Talkin’ Taxes with Bill Sweet

Click for audio From All About Your Benjamins: Unless you’re a CPA, you probably don’t like to think about taxes, but after...

Inflation Is Coming Thanks to Trump’s Tariffs Levies on steel and aluminum have yet to filter through to prices. But they will....

Inflation Is Coming Thanks to Trump’s Tariffs Levies on steel and aluminum have yet to filter through to prices. But they will....

Steel prices are up 40% this year since tariffs were introduced: Source: Torsten Sløk, Deutsche Bank Securities More on...

Steel prices are up 40% this year since tariffs were introduced: Source: Torsten Sløk, Deutsche Bank Securities More on...

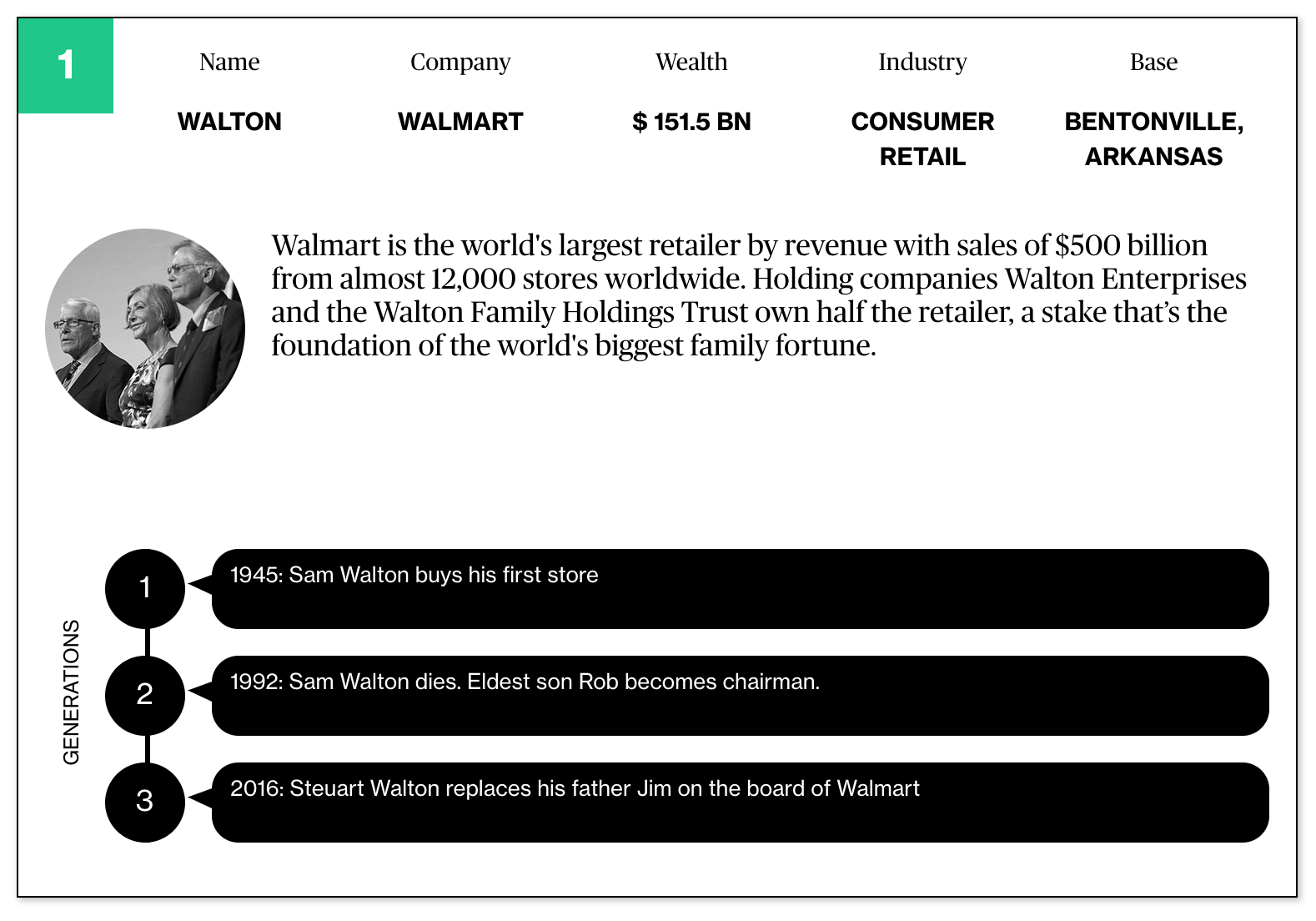

Bloomberg recently updated (no paywall) this giant set of infographics looking at the 25 biggest family fortunes. Whenever you see a...

