Cap Gains + Elimination of Carried Interest on the 1%

So we got a little lucky yesterday, noting that more income taxes were coming for the 1% and that the carried interest tax loophole was...

Update, April 29, 2021: This turned out to be more correct than I would have guessed, with a few of these assumptions...

Update, April 29, 2021: This turned out to be more correct than I would have guessed, with a few of these assumptions...

A massive shift is occurring in the labor market today, one that has been misinterpreted by economists of all stripes: On...

A massive shift is occurring in the labor market today, one that has been misinterpreted by economists of all stripes: On...

Year-End Portfolio Tweaks for an Unusual Year What not to do with your investments and taxes is just as important as what to do....

Year-End Portfolio Tweaks for an Unusual Year What not to do with your investments and taxes is just as important as what to do....

Year-End Portfolio Tweaks for an Unusual Year What not to do with your investments and taxes is just as important as what to do....

Year-End Portfolio Tweaks for an Unusual Year What not to do with your investments and taxes is just as important as what to do....

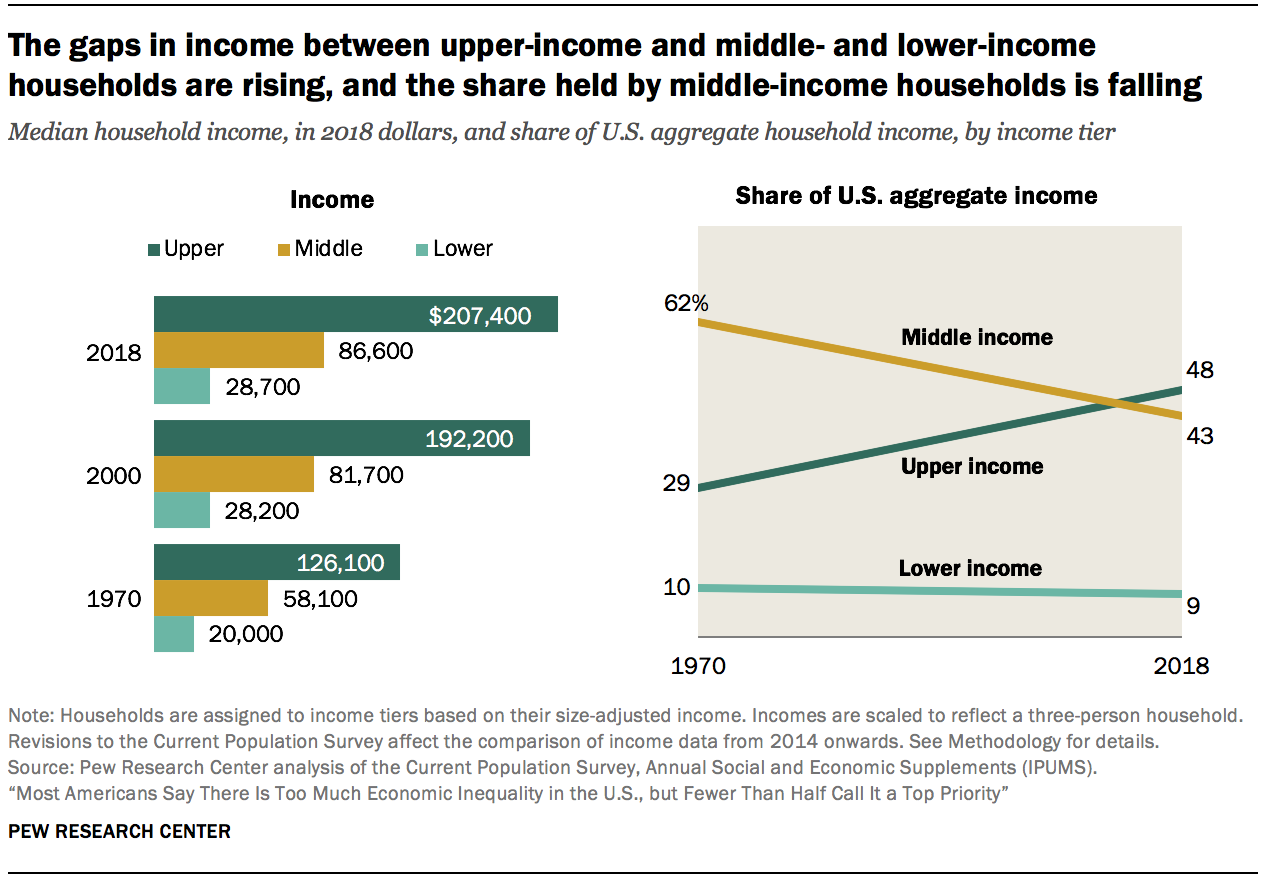

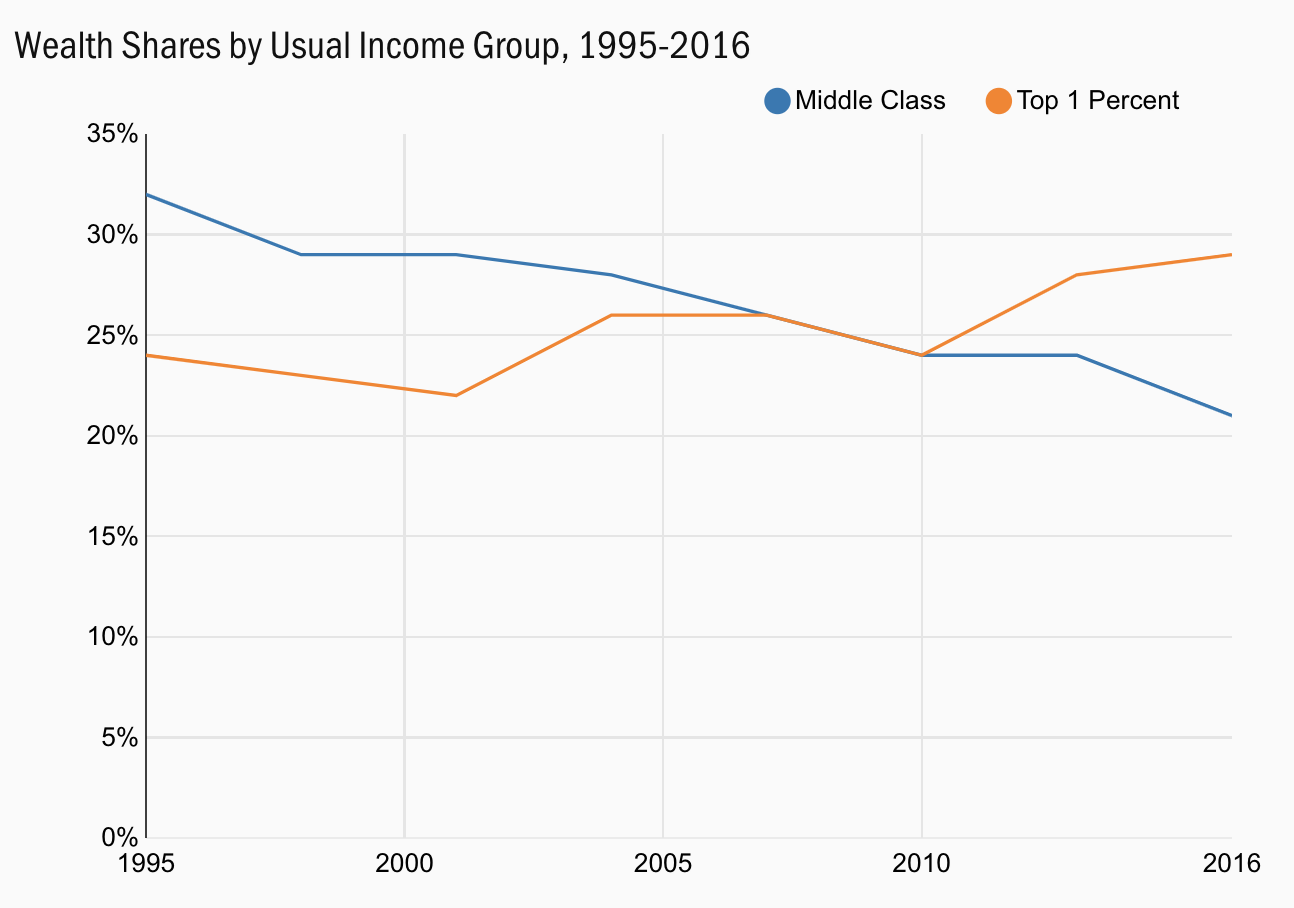

Middle Class Now Holds Less Wealth than Top 1 Percent Note: Income groups are defined by usual income, a measure of family income where...

Middle Class Now Holds Less Wealth than Top 1 Percent Note: Income groups are defined by usual income, a measure of family income where...

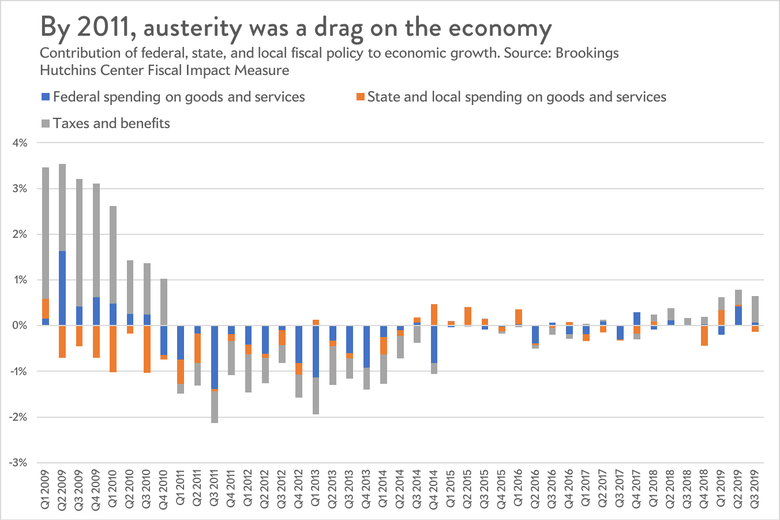

The 2010s Were an Economic Tragedy Source: Slate A regular source of fascination for me is trying to suss out causative...

The 2010s Were an Economic Tragedy Source: Slate A regular source of fascination for me is trying to suss out causative...

Get subscriber-only insights and news delivered by Barry every two weeks.