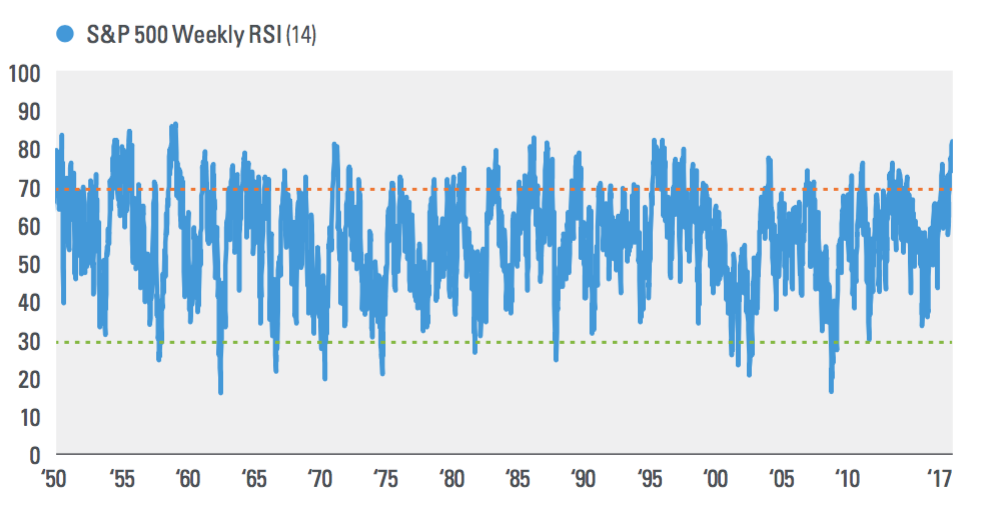

click for ginormous chart Source: RWM, Bloomberg There are many reasons why I believe you should not date bull markets from...

click for ginormous chart Source: RWM, Bloomberg There are many reasons why I believe you should not date bull markets from...

Read More

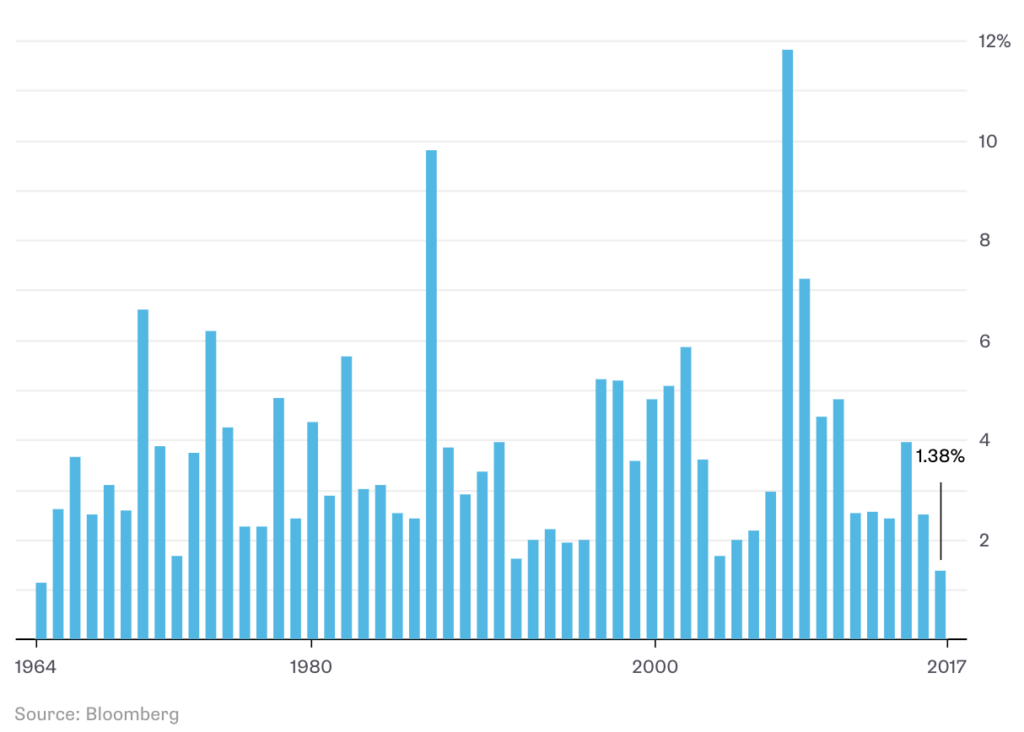

Source: Bloomberg Via Dave Wilson: The longest-ever streak without a 5 percent drop in the S&P 500 Index may end with...

Source: Bloomberg Via Dave Wilson: The longest-ever streak without a 5 percent drop in the S&P 500 Index may end with...

Read More

Ed Mendel first met Ned Davis in the 1970s at J.C. Bradford & Company, a traditional broker dealer. The 1970s-bear market was in full...

Read More

The transcript from this week’s MiB podcast with Ed Mendel is below. You can stream/download the full conversation, including...

Read More

This week, we sit down for a conversation with Ed Mendel, co-founder of Ned Davis Research Group; Mendel was one of the very...

Read More

Taking Stock of a Very Weird Year in Markets Rarely have investors had such consistent, steady gains. That bodes well for the future....

Taking Stock of a Very Weird Year in Markets Rarely have investors had such consistent, steady gains. That bodes well for the future....