Bloomberg recently updated (no paywall) this giant set of infographics looking at the 25 biggest family fortunes. Whenever you see a...

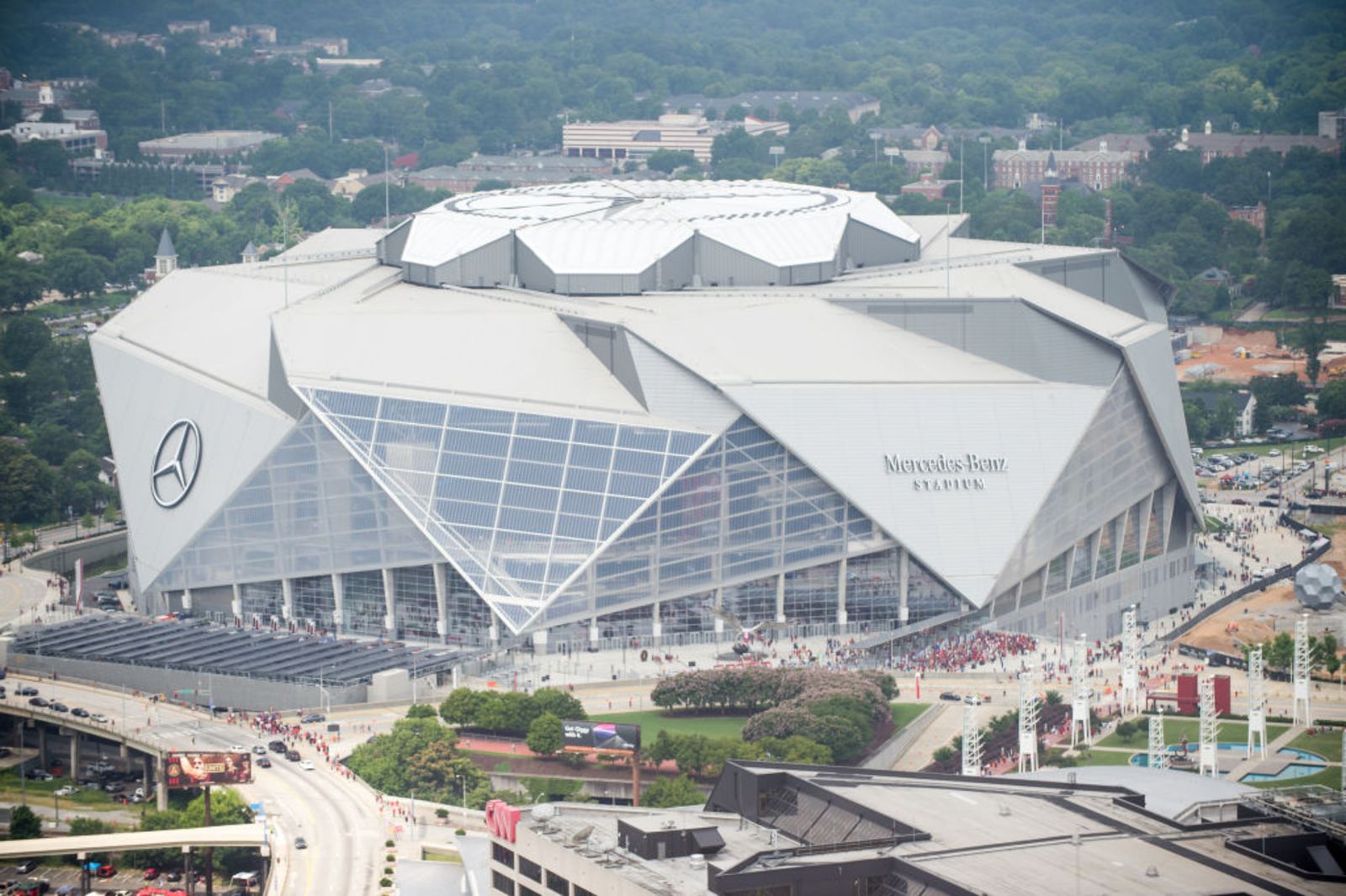

Four Reasons Taxpayers Should Never Subsidize Stadiums Elected officials have been played by team owners and sports leagues. Bloomberg,...

