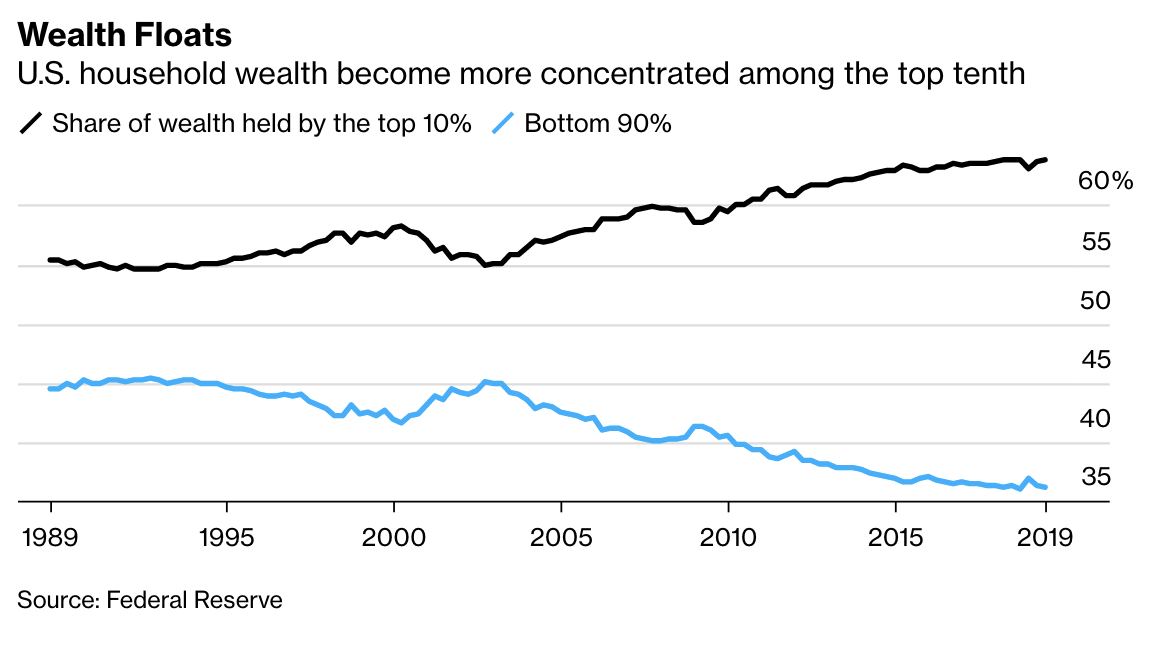

Richest 1% of Americans Close to Surpassing Wealth of Middle Class Earlier this year, we looked at a new series of data...

Richest 1% of Americans Close to Surpassing Wealth of Middle Class Earlier this year, we looked at a new series of data...

