Why would any multinational corporation pay the new 21 percent rate when it could use the new “global minimum” loophole to pay half...

Why would any multinational corporation pay the new 21 percent rate when it could use the new “global minimum” loophole to pay half...

Read More

Why Stock Buybacks Do So Little for Americans Instead of restricting share repurchases, expand the pool of people with a stake in...

Read More

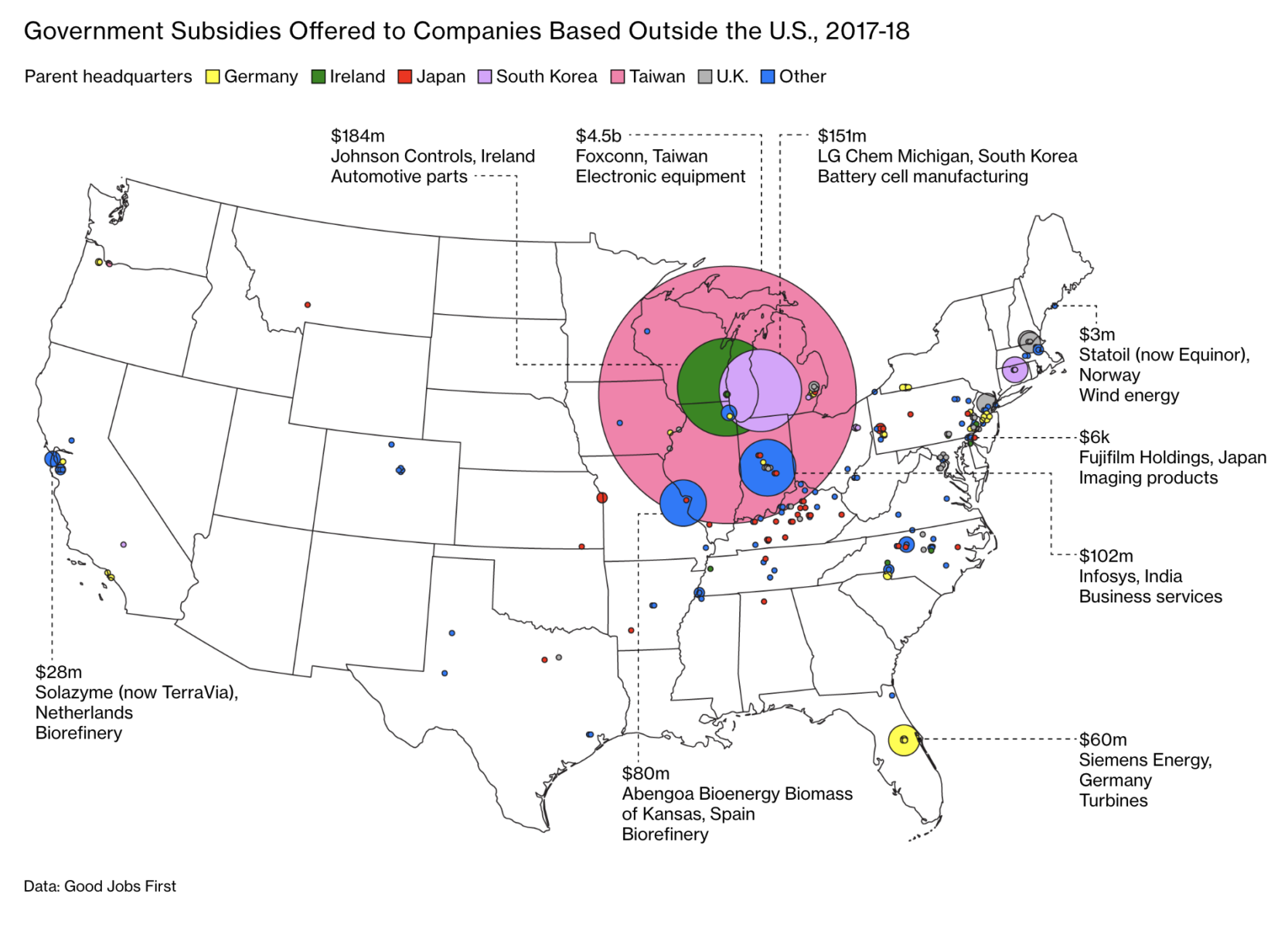

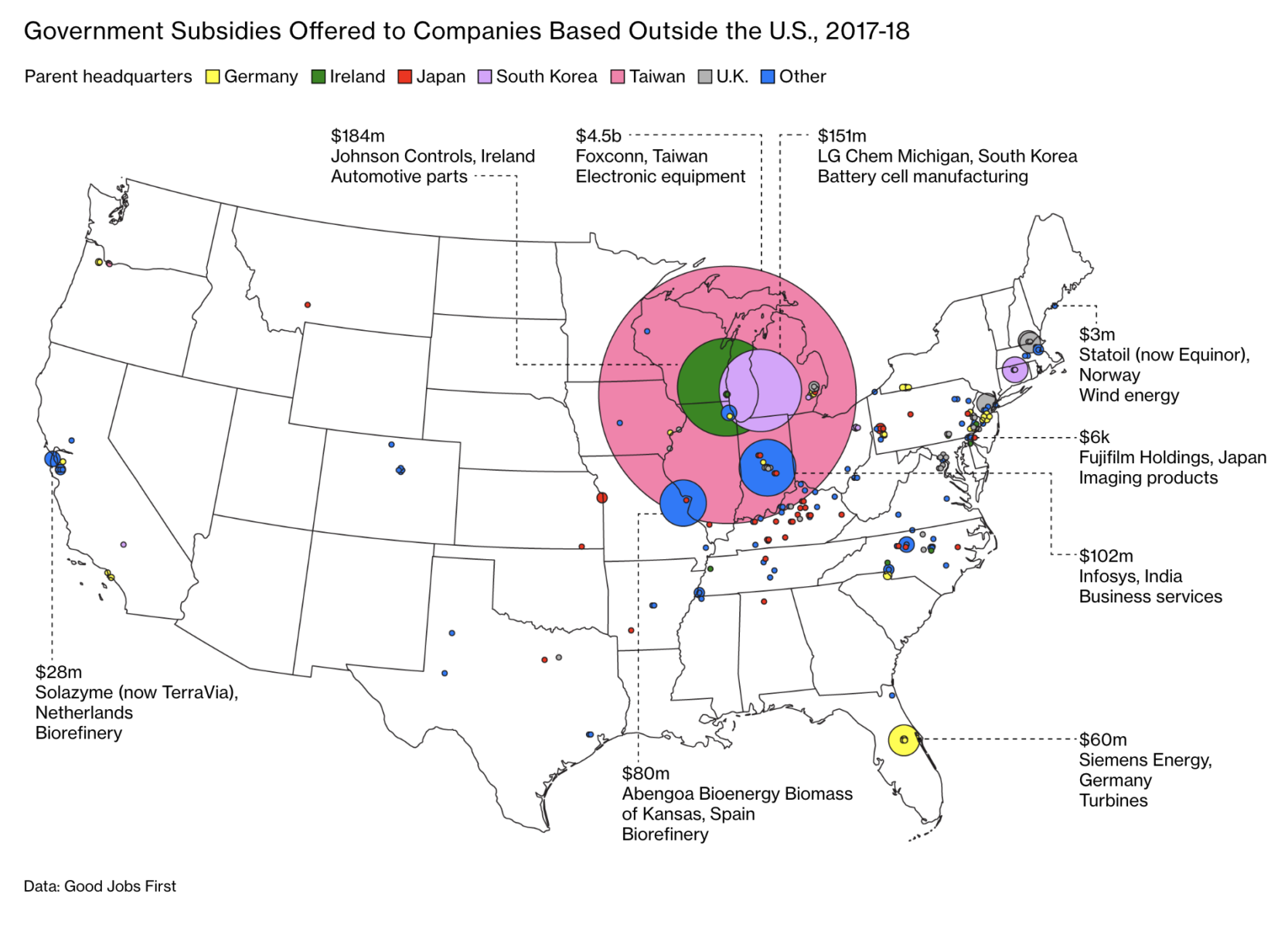

As we discussed, the Foxconn-Wisconsin tax giveaway is unfolding as per expectations. Via Businessweek, here is “The Art of the...

