Frothy!

The post-election rally has taken stock markets to all-time highs. Readers know I am not a fan of making stock-market predictions, but...

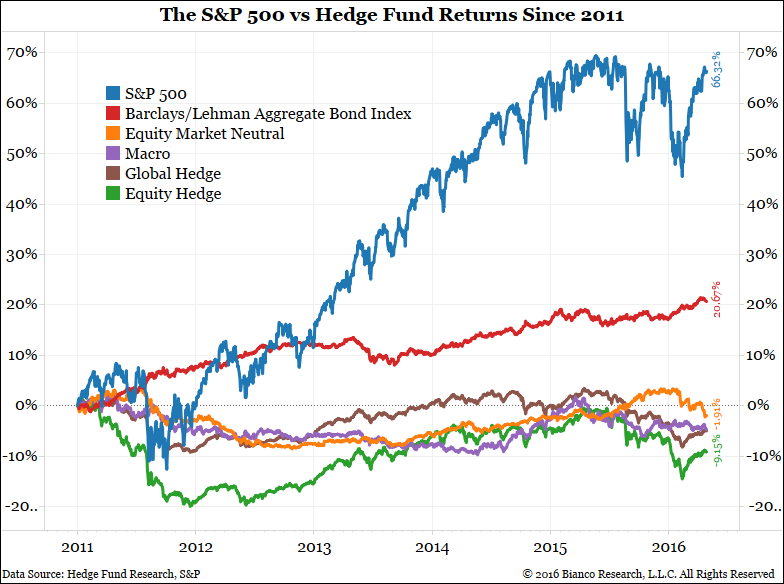

Bullish News From Wall Street’s Bearish Seers When the forecasters say one thing, it’s worth thinking about going in the...

Bullish News From Wall Street’s Bearish Seers When the forecasters say one thing, it’s worth thinking about going in the...

How do people really feel about the economy? Ben S. Bernanke Brookings, June 30, 2016 Note: this was published last month, prior...

How do people really feel about the economy? Ben S. Bernanke Brookings, June 30, 2016 Note: this was published last month, prior...

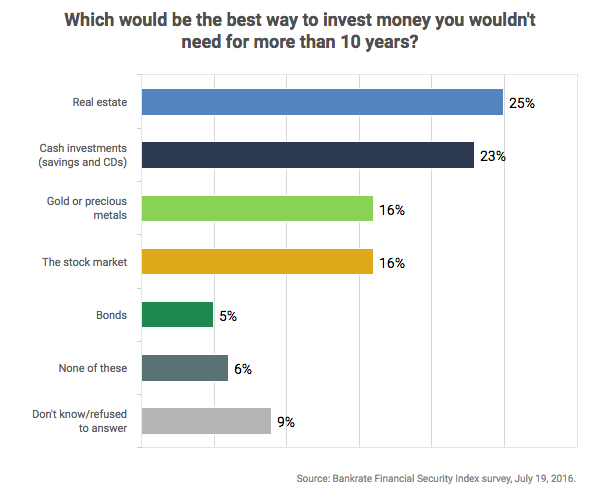

Source: Bankrate It’s the second-longest bull market in history. Stocks are expensive. This is the top. At least, that is what I...

Source: Bankrate It’s the second-longest bull market in history. Stocks are expensive. This is the top. At least, that is what I...

It is never wise to ignore market, economic or voter sentiment. Discount it, yes. Put it into broader context, for sure. But ignore it at...

It is never wise to ignore market, economic or voter sentiment. Discount it, yes. Put it into broader context, for sure. But ignore it at...

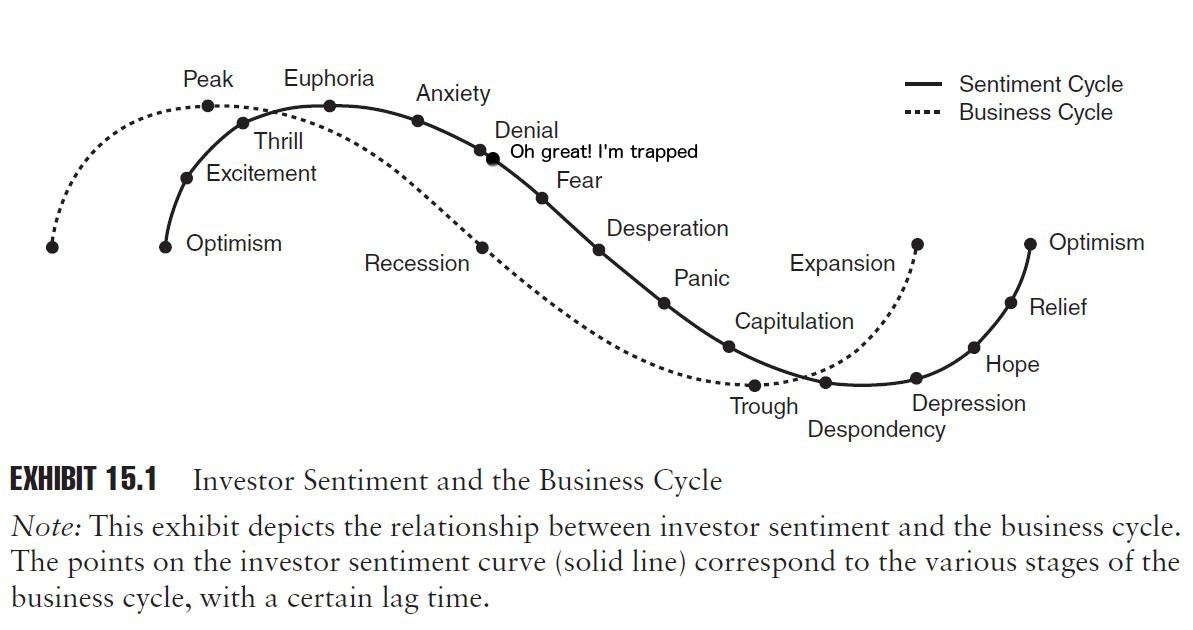

Nice way to show how the investor sentiment cycle lags behind the business cycle, yet manages to follow it . . . Source: Dunno...

Nice way to show how the investor sentiment cycle lags behind the business cycle, yet manages to follow it . . . Source: Dunno...

This is an interesting cover from a sentiment perspective, although its not much of a surprise that the Bulls are still bullish.

This is an interesting cover from a sentiment perspective, although its not much of a surprise that the Bulls are still bullish.

Get subscriber-only insights and news delivered by Barry every two weeks.