The Nasdaq Composite Index, which contains some of the biggest names in tech, hit a milestone this week, crossing 6,000 for the...

The Nasdaq Composite Index, which contains some of the biggest names in tech, hit a milestone this week, crossing 6,000 for the...

Read More

click for full agenda For those of you who are technically oriented, the MTA;s 44th Annual Symposium is coming to NYC this...

click for full agenda For those of you who are technically oriented, the MTA;s 44th Annual Symposium is coming to NYC this...

Read More

This week, I speak with John Roque, a highly regarded technical analysis. He spent the first part of his career on the sell side, working...

Read More

This week, we speak with Louise Yamada, the grande dame of technical analysis. Yamada now runs Technical Research Advisors, LLC...

Read More

This week, we speak with Louise Yamada, the grande dame of technical analysis. Yamada now runs Technical Research...

Read More

Is Momentum Really Momentum by ritholtz1 on Scribd

Read More

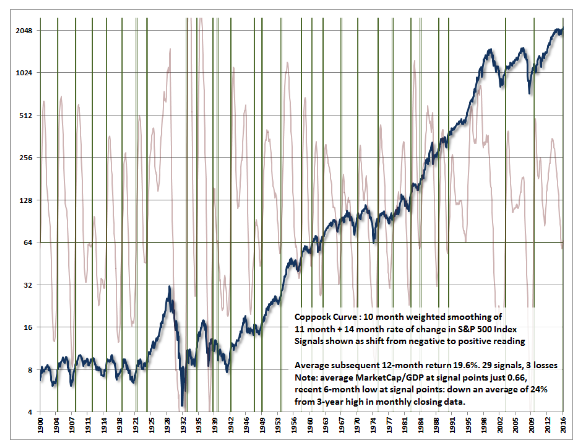

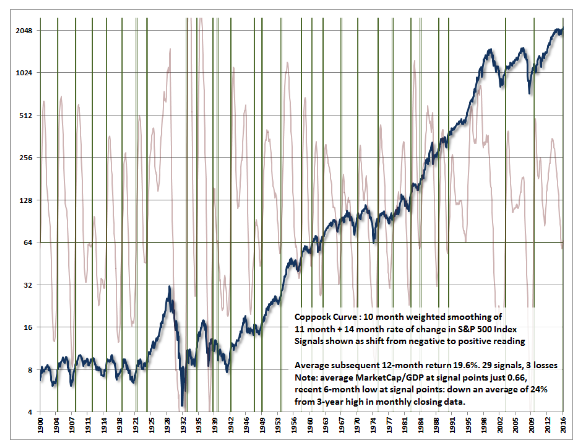

Via Meb Faber’s Idea Farm, comes this chart of a somewhat obscure technical indicator, the Coppock Curve. Ned Davis Research has...

Via Meb Faber’s Idea Farm, comes this chart of a somewhat obscure technical indicator, the Coppock Curve. Ned Davis Research has...

Read More

This week on our Masters in Business podcast, we speak with Jeff DeGraaf, founder and chief technician of Renaissance Macro. He was...

Read More

This week on our Masters in Business podcast, we speak with Jeff DeGraaf, founder and chief technician of Renaissance Macro.He was...