As we discussed, the Foxconn-Wisconsin tax giveaway is unfolding as per expectations. Via Businessweek, here is “The Art of the...

Read More

@TBPInvictus here: As the Fed was battling the after effects of the Great Financial Crisis, a group of finance types wrote an open letter...

Read More

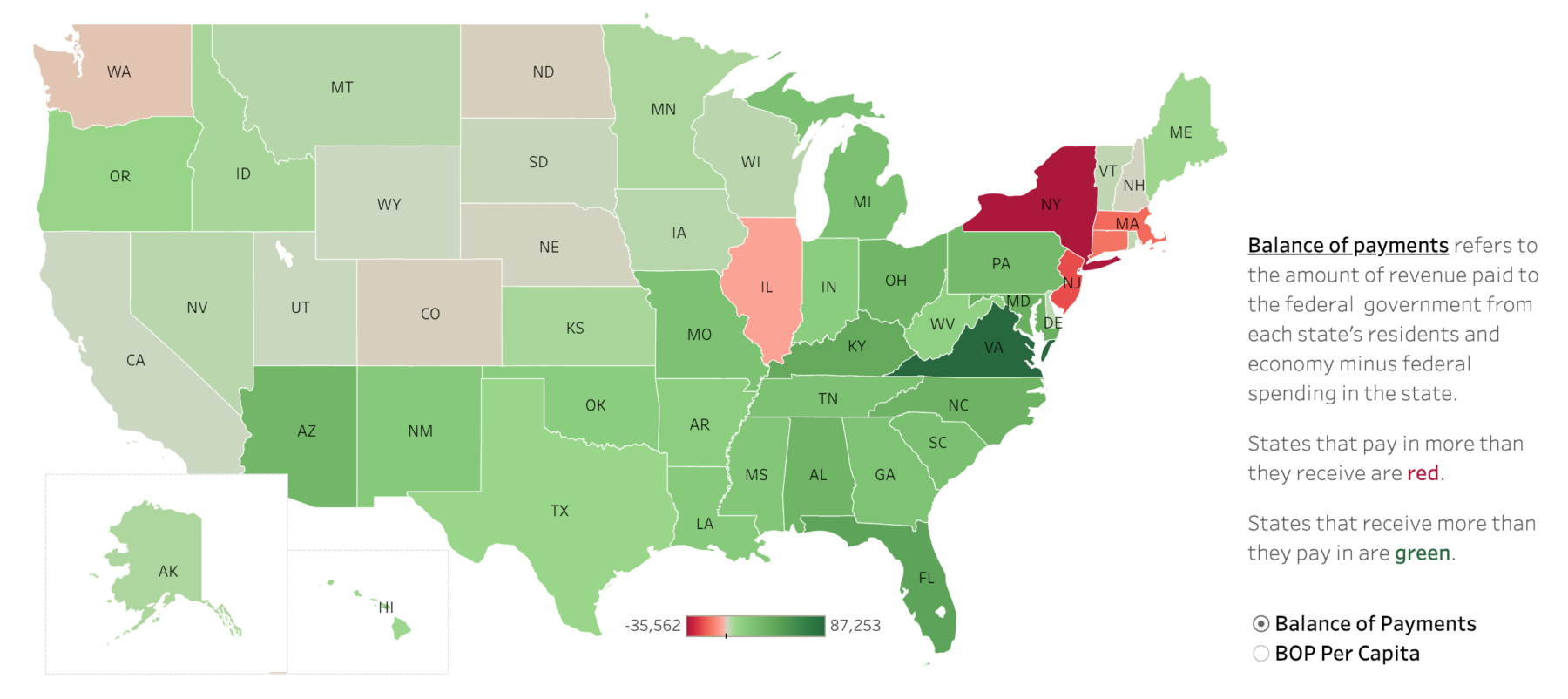

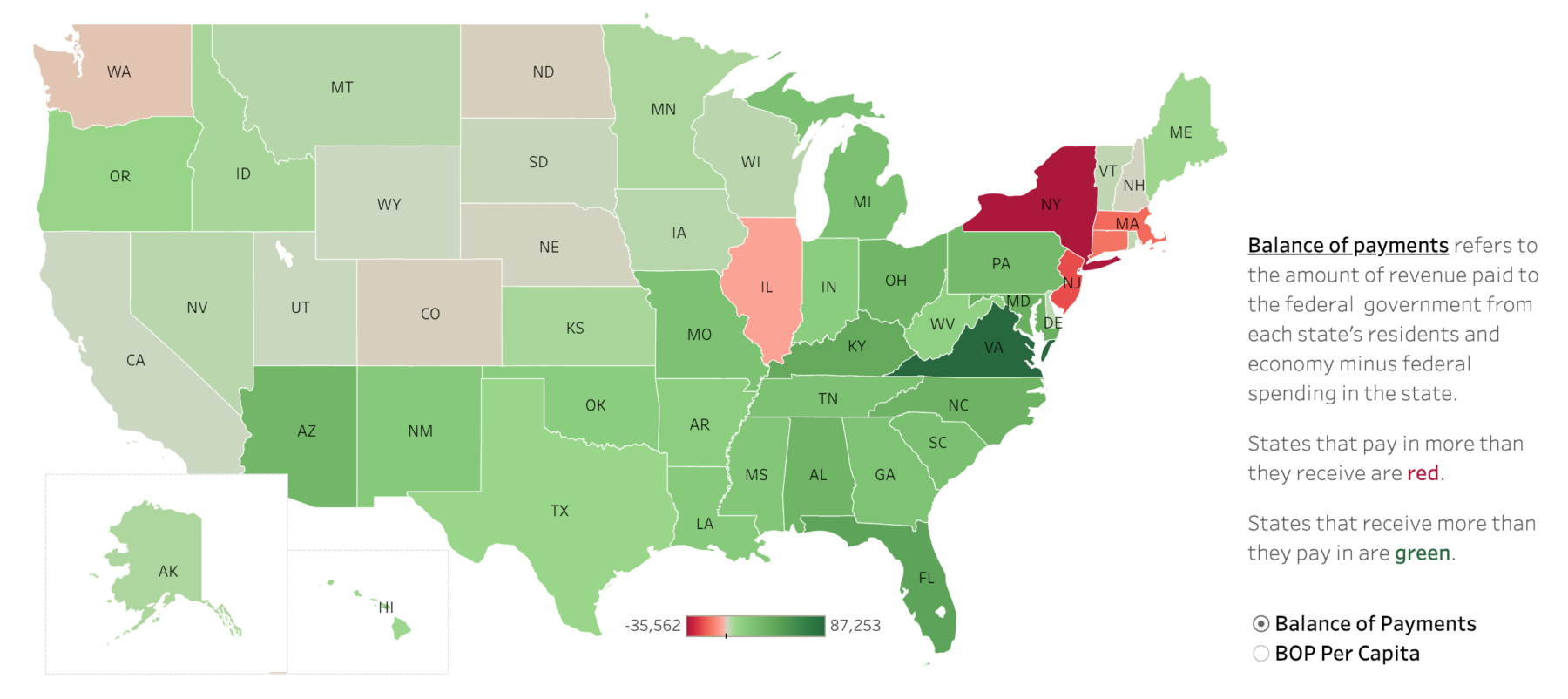

This is quite fascinating — and surprising: The folks who are most against government spending are also the biggest beneficiaries...

This is quite fascinating — and surprising: The folks who are most against government spending are also the biggest beneficiaries...