Read More

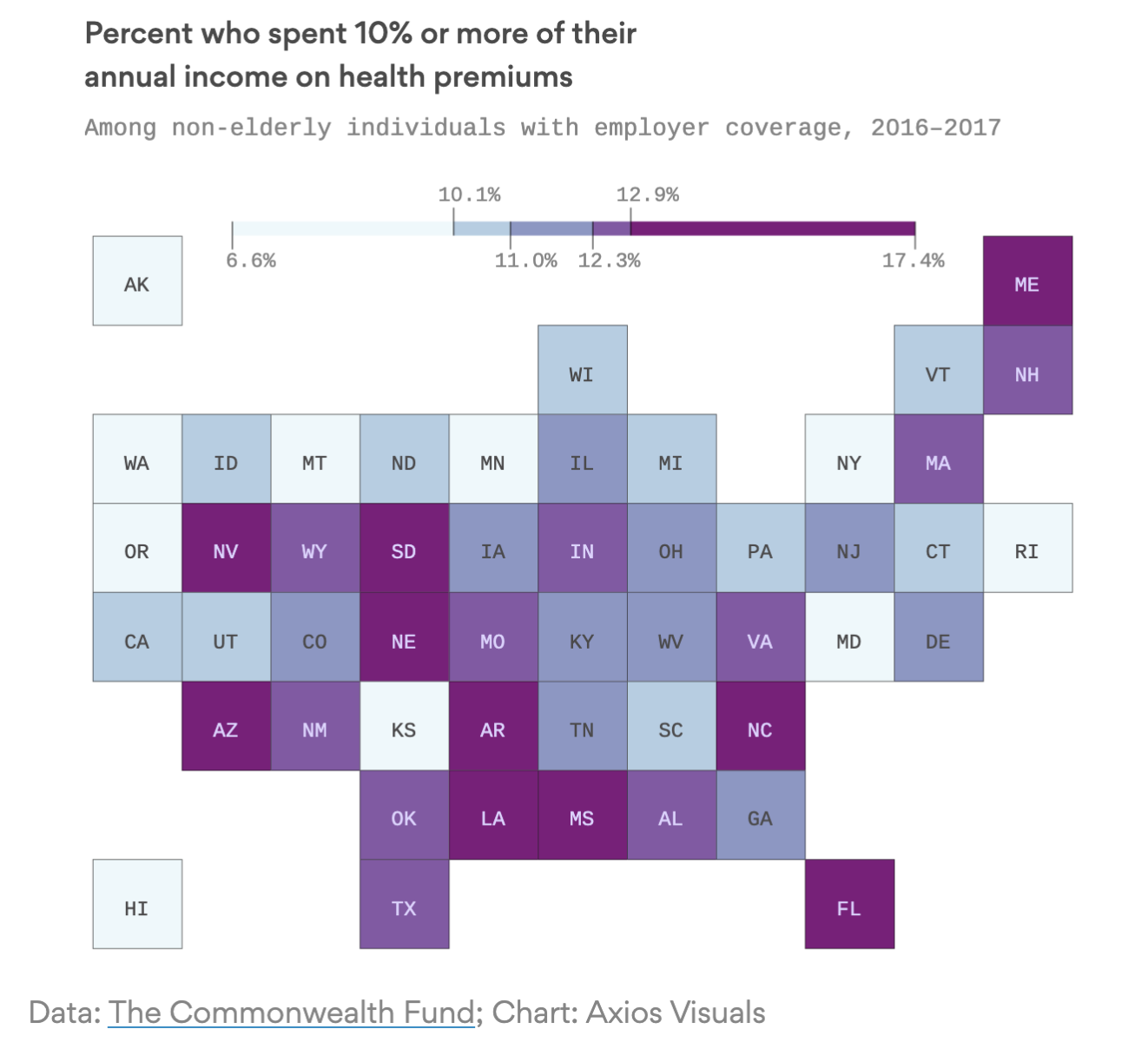

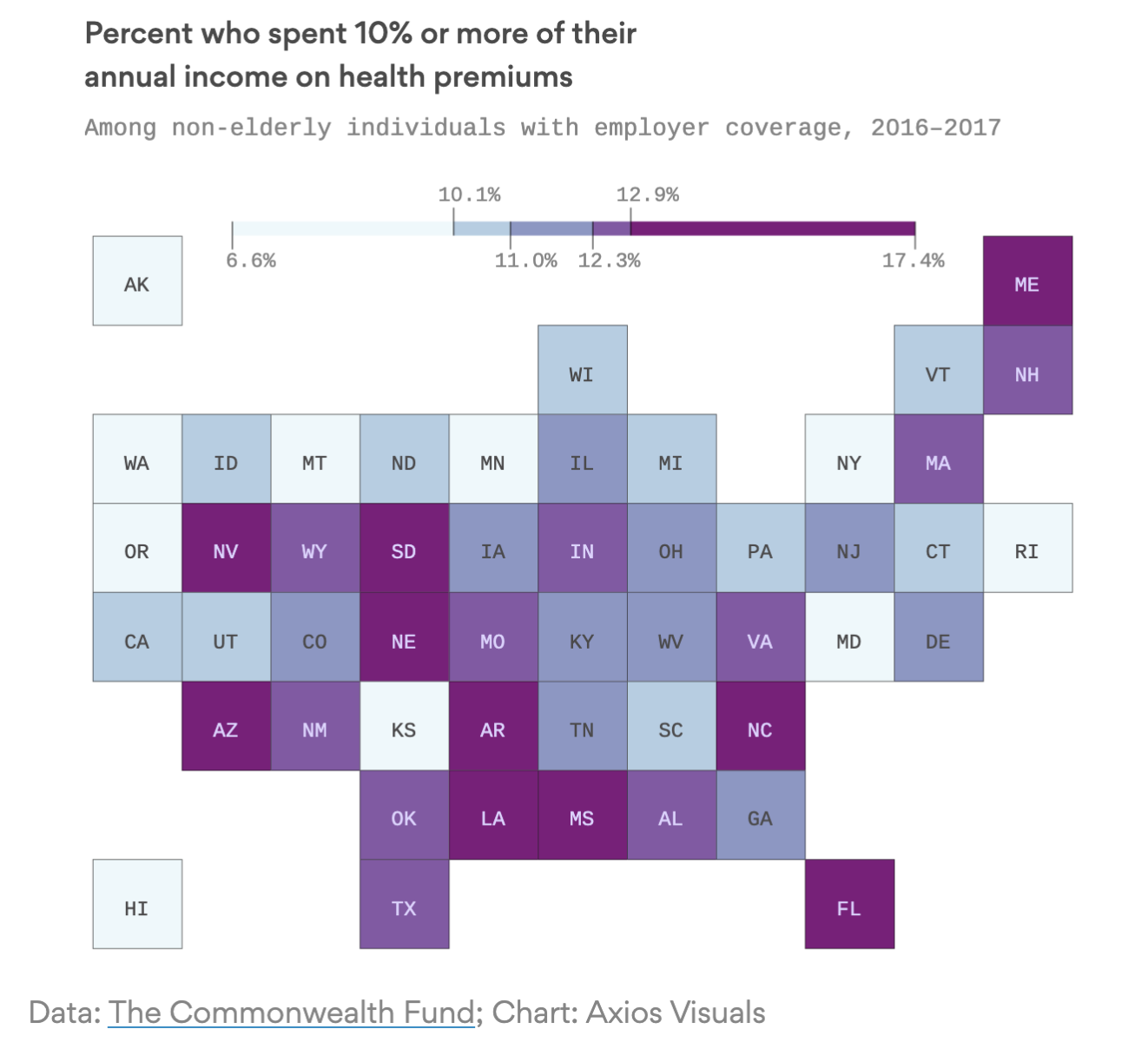

Where Premiums for employer insurance is more than 10% of incomes. Source: Axios Yesterday I mentioned the 10 most...

Where Premiums for employer insurance is more than 10% of incomes. Source: Axios Yesterday I mentioned the 10 most...

