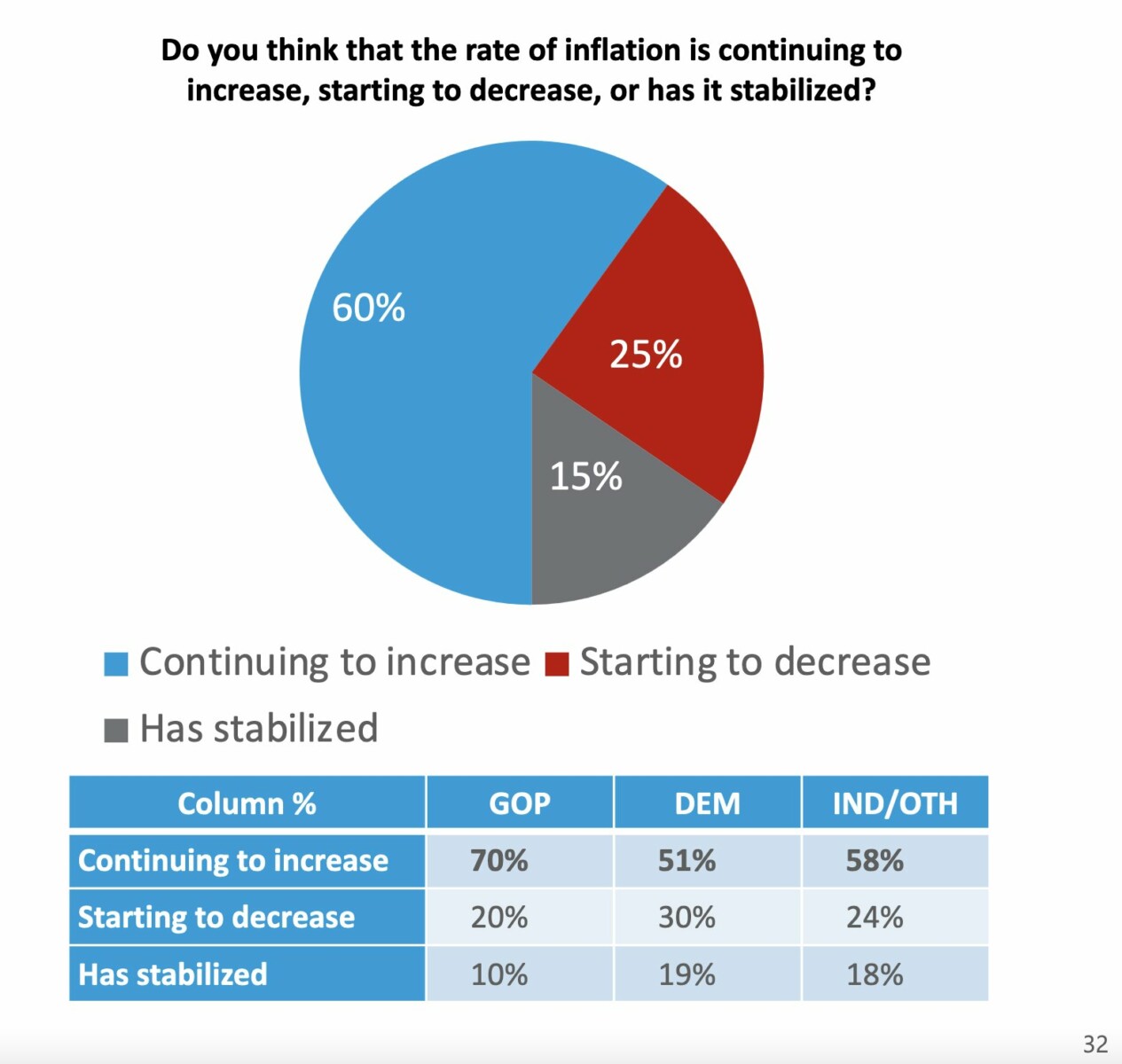

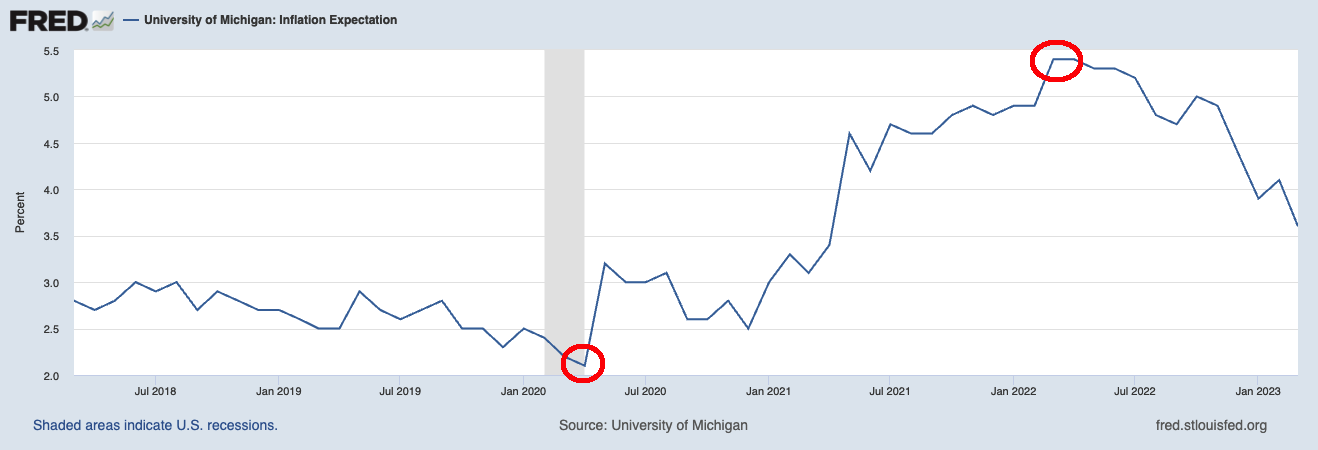

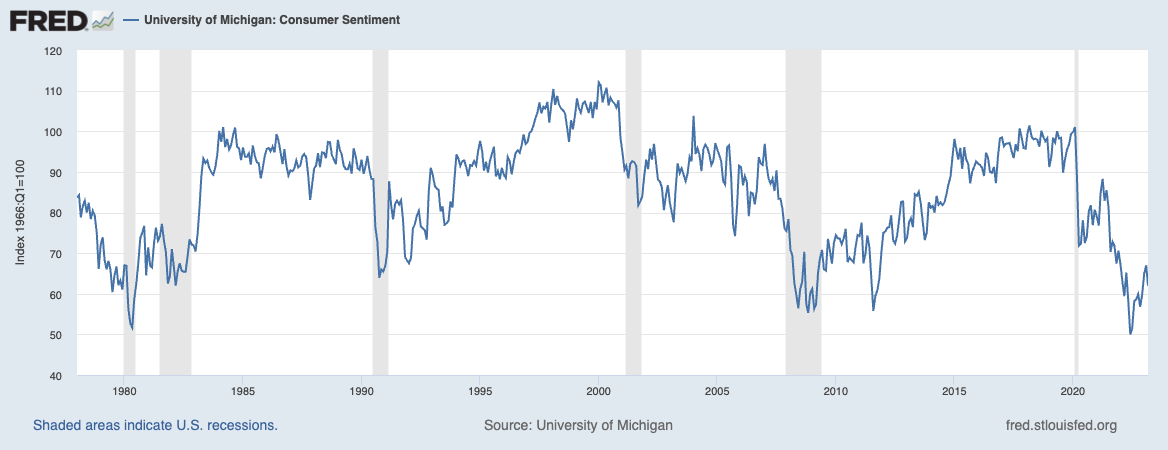

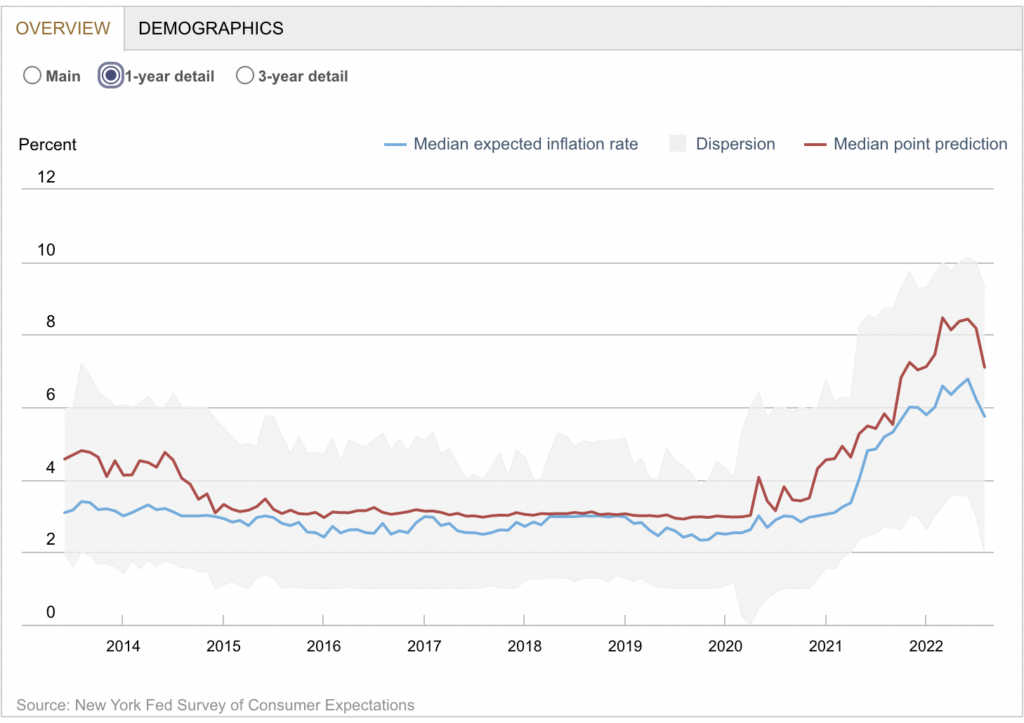