Read More

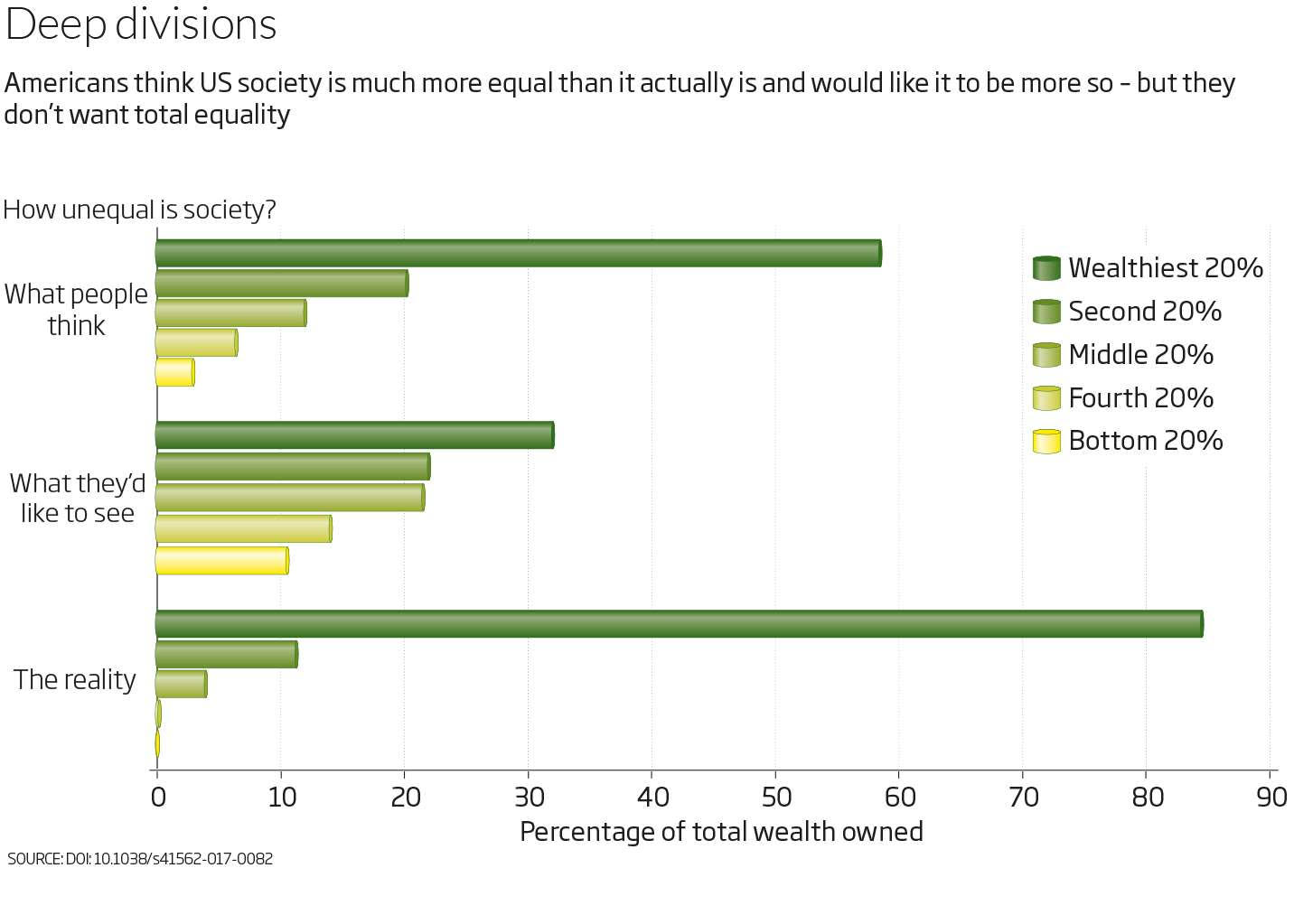

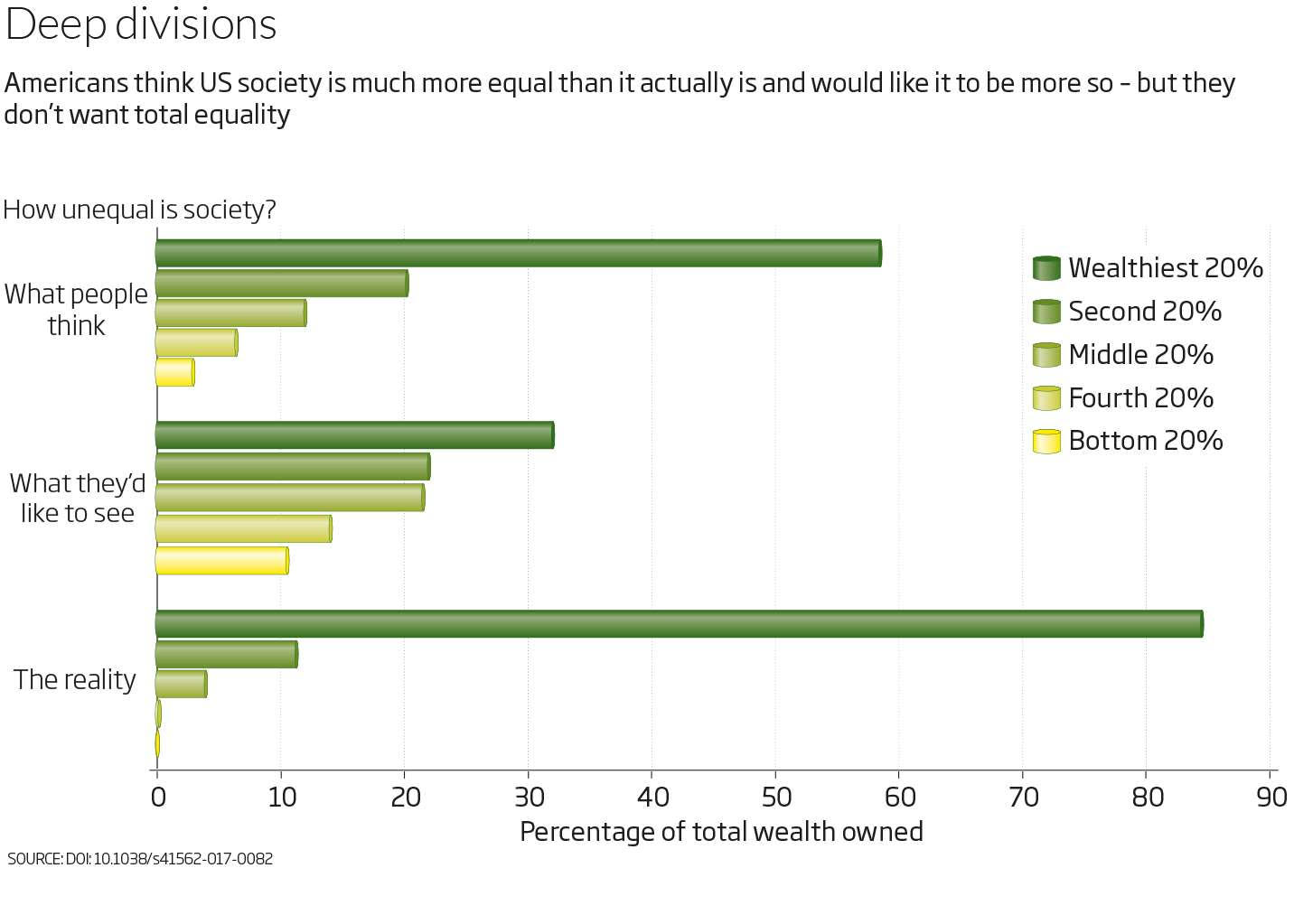

You’ve got the wealth gap all wrong. You think it is bad. The reality is its far far worse: The inequality delusion: Why...

You’ve got the wealth gap all wrong. You think it is bad. The reality is its far far worse: The inequality delusion: Why...

