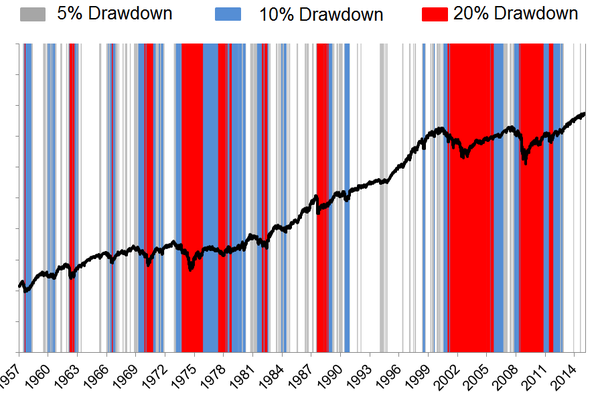

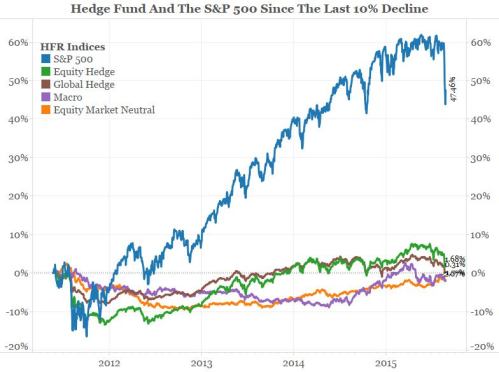

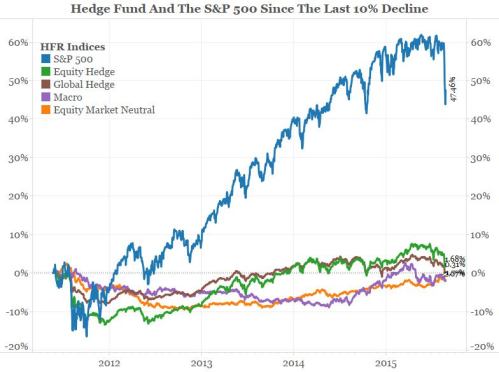

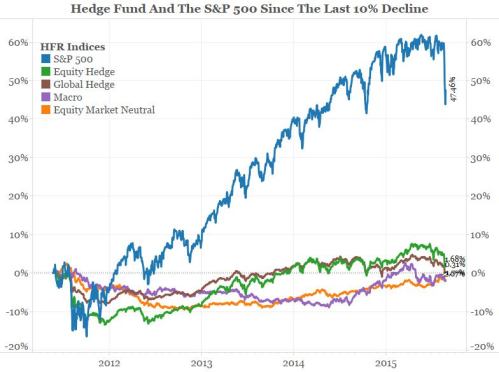

Source: Bianco Research “Its enough to give a long-term investor some hope for the future of finance.” Here’s...

Source: Bianco Research “Its enough to give a long-term investor some hope for the future of finance.” Here’s...

Read More

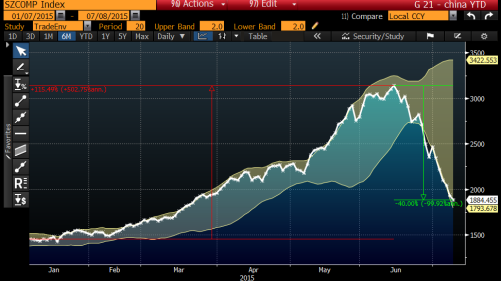

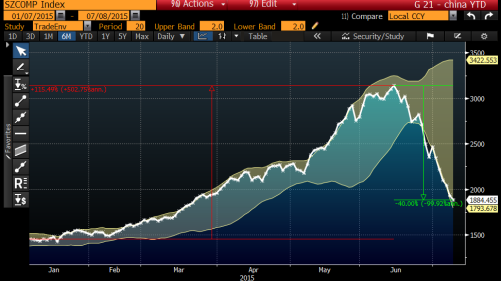

China’s markets set the tone for the day (and perhaps the week) with an 8.5 percent blood-letting. Global stocks followed suit, which...

China’s markets set the tone for the day (and perhaps the week) with an 8.5 percent blood-letting. Global stocks followed suit, which...

