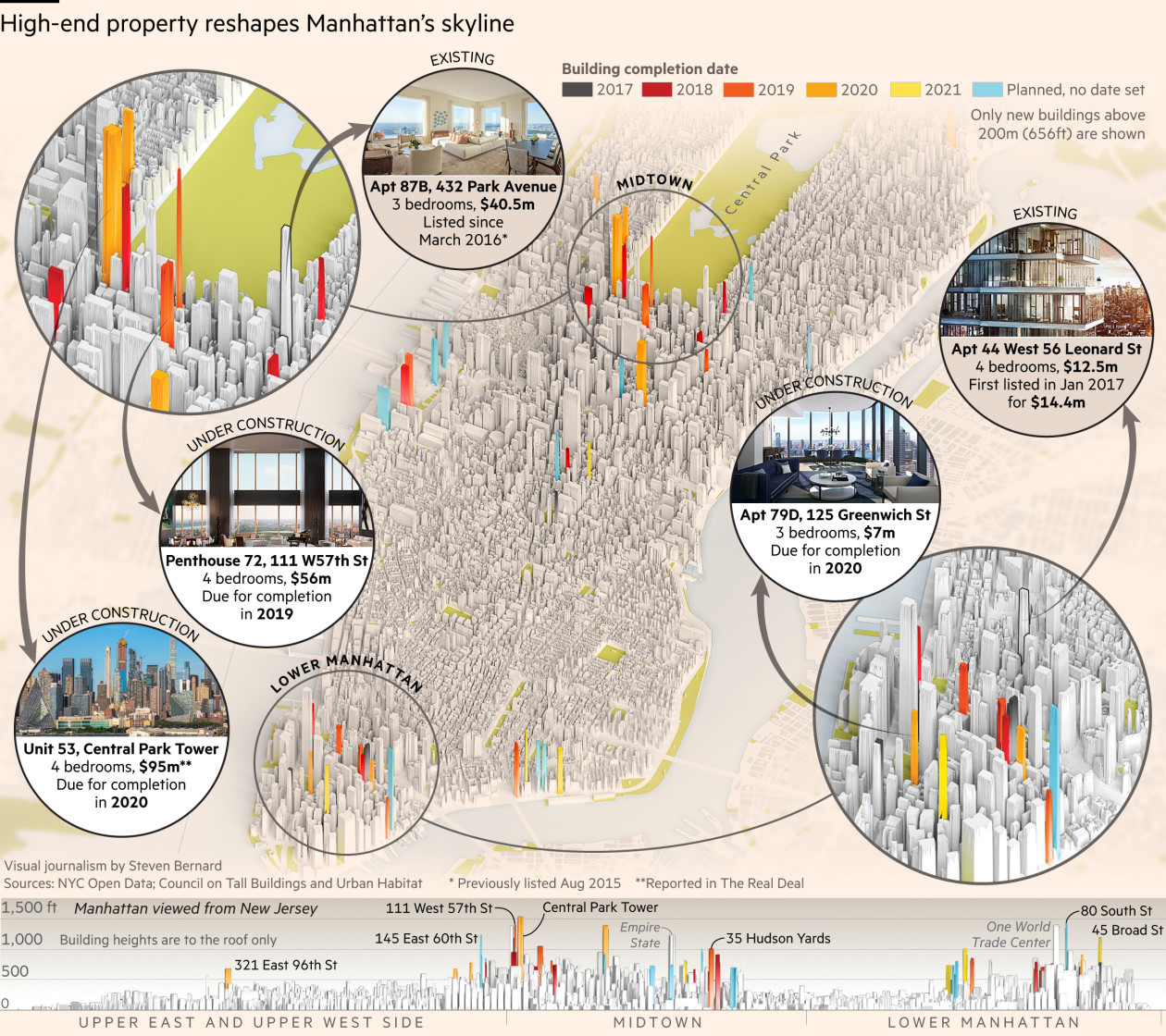

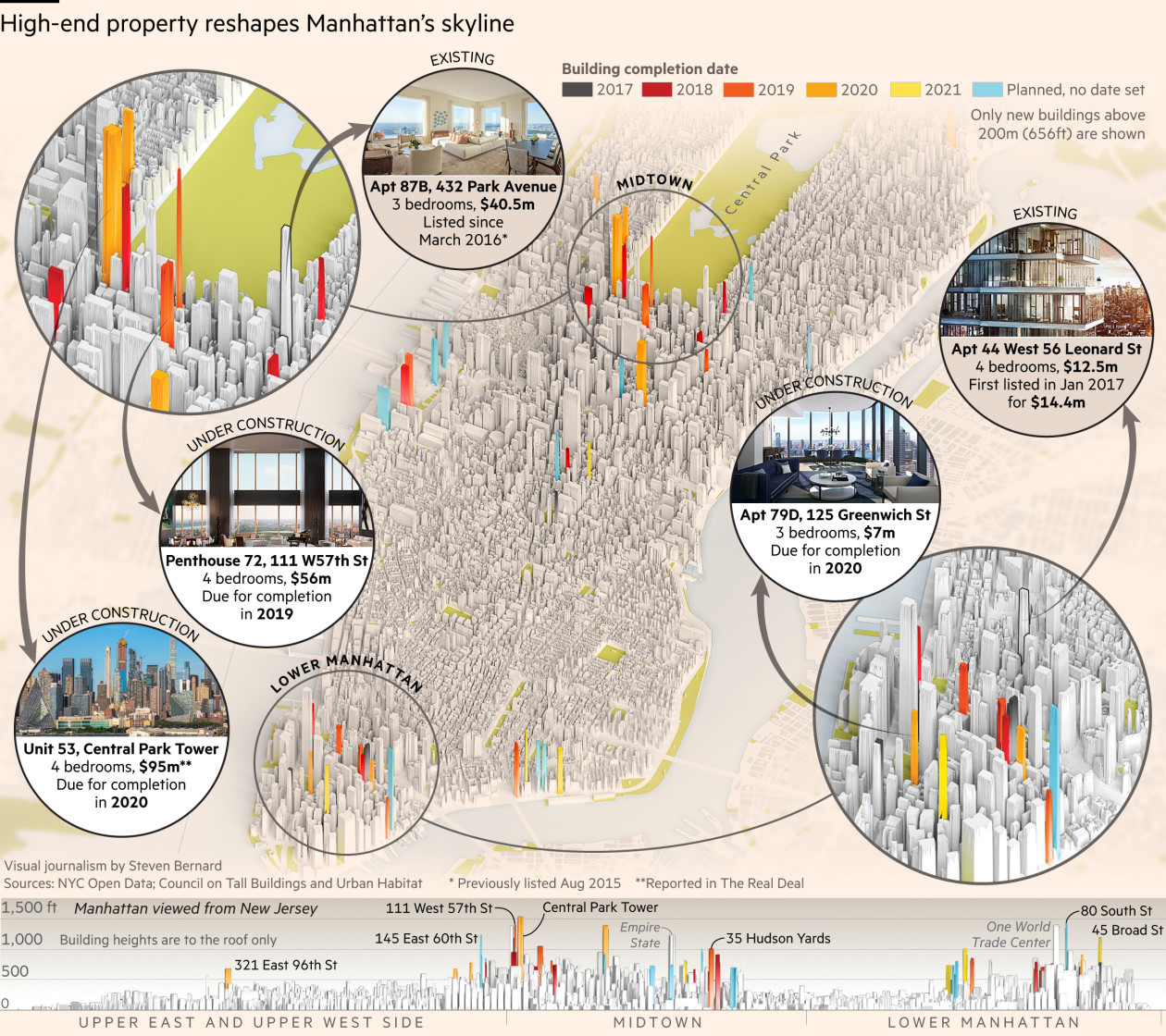

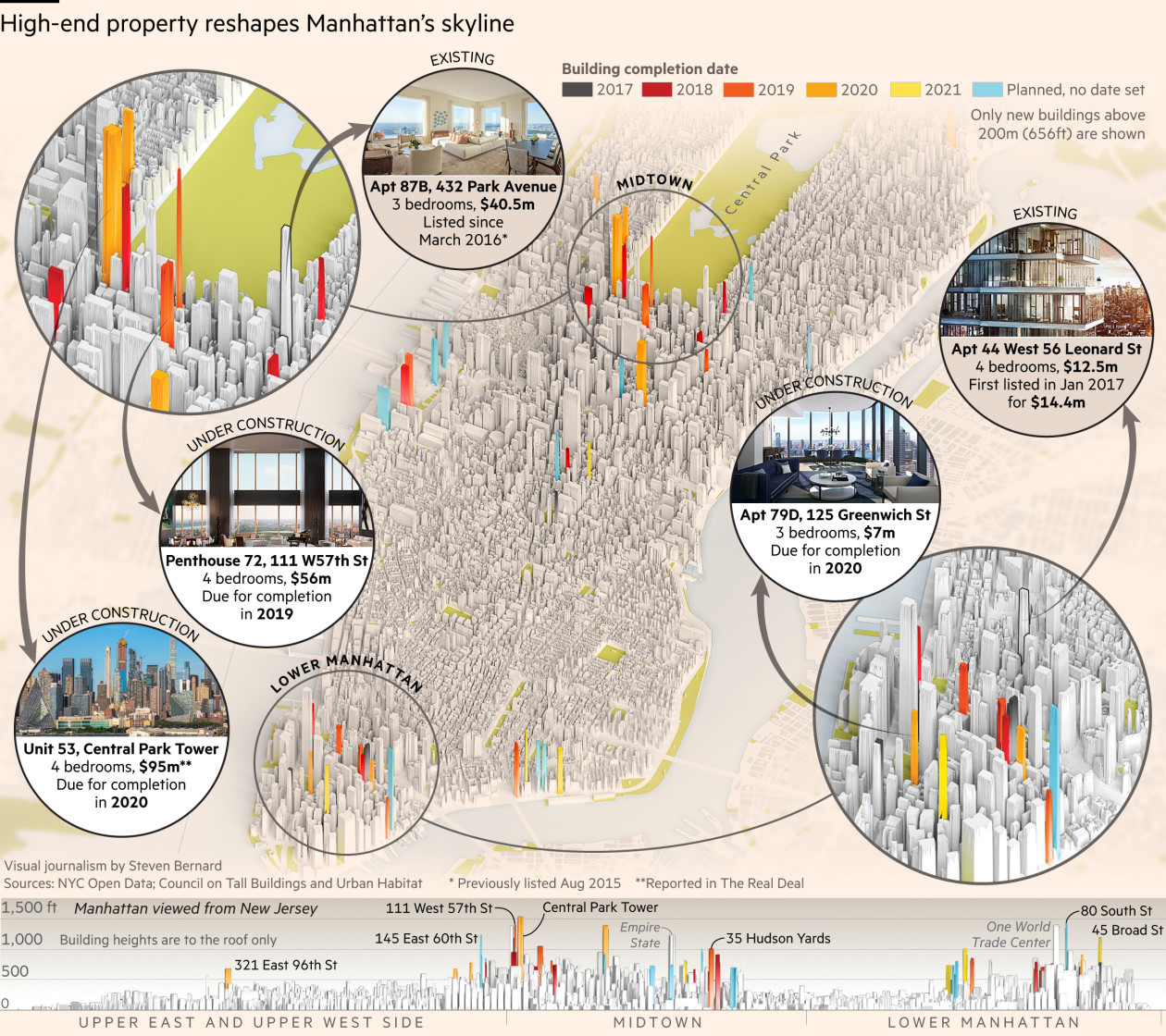

The Financial Times is raising the possibility that Manhattan RE has peaked: The number of new homes sold in Manhattan in the year to...

The Financial Times is raising the possibility that Manhattan RE has peaked: The number of new homes sold in Manhattan in the year to...

Read More

Cheap Is Great, But Free Will Cost You Whenever a company offers something at no charge, that means the price is hidden and out of sight....