Read More

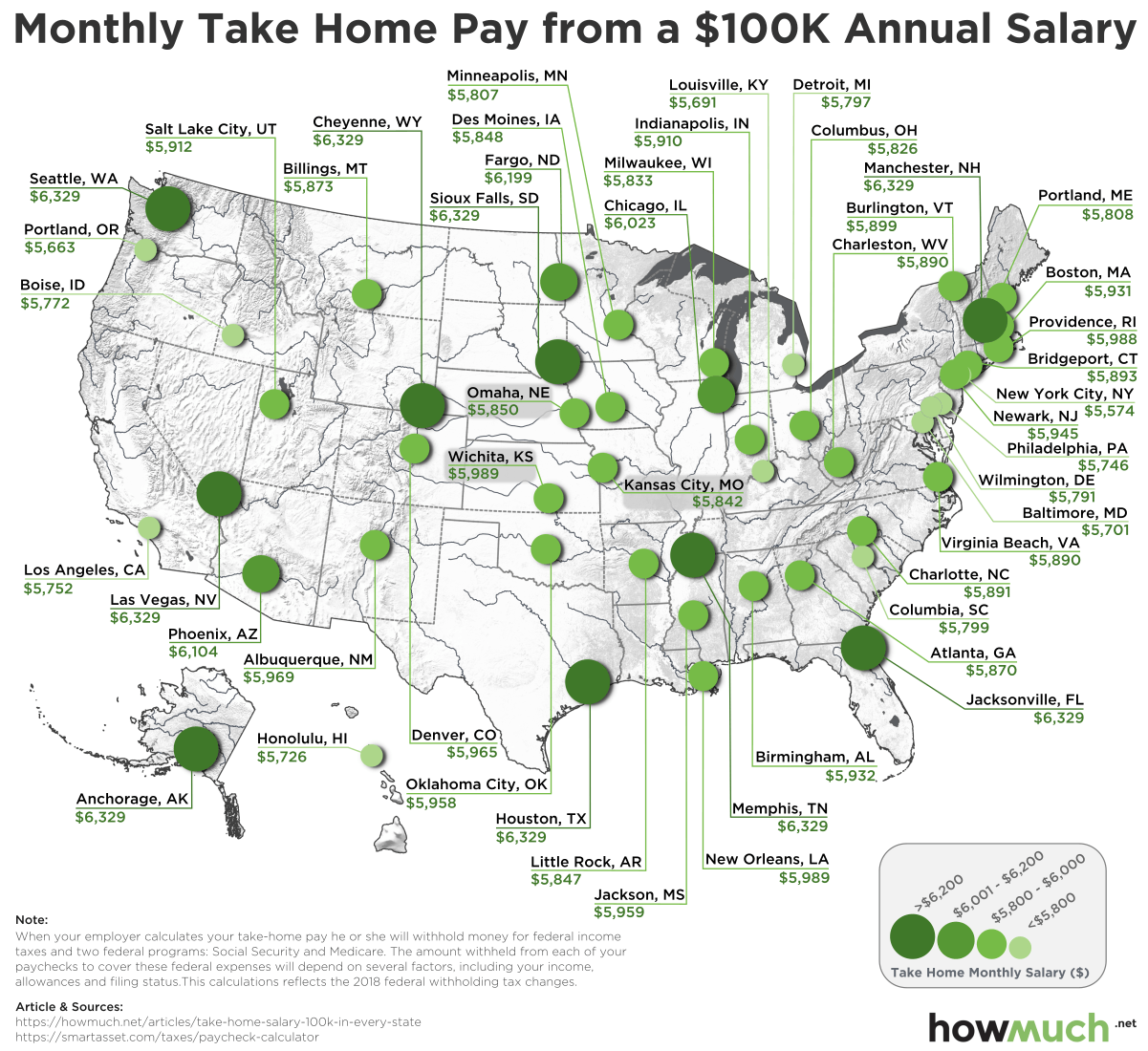

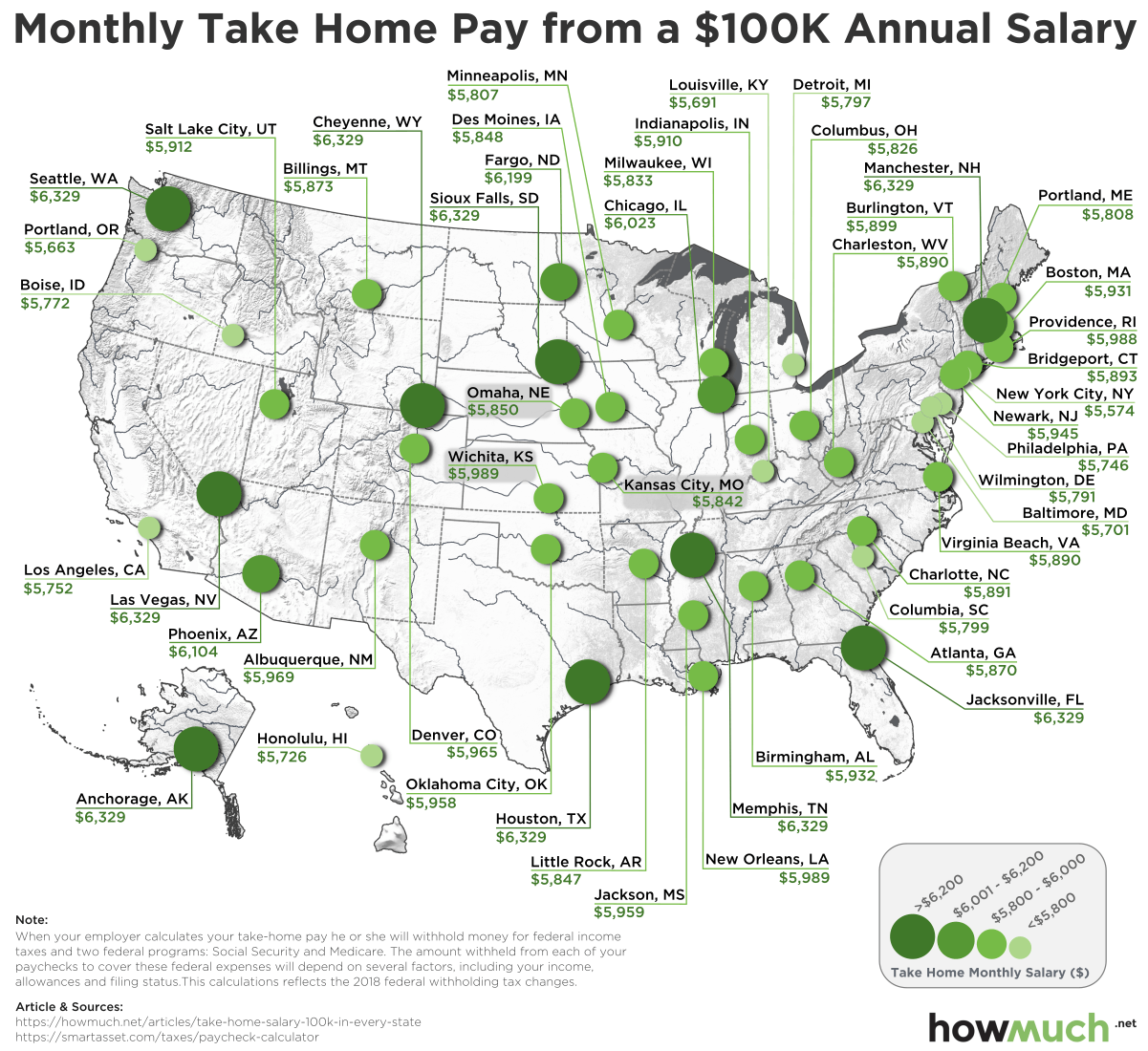

Source: How Much Cool map by How Much showing the largest city in each state and crunching the numbers on tax costs + local...

Source: How Much Cool map by How Much showing the largest city in each state and crunching the numbers on tax costs + local...