Read More

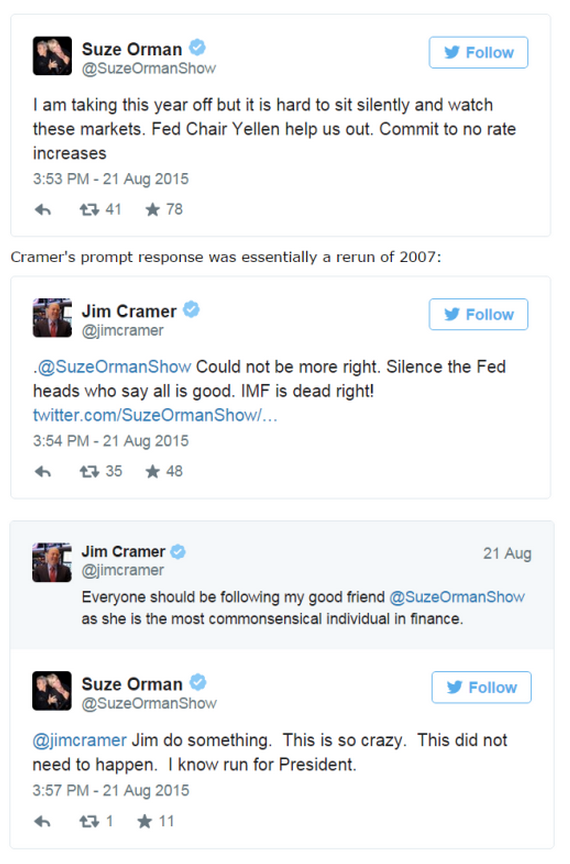

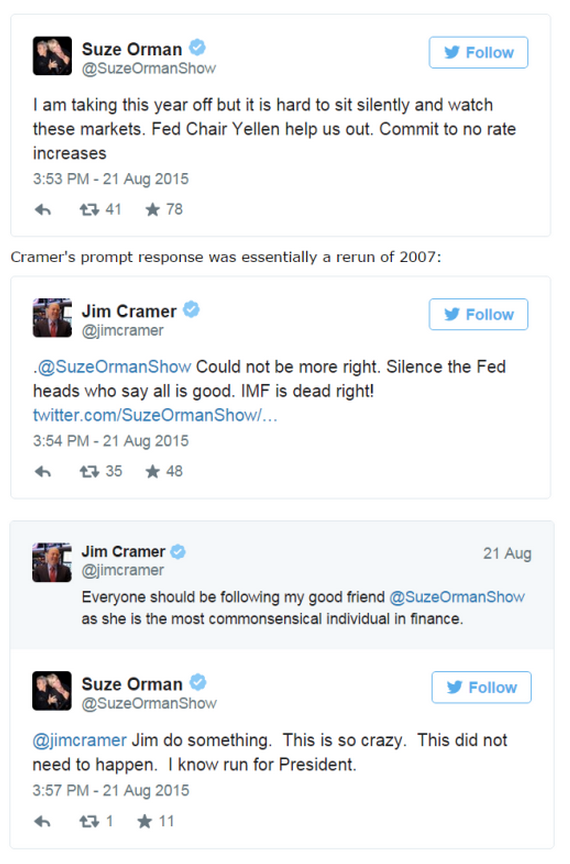

I am reminded how utterly worthless as a market observer/financial adviser Suze Orman is in this series of tweets. Its simply amazing how...

I am reminded how utterly worthless as a market observer/financial adviser Suze Orman is in this series of tweets. Its simply amazing how...

