Fannie Mae’s fuzzy math: Fortune magazine reported that the lender changed the way it discloses bad loans, which could be masking...

Fannie Mae’s fuzzy math: Fortune magazine reported that the lender changed the way it discloses bad loans, which could be masking...

Read More

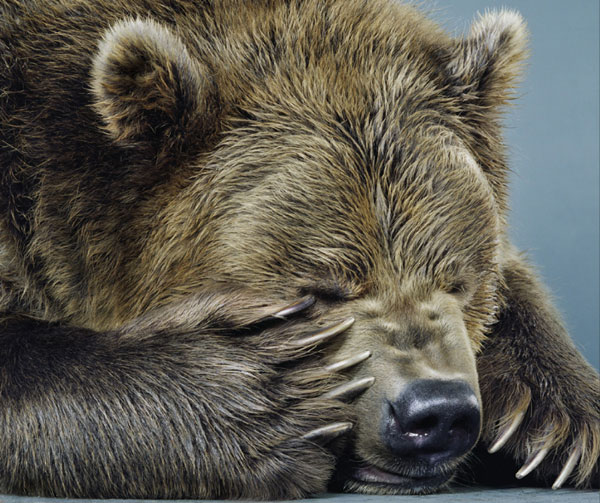

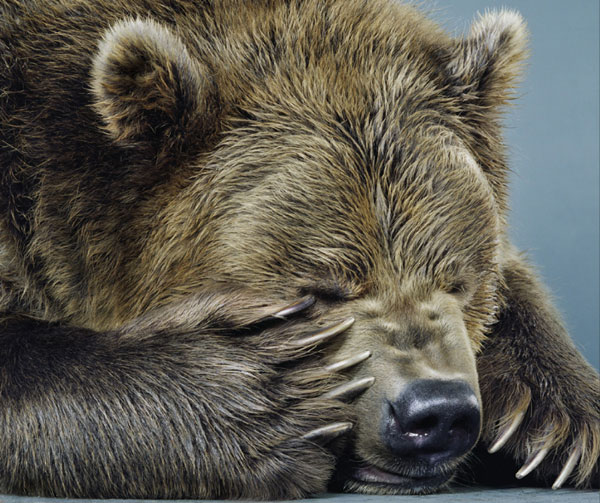

Chelsea Art Galleries in New York is showing a photography exhibit by Jill Greenberg called Ursine. It is, as you might expect, a show of...

Chelsea Art Galleries in New York is showing a photography exhibit by Jill Greenberg called Ursine. It is, as you might expect, a show of...

Read More

Over the years, I have been made the case that the U.S. economy is growing ever more slowly, while the rest of the world was...

Over the years, I have been made the case that the U.S. economy is growing ever more slowly, while the rest of the world was...

Read More

I am up in Maine this weekend at Leen’s Lodge, courtesy of David Kotok’s annual economic summit/fly fishing event....

Read More

There is a fascinating article in today’s WSJ about a contentious valuation debate: Homebuilders judged by their book value. What...

There is a fascinating article in today’s WSJ about a contentious valuation debate: Homebuilders judged by their book value. What...

Read More

I love when two articles covering the exact same topic reach directly opposed conclusions. Typically, its not a case that one is wrong...

Read More

NYSE Short Selling rose to yet another high. For the monthly period ended May 15, short interest on the NYSE rose 7% from mid-April....

NYSE Short Selling rose to yet another high. For the monthly period ended May 15, short interest on the NYSE rose 7% from mid-April....

Read More

No wonder China’s 4.5% correction had so little impact here: There are a record number of bearish bets made on the NYSE. We had...

Read More

Yesterday’s conversation about Margin leads us to today’s headline: Bears’ Bets Fall on the NYSE....

Read More

Fannie Mae’s fuzzy math: Fortune magazine reported that the lender changed the way it discloses bad loans, which could be masking...

Fannie Mae’s fuzzy math: Fortune magazine reported that the lender changed the way it discloses bad loans, which could be masking...

Fannie Mae’s fuzzy math: Fortune magazine reported that the lender changed the way it discloses bad loans, which could be masking...

Fannie Mae’s fuzzy math: Fortune magazine reported that the lender changed the way it discloses bad loans, which could be masking...