MIB: Andrew Ang Explains Why Value Has Underperformed

In 2018, “Value” had the fourth worst drawdown in almost 100 years of data going back to 1925 (See Fama-French data set) according...

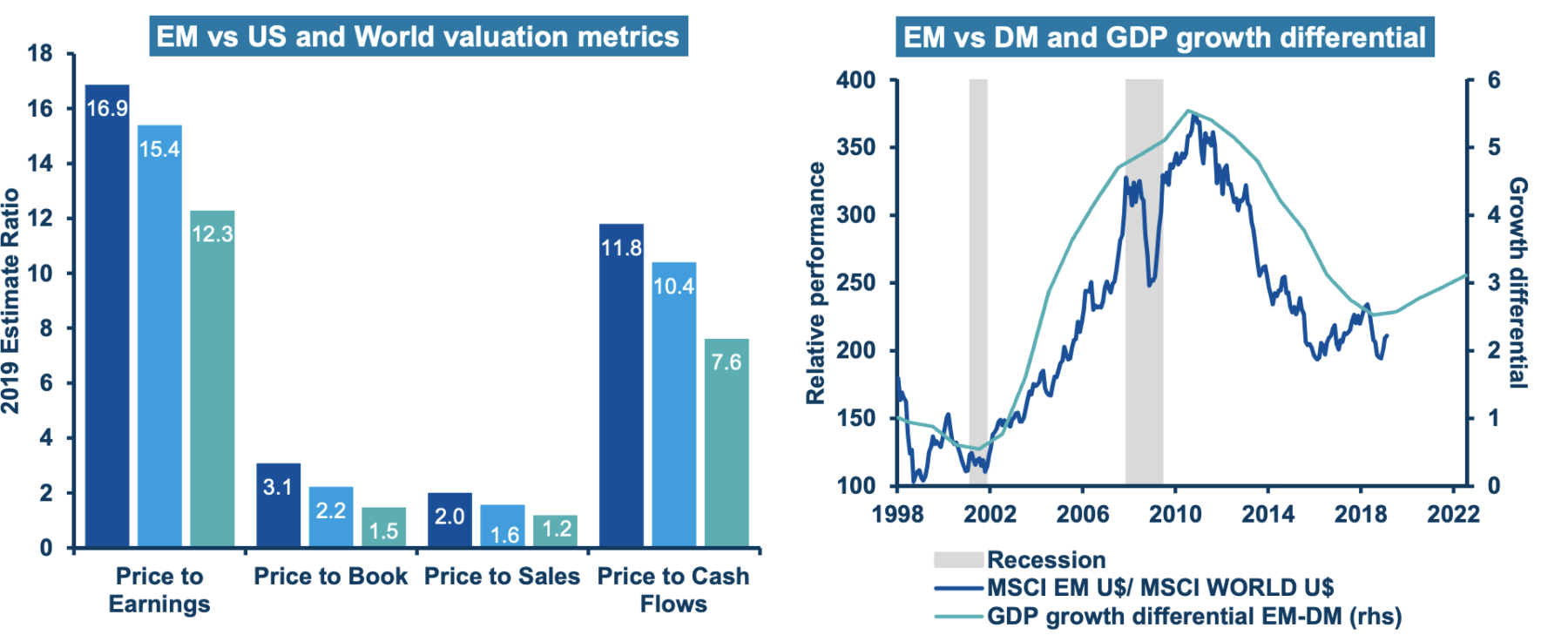

My friend Meb Faber of Cambria Investments referenced these charts via Amundi in his research email list. (You can sign up here) Several...

My friend Meb Faber of Cambria Investments referenced these charts via Amundi in his research email list. (You can sign up here) Several...