Read More

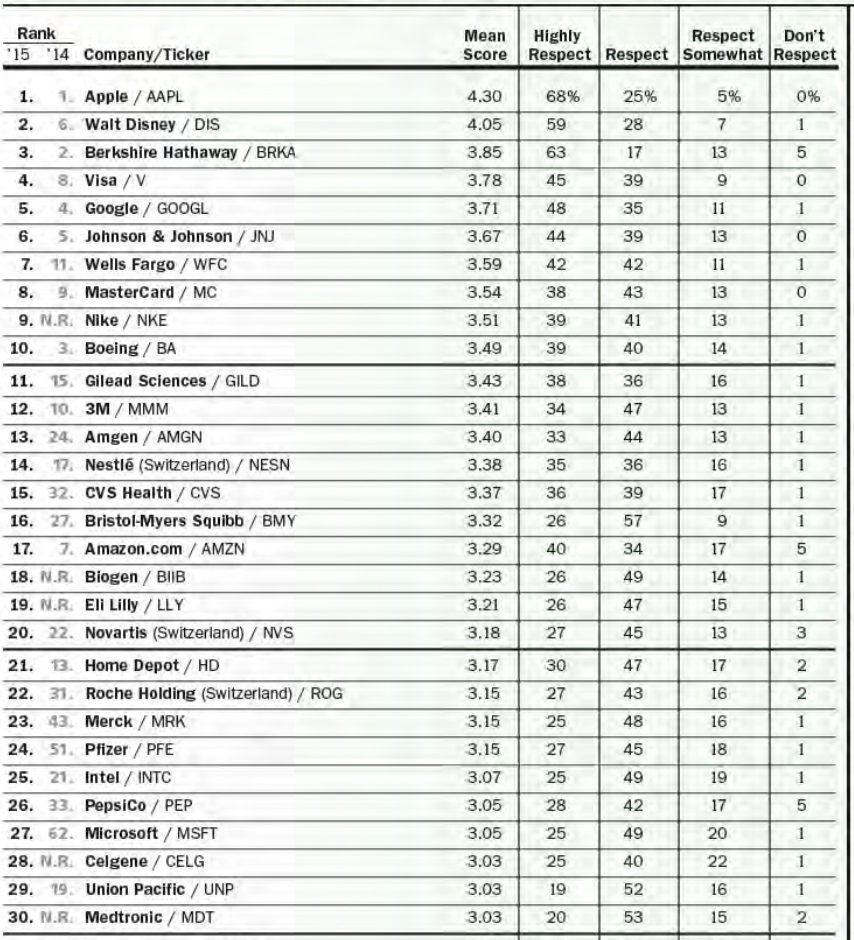

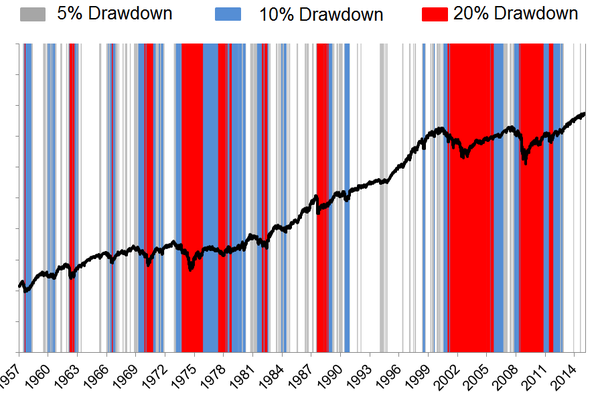

Click for ginormous chart A market, by definition, is a place where buyers and sellers can come together to exchange goods and services....

Click for ginormous chart A market, by definition, is a place where buyers and sellers can come together to exchange goods and services....

Read More

A message from the Supply Lord of The Afterscape. Apocalypse Dow Hat tip WSJ

Read More

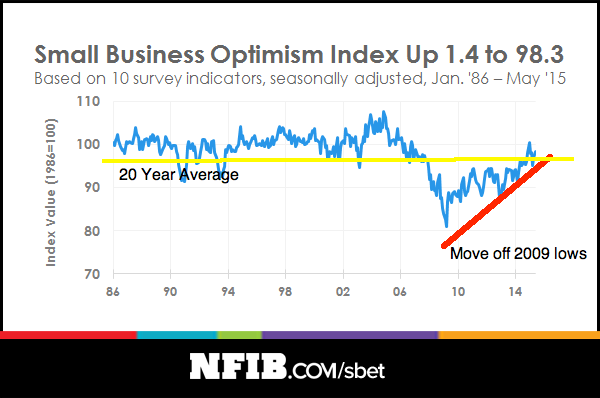

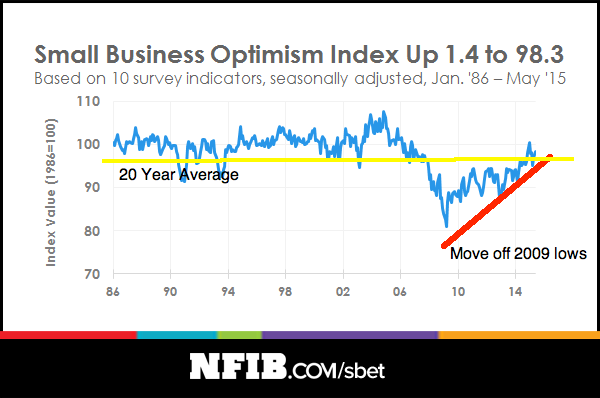

Small business sentiment readings are now over their 20 year average, and have moved steadily higher since the crisis ended in 2009. If...

