Can an esteemed professor of finance ever escape his reputation as a “perma-bull?” That was the question running through my mind...

Can an esteemed professor of finance ever escape his reputation as a “perma-bull?” That was the question running through my mind...

Read More

Markets have shrugged off a torrent of horrific economic news. They have powered far above the post-pandemic crash lows of March....

Read More

I am in the middle of a debate with my friend Nir Kaissar about peoples’ consumption habits. My position is as long as you can afford...

Read More

The transcript from this week’s, MiB: Jame Montier, GMO, is below. You can stream and download our full conversation,...

Read More

This week, we speak with James Montier, a member of GMO’s Asset Allocation team. Prior to joining GMO in 2009, he was co-head of Global...

Read More

Stock-Market Bubble Fears Are Greatly Overblown Despite some pockets of excess, valuations today are nothing like those of the dot-com...

Read More

Most investor’s definitions of value are too narrow. Merely looking at Price to Earnings ratios (P/E) or Price to book (P/B) misses key...

Read More

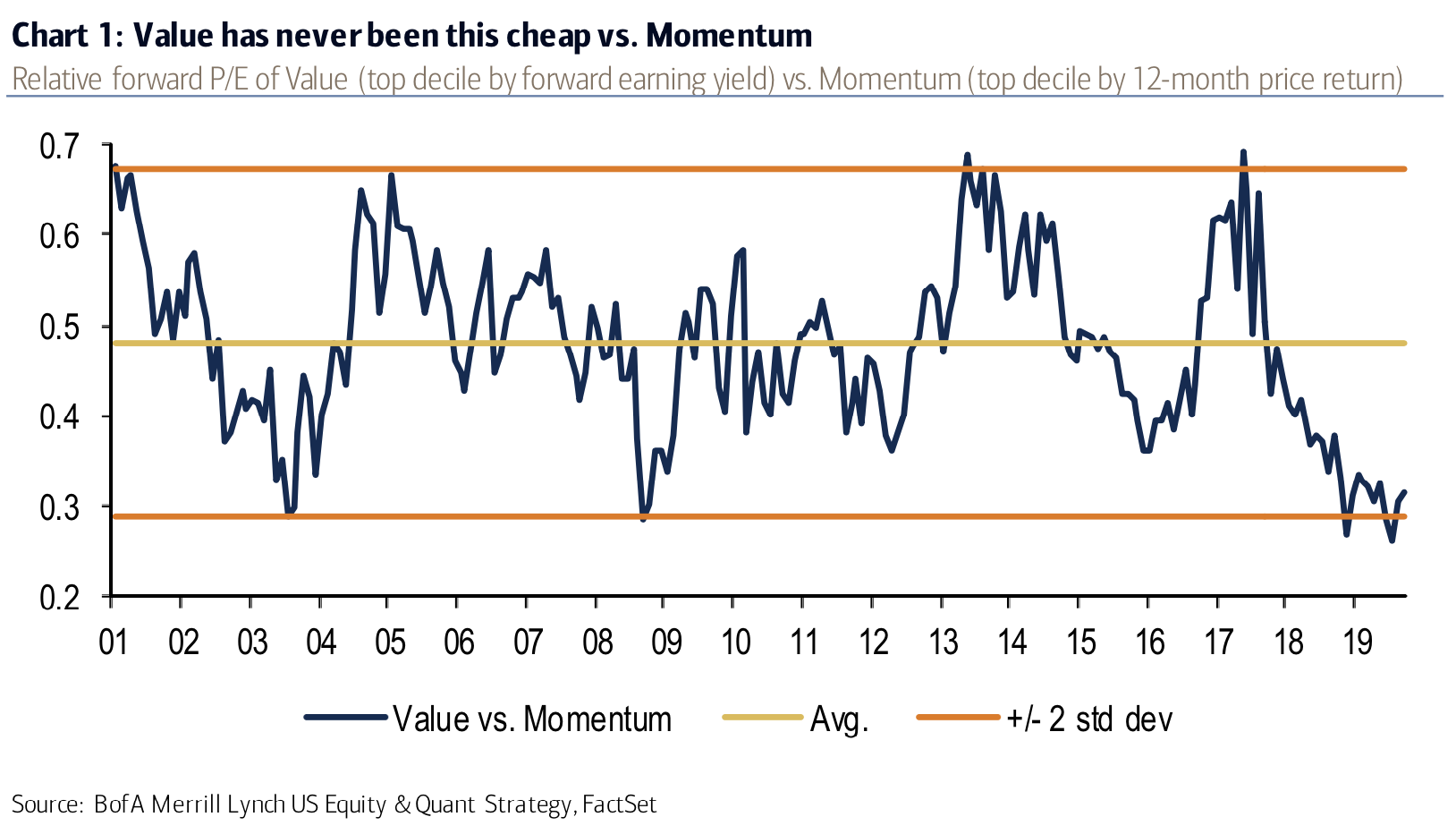

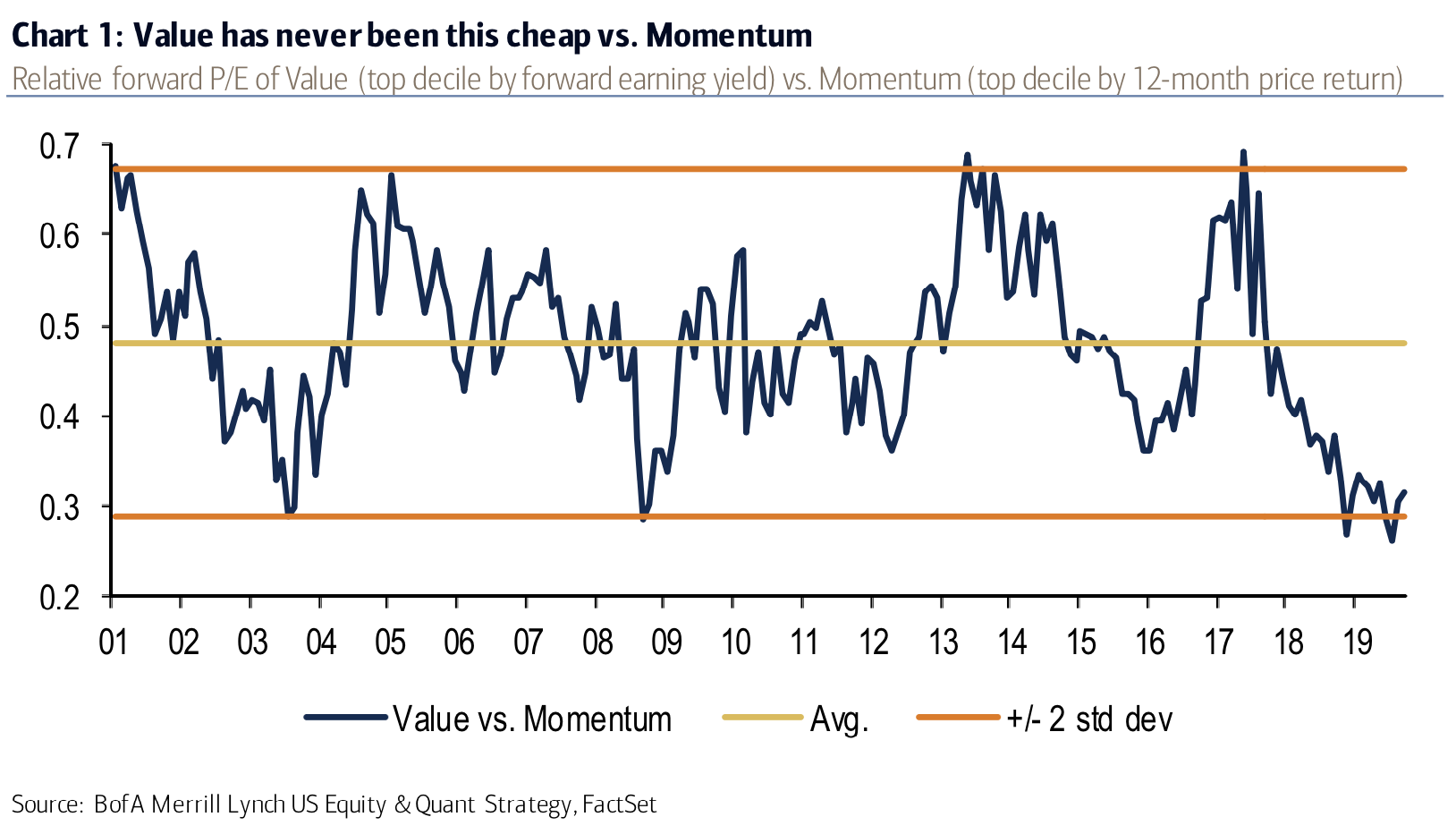

Source: Bank of America Merrill Lynch The chart above is quite amazing. It comes to use from Savita Subramanian, who runs the...