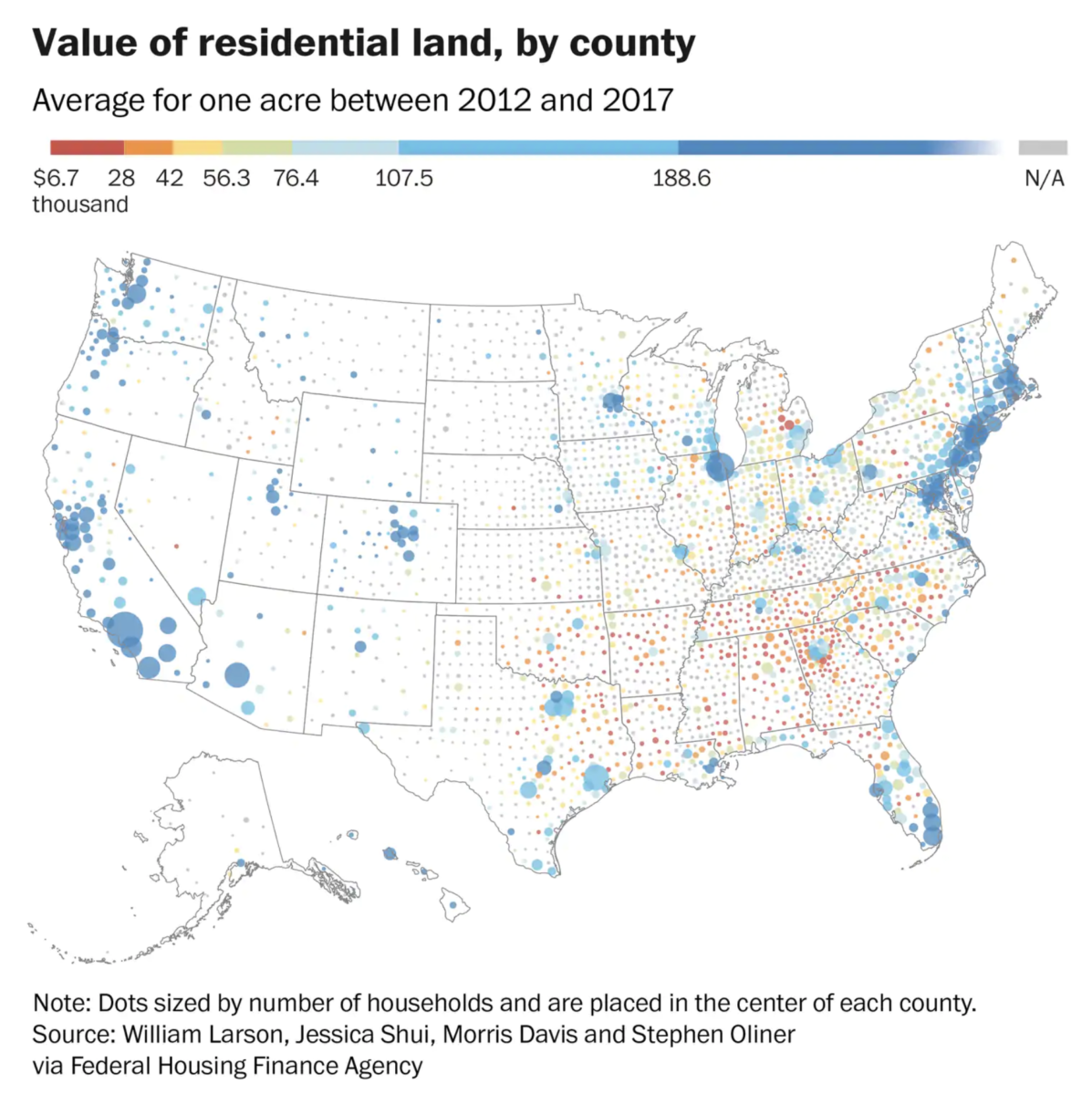

Very interesting data set showing the value of land, minus the structures built on it, across the country: “The analysis provides...

Very interesting data set showing the value of land, minus the structures built on it, across the country: “The analysis provides...