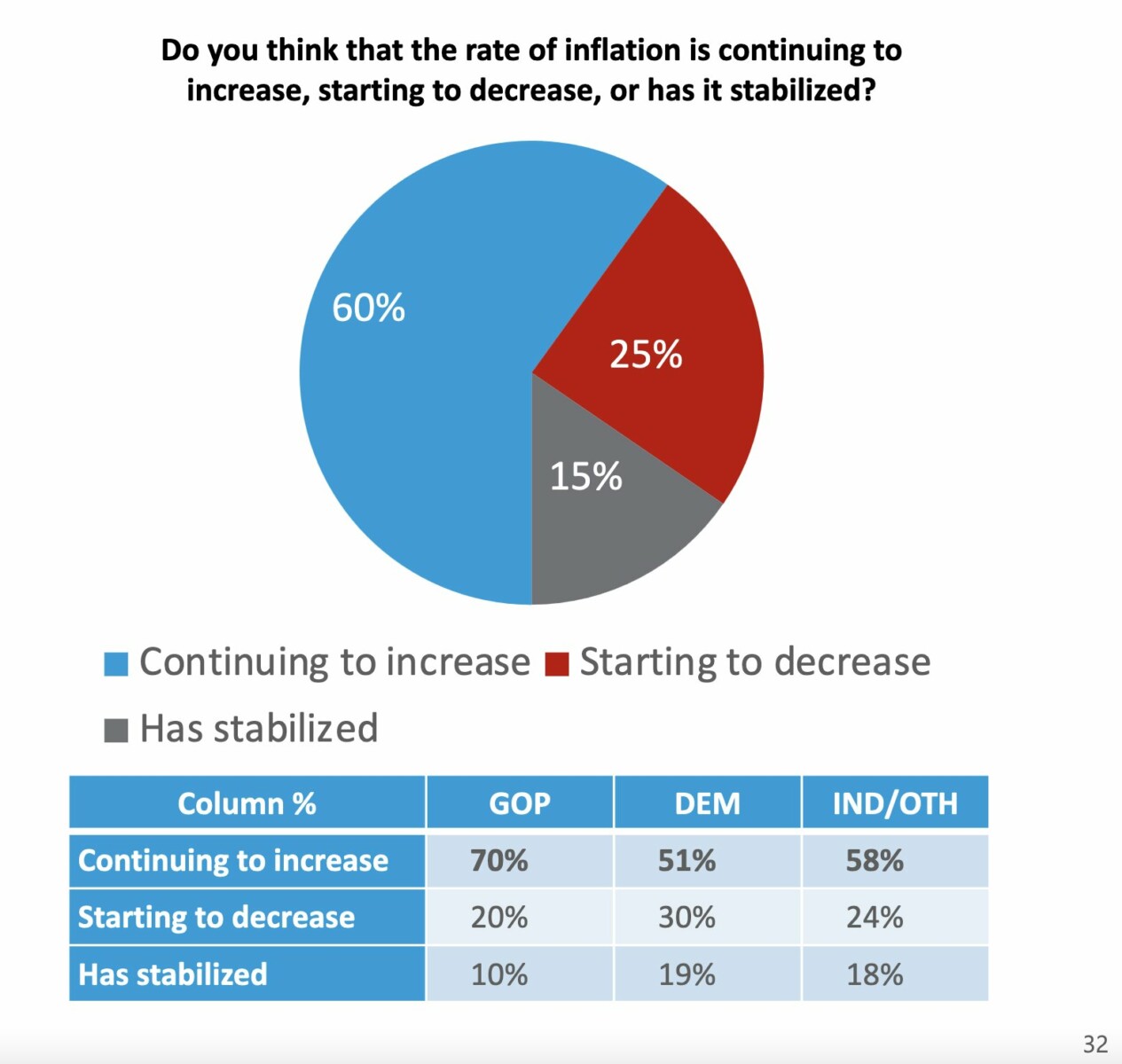

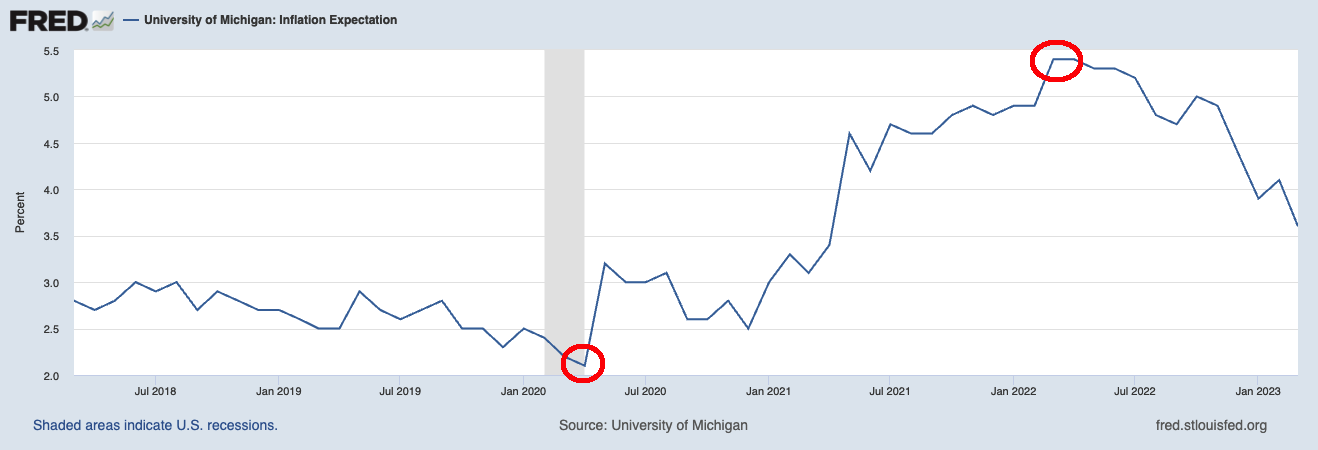

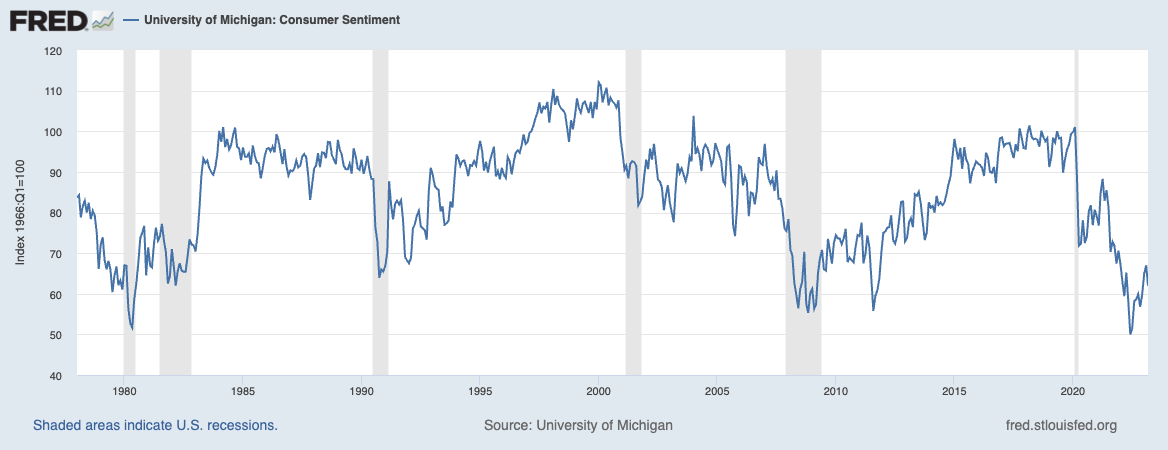

