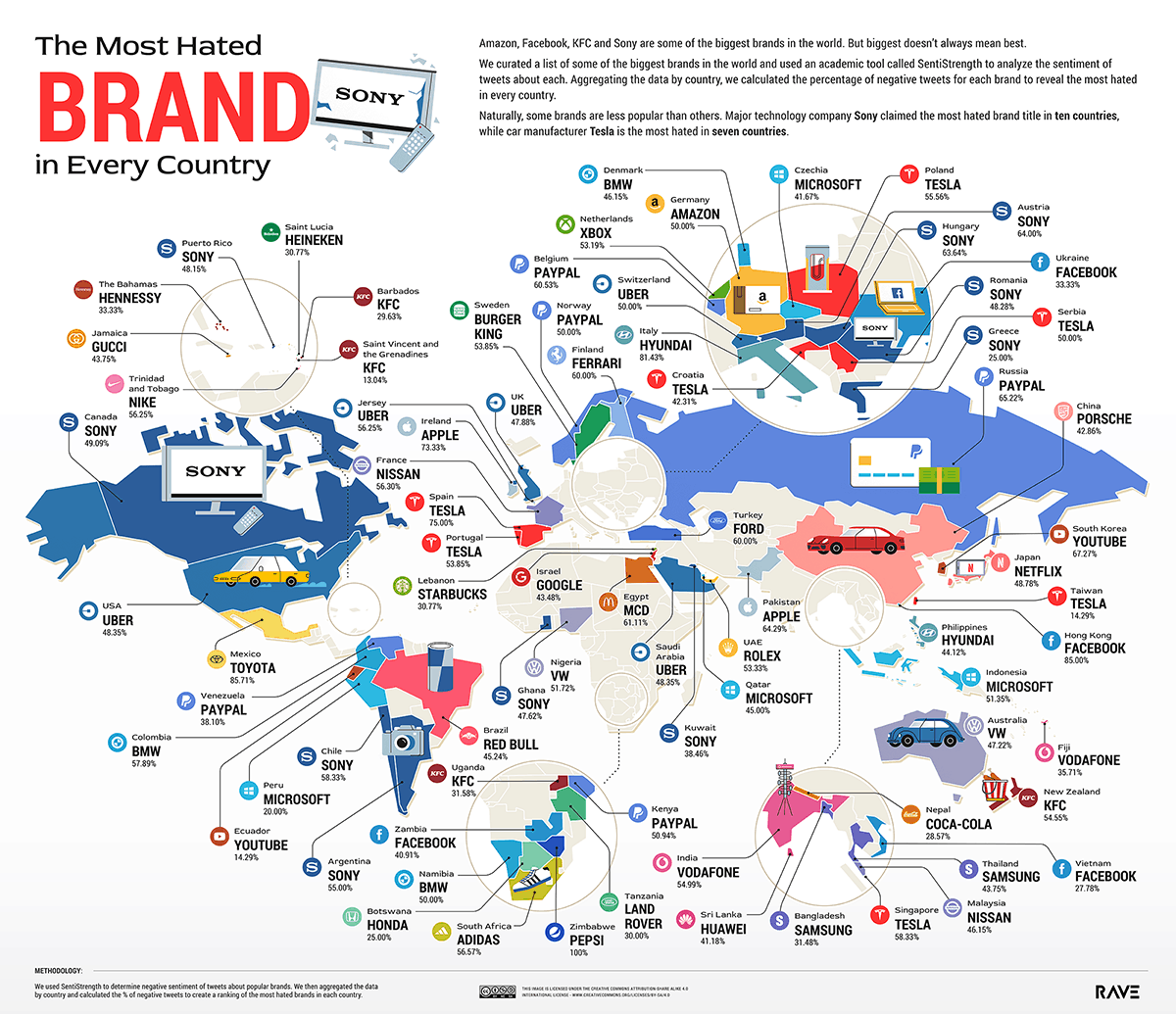

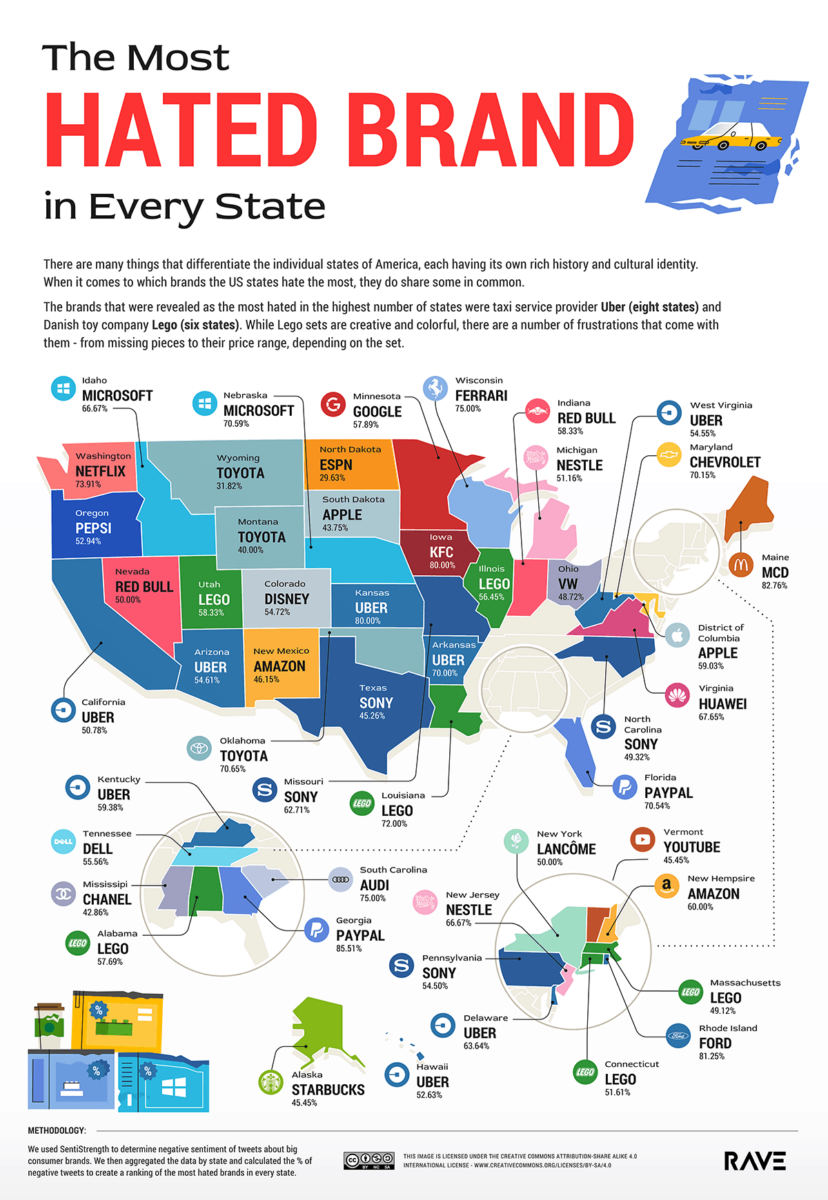

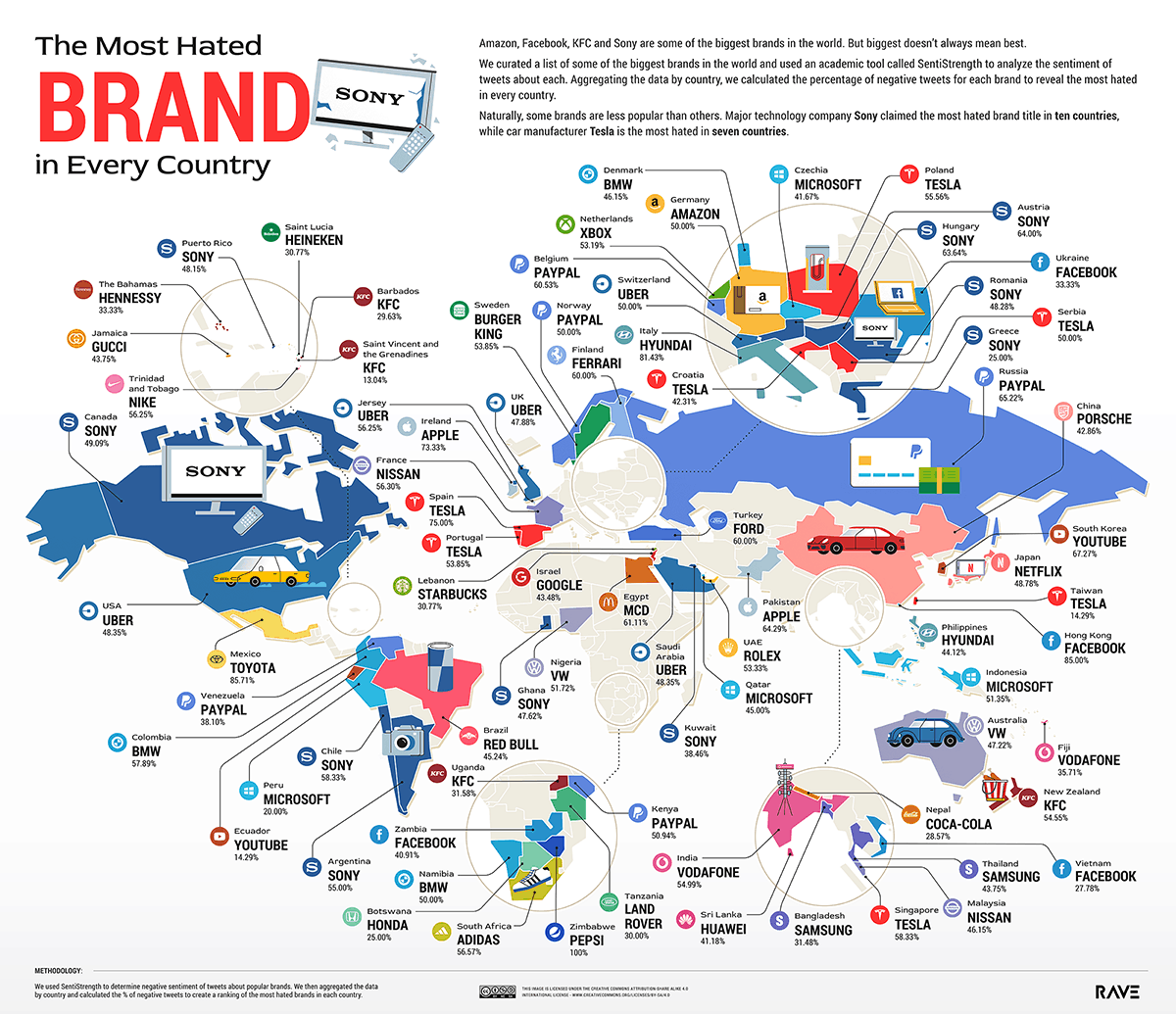

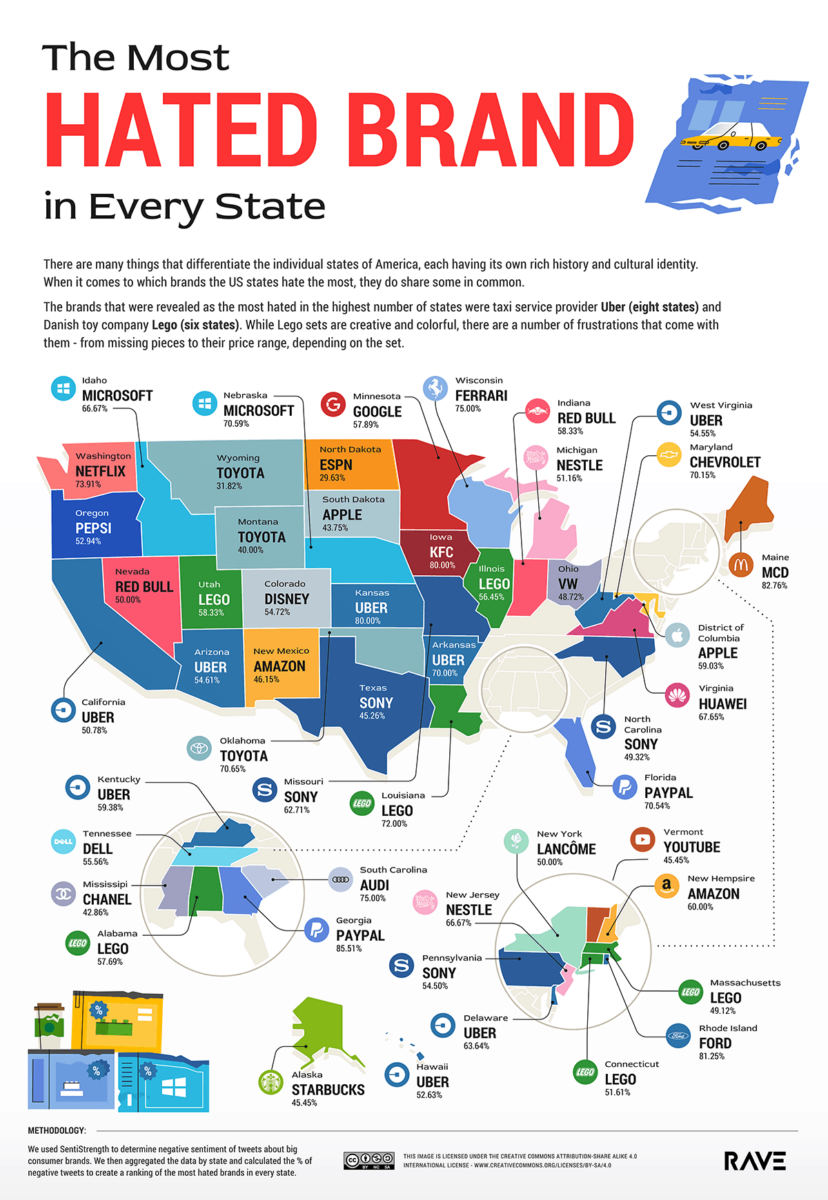

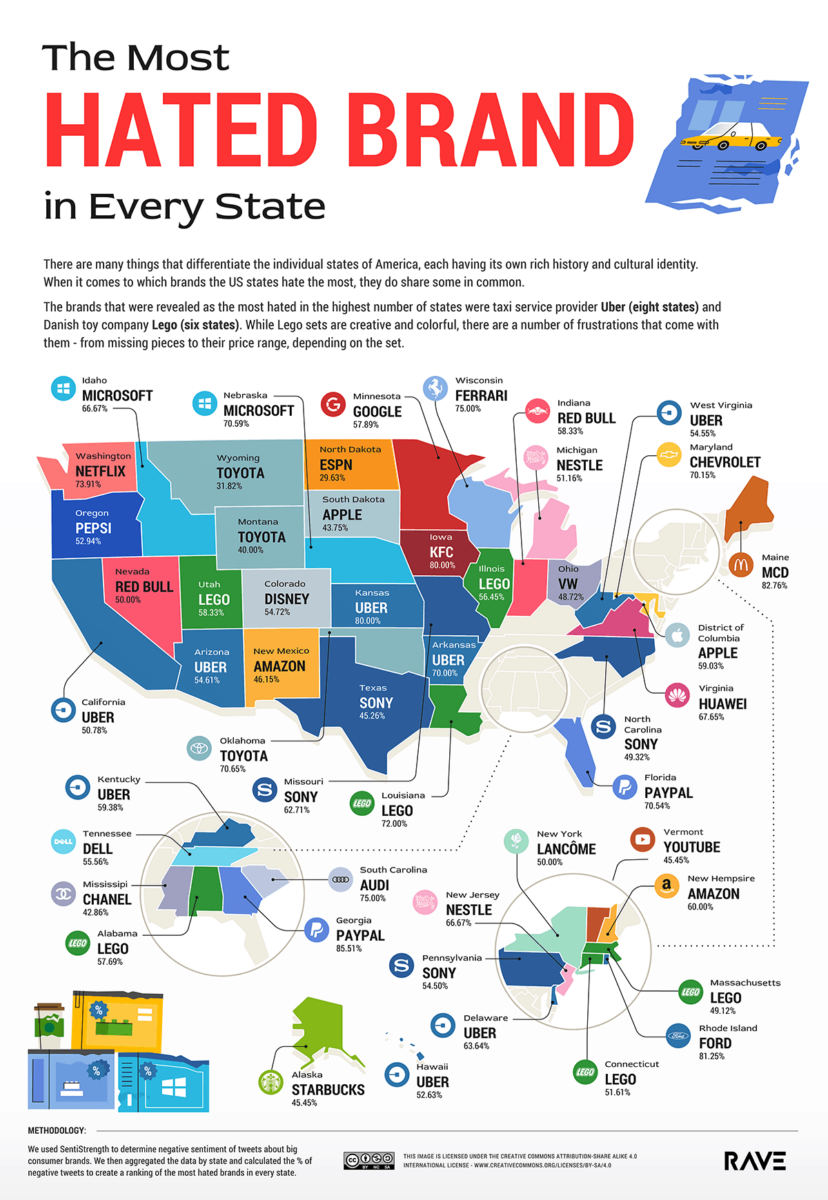

Source: Rave I am somewhat perplexed by this list — I can understand why someone might hate Paypal, Dell or Uber. . ....

Source: Rave I am somewhat perplexed by this list — I can understand why someone might hate Paypal, Dell or Uber. . ....

Read More

Source: Politico It is amazing how much of the daily “News” is useless noise. To wit, the coverage of...

Source: Politico It is amazing how much of the daily “News” is useless noise. To wit, the coverage of...

Read More

To hear an audio spoken word version of this post, click here. What does it mean when markets go long...

To hear an audio spoken word version of this post, click here. What does it mean when markets go long...

Read More

Source: Rave The site Rave also has most hated gaming cos, fast food outlets, tech companies, etc

Source: Rave The site Rave also has most hated gaming cos, fast food outlets, tech companies, etc