Read More

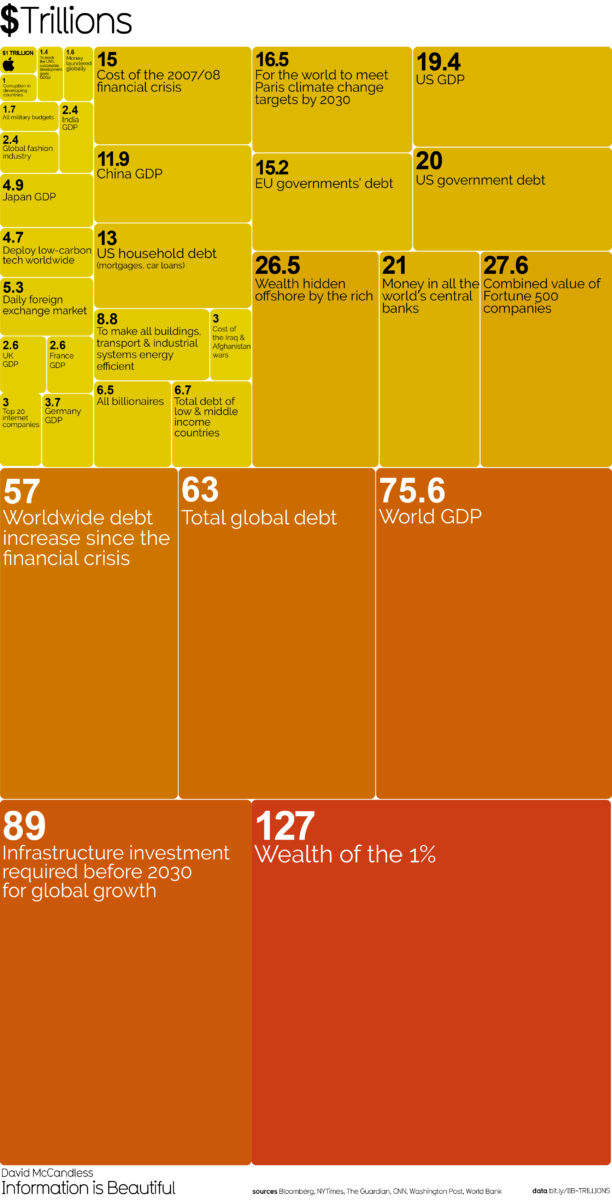

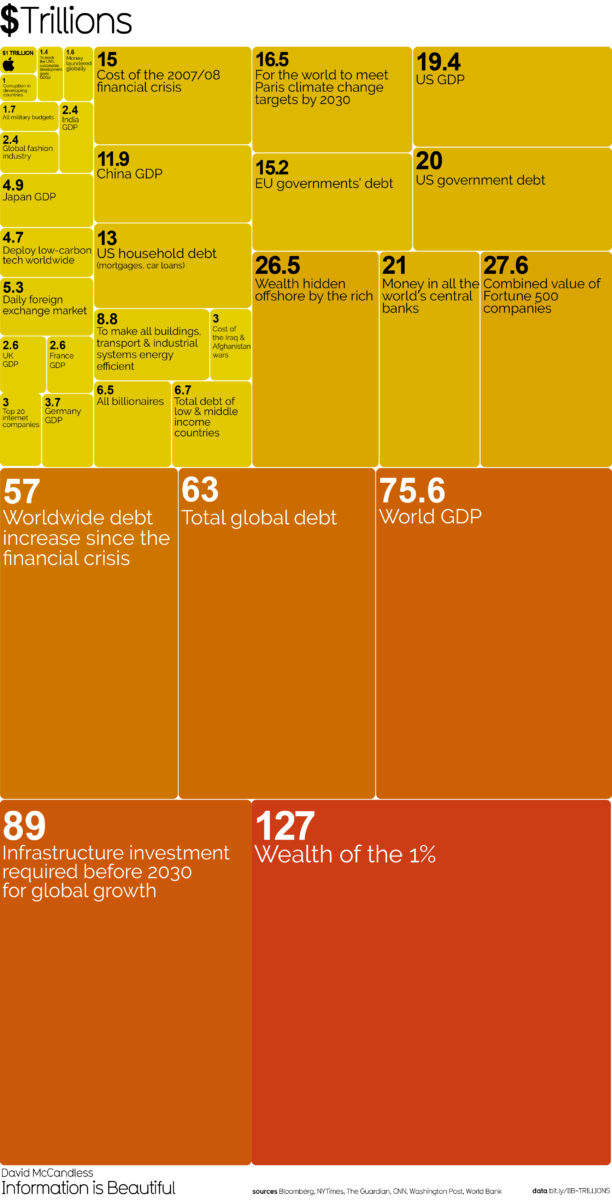

This is absolutely fascinating: Source: Information Is Beautiful

This is absolutely fascinating: Source: Information Is Beautiful

Read More

Warren Buffett’s First Television Interview – Discussing Timeless Investment Principles