Read More

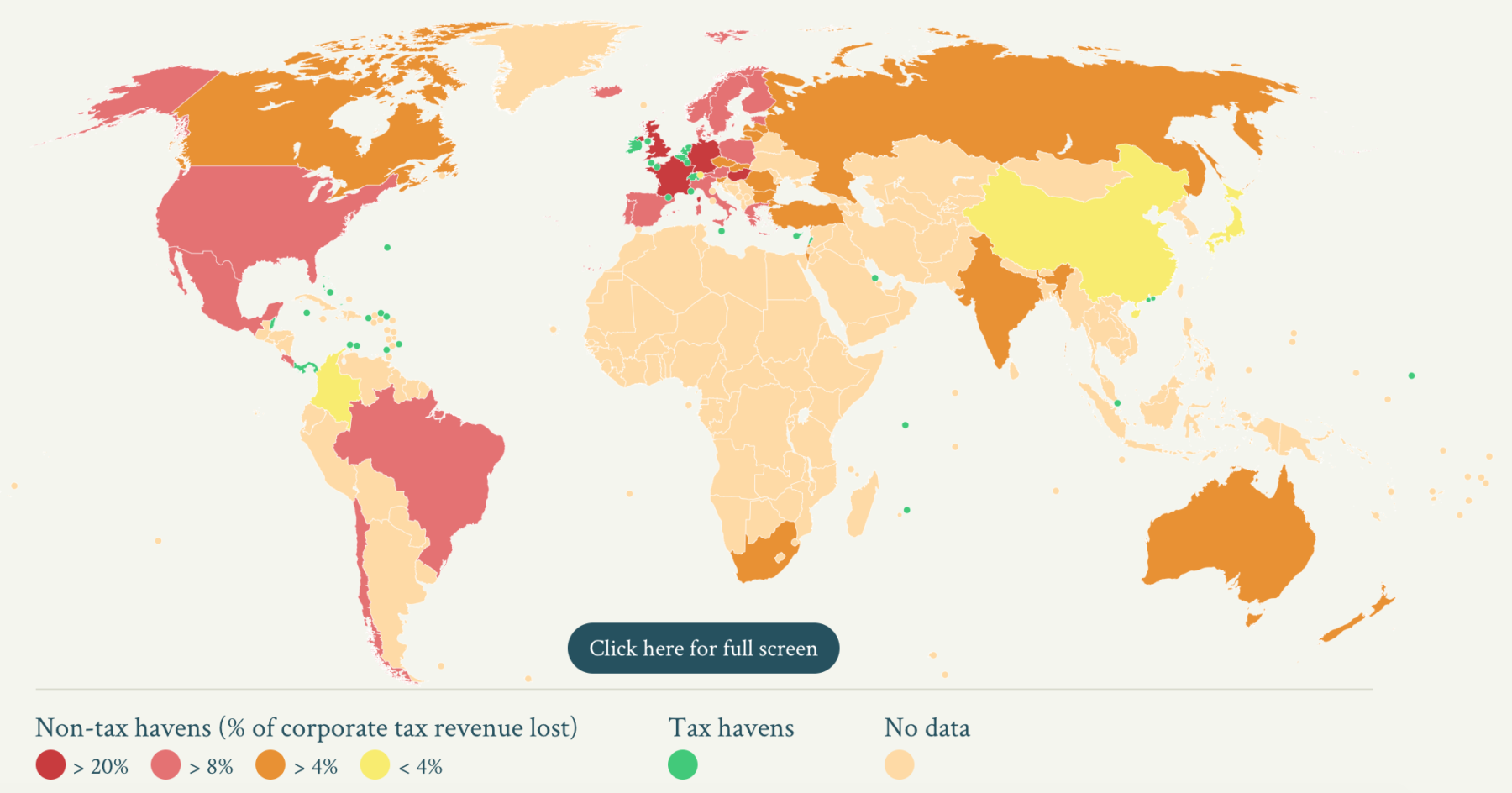

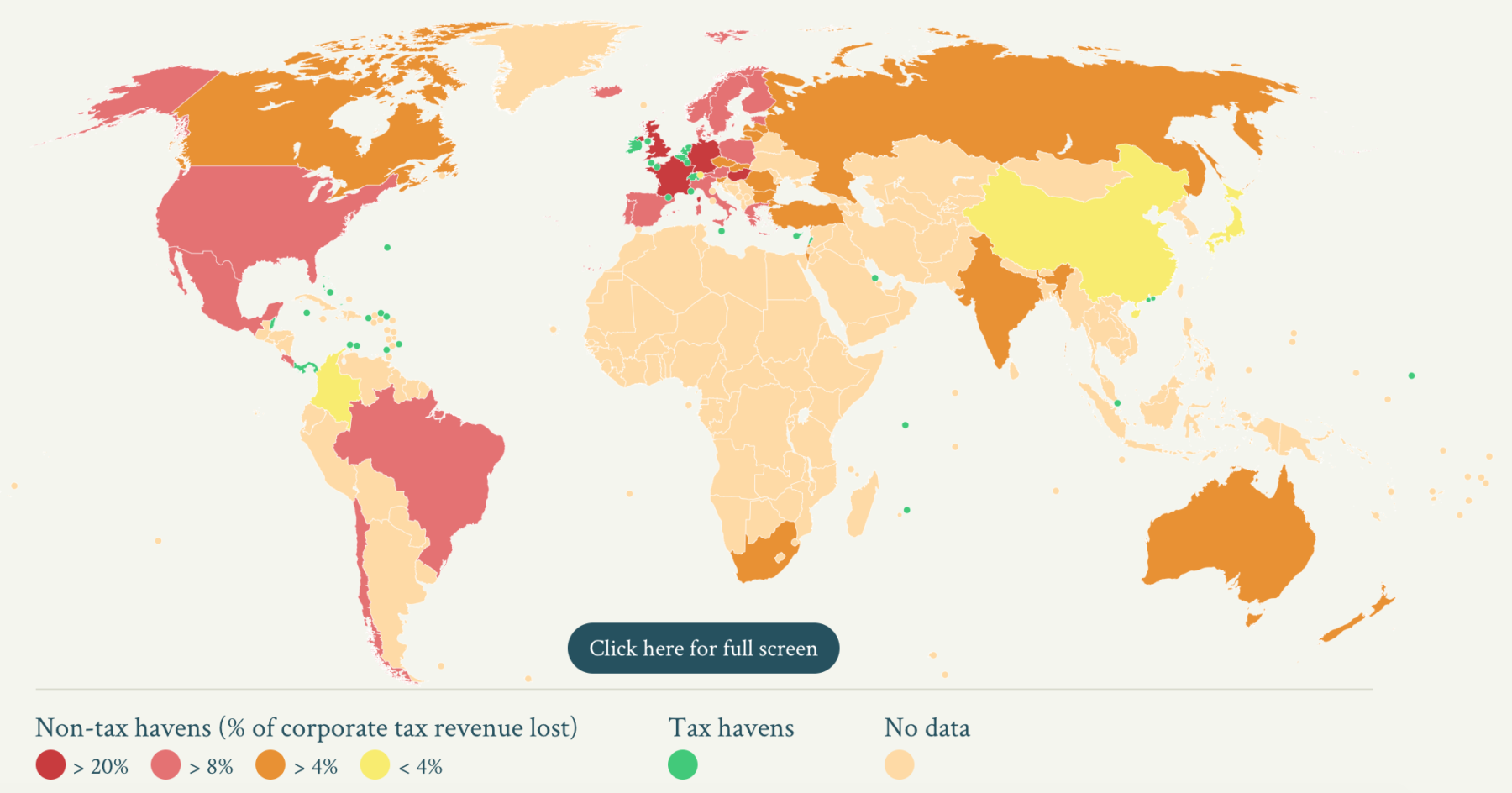

40% of multinational profits are shifted to tax havens each year Source: Missing Profits Globally, about $650 billion in profits...

40% of multinational profits are shifted to tax havens each year Source: Missing Profits Globally, about $650 billion in profits...

