MiB: David Einhorn, Greenlight Capital

This week, we speak with David Einhorn. president of Greenlight Capital. He launched the value-oriented...

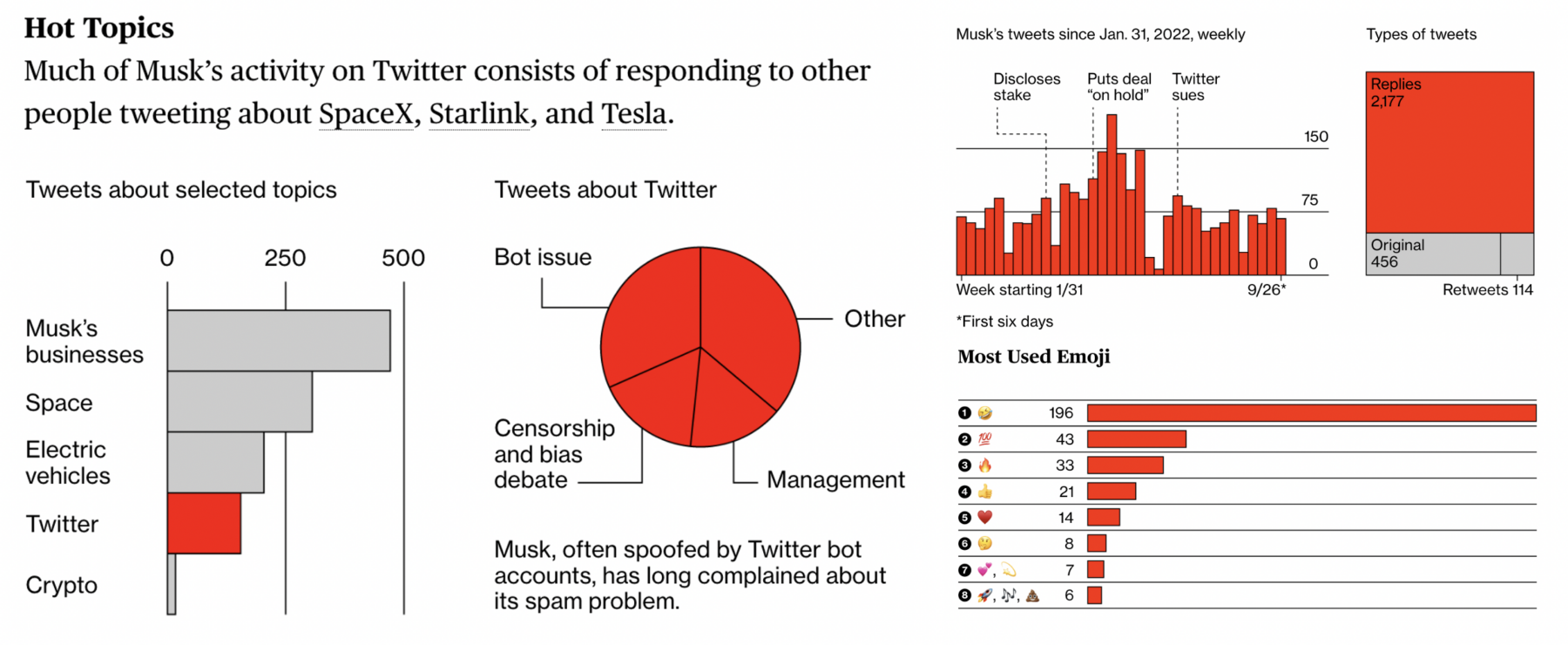

US equity markets are off about 25% YTD; Tech-heavy Nasdaq is off 32%; But the poster child for the past few years has been Tesla...

US equity markets are off about 25% YTD; Tech-heavy Nasdaq is off 32%; But the poster child for the past few years has been Tesla...