Read More

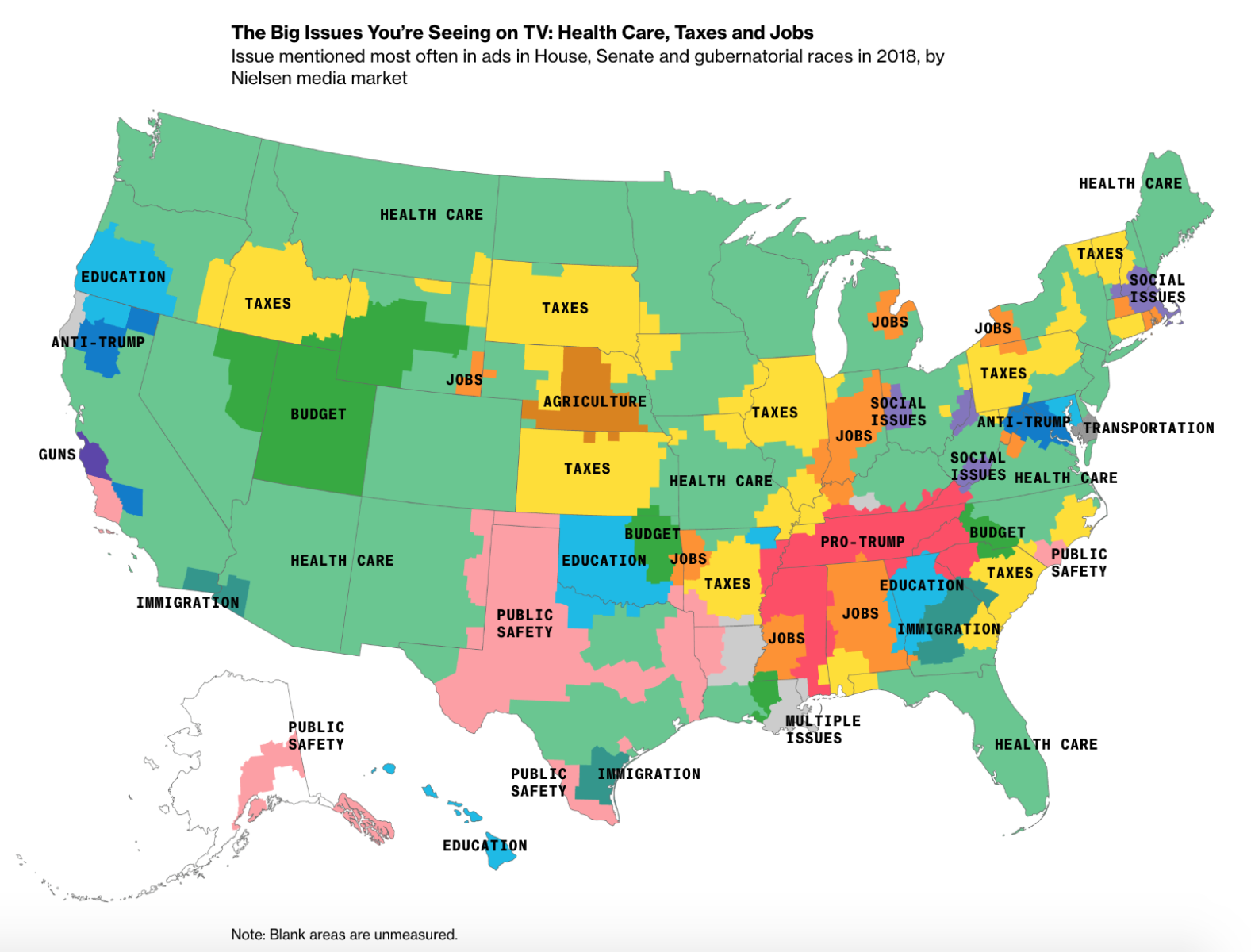

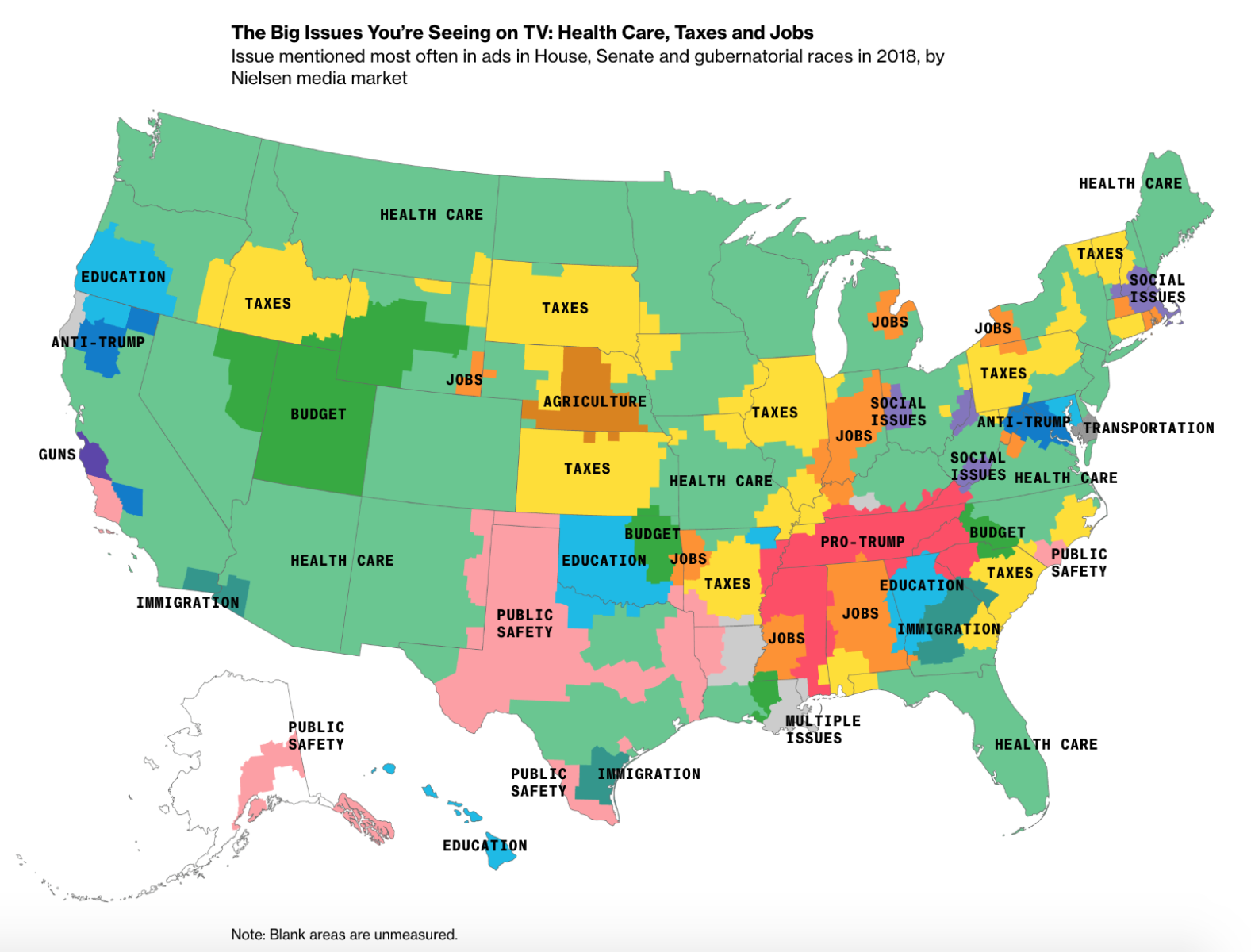

What the 2018 Campaign Looks Like in Your Hometown Source: Bloomberg Here are the details: “For much of the nation, health...

What the 2018 Campaign Looks Like in Your Hometown Source: Bloomberg Here are the details: “For much of the nation, health...