Four Reasons Taxpayers Should Never Subsidize Stadiums Elected officials have been played by team owners and sports leagues. Bloomberg,...

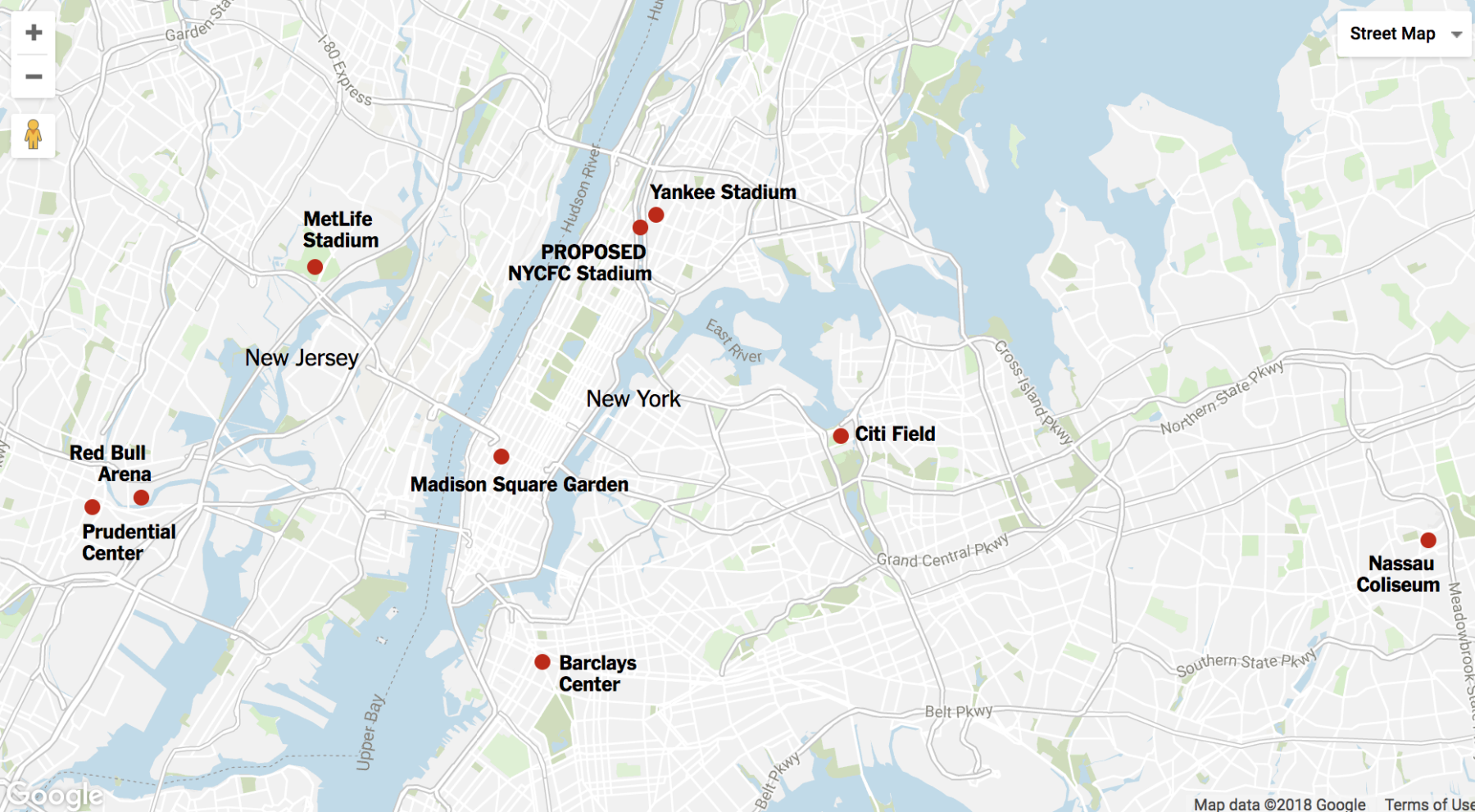

Source: New York Times Via the NYT, this is a simply mind-blowing stat: “New York area is one of the most crowded regions in...