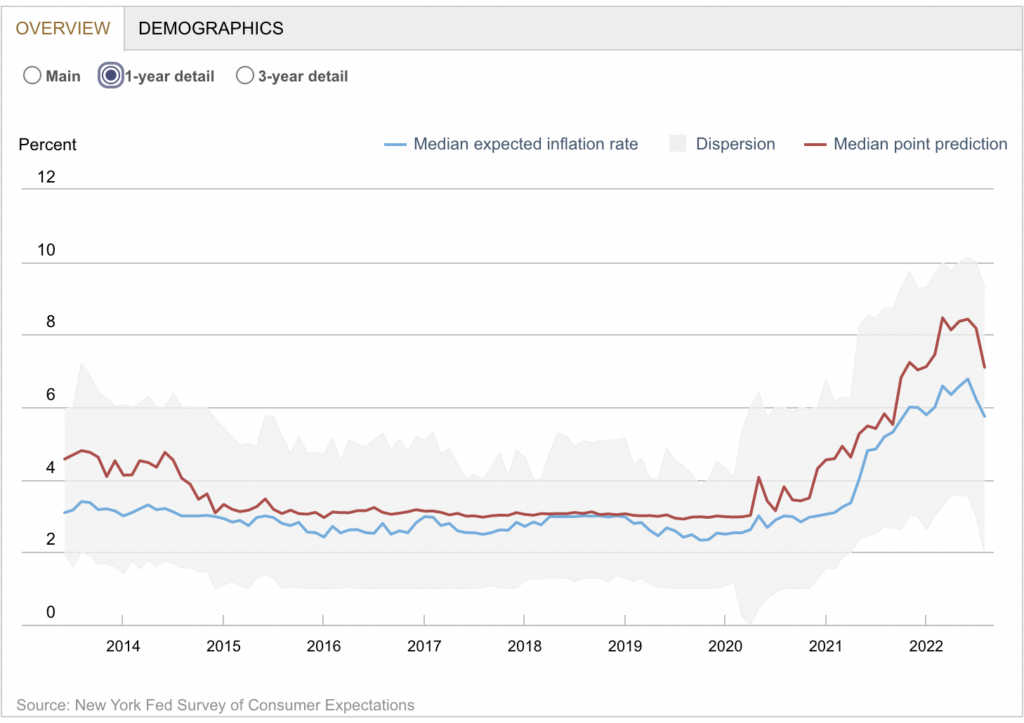

Jerome Powell and the Federal Reserve spend a lot of time worrying about Inflation Expectations. They shouldn’t. Generally,...