Read More

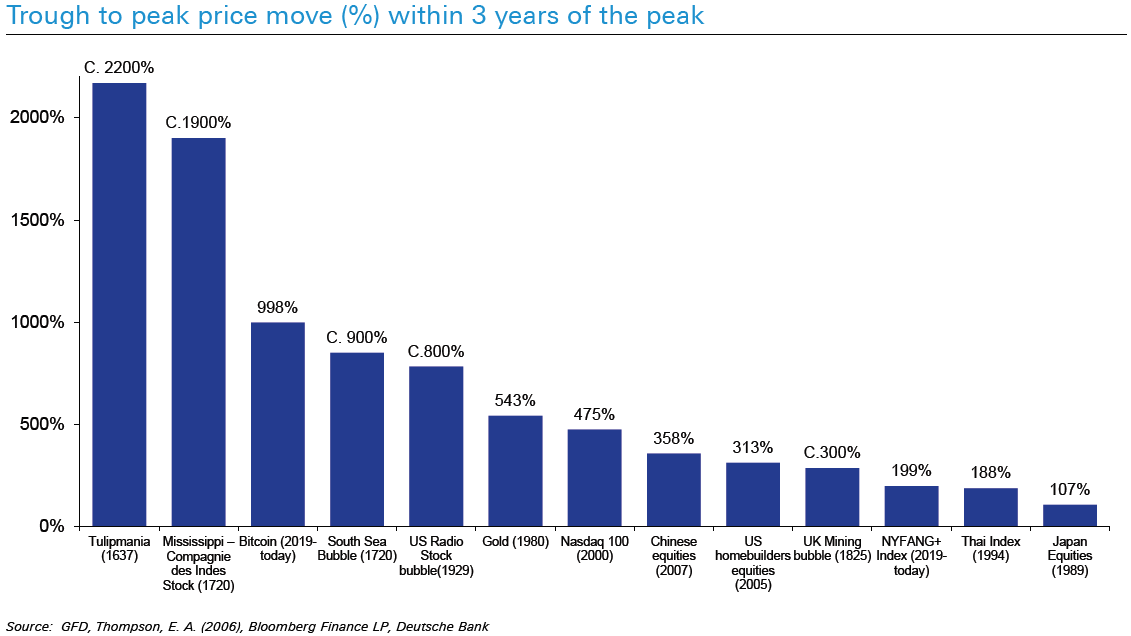

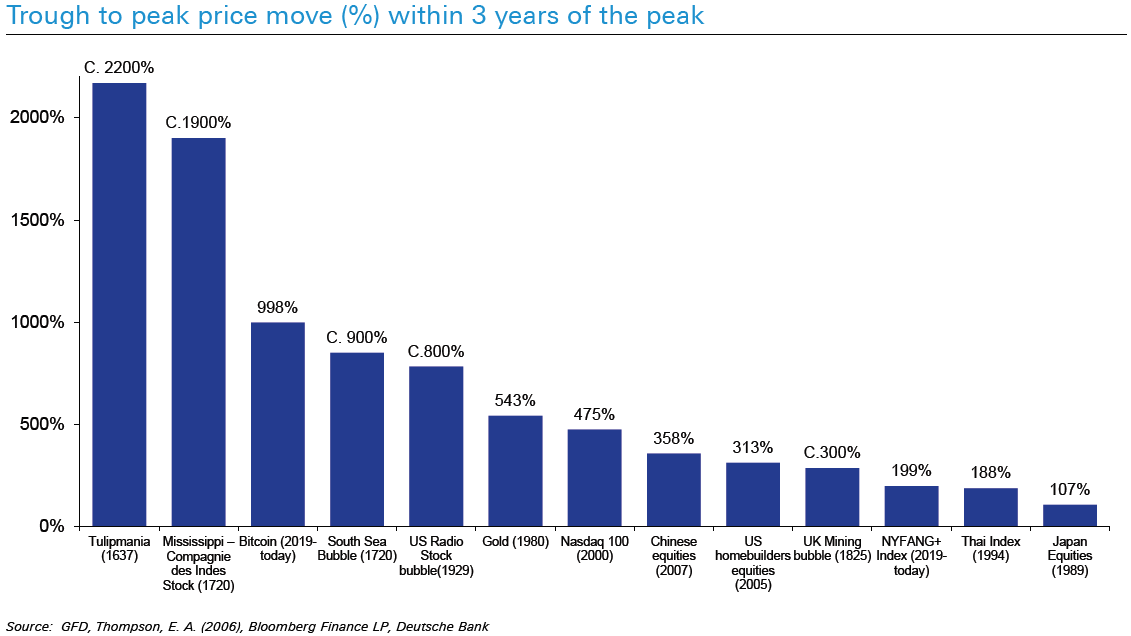

Source: Deutsche Bank I have no real opinion on Bitcoin — I understand the basics of blockchain and mining, but I...

Source: Deutsche Bank I have no real opinion on Bitcoin — I understand the basics of blockchain and mining, but I...

Read More

I have made my views on the folly of forecast and the perils of predictions absolutely clear. (See all of these dating back...

I have made my views on the folly of forecast and the perils of predictions absolutely clear. (See all of these dating back...

