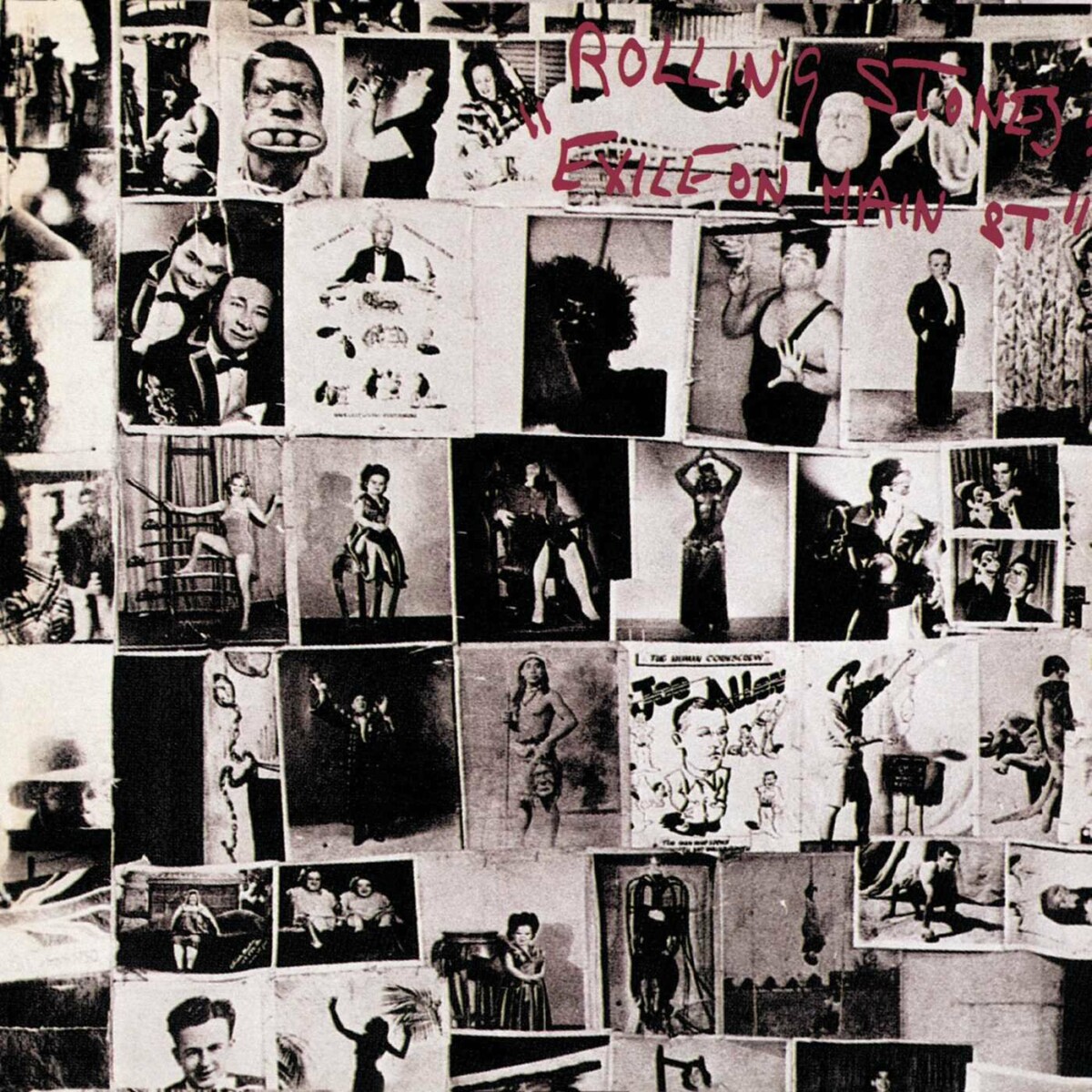

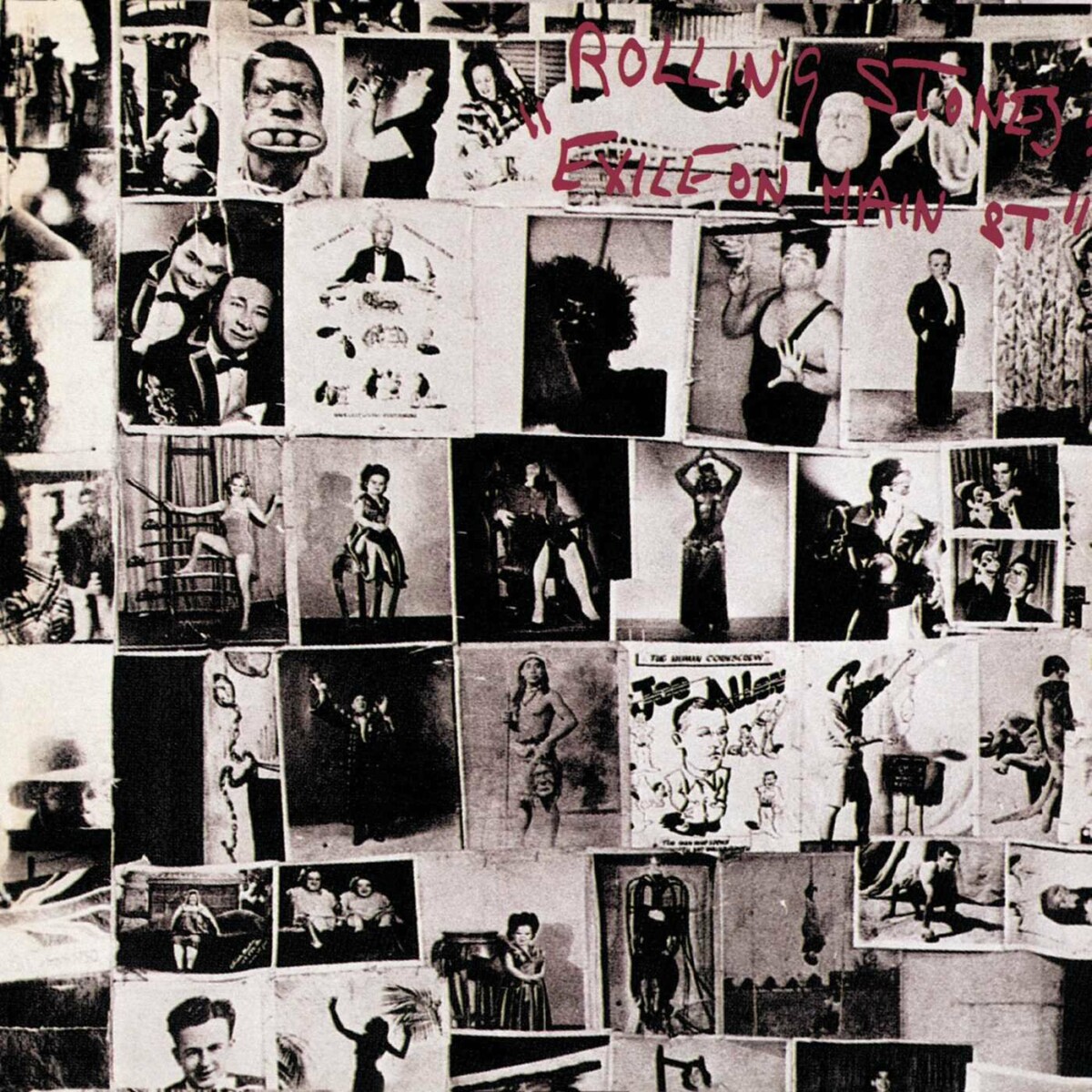

Listen along on your favored streamer — here is Amazon Music. 1. Exile On Main Street, 50th Anniversary is...

Listen along on your favored streamer — here is Amazon Music. 1. Exile On Main Street, 50th Anniversary is...

Read More

“Freezing Order: A True Story of Money Laundering, Murder, and Surviving Vladimir Putin’s Wrath“...

“Freezing Order: A True Story of Money Laundering, Murder, and Surviving Vladimir Putin’s Wrath“...

Read More

Netflix isn’t in trouble, Wall Street is. Now let me get this straight, you’ve got “professional” investors and analysts,...

Netflix isn’t in trouble, Wall Street is. Now let me get this straight, you’ve got “professional” investors and analysts,...

Read More

People have too much money. This is what happens when belief in the American Dream runs amok. The American Dream is dead,...

People have too much money. This is what happens when belief in the American Dream runs amok. The American Dream is dead,...

Read More

“Last Chance Texaco: Chronicles of an American Troubadour“ It’s amazing she’s alive. This book has...

“Last Chance Texaco: Chronicles of an American Troubadour“ It’s amazing she’s alive. This book has...