Jerome Powell and the Federal Reserve spend a lot of time worrying about Inflation Expectations. They shouldn’t. Generally,...

Read More

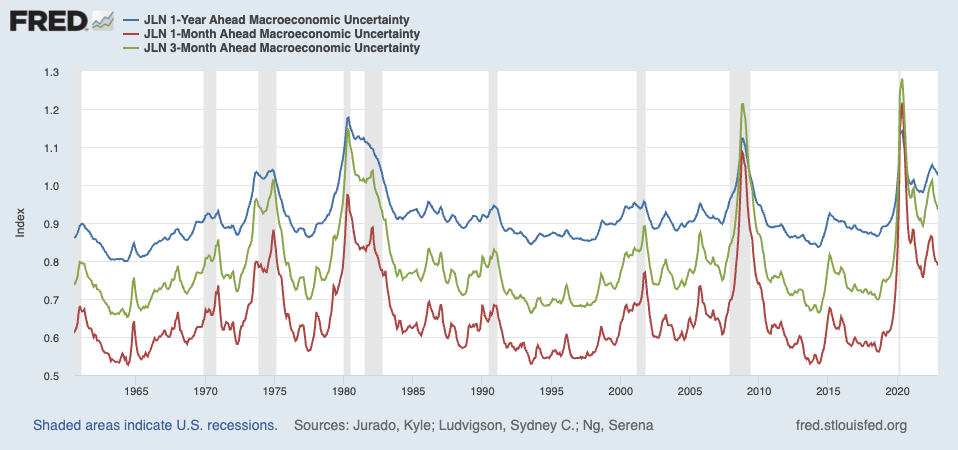

Source: FRED, May 8, 2023 There’s an old joke about a hypochondriac who is constantly complaining to his doctor about his...

Source: FRED, May 8, 2023 There’s an old joke about a hypochondriac who is constantly complaining to his doctor about his...

