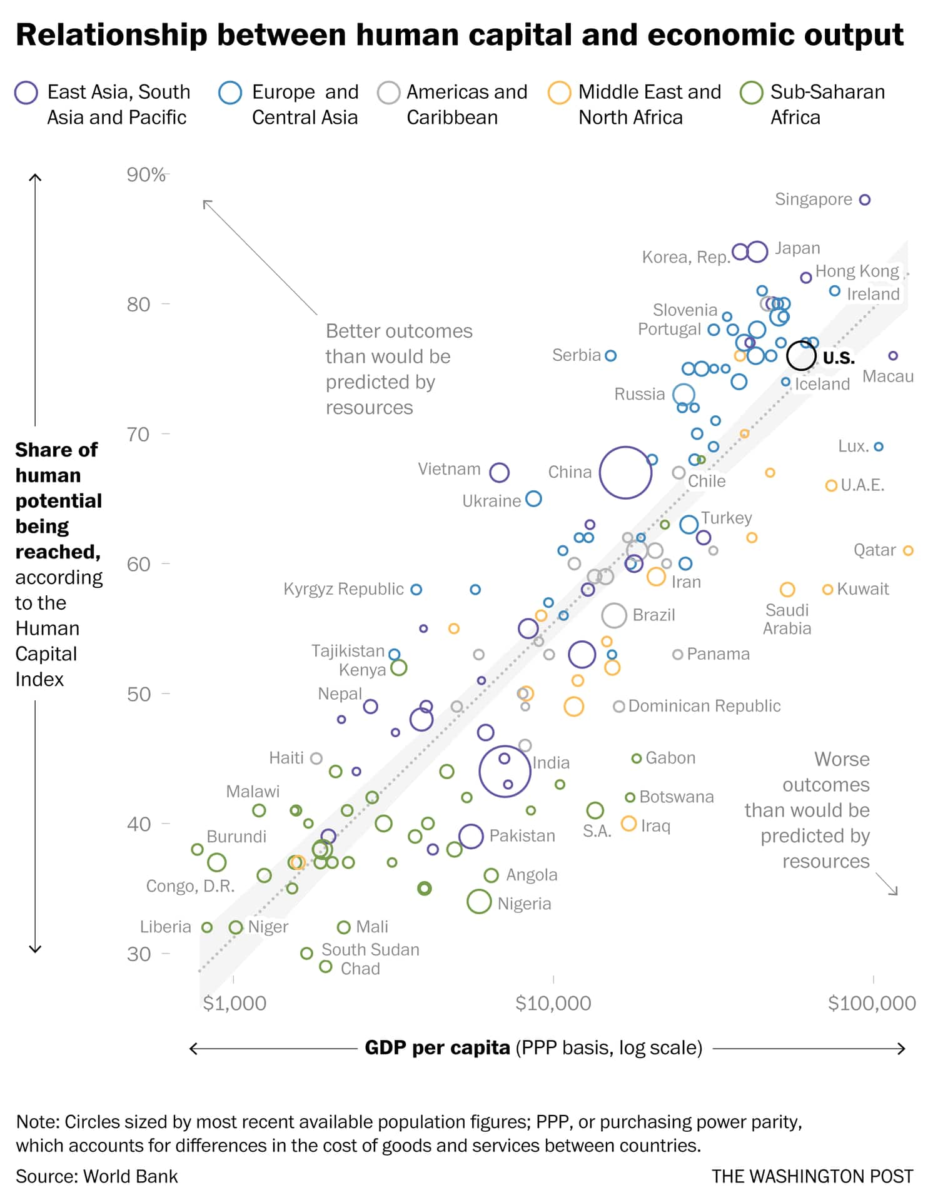

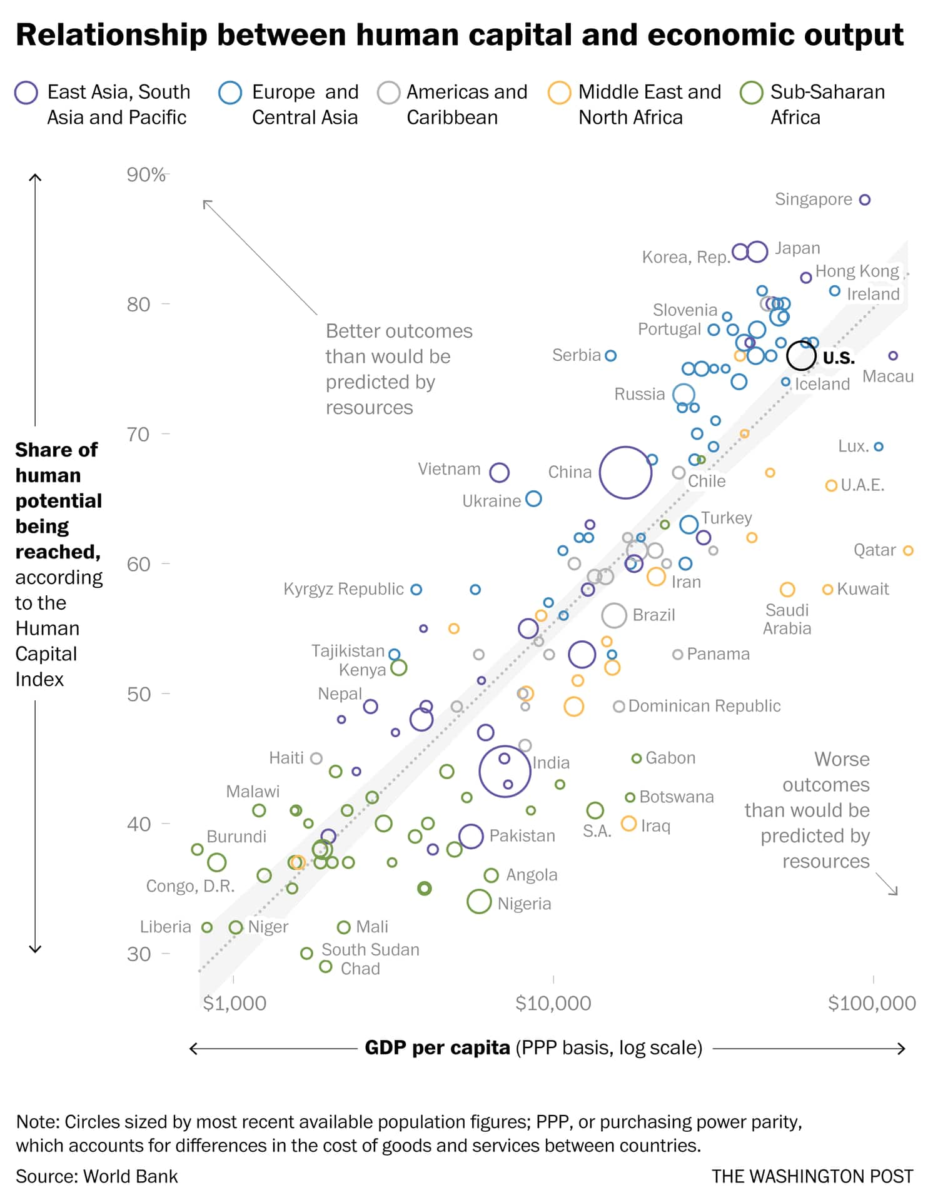

Source: Washington Post This is intriguing: “The desire to climb arbitrary ranking ladders seems to be an innate...

Source: Washington Post This is intriguing: “The desire to climb arbitrary ranking ladders seems to be an innate...

Read More

Trump Models U.S. Economy on Kansas. That’s a Mistake The better choice is one of his favorite whipping boys, California, which has a...

