MIB: Katie Stockton on Technicals in College

Not many strategists begin studying technicals in college, but that was the route Katie Stockton took. As an undergraduate at the...

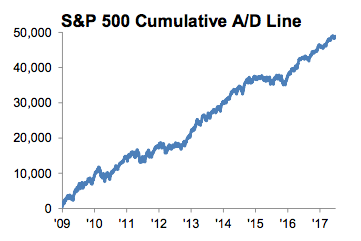

“This is the conclusion on which I base my facts.” -Adlai Stevenson The folks at Birinyi Research point out...

“This is the conclusion on which I base my facts.” -Adlai Stevenson The folks at Birinyi Research point out...

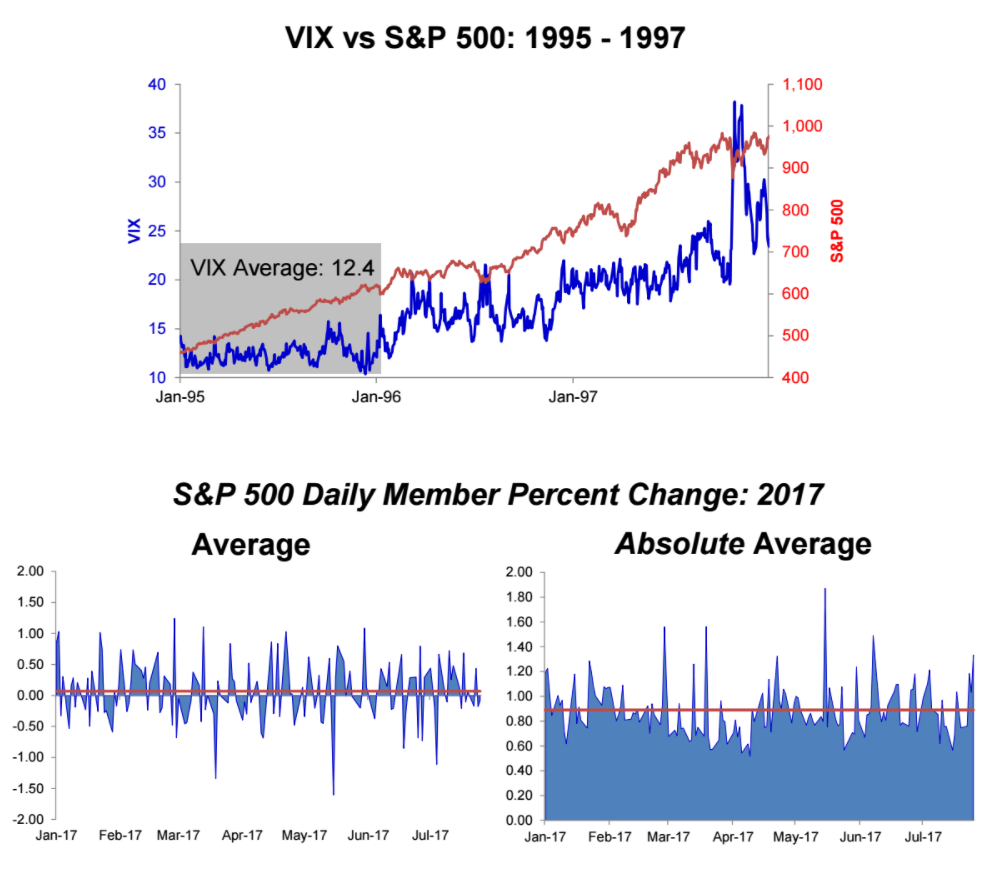

Source: Birinyi Jeffrey Yale Rubin of Birinyi looks at the issue of low volatility. He makes two interesting...

Source: Birinyi Jeffrey Yale Rubin of Birinyi looks at the issue of low volatility. He makes two interesting...

