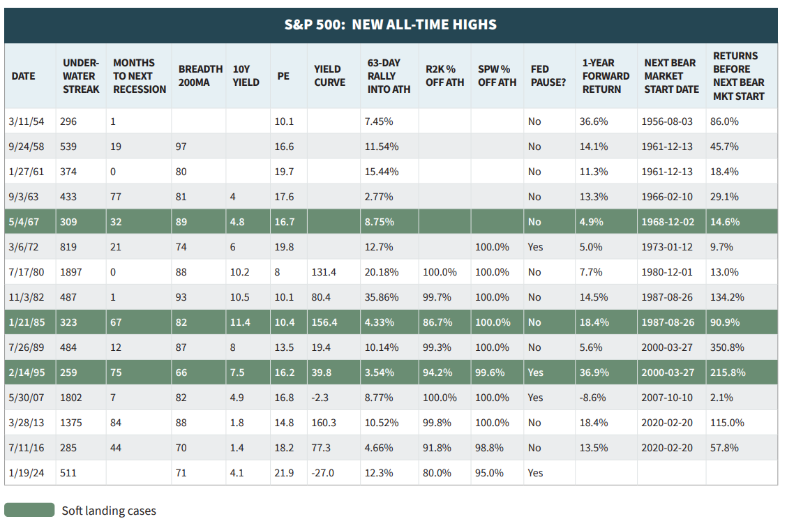

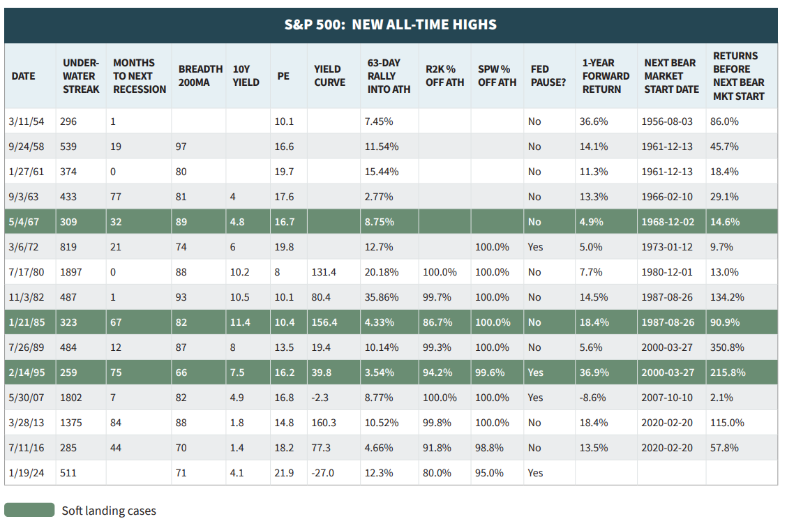

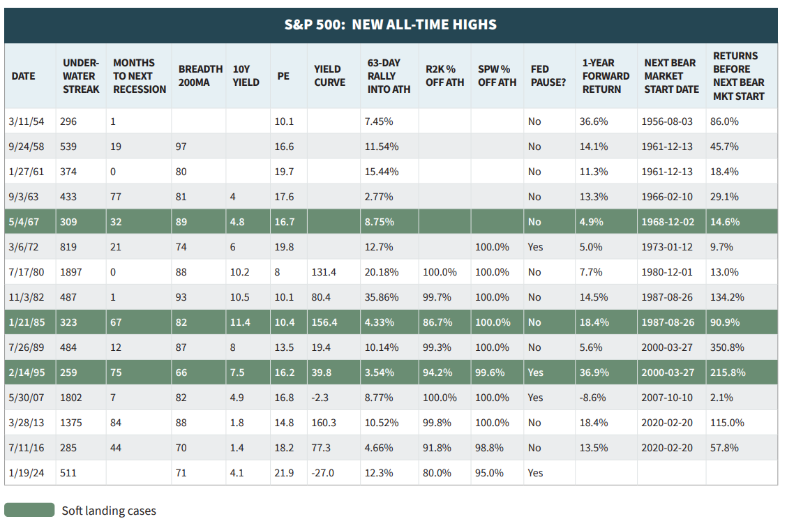

A quick note to answer this question: What happens after markets make a new all-time high (after a year w/o one)? Check out the...

A quick note to answer this question: What happens after markets make a new all-time high (after a year w/o one)? Check out the...

Read More

The transcript from this week’s, MiB: Stephen Suttmeier, BAML Chief Equity Technical Strategist, is below. You can stream...

Read More

This week, we speak with Stephen Suttmeier, director and chief equity technical strategist at B of A Merrill Lynch. His...