Read More

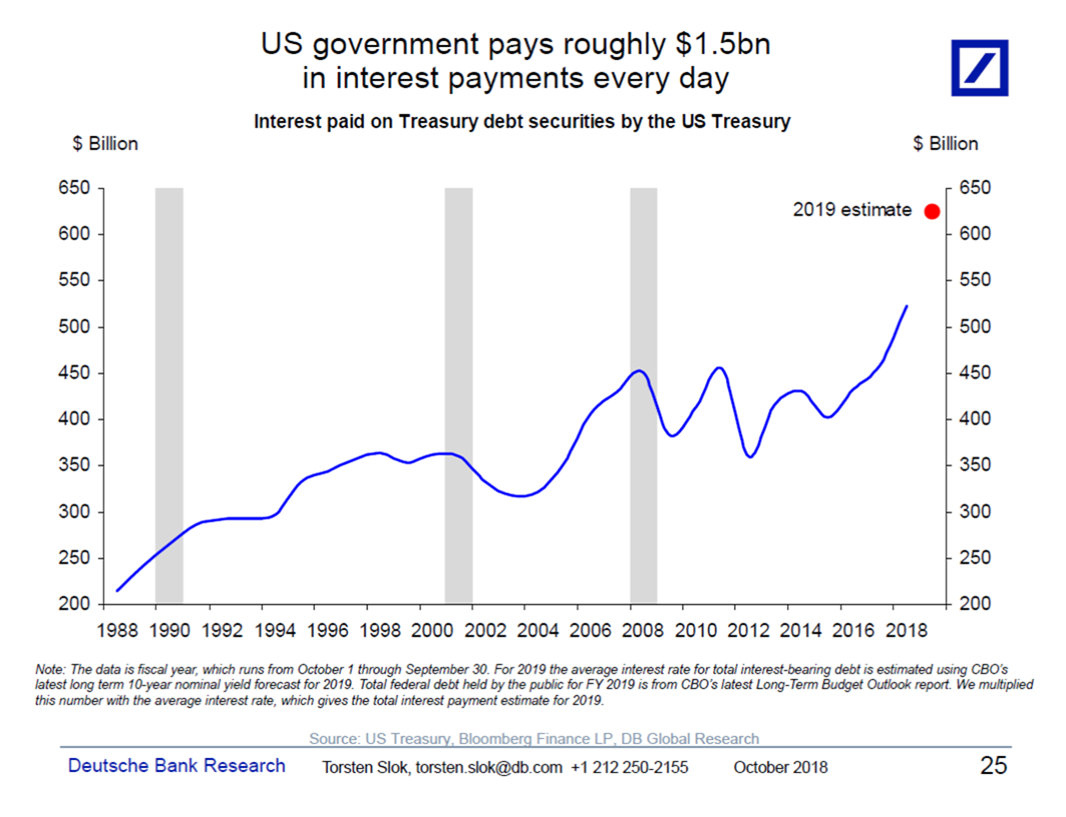

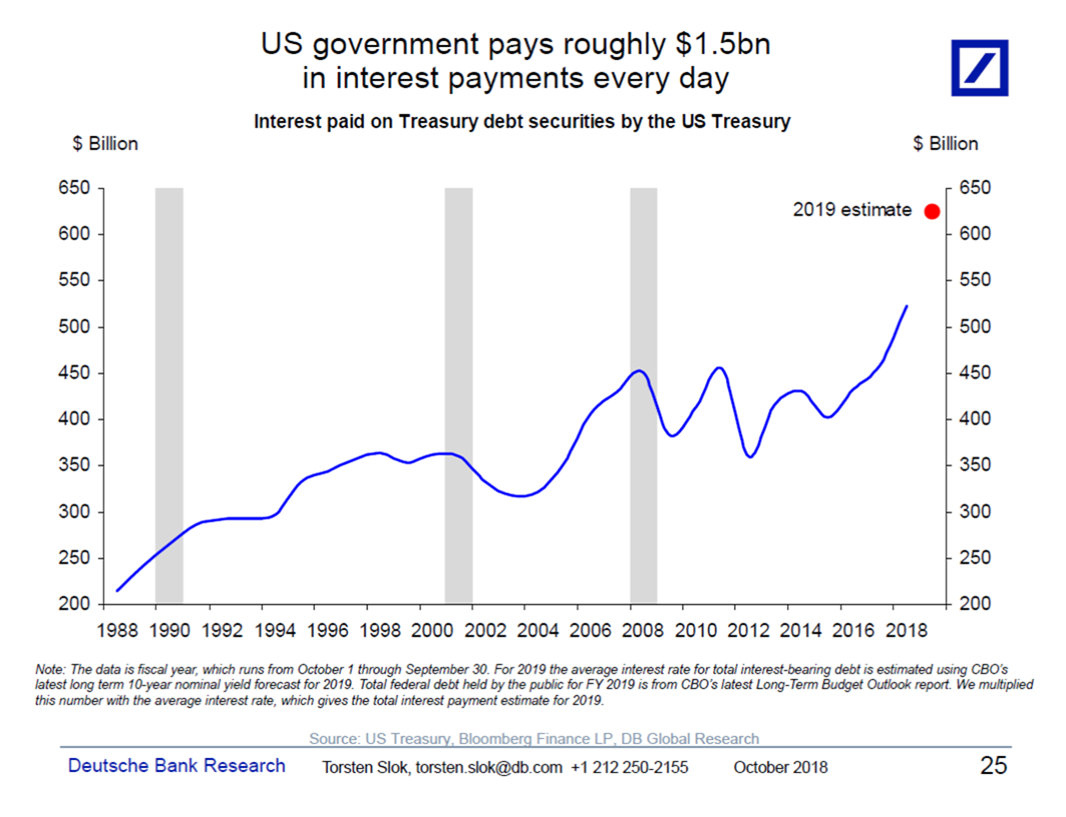

From Torsten Slok: Here is a number for your dinner conversation tonight: Did you know that the US government last year on average paid...

From Torsten Slok: Here is a number for your dinner conversation tonight: Did you know that the US government last year on average paid...