Source: Bank of America Merrill Lynch The chart above is quite amazing. It comes to use from Savita Subramanian, who runs the...

Read More

I am excited about our next Masters in Business: Live! This time, we will be chatting with Nobel Laureate Gene...

I am excited about our next Masters in Business: Live! This time, we will be chatting with Nobel Laureate Gene...

Read More

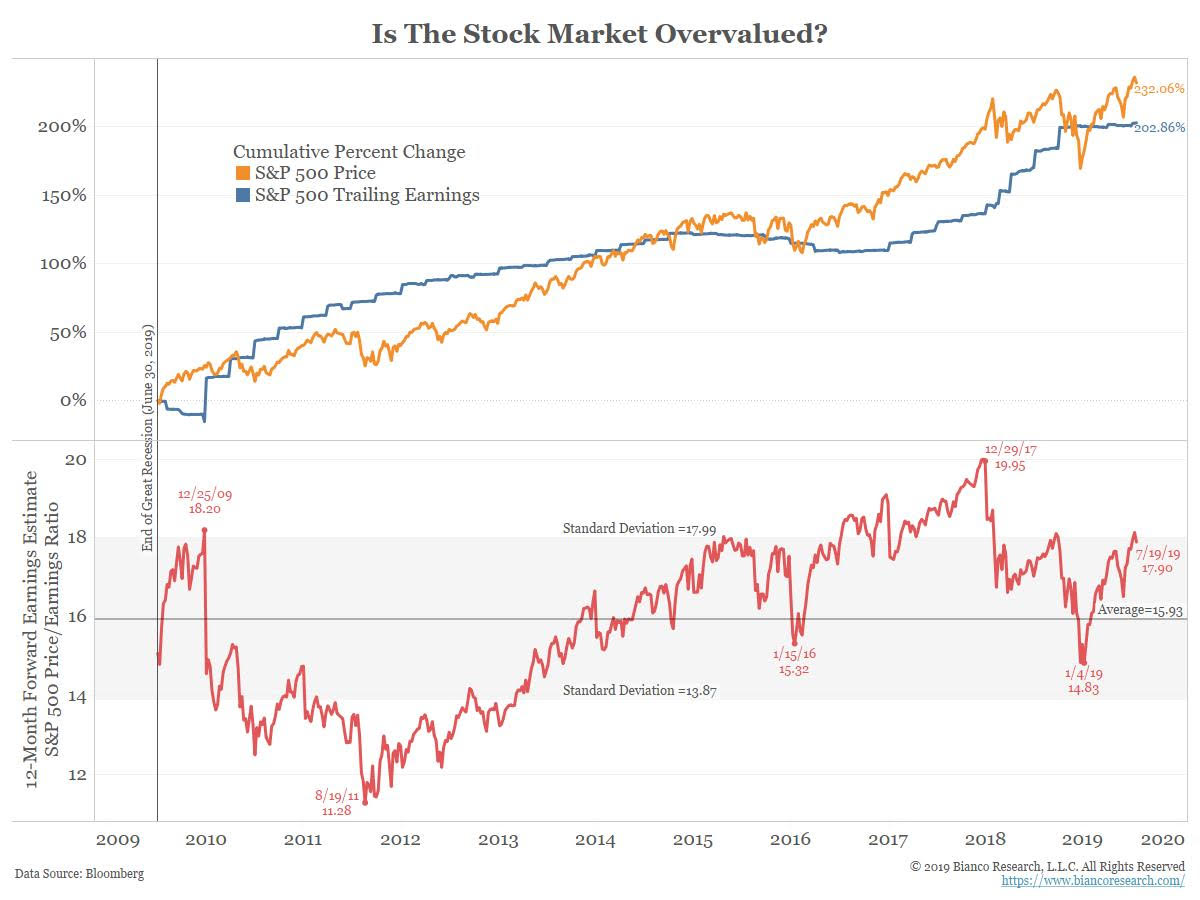

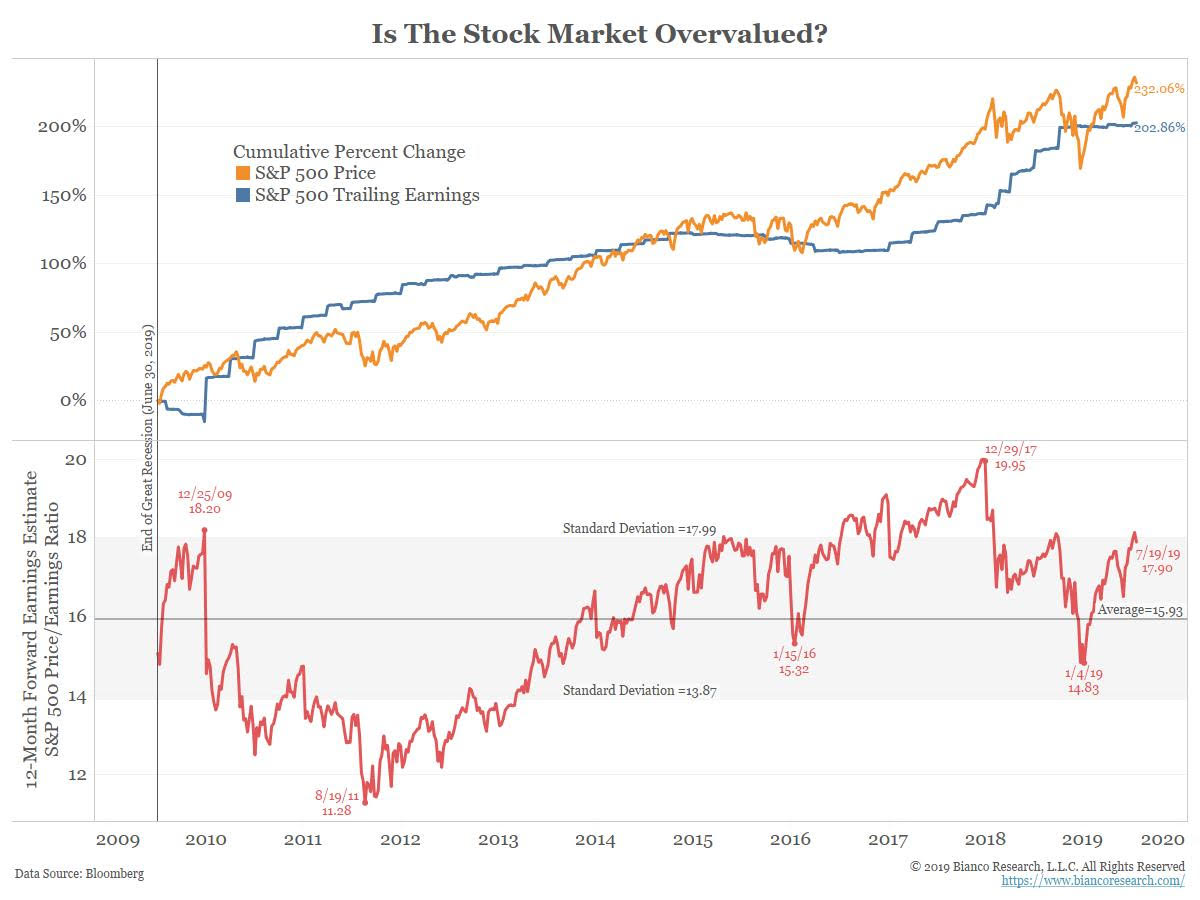

Source: @biancoresearch One of the least understood details of the great 1982-2000 bull market was just how significant the...

Source: @biancoresearch One of the least understood details of the great 1982-2000 bull market was just how significant the...

Read More

Can an esteemed professor of finance ever escape his reputation as a “perma-bull?” That was the question running through my mind...

Can an esteemed professor of finance ever escape his reputation as a “perma-bull?” That was the question running through my mind...

Can an esteemed professor of finance ever escape his reputation as a “perma-bull?” That was the question running through my mind...

Can an esteemed professor of finance ever escape his reputation as a “perma-bull?” That was the question running through my mind...