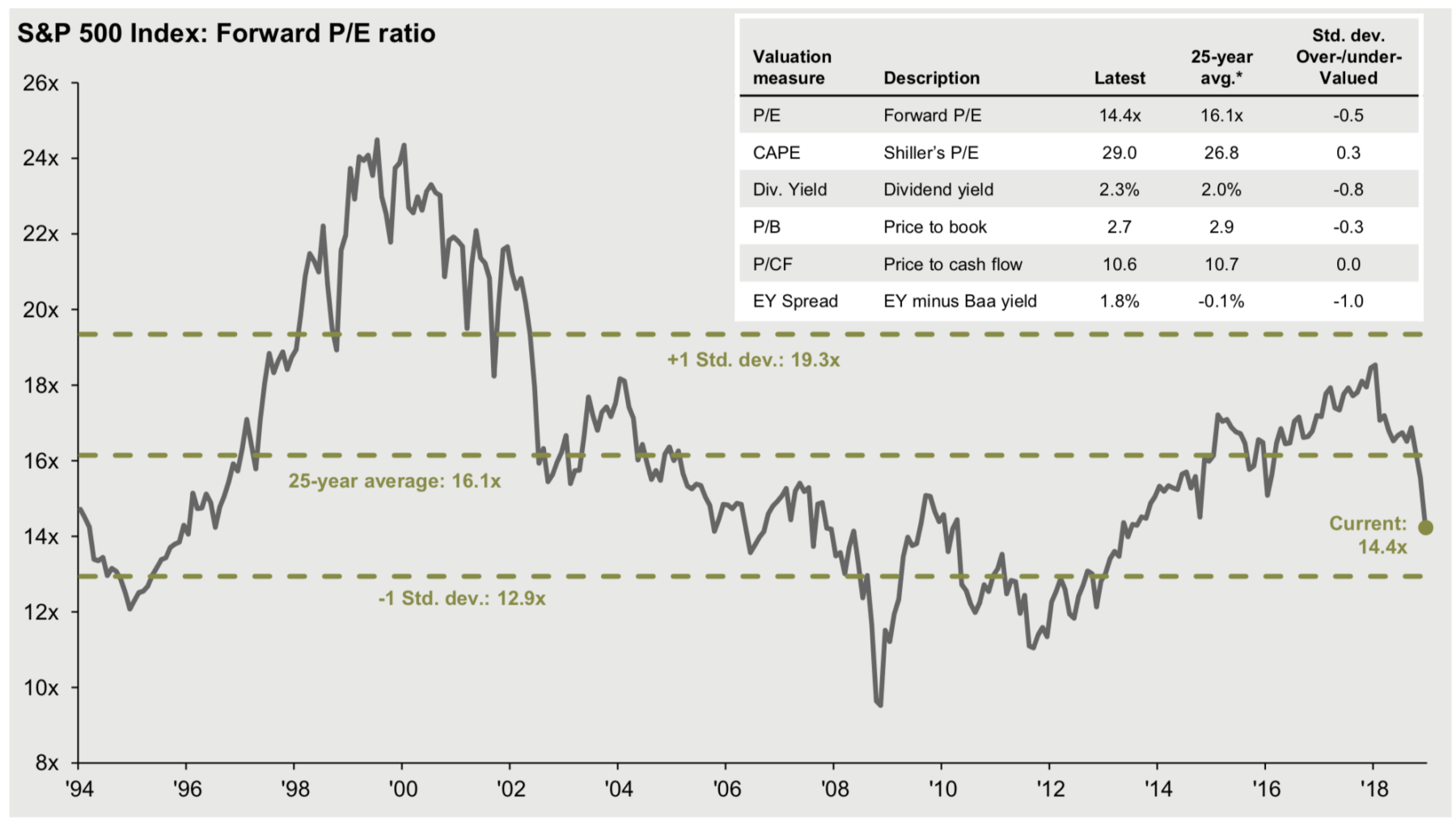

One good thing we can say about market volatility is that the 20 percent sell off in stock prices since Q4 began have returned valuations...

One good thing we can say about market volatility is that the 20 percent sell off in stock prices since Q4 began have returned valuations...

Get subscriber-only insights and news delivered by Barry every two weeks.