Read More

This week, we speak with Peter Borish, who is chairman and chief executive officer of Computer Trading Corporation, an investment...

Read More

Today, I am interviewing Peter Borish, one of the legends of trading & investing: Founding partner and right-hand man...

Today, I am interviewing Peter Borish, one of the legends of trading & investing: Founding partner and right-hand man...

Read More

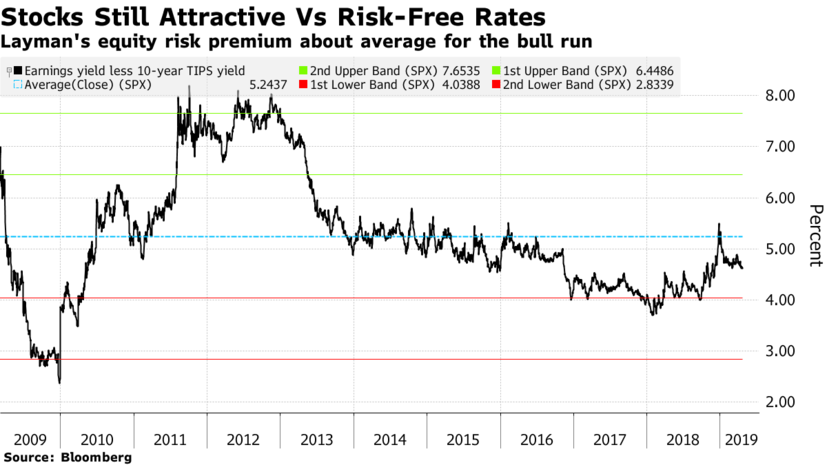

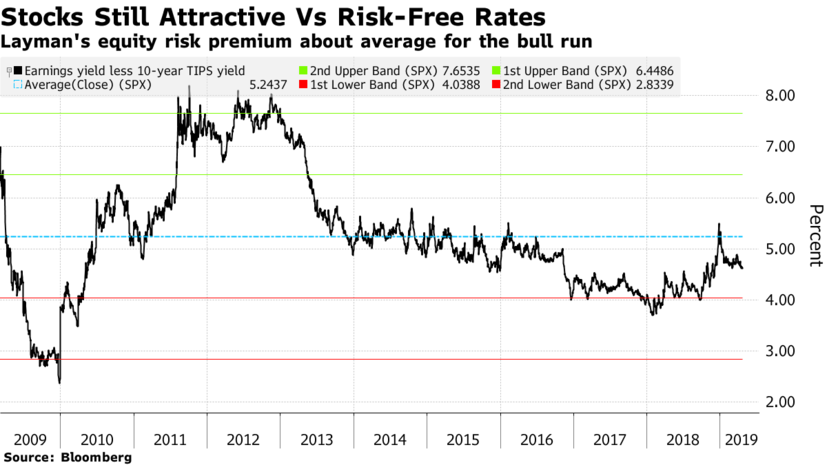

There seems to be a debate going on today between economists and market technicians (!?) as to whether we are in a bull or...

There seems to be a debate going on today between economists and market technicians (!?) as to whether we are in a bull or...

Read More

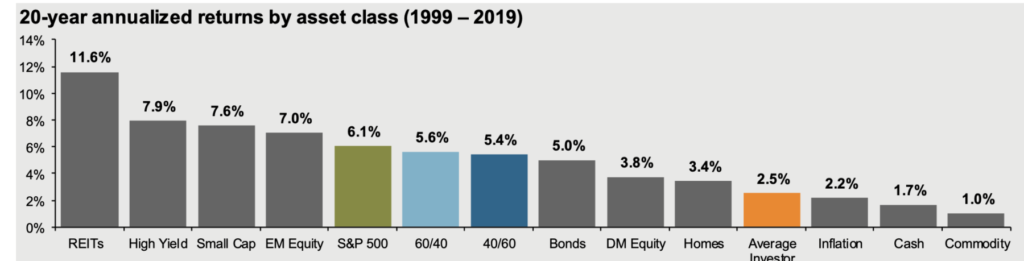

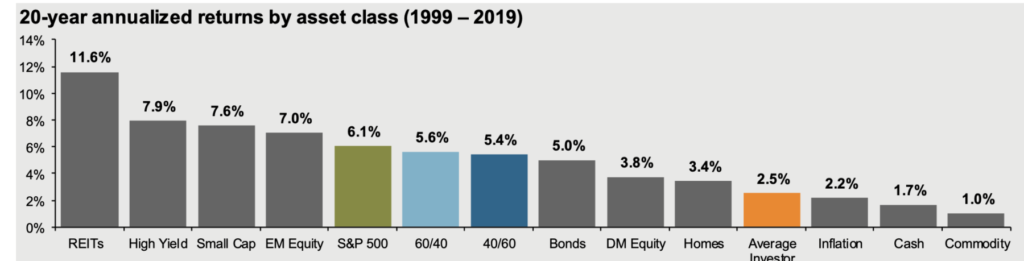

Source: JPM Chase My favorite market chart book is out, and as always, its filled with 86 pages of great charts and insightful...

