MiB: Ben Inker, GMO

This week, we speak with Ben Inker, head of Asset Allocation at GMO. The legendary Boston-based institutional...

To hear an audio spoken word version of this post, click here. I wrote a column yesterday (out tomorrow) on how to...

To hear an audio spoken word version of this post, click here. I wrote a column yesterday (out tomorrow) on how to...

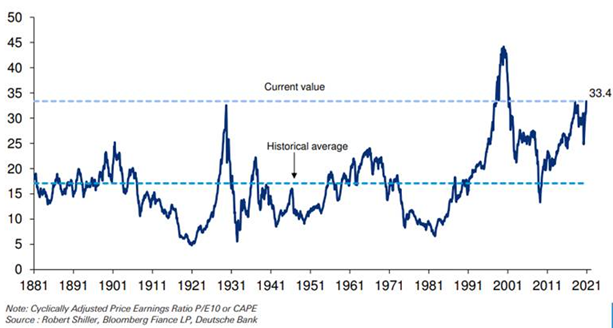

S&P 500 CAPE ratio now above 1929 levels for the only time apart from 1998-2001 Source: Jim Reid, Deutsche Bank One of...

S&P 500 CAPE ratio now above 1929 levels for the only time apart from 1998-2001 Source: Jim Reid, Deutsche Bank One of...

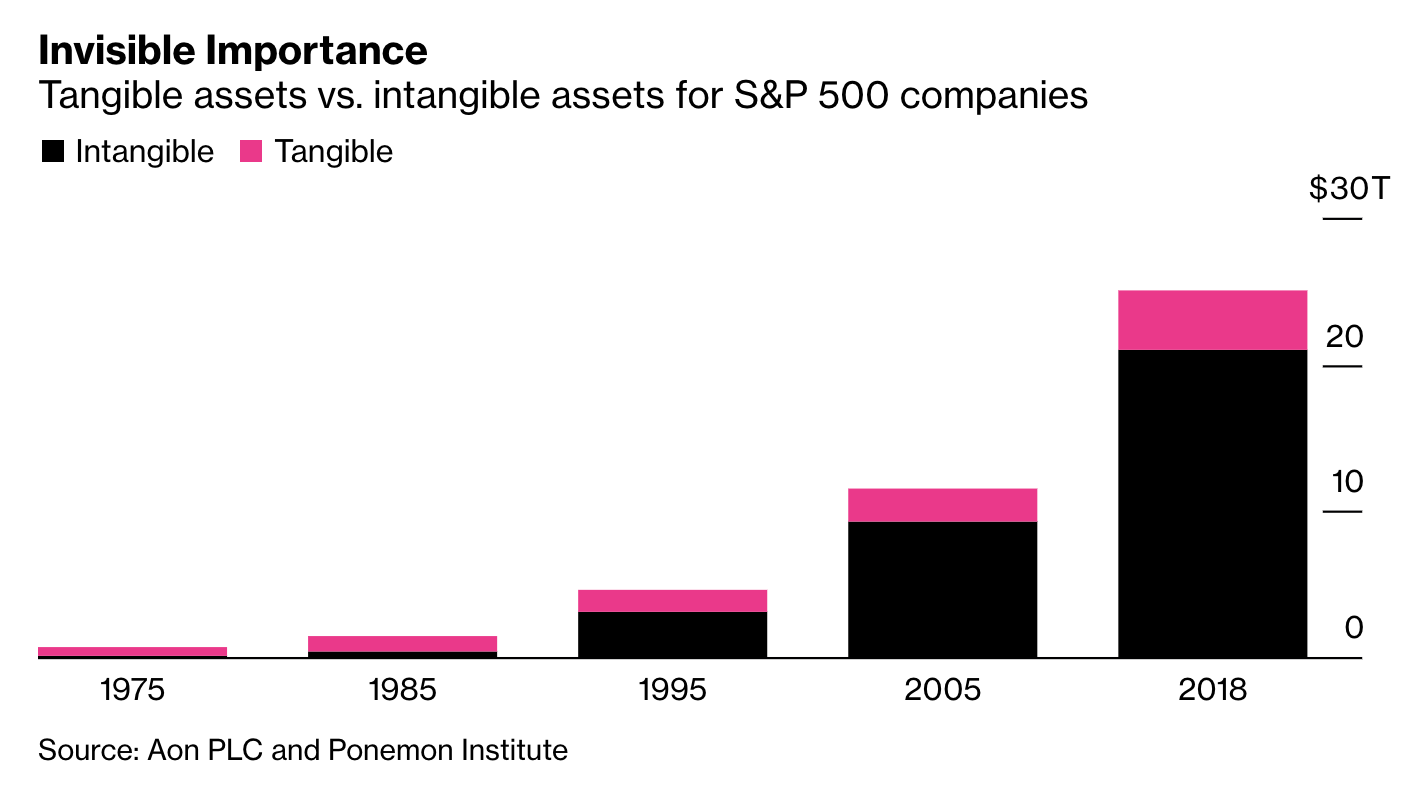

Source: Bloomberg Today’s must read column is by Sarah Ponczek of Bloomberg News: Epic S&P 500 Rally Is Powered...

Source: Bloomberg Today’s must read column is by Sarah Ponczek of Bloomberg News: Epic S&P 500 Rally Is Powered...

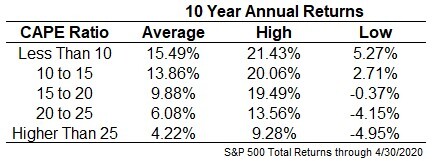

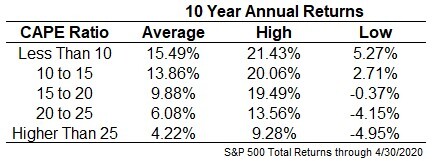

Is the Stock Market Overvalued, Cheap or Just Right? A Debate Valuation metrics can help in investment decisions, but they’re also...

Is the Stock Market Overvalued, Cheap or Just Right? A Debate Valuation metrics can help in investment decisions, but they’re also...

Is the Stock Market Overvalued, Cheap or Just Right? A Debate Valuation metrics can help in investment decisions, but they’re also...

Is the Stock Market Overvalued, Cheap or Just Right? A Debate Valuation metrics can help in investment decisions, but they’re also...

Get subscriber-only insights and news delivered by Barry every two weeks.