Read More

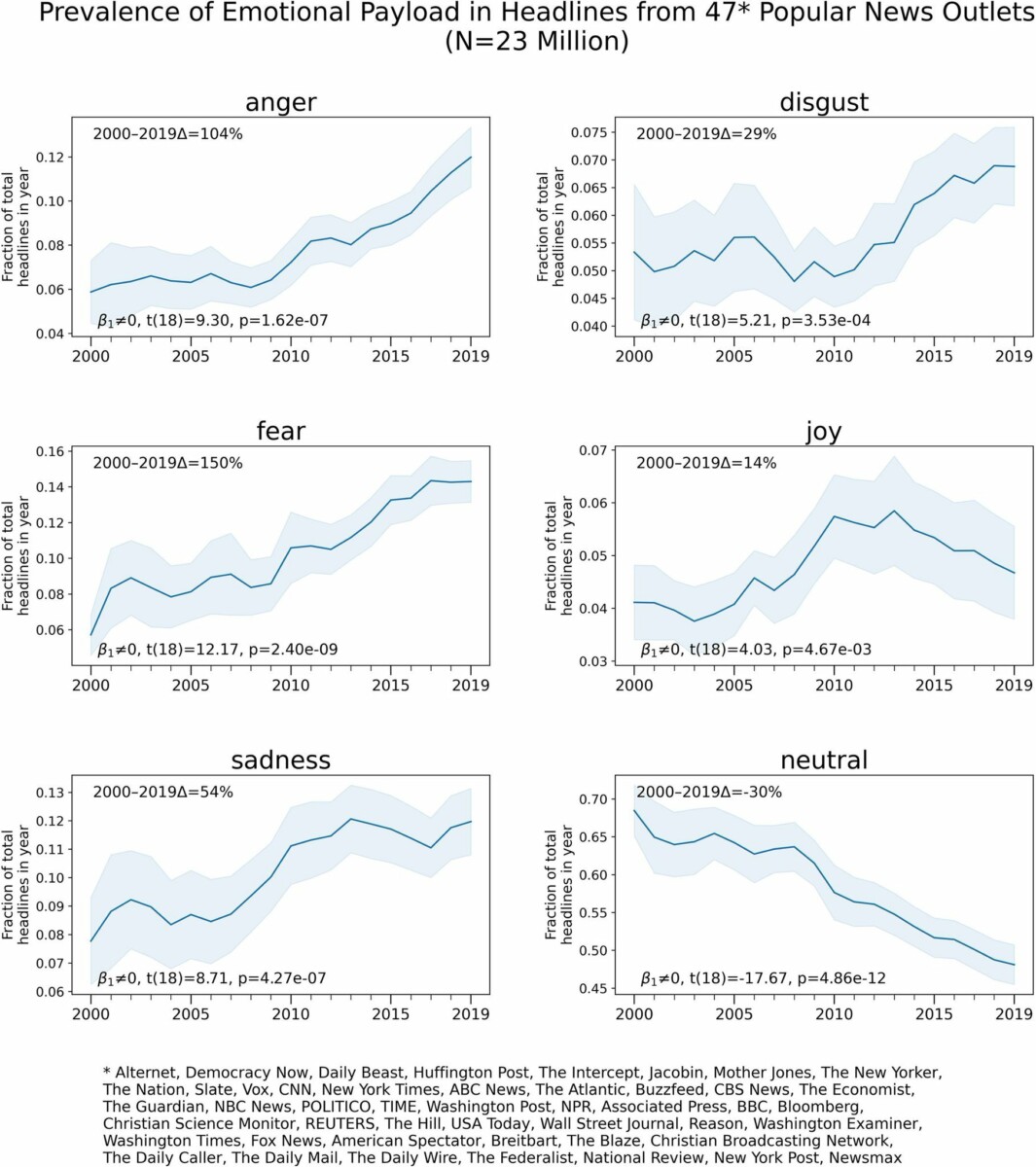

One of the things we know about inflation expectations is that Federal Reserve Chairman Jerome Powell relies heavily on them. He...

One of the things we know about inflation expectations is that Federal Reserve Chairman Jerome Powell relies heavily on them. He...

Read More

Barry Ritholtz, Ritholtz Wealth Management Chairman and CIO & “Masters in Business” host, discusses recession risk and...

Read More

I have a vivid recollection of the period following the Great Financial Crisis: I spent March to September of 2008 writing Bailout...

I have a vivid recollection of the period following the Great Financial Crisis: I spent March to September of 2008 writing Bailout...

I have a vivid recollection of the period following the Great Financial Crisis: I spent March to September of 2008 writing Bailout...

I have a vivid recollection of the period following the Great Financial Crisis: I spent March to September of 2008 writing Bailout...