Read More

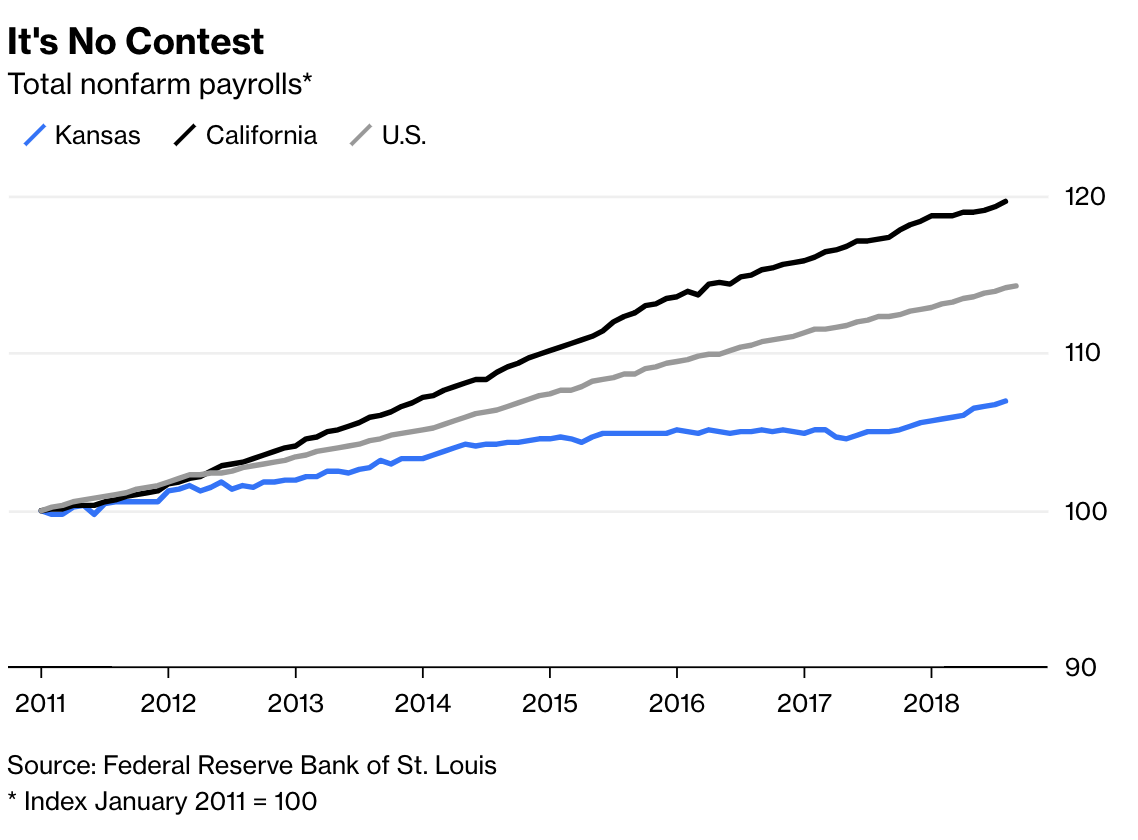

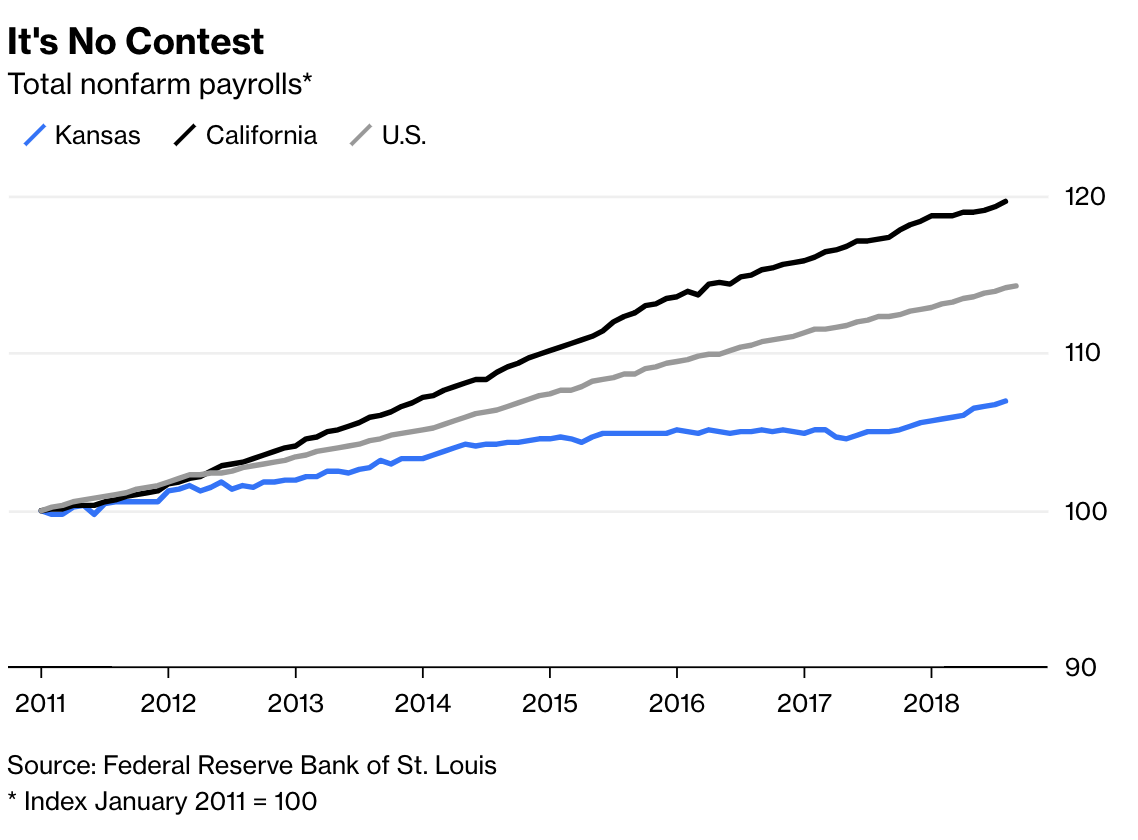

Trump Models U.S. Economy on Kansas. That’s a Mistake The better choice is one of his favorite whipping boys, California, which has a...

Trump Models U.S. Economy on Kansas. That’s a Mistake The better choice is one of his favorite whipping boys, California, which has a...