Read More

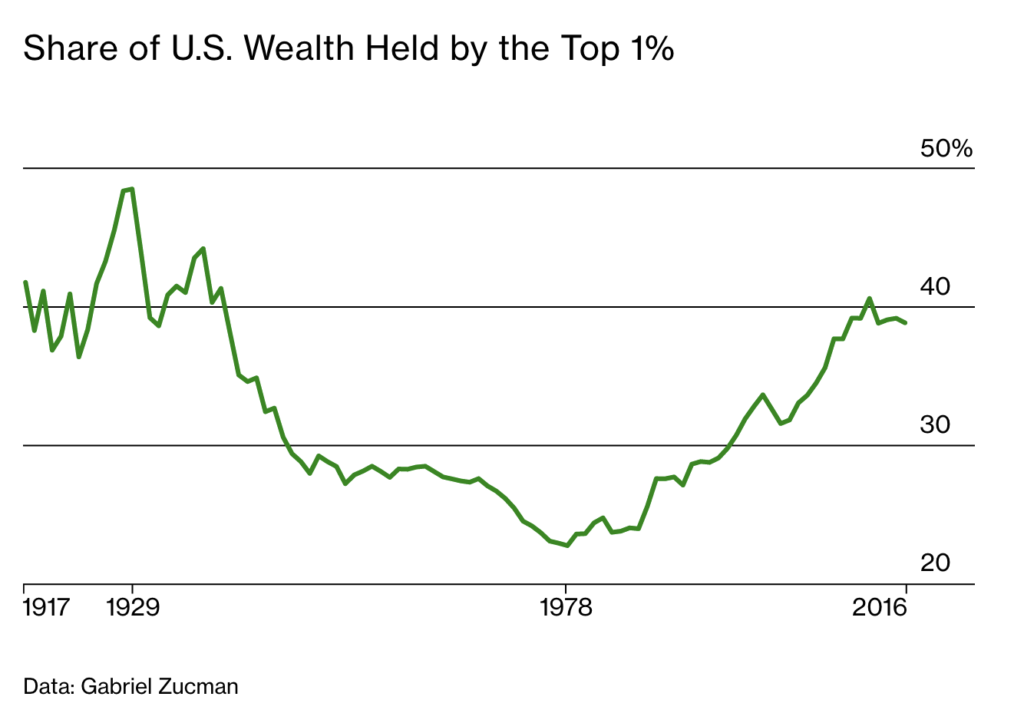

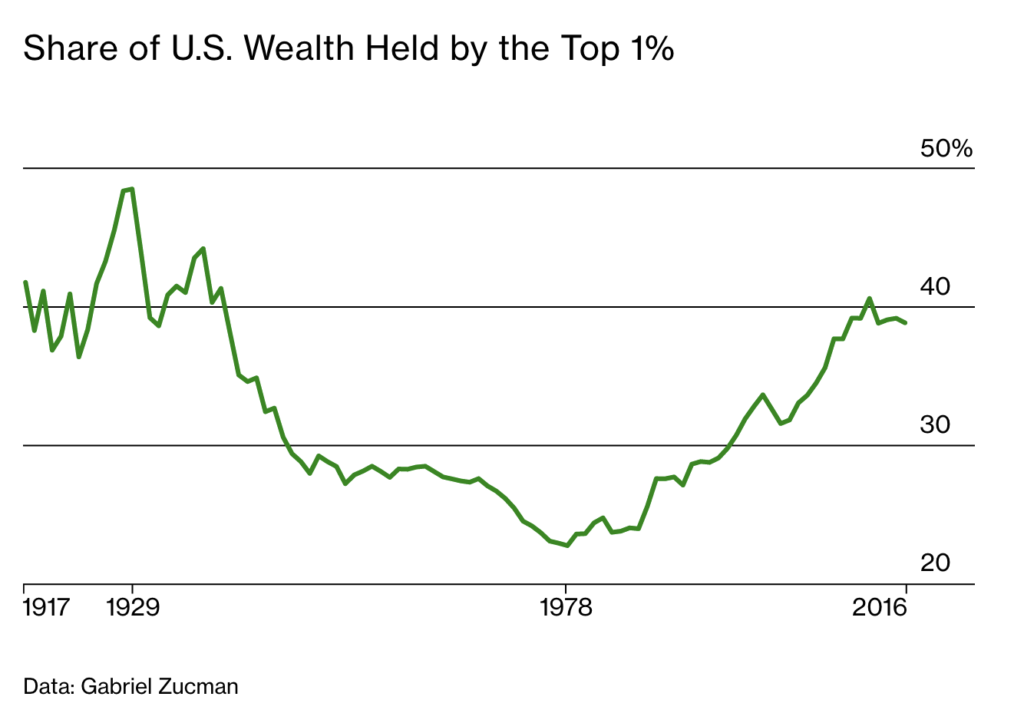

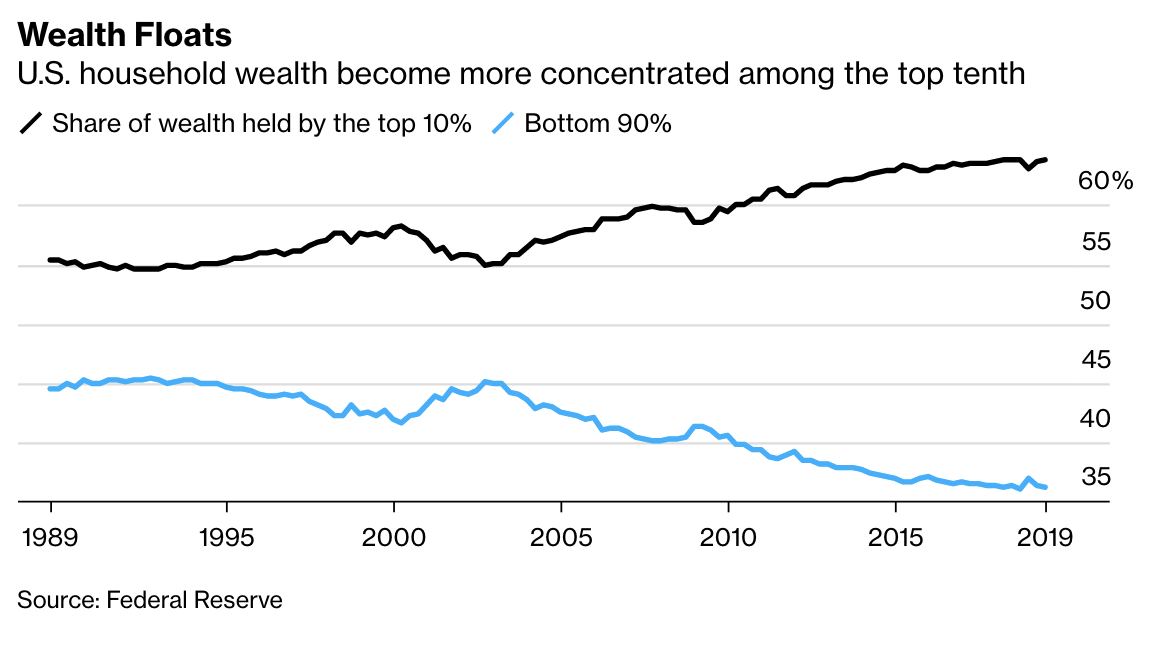

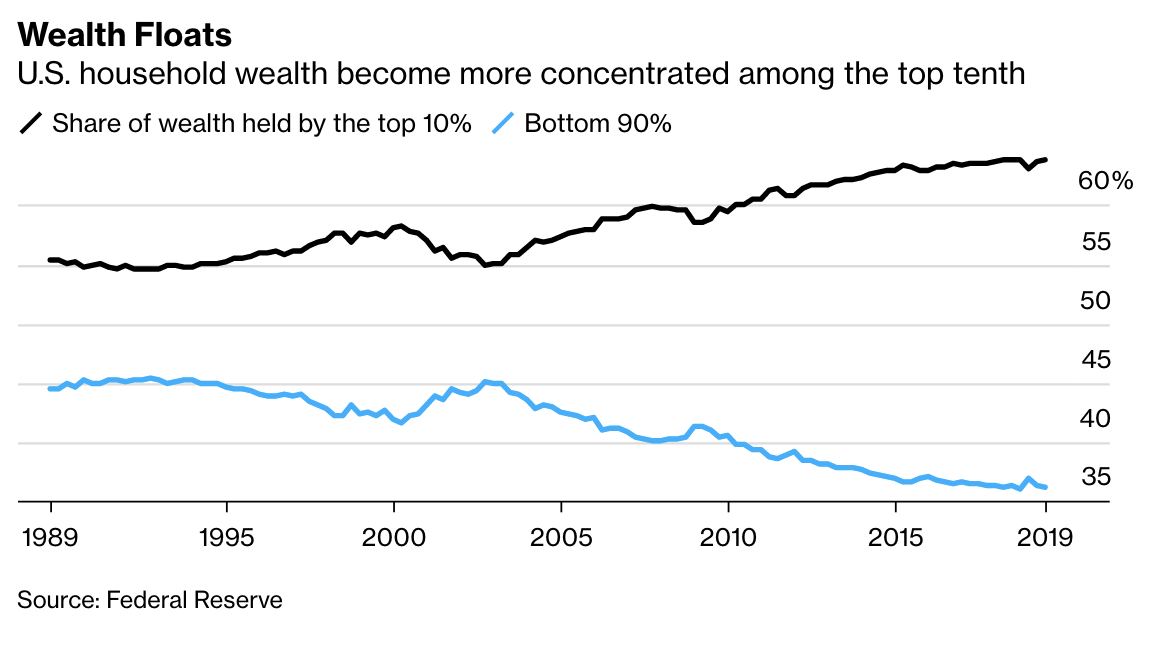

This data series is simply astonishing: The top 0.1% of taxpayers (170,000 families) control 20% of American wealth, the highest share...