Read More

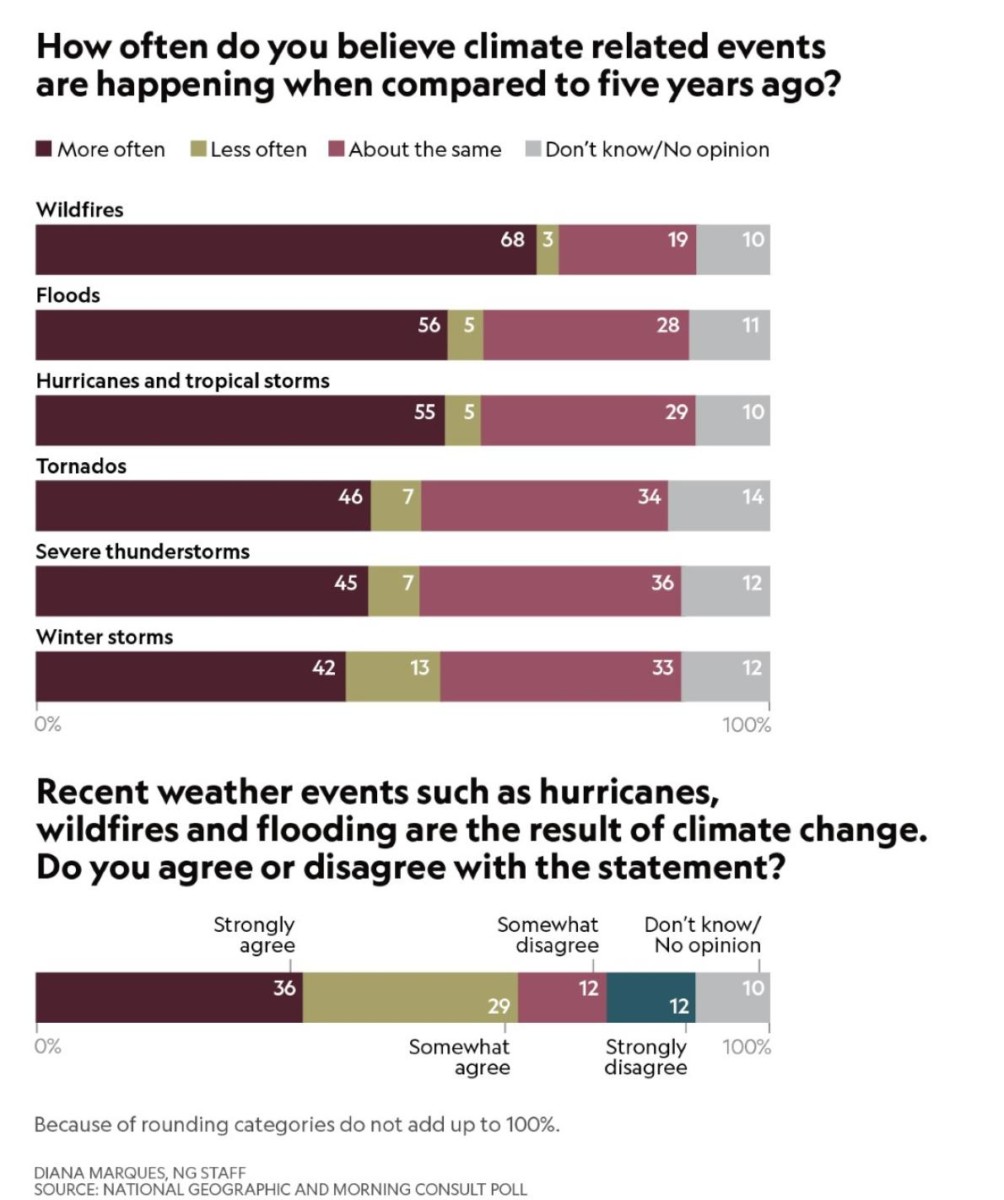

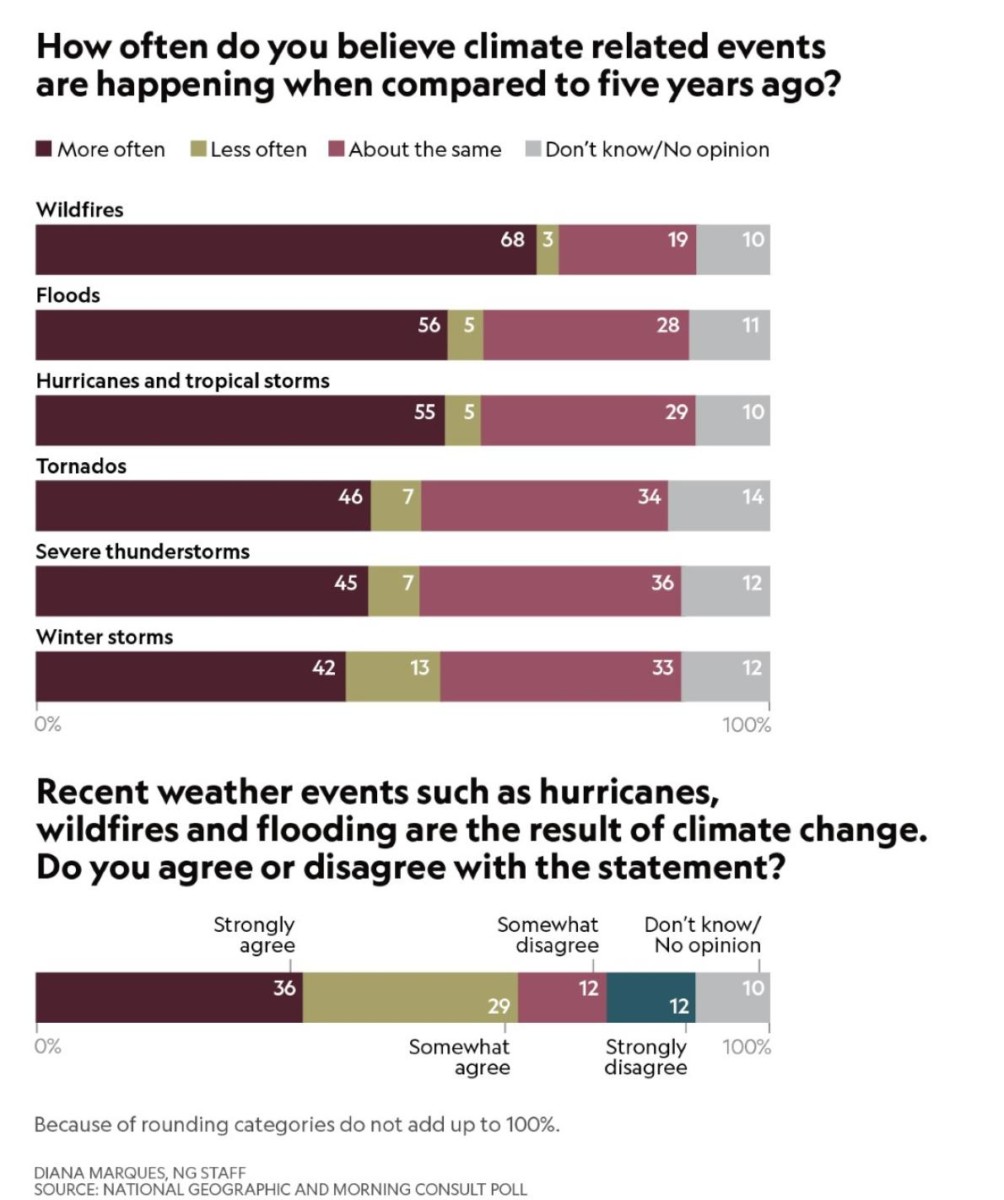

Are Americans seeing more extreme weather? Source: National Geographic Interesting polling from National Geographic:...

Are Americans seeing more extreme weather? Source: National Geographic Interesting polling from National Geographic:...