Read More

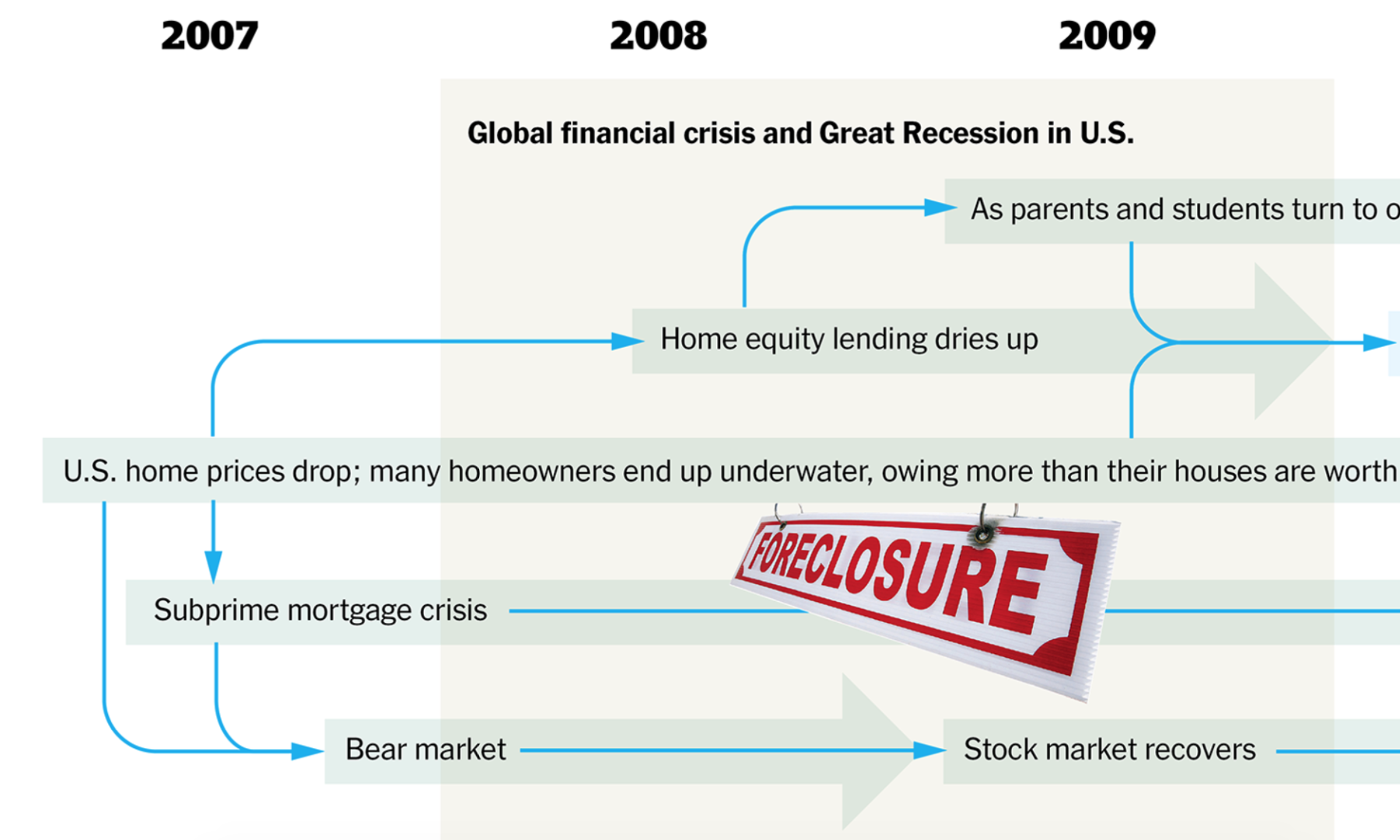

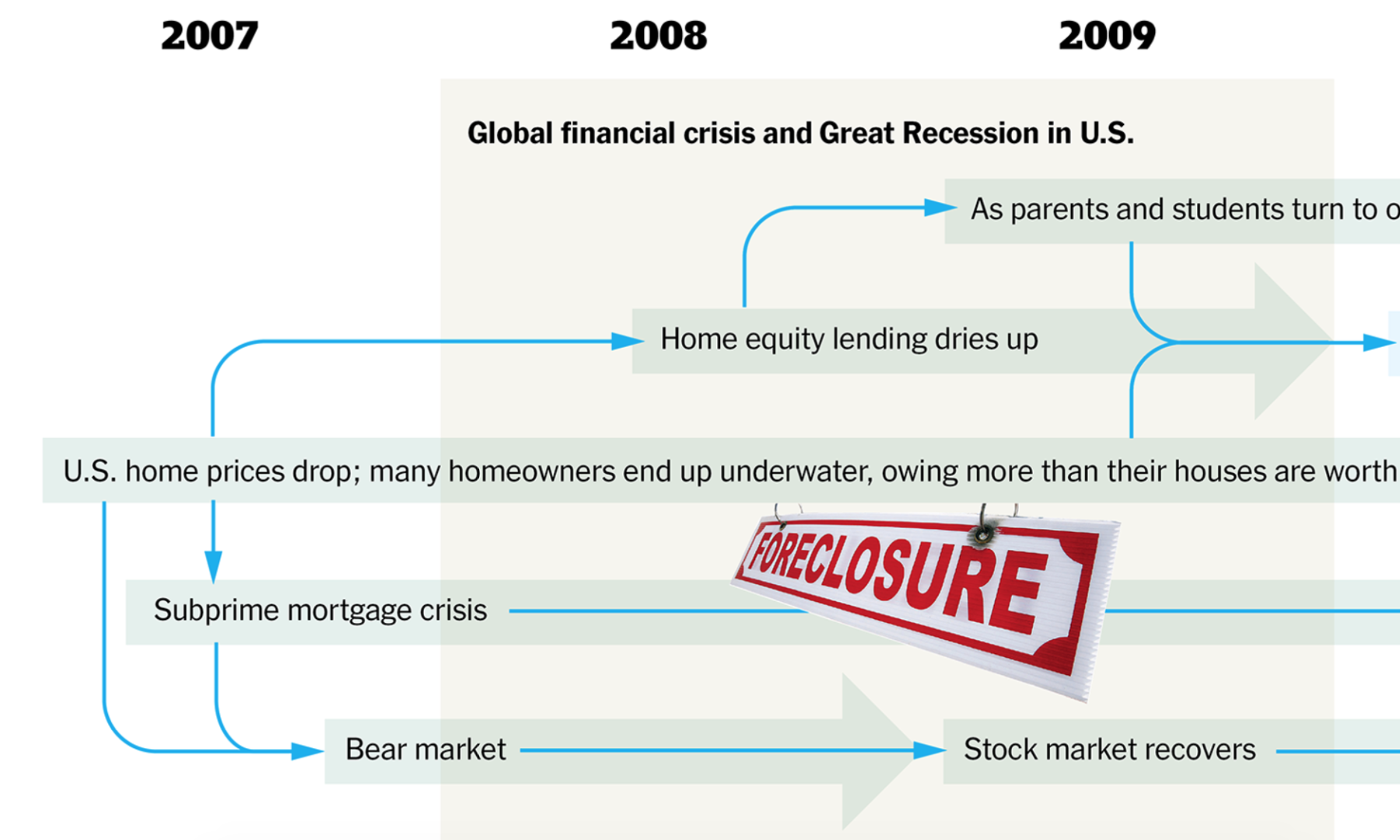

From bank bailouts to rock-bottom interest rates, the fallout influenced economics, politics and even the rise of Bitcoin over the past...

From bank bailouts to rock-bottom interest rates, the fallout influenced economics, politics and even the rise of Bitcoin over the past...

