1. I don’t know anybody with polio. Back in the fifties, before parents became their children’s best friends, when if...

1. I don’t know anybody with polio. Back in the fifties, before parents became their children’s best friends, when if...

Read More

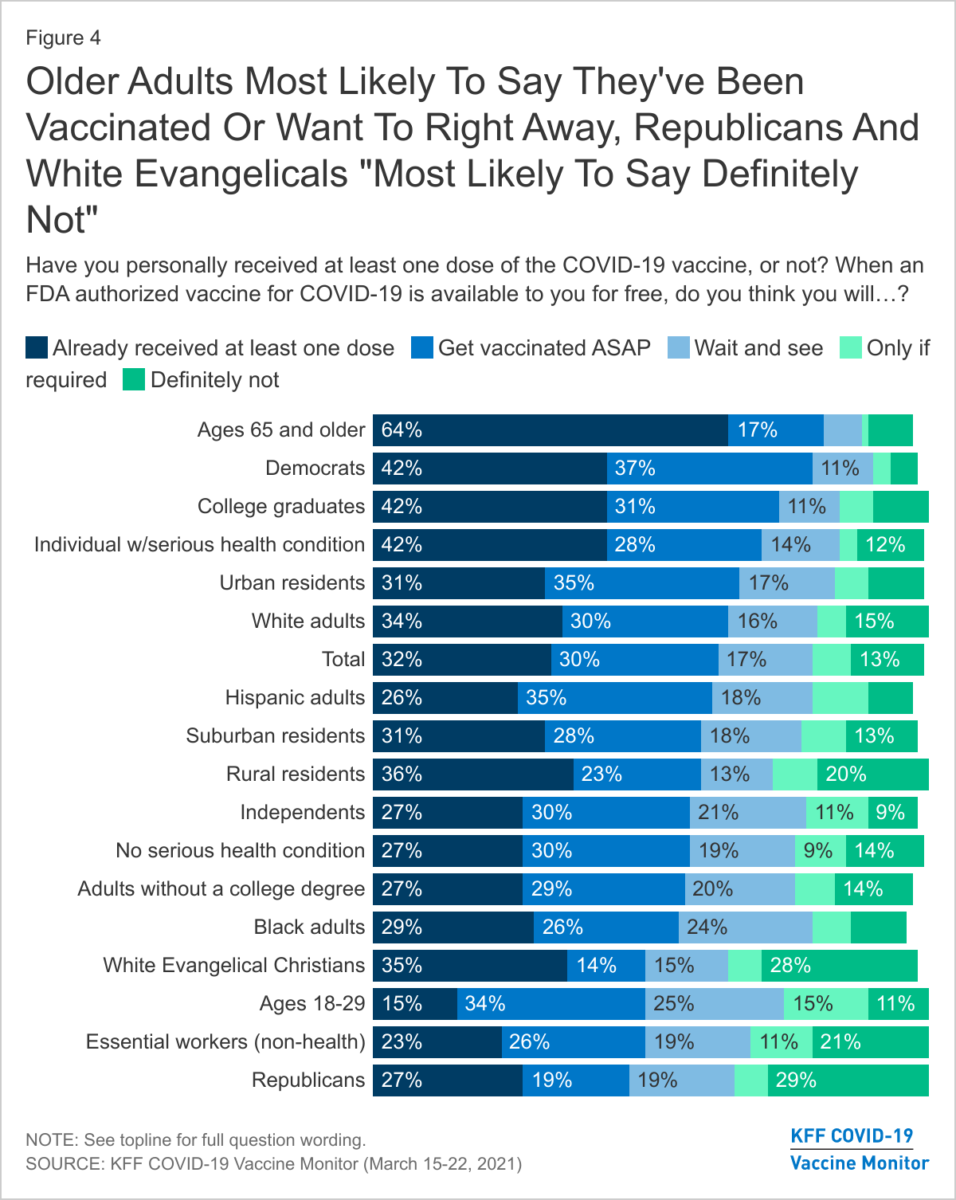

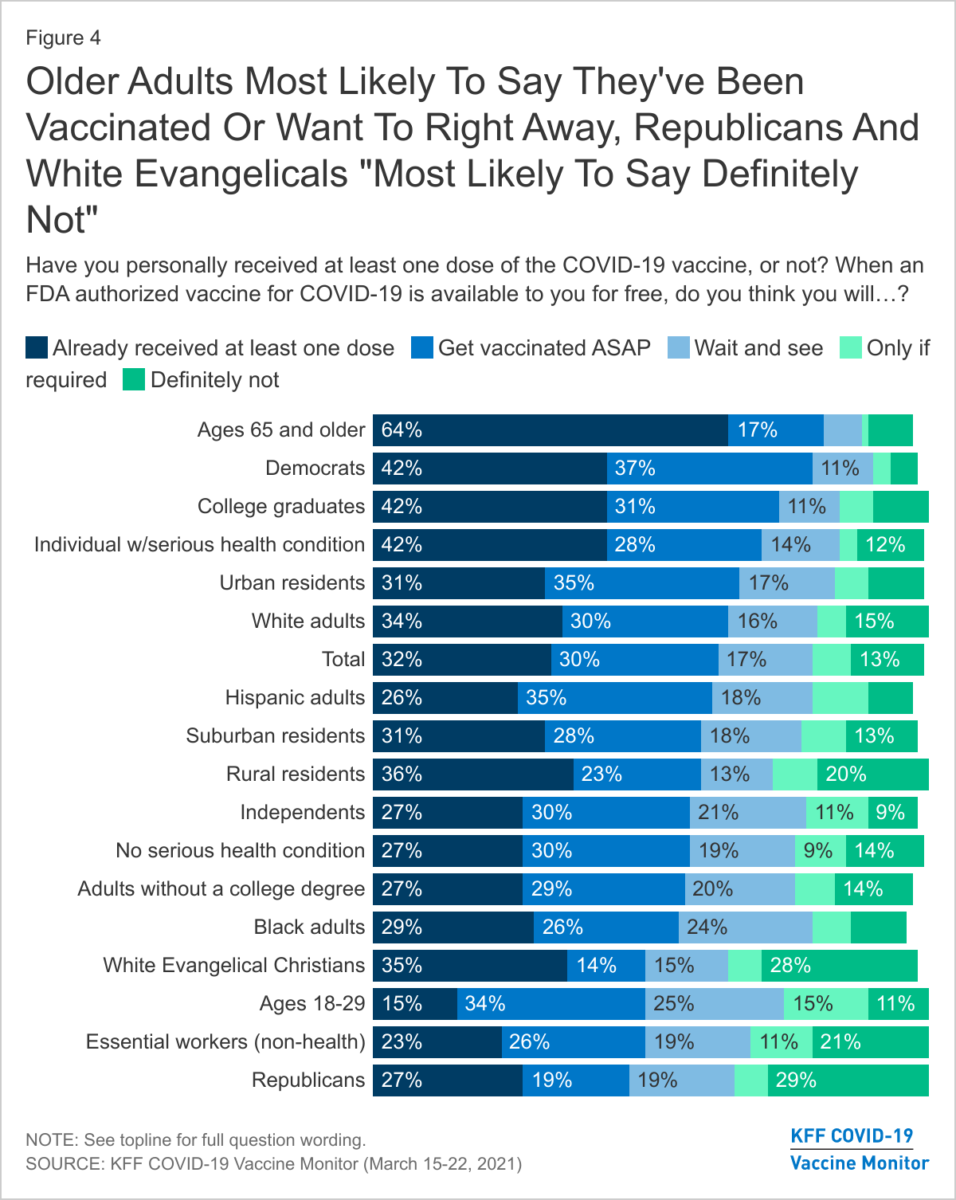

Vaccine Hesitancy and the Long Shadow of Racism in U.S. Health Care Nearly a third of Black Americans are taking a wait-and-see approach...

Vaccine Hesitancy and the Long Shadow of Racism in U.S. Health Care Nearly a third of Black Americans are taking a wait-and-see approach...

Read More

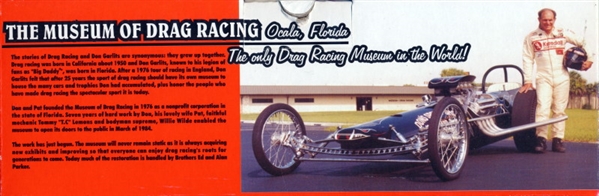

Subject: “Big Daddy” Don Garlits Did Not… appreciate my enlightening share, evidently. Take me off your fucking...

Subject: “Big Daddy” Don Garlits Did Not… appreciate my enlightening share, evidently. Take me off your fucking...

Read More

Washington’s Inflation Hysteria Is Fueled by Corporate Greed With the help of Larry Summers and a battery of...

Washington’s Inflation Hysteria Is Fueled by Corporate Greed With the help of Larry Summers and a battery of...