Source: JPM Chase My favorite market chart book is out, and as always, its filled with 86 pages of great charts and insightful...

Read More

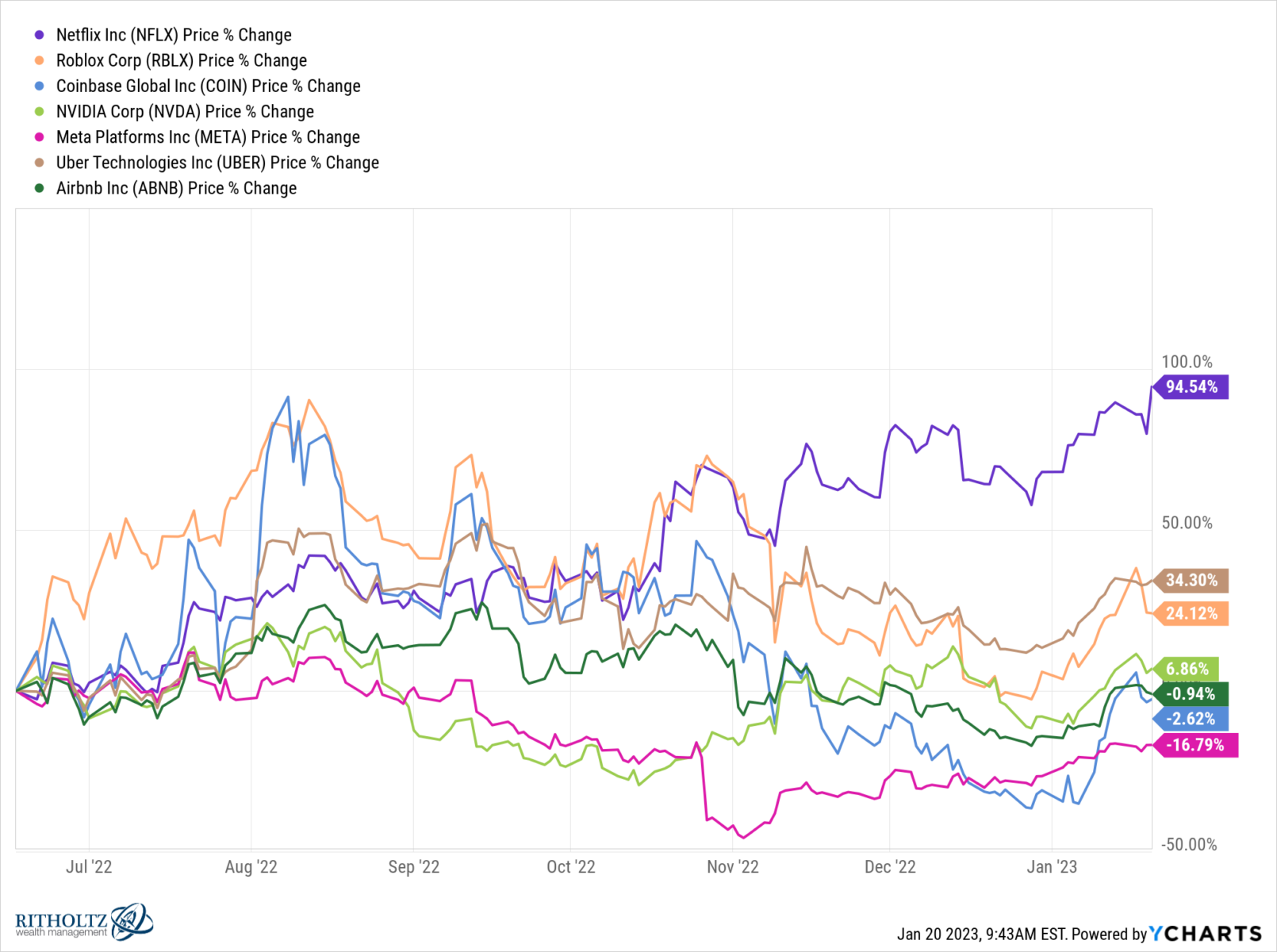

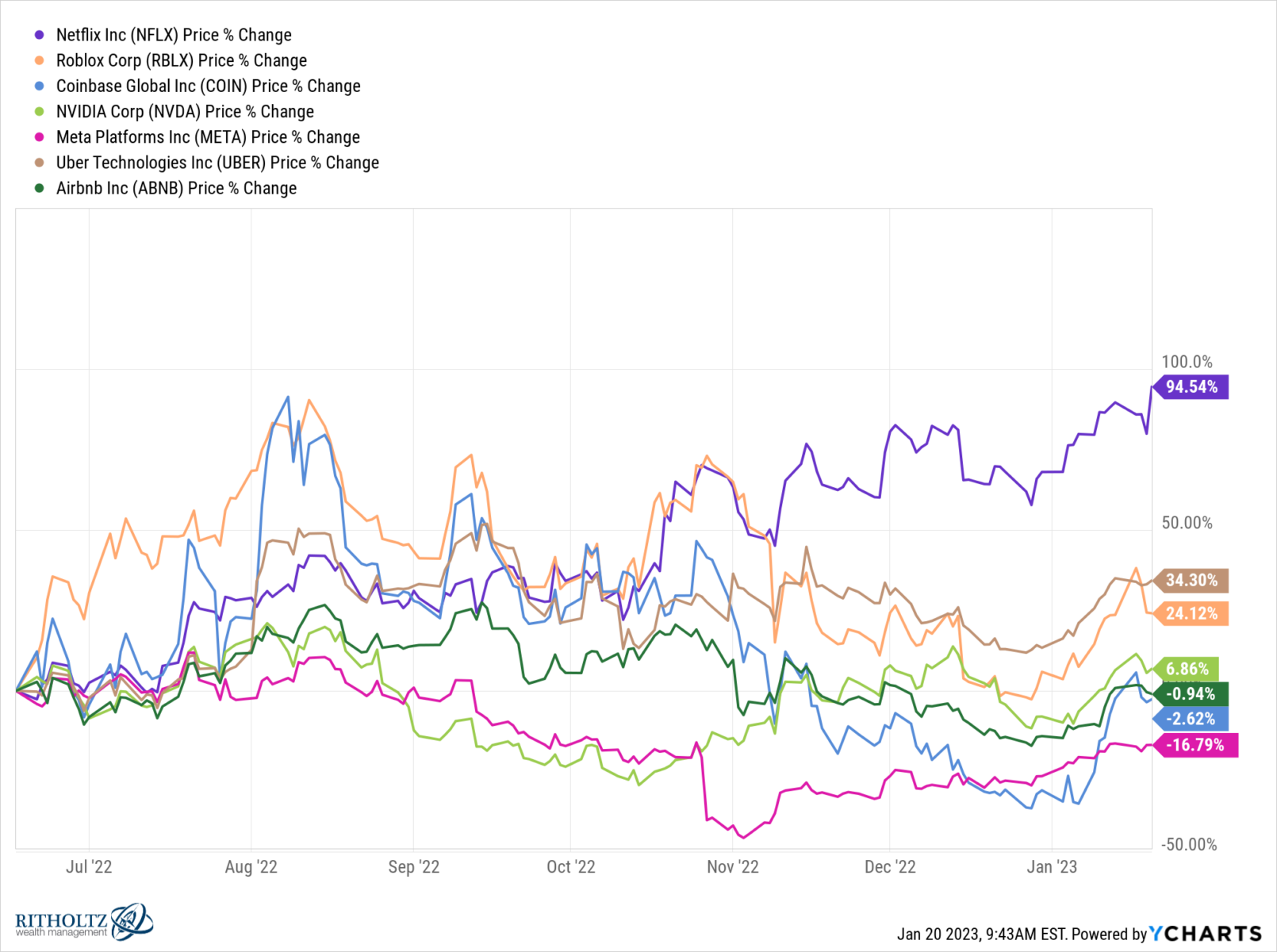

A number of media outlets, including Barron’s, CNN, and Marketwatch, have suggested that the 20% move off of the lows qualifies as a...

Read More

John Roque joins me in The Compound to explain why technical trading signals stopped working and how he has adapted his trading style to...

Read More

Some interesting thoughts via Bloomberg: “It took 14 weeks to fall, 17 weeks to recover, and if you managed never to sell during...

Some interesting thoughts via Bloomberg: “It took 14 weeks to fall, 17 weeks to recover, and if you managed never to sell during...

Read More

A quick note to answer this question: What happens after markets make a new all-time high (after a year w/o one)? Check out the...

A quick note to answer this question: What happens after markets make a new all-time high (after a year w/o one)? Check out the...

A quick note to answer this question: What happens after markets make a new all-time high (after a year w/o one)? Check out the...

A quick note to answer this question: What happens after markets make a new all-time high (after a year w/o one)? Check out the...