Read More

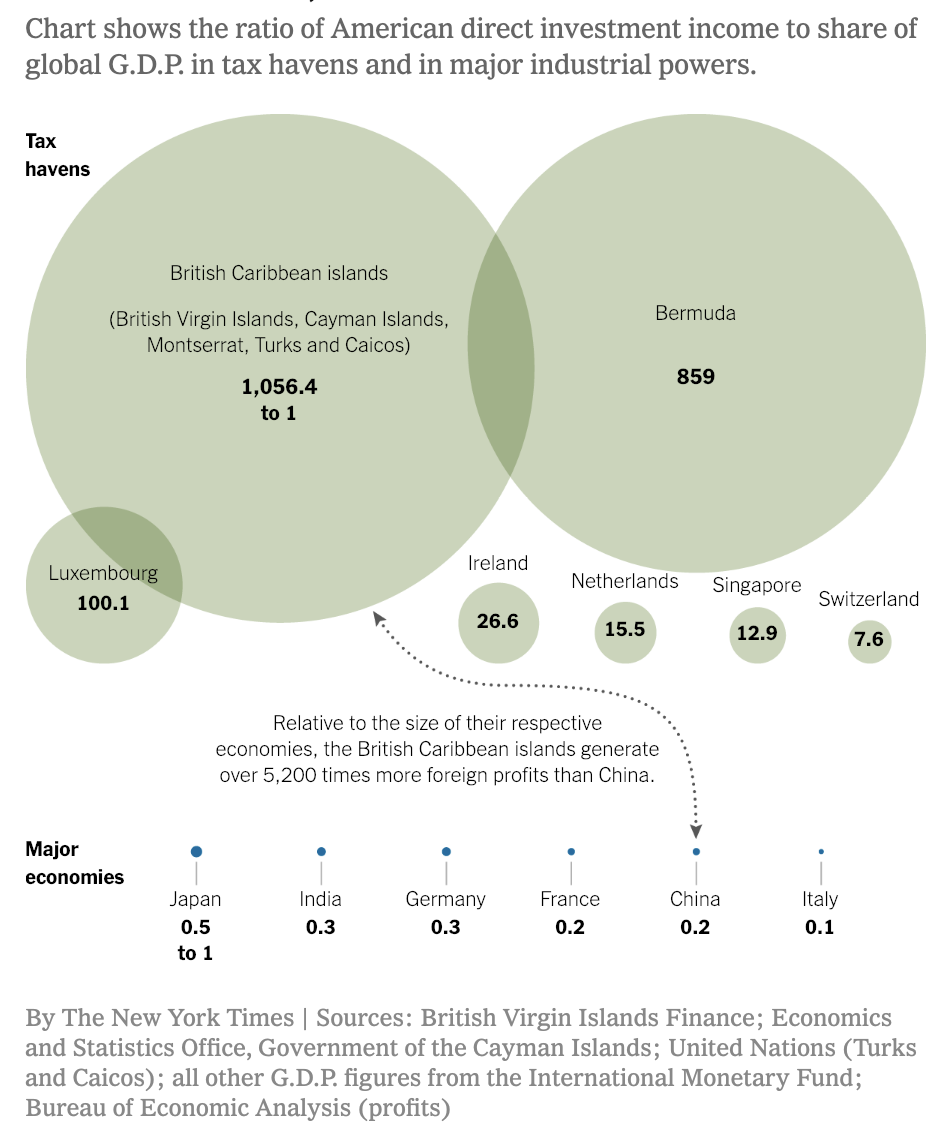

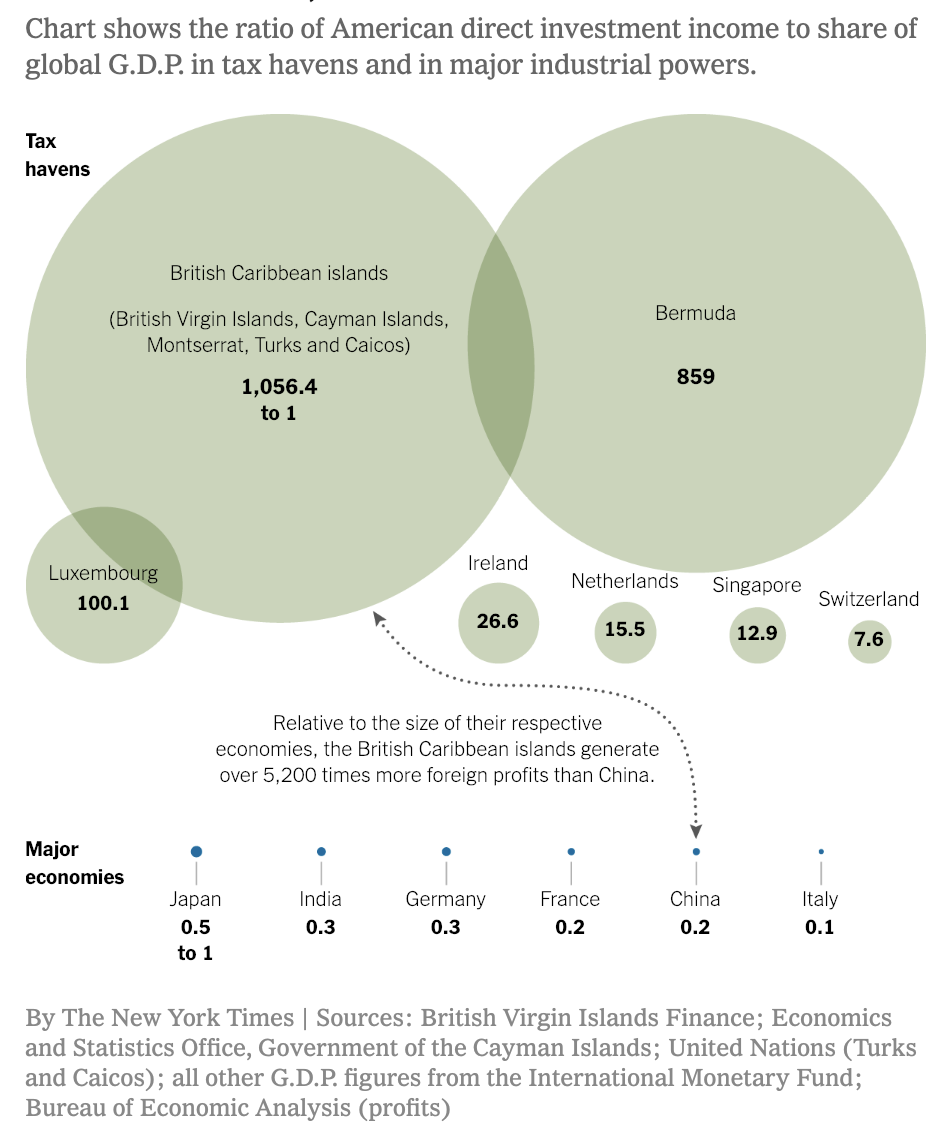

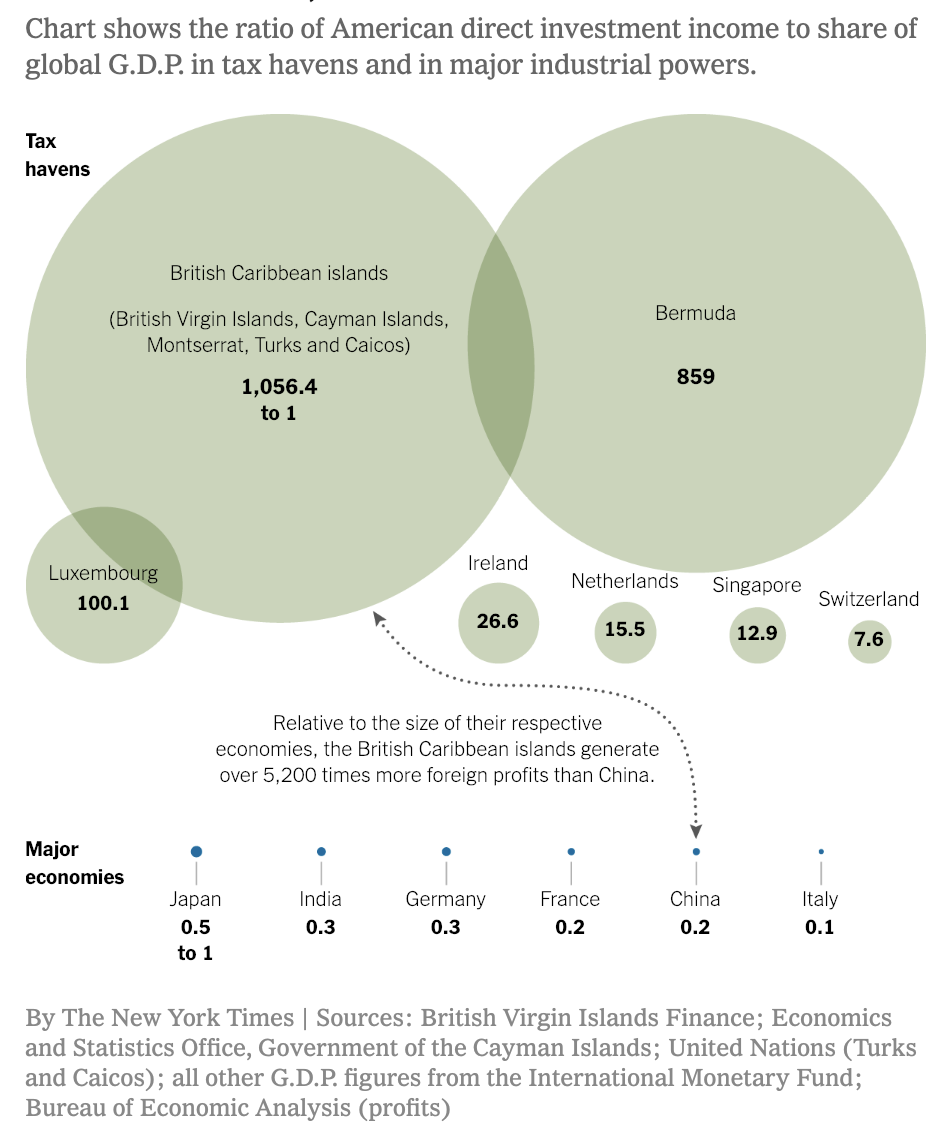

Why would any multinational corporation pay the new 21 percent rate when it could use the new “global minimum” loophole to pay half...

Why would any multinational corporation pay the new 21 percent rate when it could use the new “global minimum” loophole to pay half...

Why would any multinational corporation pay the new 21 percent rate when it could use the new “global minimum” loophole to pay half...

Why would any multinational corporation pay the new 21 percent rate when it could use the new “global minimum” loophole to pay half...