The First Totally Honest Stock Market Story

The First Totally Honest Stock Market Story FRIDAY’S MARKETS By Vinnie Foster Wynans III Staff Reporter of The Wall Street Journal...

The Future of the Right by Bruce Bartlett Published on Twitter 8/20/2022 I’m glad to see right-wingers abandoning Trump, but...

The Future of the Right by Bruce Bartlett Published on Twitter 8/20/2022 I’m glad to see right-wingers abandoning Trump, but...

Evolve or die. Every time a tech company capitulates to its audience and rolls back the future it’s a mistake. The...

Evolve or die. Every time a tech company capitulates to its audience and rolls back the future it’s a mistake. The...

This story has been buzzing for months, but I point you to a recent article on the decline of new music in the United States:...

This story has been buzzing for months, but I point you to a recent article on the decline of new music in the United States:...

Elon’s Out Musk lost interest in pretending to buy Twitter. Bloomberg, July 9, 2022 I have occasionally spotlighted the...

Elon’s Out Musk lost interest in pretending to buy Twitter. Bloomberg, July 9, 2022 I have occasionally spotlighted the...

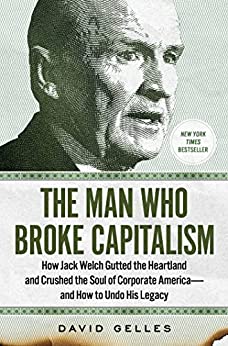

If everybody in America read this book there would be a revolution: “The Man Who Broke Capitalism: How Jack Welch Gutted the...

If everybody in America read this book there would be a revolution: “The Man Who Broke Capitalism: How Jack Welch Gutted the...

Brian Wilson: Long Promised Road (Stream free in the U.S.) He’s completely internalized. Brian Wilson has been on an...

Brian Wilson: Long Promised Road (Stream free in the U.S.) He’s completely internalized. Brian Wilson has been on an...

And brings Tesla down in the process. By the time you read this, “The New York Times” documentary on Tesla will have...

And brings Tesla down in the process. By the time you read this, “The New York Times” documentary on Tesla will have...

Get subscriber-only insights and news delivered by Barry every two weeks.