Source: New York Times Via the NYT, this is a simply mind-blowing stat: “New York area is one of the most crowded regions in...

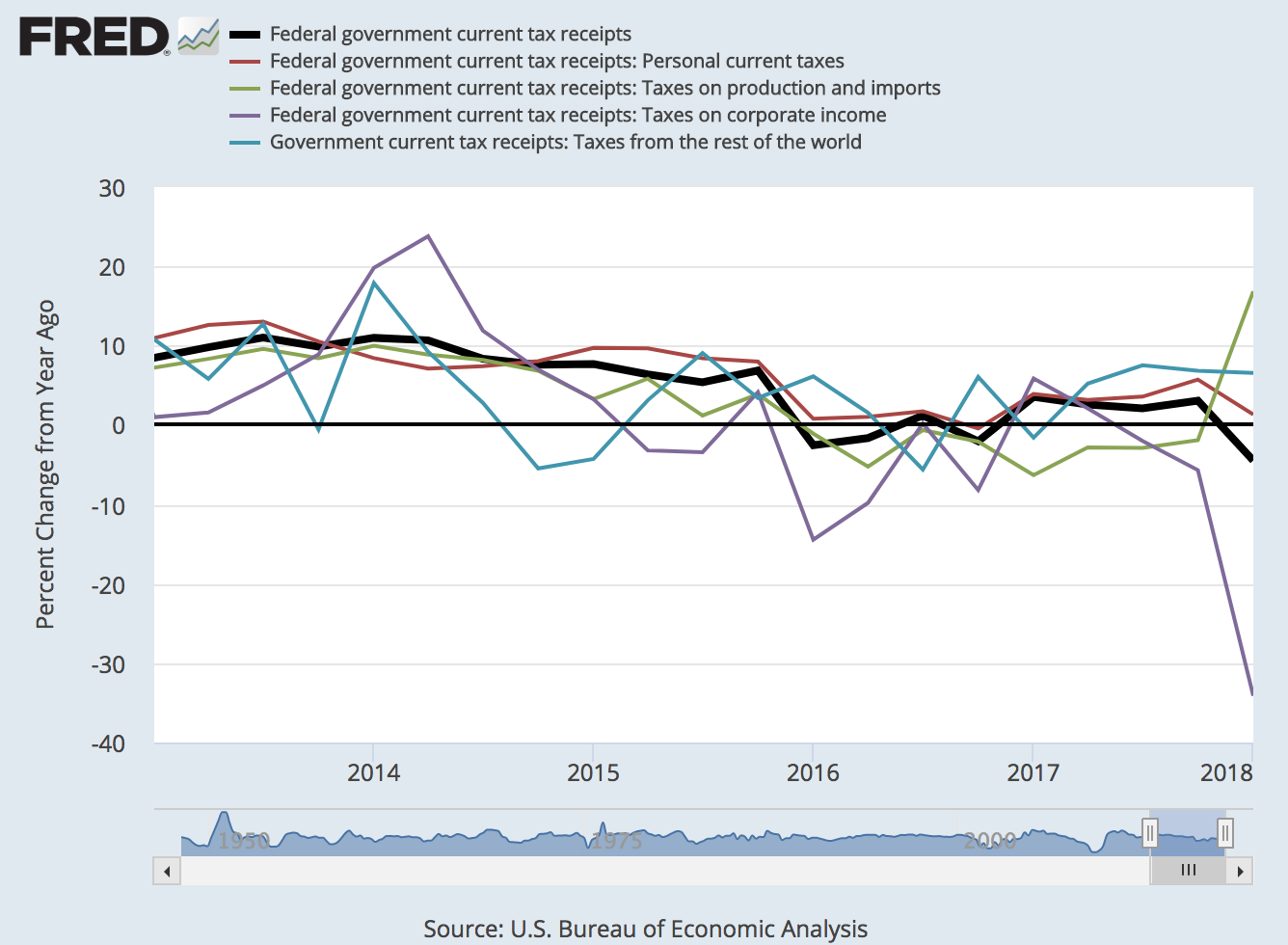

The Tax Cuts and Jobs Act of 2017 applies to taxes starting in 2018, and the first quarterly data on tax revenue are in. This graph...