This data series is simply astonishing: The top 0.1% of taxpayers (170,000 families) control 20% of American wealth, the highest share...

Read More

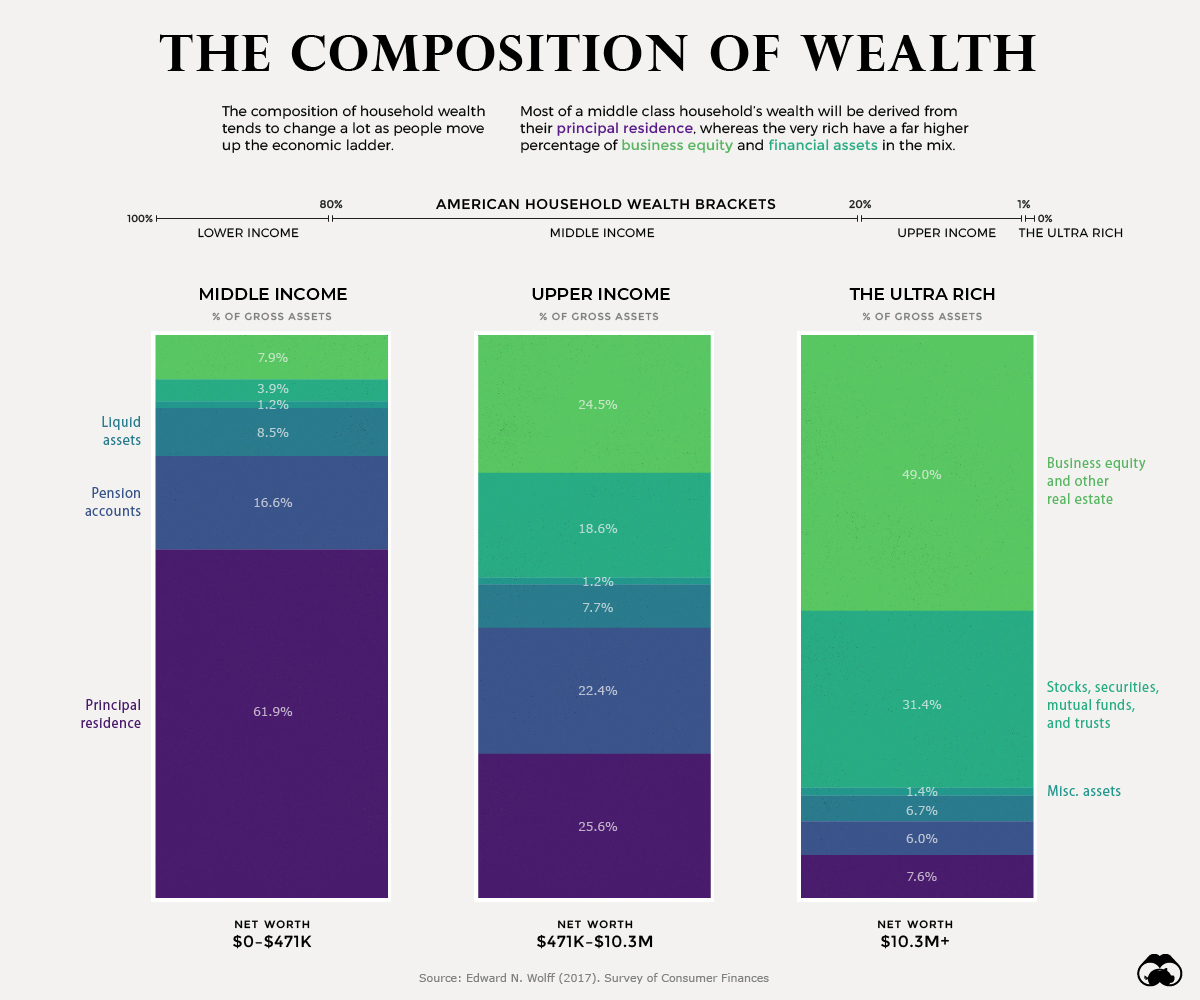

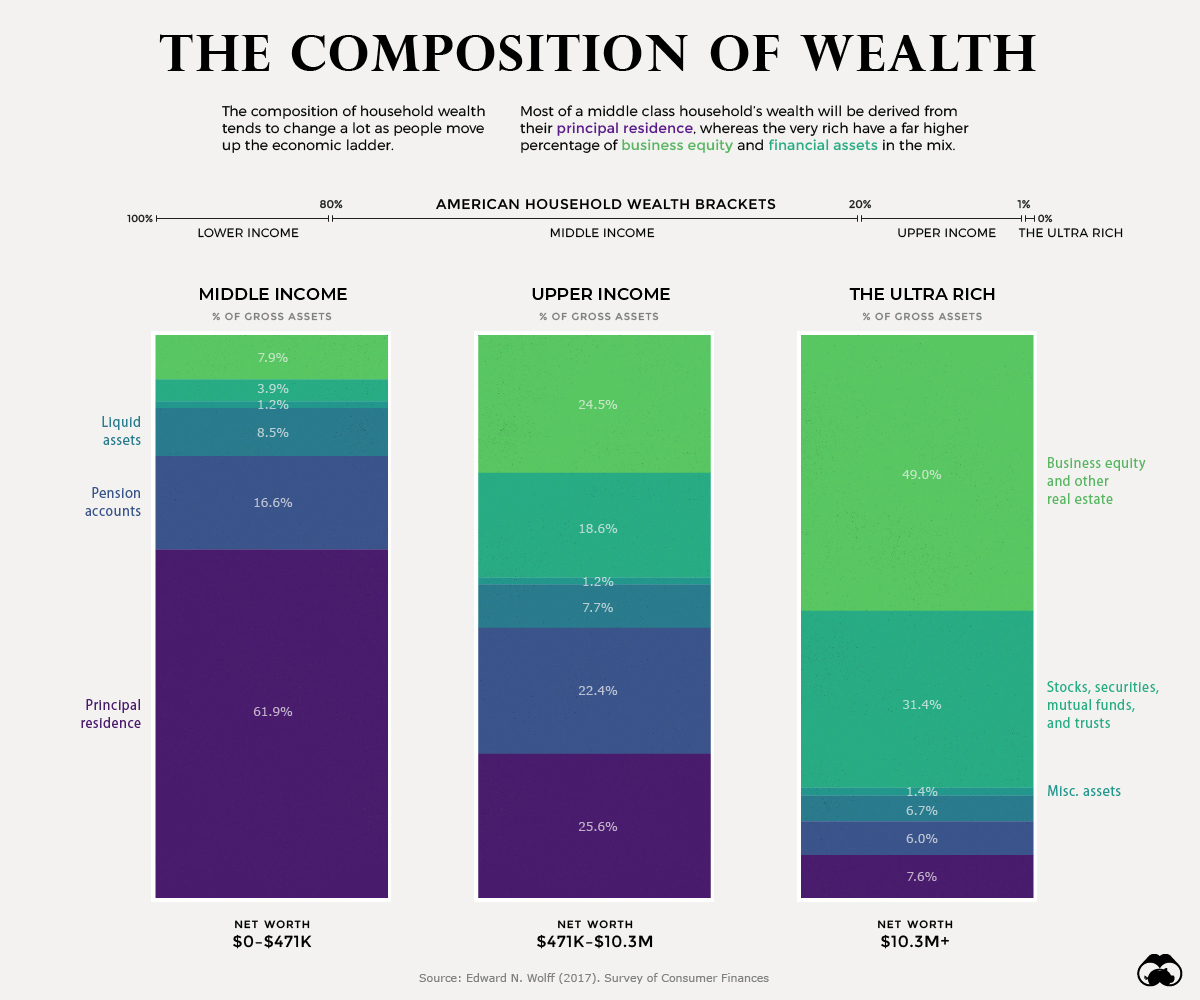

The differences in the composition of wealth between middle income, upper income, and ultra wealthy (top 1%) of American households help...

The differences in the composition of wealth between middle income, upper income, and ultra wealthy (top 1%) of American households help...

Read More

Peter Boockvar is the CIO of Bleakley Advisory Group and Editor of The Boock Report. ~~~ After listening to the Home Depot conference,...

Read More

Vanguard Fund Investors Get Control of Paying Taxes The big money manager found a way to defer taxes on mutual-fund capital gains via...

Read More

Vanguard Fund Investors Get Control of Paying Taxes The big money manager found a way to defer taxes on mutual-fund capital gains via...

Read More

Warren Has a Good Beginning for Ending Corporate-Tax Avoidance Something’s not right when the most profitable companies can avoid...

Read More

Warren Has a Good Beginning for Ending Corporate-Tax Avoidance Something’s not right when the most profitable companies can avoid...

Read More

Richest 1% of Americans Close to Surpassing Wealth of Middle Class Earlier this year, we looked at a new series of data...

Richest 1% of Americans Close to Surpassing Wealth of Middle Class Earlier this year, we looked at a new series of data...

Richest 1% of Americans Close to Surpassing Wealth of Middle Class Earlier this year, we looked at a new series of data...

Richest 1% of Americans Close to Surpassing Wealth of Middle Class Earlier this year, we looked at a new series of data...