Read More

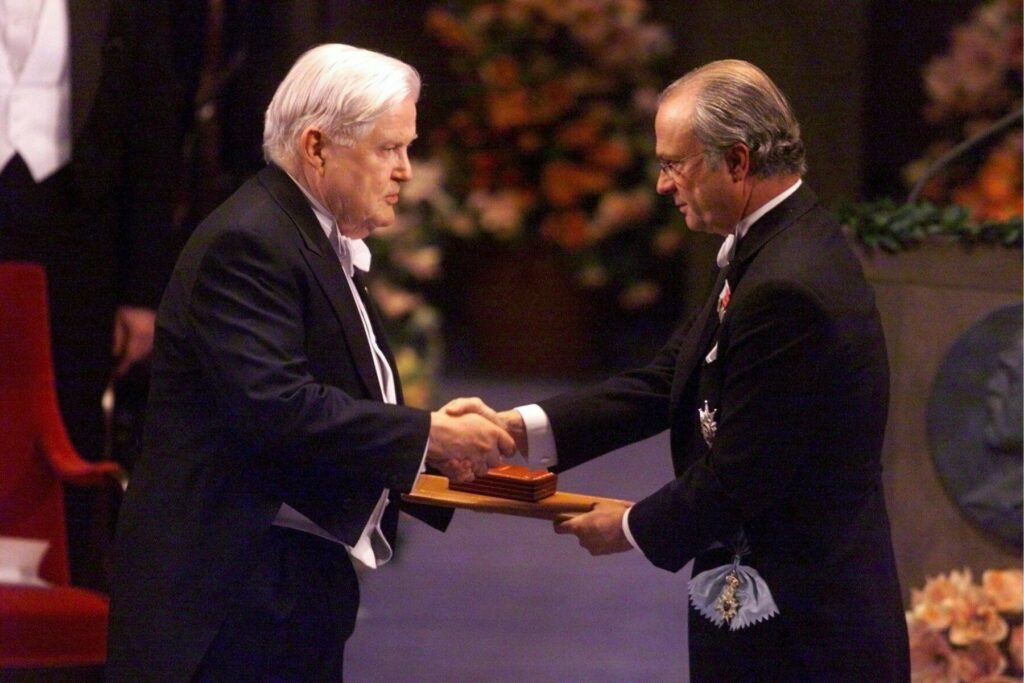

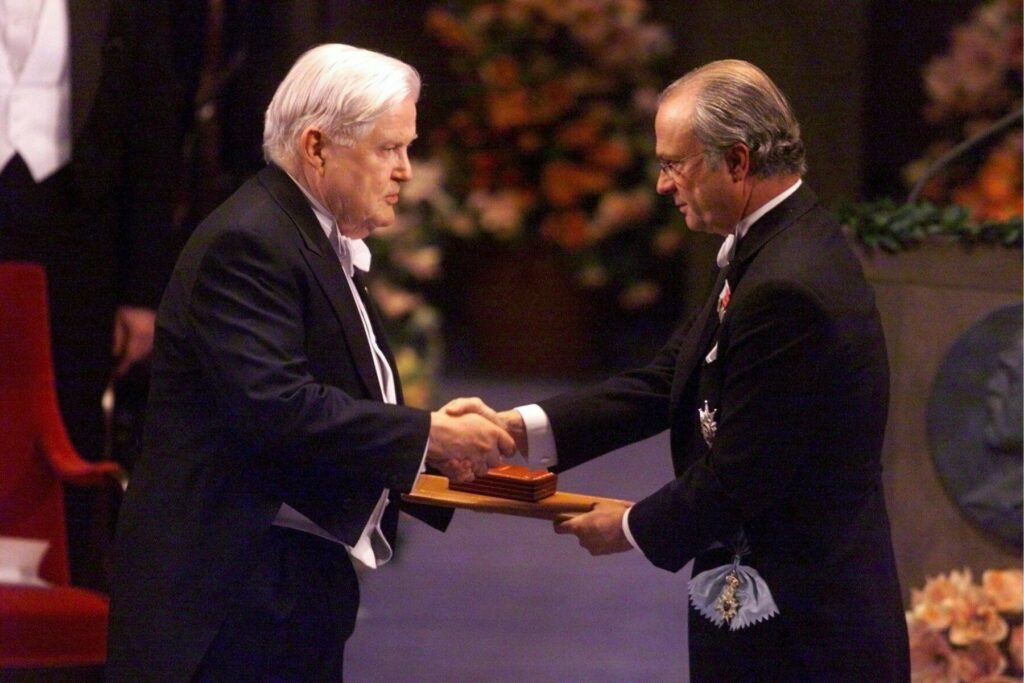

Remembering the Father of Supply-Side Economics Robert Mundell’s theories spawned decades of economic debate and still...

Remembering the Father of Supply-Side Economics Robert Mundell’s theories spawned decades of economic debate and still...

Read More

Socialism Is as American as Apple Pie The ideology that Republicans love to hate is woven through the fabric of the...

Socialism Is as American as Apple Pie The ideology that Republicans love to hate is woven through the fabric of the...

Read More

Republicans Greet Covid Stimulus with Another Round of Inflation Fearmongering Their cry-wolf act is well practiced but lacks...

Republicans Greet Covid Stimulus with Another Round of Inflation Fearmongering Their cry-wolf act is well practiced but lacks...

Read More

Image by Jörg Peter from Pixabay Everything you’re told is big is actually getting smaller. You used to feel...

Image by Jörg Peter from Pixabay Everything you’re told is big is actually getting smaller. You used to feel...

Read More

My guest this coming week on Masters in Business is William Bernstein, someone whose work I have long admired. Our...

My guest this coming week on Masters in Business is William Bernstein, someone whose work I have long admired. Our...

Read More

I Was a Rush Limbaugh Whisperer His radio show was once a vital outlet of conservative news—and I was one of his sources. But it became...

Read More

1. I don’t know anybody with polio. Back in the fifties, before parents became their children’s best friends, when if...

1. I don’t know anybody with polio. Back in the fifties, before parents became their children’s best friends, when if...

1. I don’t know anybody with polio. Back in the fifties, before parents became their children’s best friends, when if...

1. I don’t know anybody with polio. Back in the fifties, before parents became their children’s best friends, when if...