The Tax Cuts and Jobs Act of 2017 applies to taxes starting in 2018, and the first quarterly data on tax revenue are in. This graph...

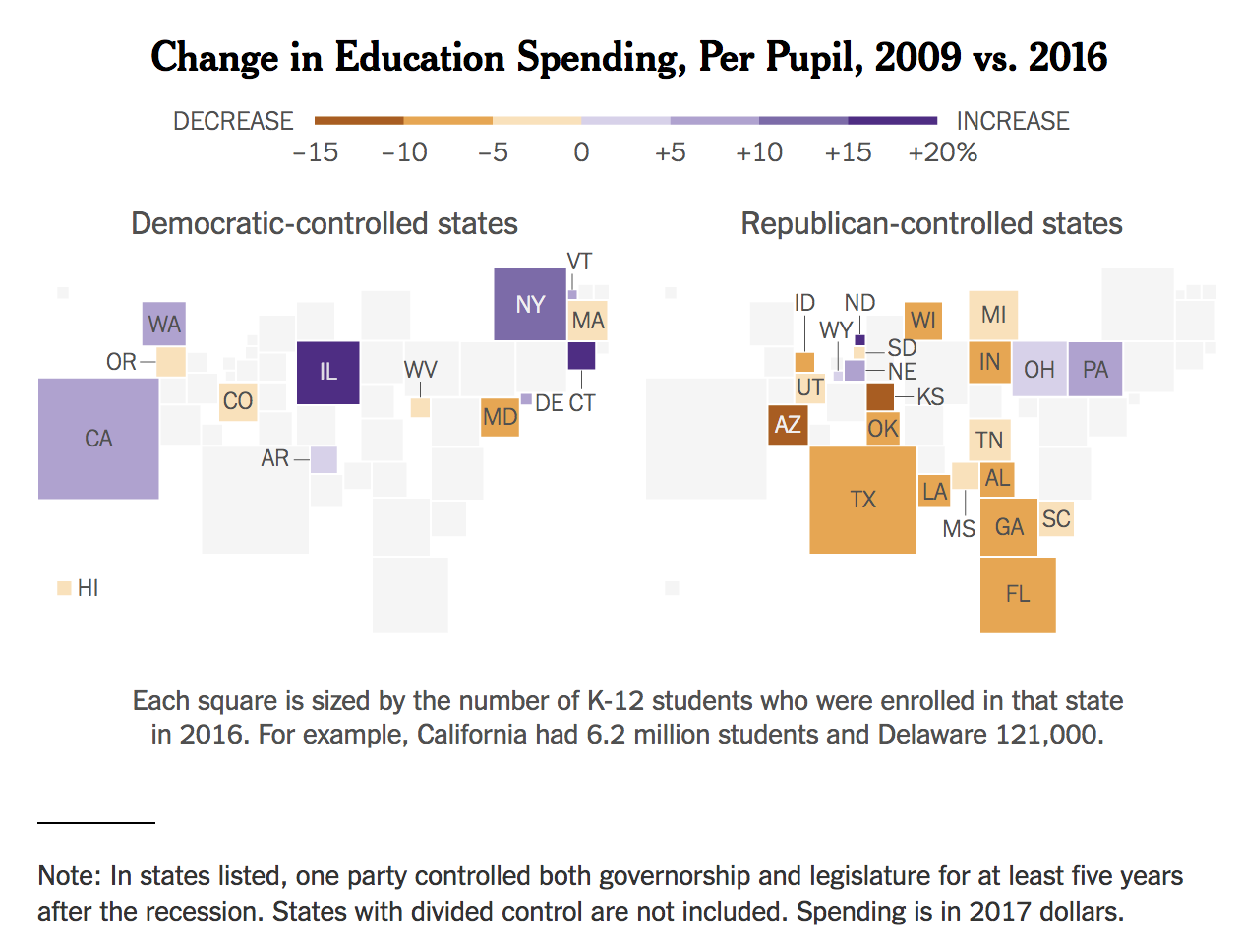

Source: The Upshot From Upshot: the underlying conflict between public school employees and policymakers has roots in decisions...

Source: The Upshot From Upshot: the underlying conflict between public school employees and policymakers has roots in decisions...

Get subscriber-only insights and news delivered by Barry every two weeks.