Elizabeth Holmes said she was too pretty to go to jail. Needless to say, Holmes is on trial as we speak, blaming her heinous...

Elizabeth Holmes said she was too pretty to go to jail. Needless to say, Holmes is on trial as we speak, blaming her heinous...

Read More

This is what America voted for. This is what America WANTS! For far too long politicians have been afraid of their...

This is what America voted for. This is what America WANTS! For far too long politicians have been afraid of their...

Read More

The Day That Richard Nixon Changed U.S. Economic Policy Forever Fifty years ago, in response to rising inflation, he rejected...

The Day That Richard Nixon Changed U.S. Economic Policy Forever Fifty years ago, in response to rising inflation, he rejected...

Read More

Speak from the heart, not the head. Go with what feels right. The more you think about it, the greater the chance...

Speak from the heart, not the head. Go with what feels right. The more you think about it, the greater the chance...

Read More

Lewis Hamilton is one of the fittest athletes on the planet. Today the Formula 1 race was in Budapest. That’s Hungary in...

Lewis Hamilton is one of the fittest athletes on the planet. Today the Formula 1 race was in Budapest. That’s Hungary in...

Read More

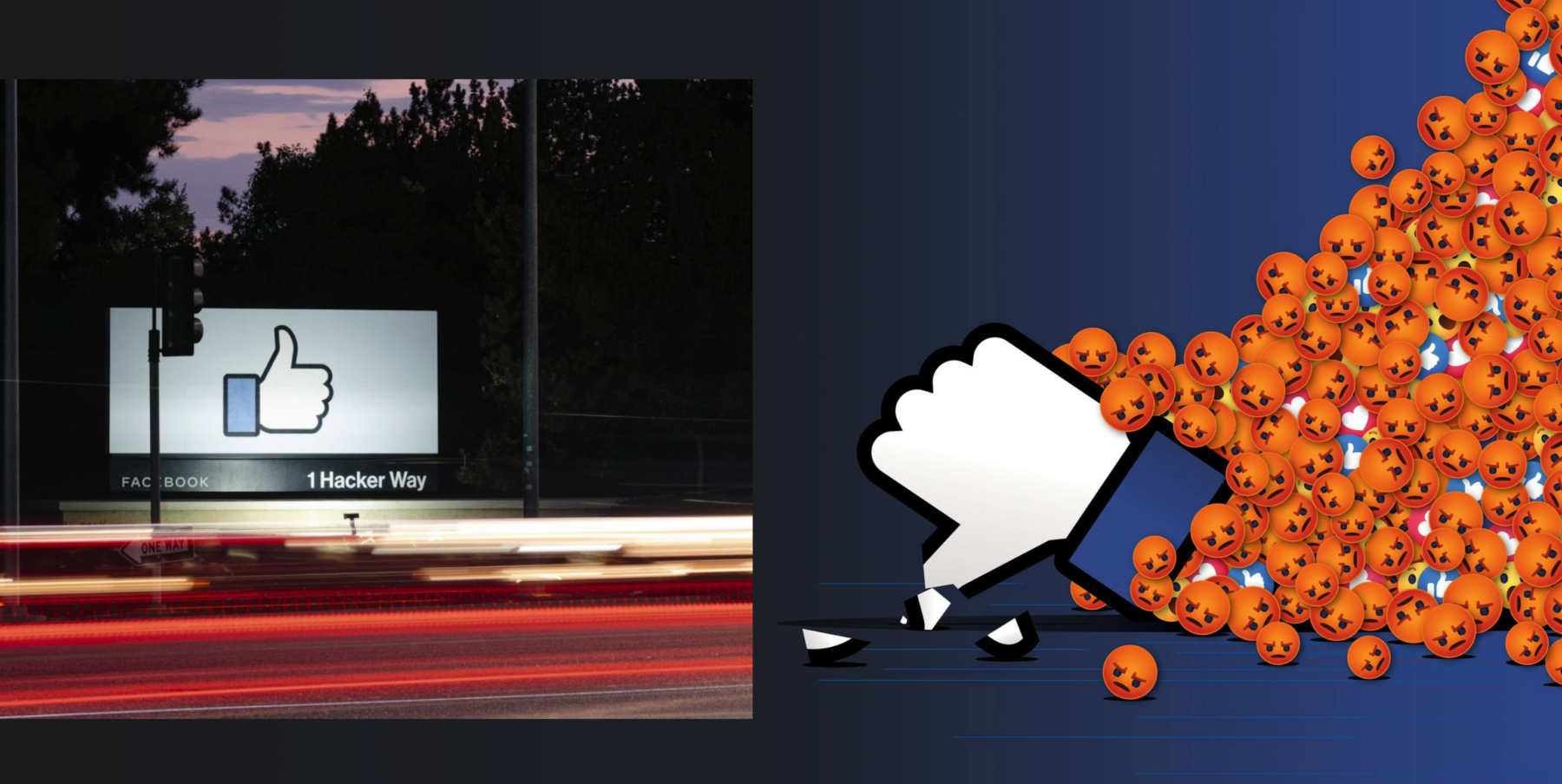

“On Saturday, Mr. Rosen said in the blog post that among Facebook’s American users, vaccine hesitancy had declined by...

“On Saturday, Mr. Rosen said in the blog post that among Facebook’s American users, vaccine hesitancy had declined by...

Read More

It’s every bit as good as they say it is. Can’t say I was eager to see it, being burned out on Questlove, he’s...

Read More

Peter Boockvar is the CIO of Bleakley Advisory Group and Editor of The Boock Report. So Powell was asked...

Peter Boockvar is the CIO of Bleakley Advisory Group and Editor of The Boock Report. So Powell was asked...

Read More

“CDC Ramps Up Research on Highly Contagious Variant from India” The ignorant pay the price. “Lauren Boebert stated there...

“CDC Ramps Up Research on Highly Contagious Variant from India” The ignorant pay the price. “Lauren Boebert stated there...

Read More

1 This Netflix series is strangely satisfying…no, it’s incredibly engrossing, if you turn it on you won’t turn it...

Read More

Elizabeth Holmes said she was too pretty to go to jail. Needless to say, Holmes is on trial as we speak, blaming her heinous...

Elizabeth Holmes said she was too pretty to go to jail. Needless to say, Holmes is on trial as we speak, blaming her heinous...

Elizabeth Holmes said she was too pretty to go to jail. Needless to say, Holmes is on trial as we speak, blaming her heinous...

Elizabeth Holmes said she was too pretty to go to jail. Needless to say, Holmes is on trial as we speak, blaming her heinous...