Read More

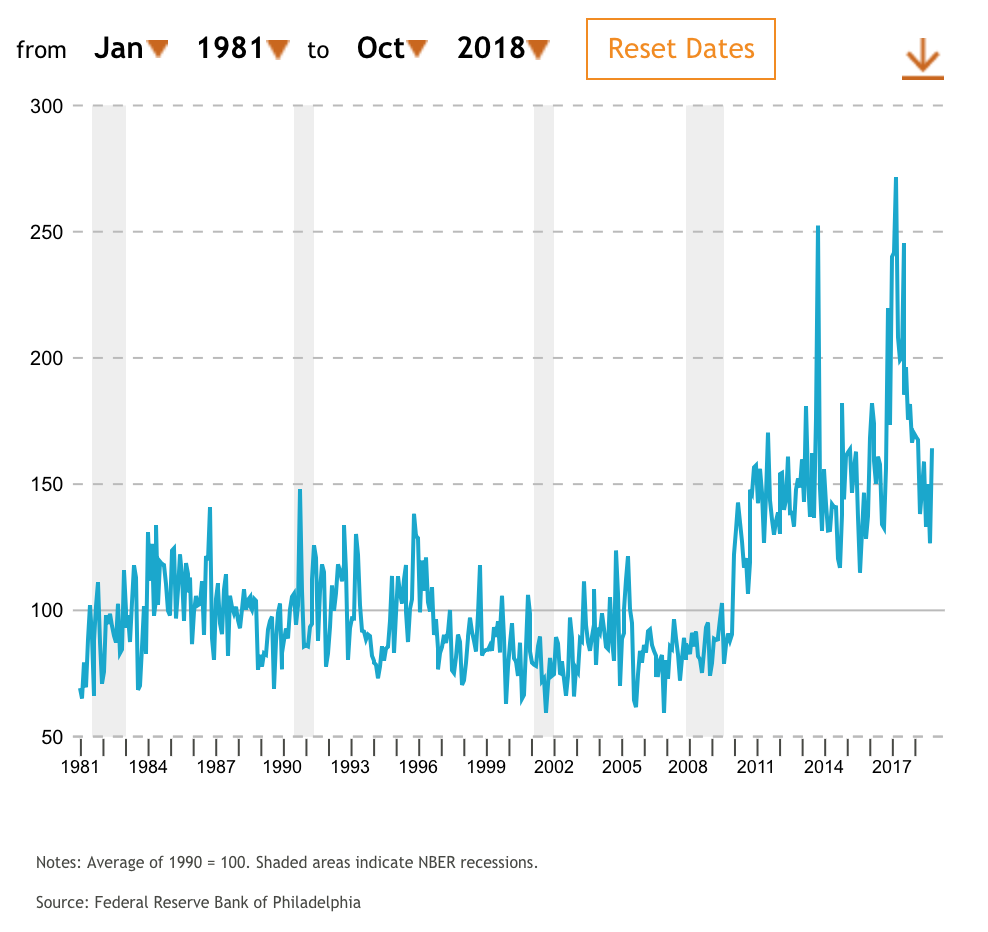

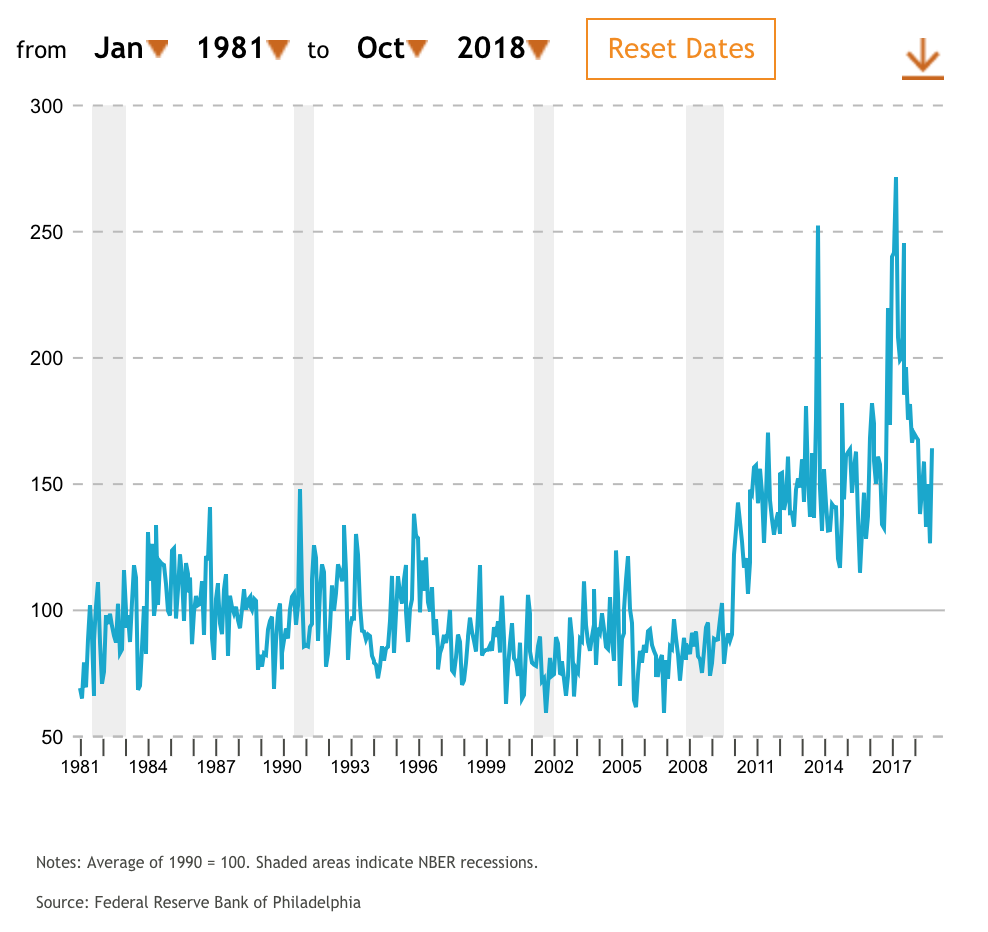

I was reading an NBER paper about the political bias of analysts (more on this later) when I read about the Federal Reserve Bank of...

I was reading an NBER paper about the political bias of analysts (more on this later) when I read about the Federal Reserve Bank of...

Read More

How to Debate Finance Without Being a Jerk A few rules can help prevent financial discussions from becoming as overheated and useless as...

Read More

How to Debate Finance Without Being a Jerk A few rules can help prevent financial discussions from becoming as overheated and useless as...

How to Debate Finance Without Being a Jerk A few rules can help prevent financial discussions from becoming as overheated and useless as...

Read More

Source: Rave I am somewhat perplexed by this list — I can understand why someone might hate Paypal, Dell or Uber. . ....

Source: Rave I am somewhat perplexed by this list — I can understand why someone might hate Paypal, Dell or Uber. . ....

Source: Rave I am somewhat perplexed by this list — I can understand why someone might hate Paypal, Dell or Uber. . ....

Source: Rave I am somewhat perplexed by this list — I can understand why someone might hate Paypal, Dell or Uber. . ....