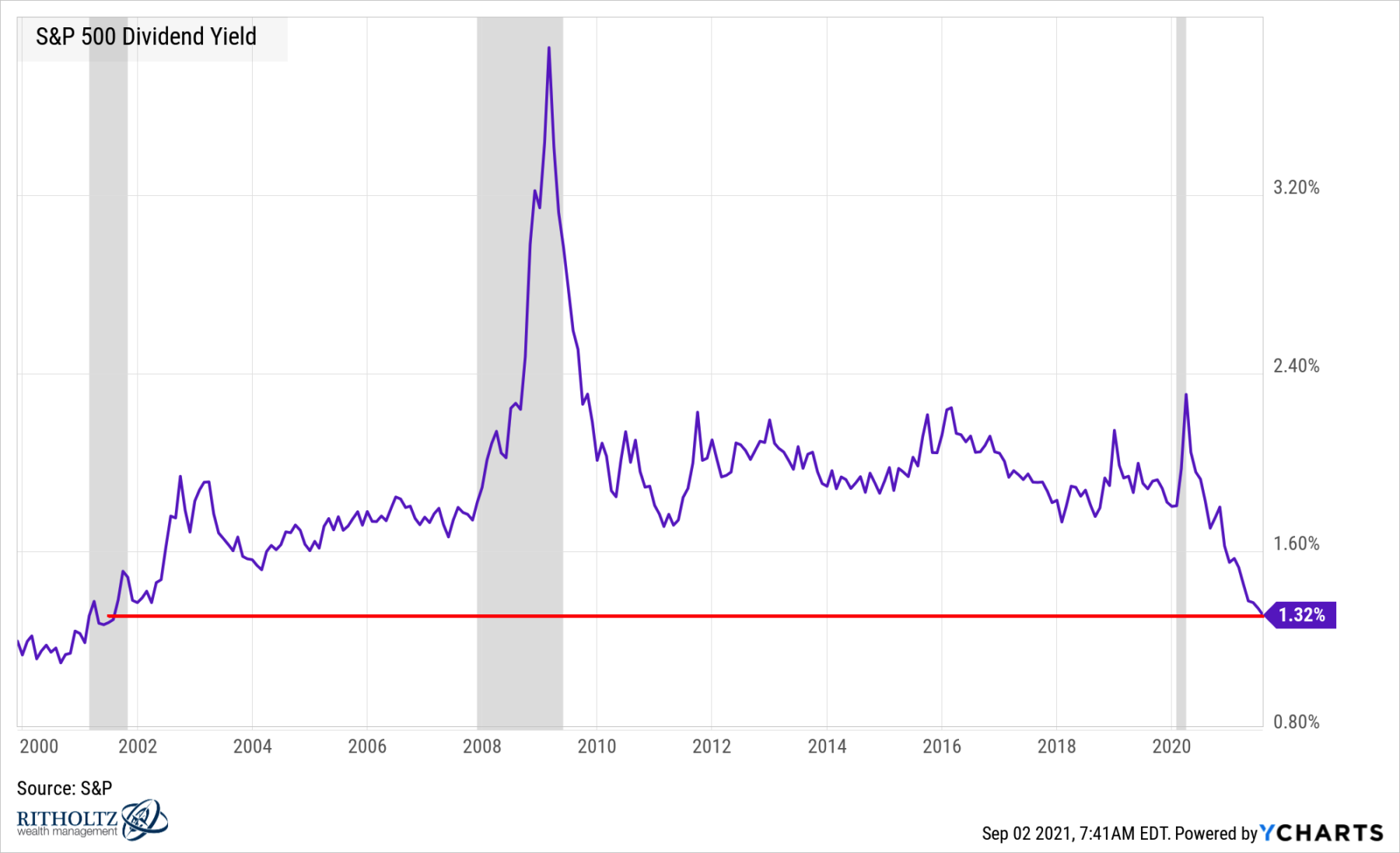

The Standard & Poor’s 500 stock market index tracks ~$45 trillion dollars in US Equities. It is a key component...

The Standard & Poor’s 500 stock market index tracks ~$45 trillion dollars in US Equities. It is a key component...

Get subscriber-only insights and news delivered by Barry every two weeks.