Read More

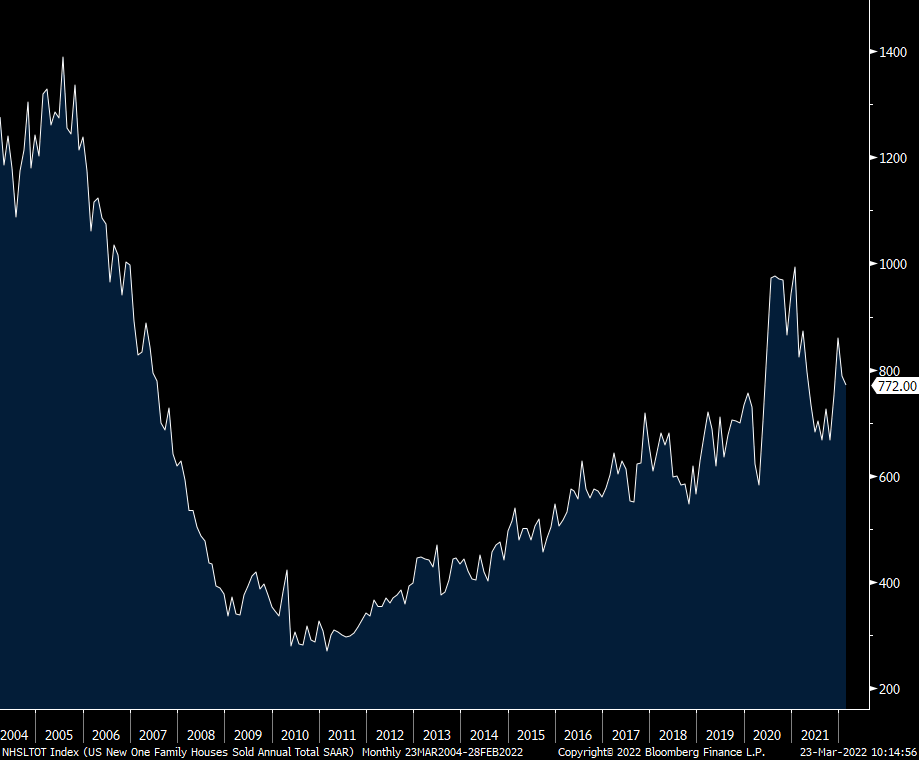

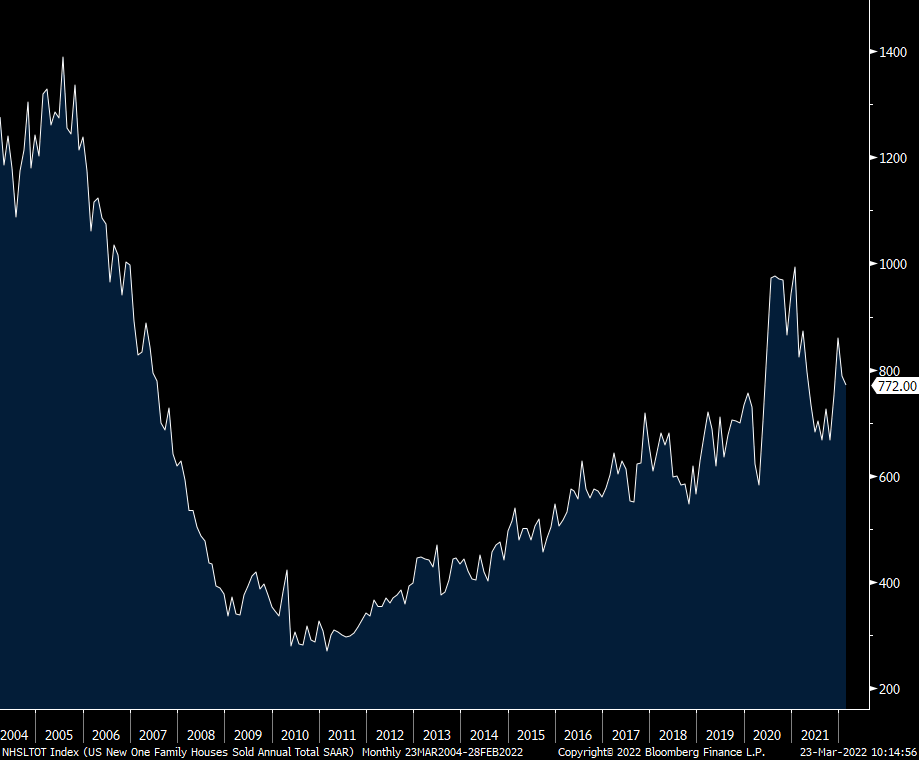

New home sales in February totaled 772k, 38k less than expected and January was revised down by 13k to 788k. Keep in mind that the...

New home sales in February totaled 772k, 38k less than expected and January was revised down by 13k to 788k. Keep in mind that the...

Read More

What kind of crazy, fucked-up world do we live in where John Oliver gets the Ticketmaster story exactly right? One...

Read More

“Downfall: The Case Against Boeing” You want to watch this. On Netflix. I’ve had a fascination with aircraft ever...

Read More

The business world is starting to recognize the economic impact of Long Covid: “Where Are the Workers? Millions Are Sick...

The business world is starting to recognize the economic impact of Long Covid: “Where Are the Workers? Millions Are Sick...

Read More

Turns out buying your way into the future is a bad strategy. The biggest story this week for me was Facebook (I refuse to call it...

Turns out buying your way into the future is a bad strategy. The biggest story this week for me was Facebook (I refuse to call it...

Read More

Listen along on your favored streamer — here is Amazon Music. 1. Exile On Main Street, 50th Anniversary is...

Listen along on your favored streamer — here is Amazon Music. 1. Exile On Main Street, 50th Anniversary is...

Listen along on your favored streamer — here is Amazon Music. 1. Exile On Main Street, 50th Anniversary is...

Listen along on your favored streamer — here is Amazon Music. 1. Exile On Main Street, 50th Anniversary is...