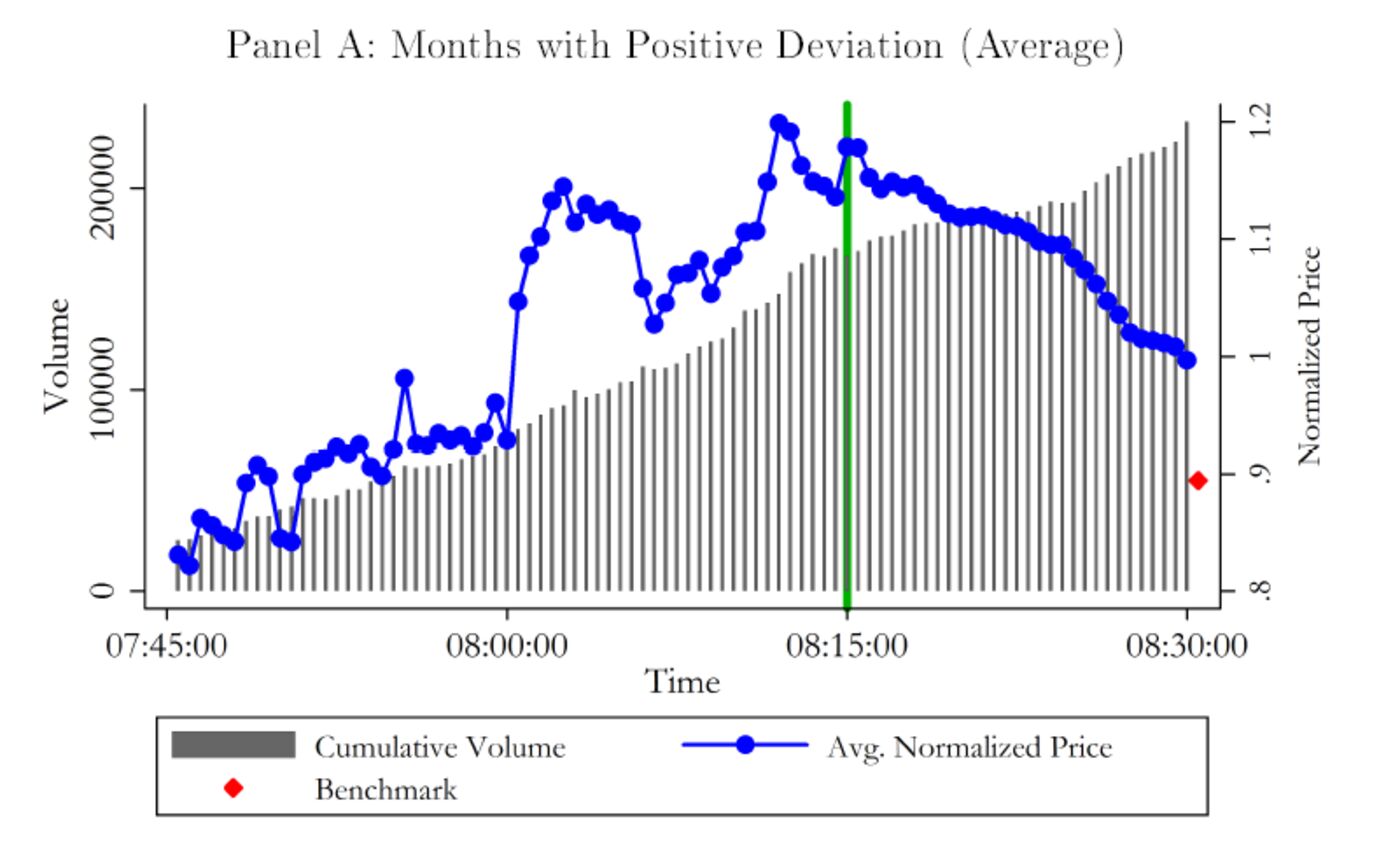

I have repeatedly admonished readers to subscribe to Matt Levine’s daily market write up. His conversation on VIX manipulation is...

I have repeatedly admonished readers to subscribe to Matt Levine’s daily market write up. His conversation on VIX manipulation is...

The VIX Tells Us Very Little About Tomorrow All the hand-wringing because the “fear index” has fallen below 10 is a waste of time....

The VIX Tells Us Very Little About Tomorrow All the hand-wringing because the “fear index” has fallen below 10 is a waste of time....

Get subscriber-only insights and news delivered by Barry every two weeks.