Read More

Why America Has a Two-Track Economy Depending on where you live, your education and job, things are either pretty great or pretty bad....

Read More

Why America Has a Two-Track Economy Depending on where you live, your education and job, things are either pretty great or pretty bad....

Read More

10 Things People Still Get Wrong About the Financial Crisis All are the result of bias, ignorance, laziness or bad faith. Bloomberg,...

Read More

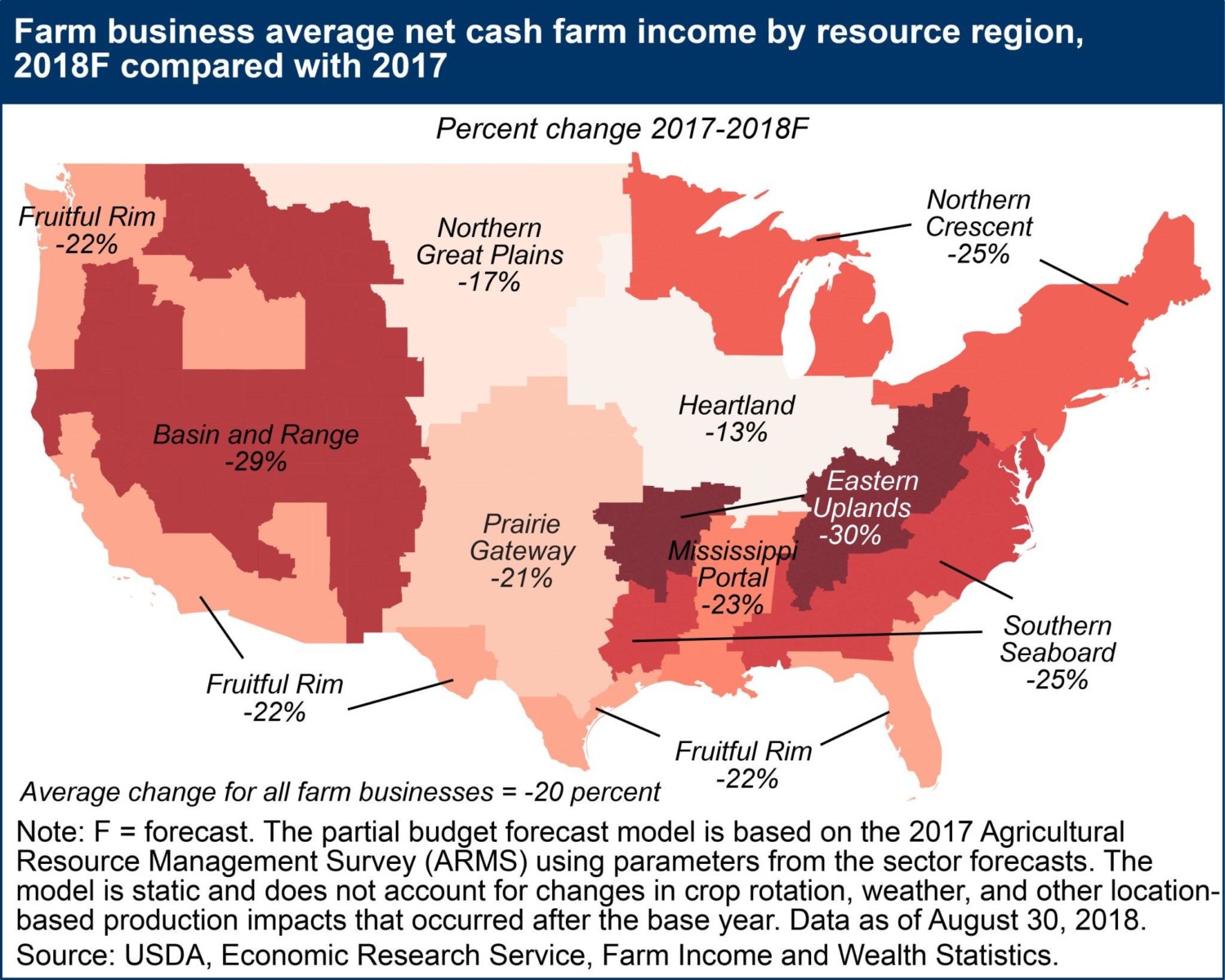

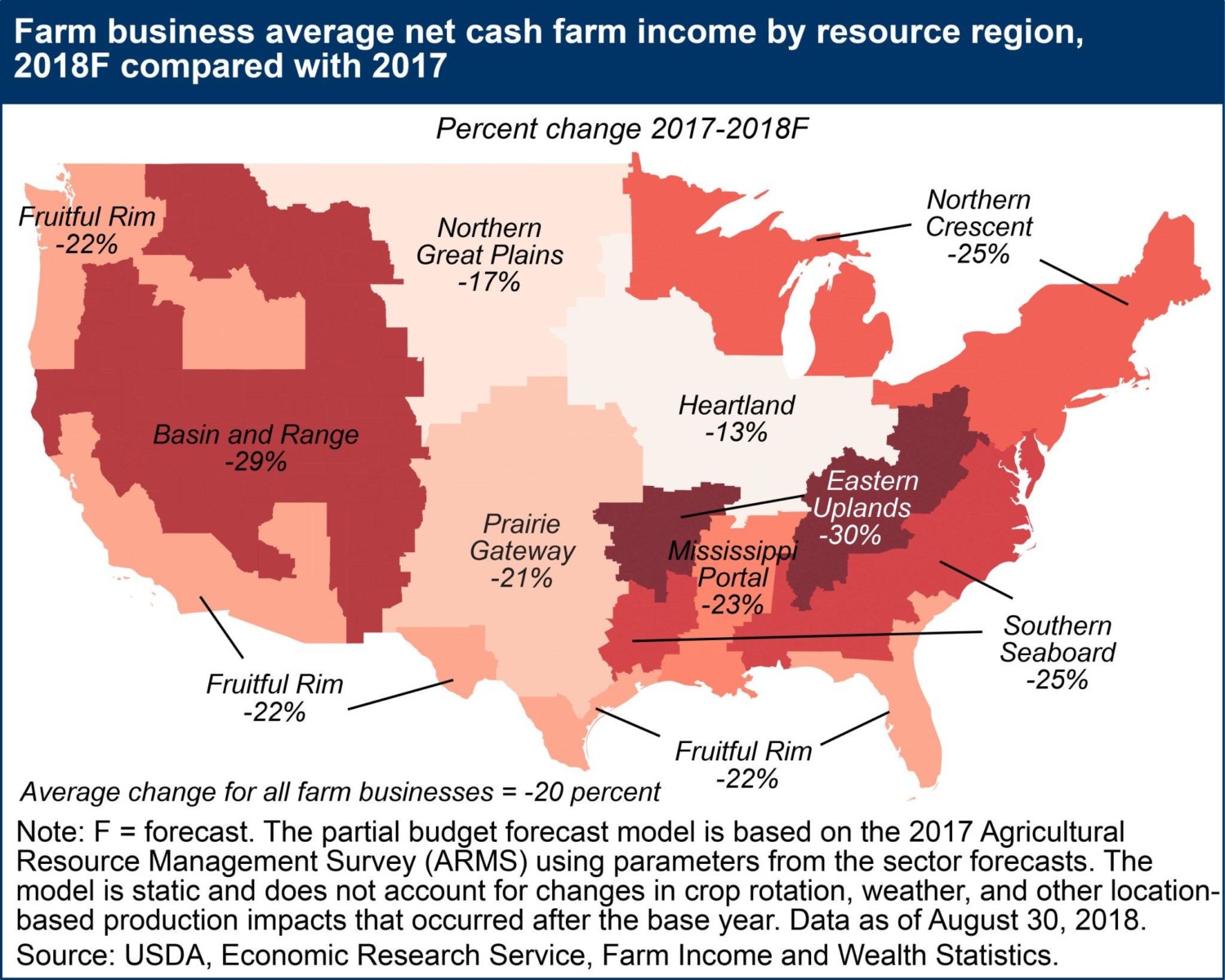

You may be unaware, but so far, the biggest sufferers from the Trade War tariffs have been American Farmers. That is according to Farm...

You may be unaware, but so far, the biggest sufferers from the Trade War tariffs have been American Farmers. That is according to Farm...

Read More

Bill Janeway is known as a “key creator of modern venture capital.” helped to created BEA Systems, which connected software...

Read More

This week, Bill Janeway returns to MIB to update us his work as a venture capitalist. He is also a former Warburg Pincus banker. He...

Read More

Donald Trump is waging a trade war that hurts a lot of American workers. Maybe he would understand that if our heavy-handed documentaries...

Read More

Source: Washington Post This is intriguing: “The desire to climb arbitrary ranking ladders seems to be an innate...

Source: Washington Post This is intriguing: “The desire to climb arbitrary ranking ladders seems to be an innate...

Source: Washington Post This is intriguing: “The desire to climb arbitrary ranking ladders seems to be an innate...

Source: Washington Post This is intriguing: “The desire to climb arbitrary ranking ladders seems to be an innate...