Small business sentiment readings are now over their 20 year average, and have moved steadily higher since the crisis ended in 2009. If...

Read More

click for ginormous chart Source: Bloomberg On this day 53 years ago, Wall Street had one of its worst sessions ever. As the Wall Street...

click for ginormous chart Source: Bloomberg On this day 53 years ago, Wall Street had one of its worst sessions ever. As the Wall Street...

Read More

Does Picasso Sale Signal a Top for Stocks? Art auction records say more about billionaires than markets. Bloomberg, May 12, 2015 ...

Read More

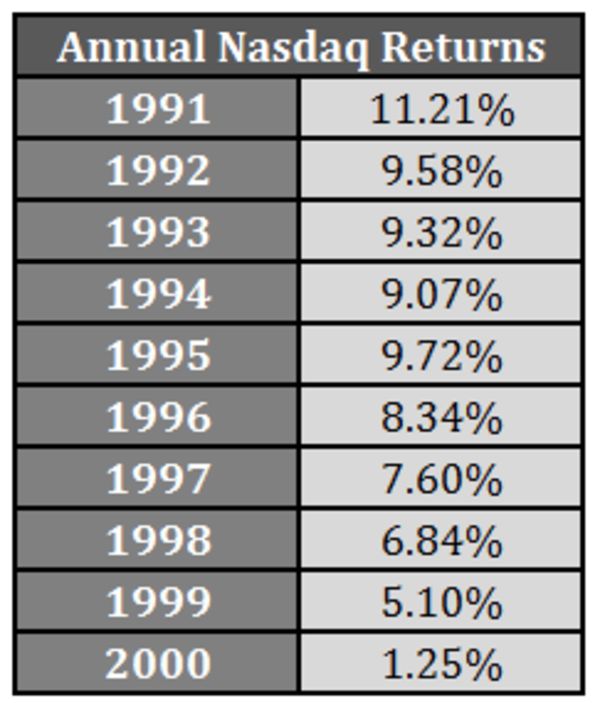

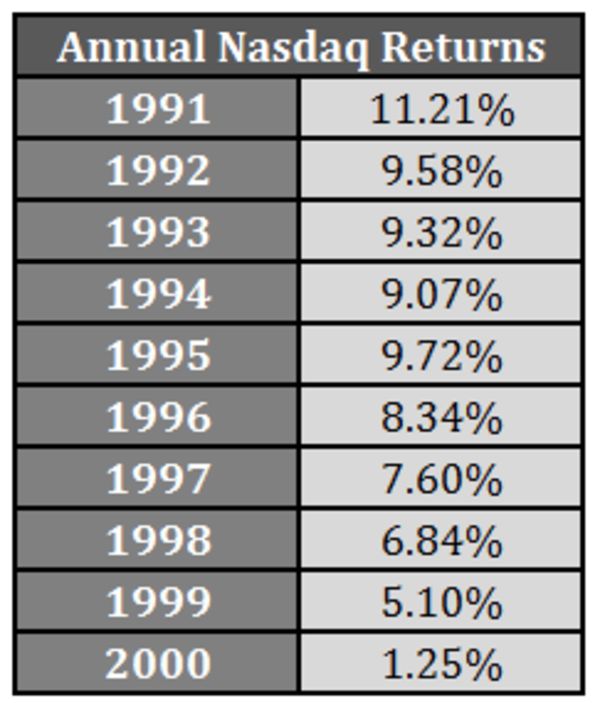

How a Bubble Steals From the Future It can take years to recover from the frenzy. Bloomberg, April 24, 2015 ...

How a Bubble Steals From the Future It can take years to recover from the frenzy. Bloomberg, April 24, 2015 ...

Read More

Source: Bianco Research “Its enough to give a long-term investor some hope for the future of finance.” Here’s...

Source: Bianco Research “Its enough to give a long-term investor some hope for the future of finance.” Here’s...

Source: Bianco Research “Its enough to give a long-term investor some hope for the future of finance.” Here’s...

Source: Bianco Research “Its enough to give a long-term investor some hope for the future of finance.” Here’s...