Read More

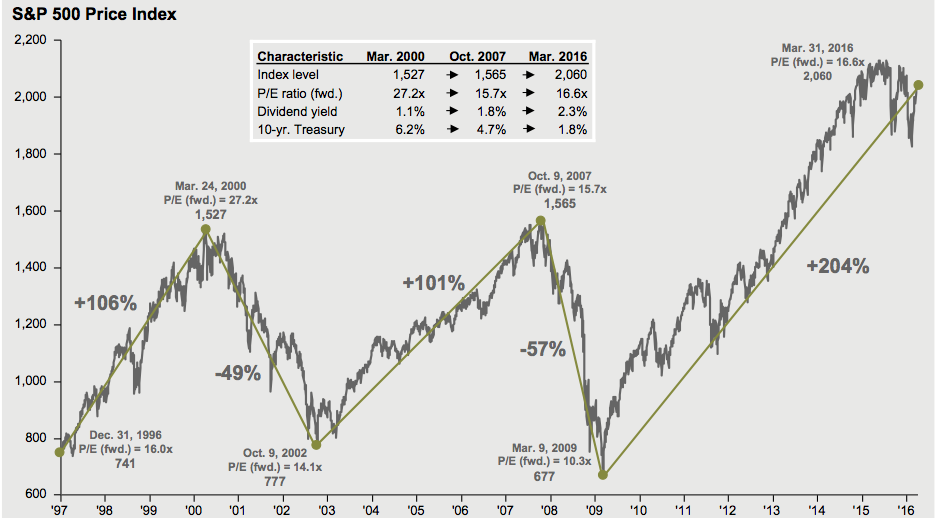

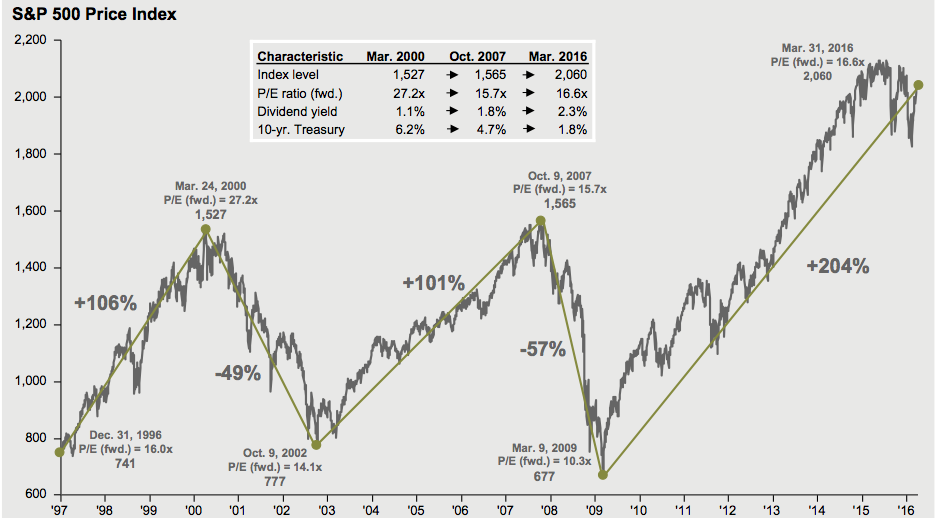

One of my favorite quarterly chart books, updated for Q2, from JPM: S&P500 Cycle Trend, 1997-2016 Source: JPM ...

One of my favorite quarterly chart books, updated for Q2, from JPM: S&P500 Cycle Trend, 1997-2016 Source: JPM ...

Read More

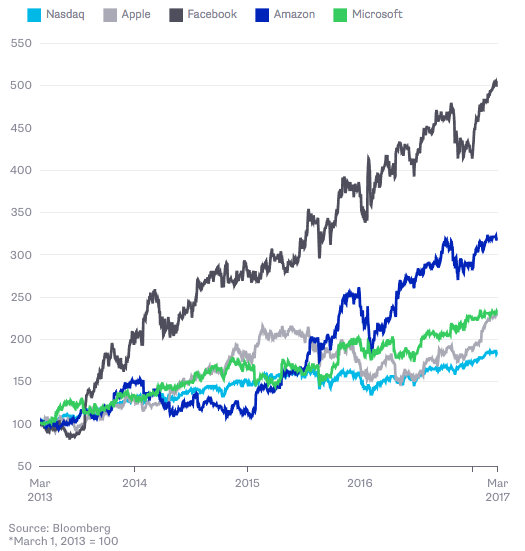

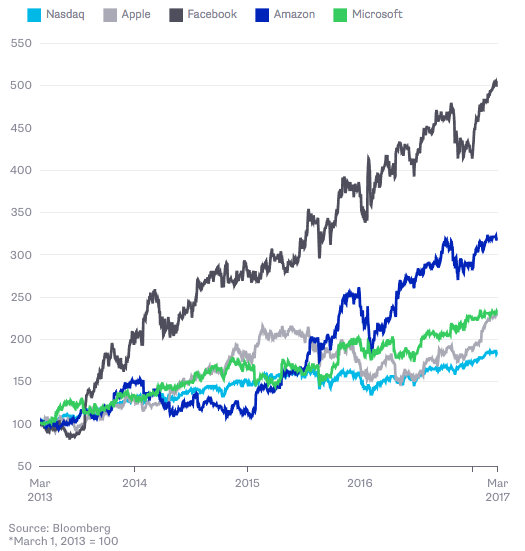

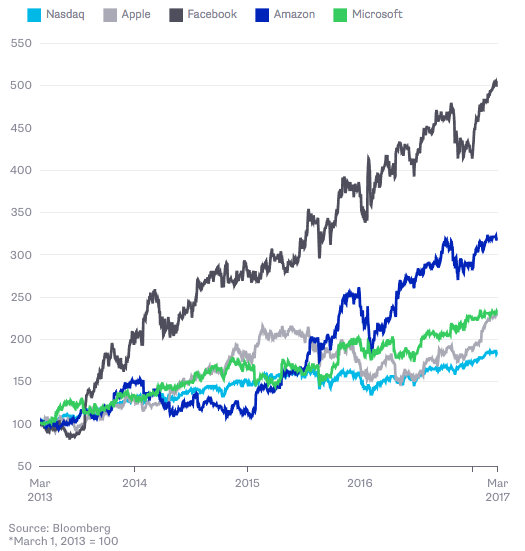

The Nasdaq Composite Index, which contains some of the biggest names in tech, hit a milestone this week, crossing 6,000 for the...

The Nasdaq Composite Index, which contains some of the biggest names in tech, hit a milestone this week, crossing 6,000 for the...

The Nasdaq Composite Index, which contains some of the biggest names in tech, hit a milestone this week, crossing 6,000 for the...

The Nasdaq Composite Index, which contains some of the biggest names in tech, hit a milestone this week, crossing 6,000 for the...