Read More

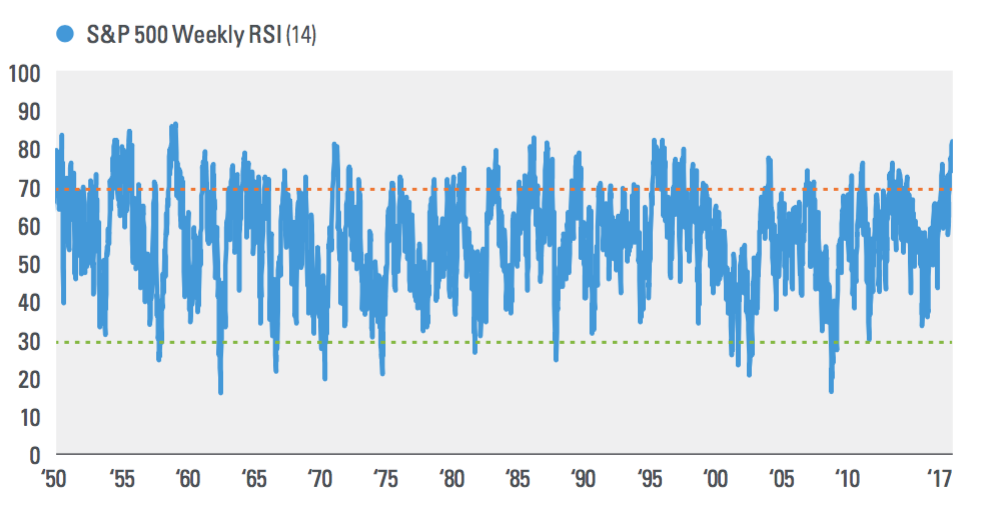

Interesting chart from John Lynch Chief Investment Strategist and Ryan Detrick, CMT Senior Market Strategist, LPL Financial discussing...

Interesting chart from John Lynch Chief Investment Strategist and Ryan Detrick, CMT Senior Market Strategist, LPL Financial discussing...

Read More

This week we sit down with legendary investor Felix Zulauf. In 1990, he founded Zulauf Asset Management, a...

Read More

Josh Brown is the Chief Executive Officer at RWM. He has spent his career helping people invest and manage portfolios. Josh writes...

Josh Brown is the Chief Executive Officer at RWM. He has spent his career helping people invest and manage portfolios. Josh writes...

Read More

There’s Nothing Old About This Bull Market Claims that it’s the second-longest ever don’t hold up Bloomberg, September...

Read More

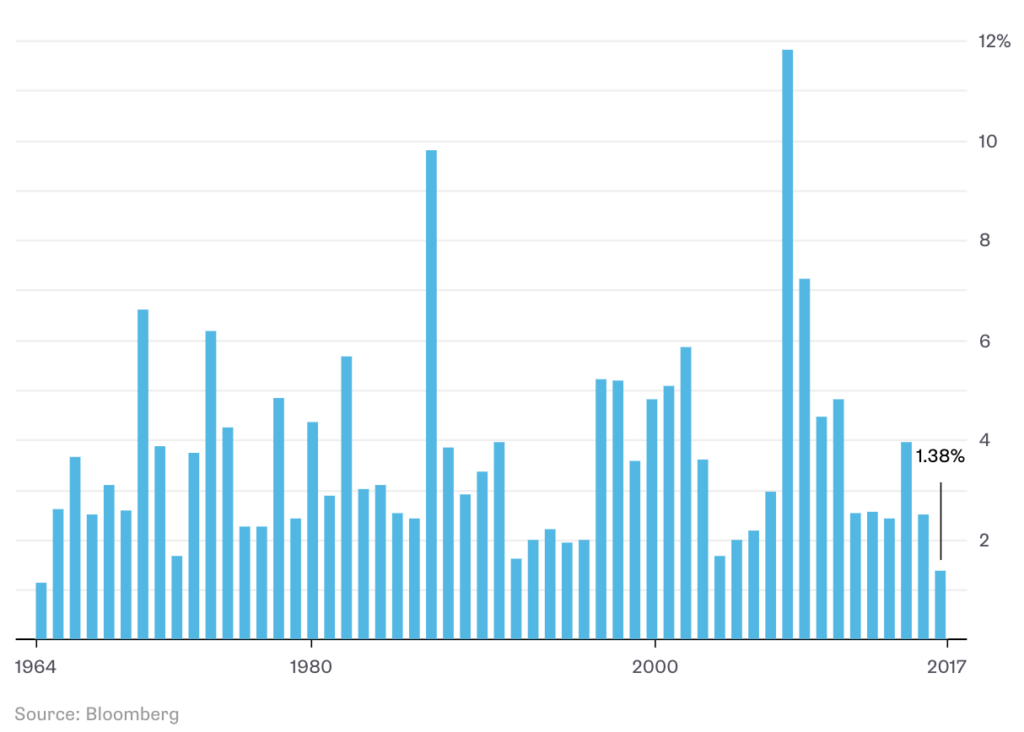

click for ginormous chart Source: RWM, Bloomberg There are many reasons why I believe you should not date bull markets from...

click for ginormous chart Source: RWM, Bloomberg There are many reasons why I believe you should not date bull markets from...

click for ginormous chart Source: RWM, Bloomberg There are many reasons why I believe you should not date bull markets from...

click for ginormous chart Source: RWM, Bloomberg There are many reasons why I believe you should not date bull markets from...