Read More

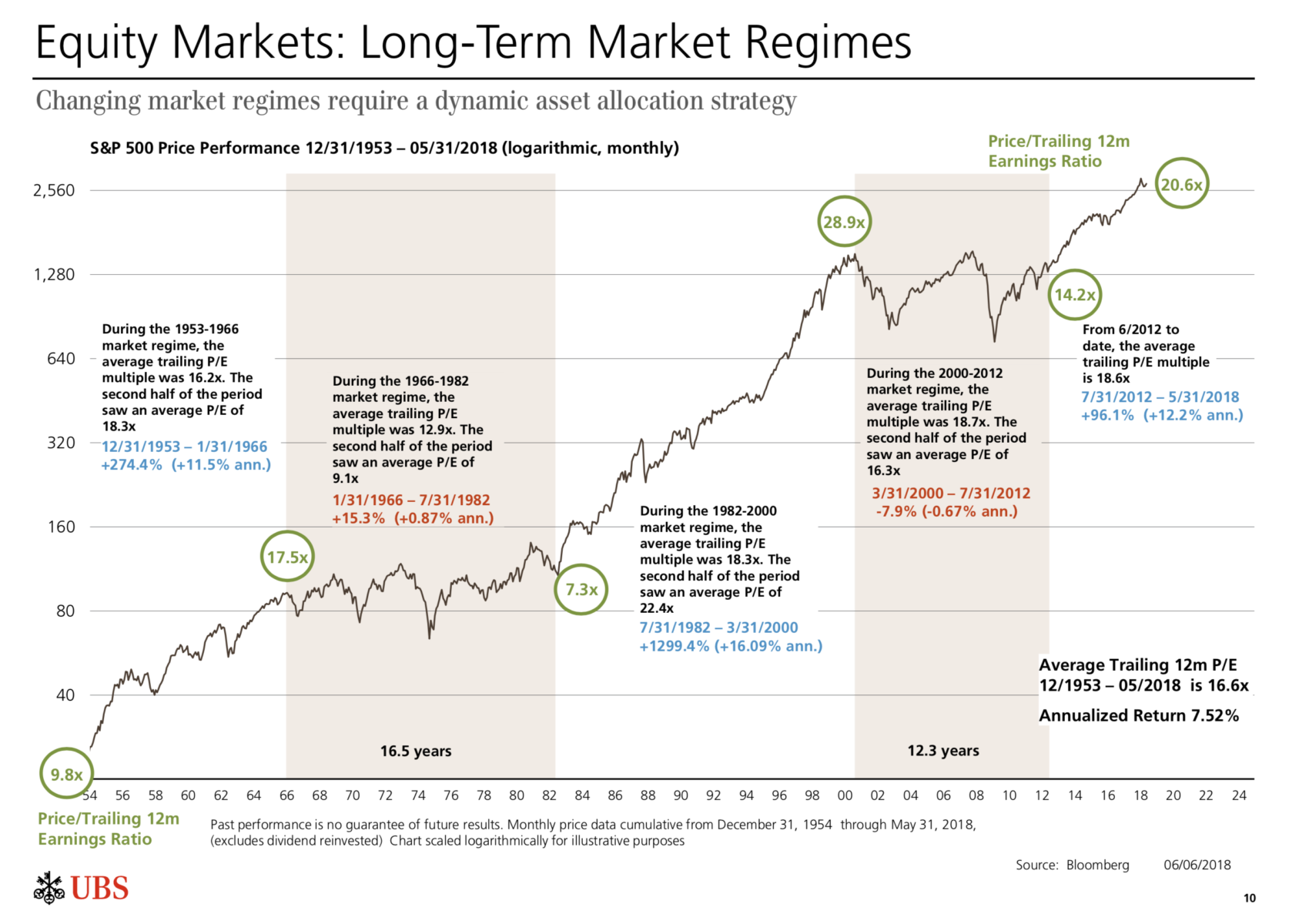

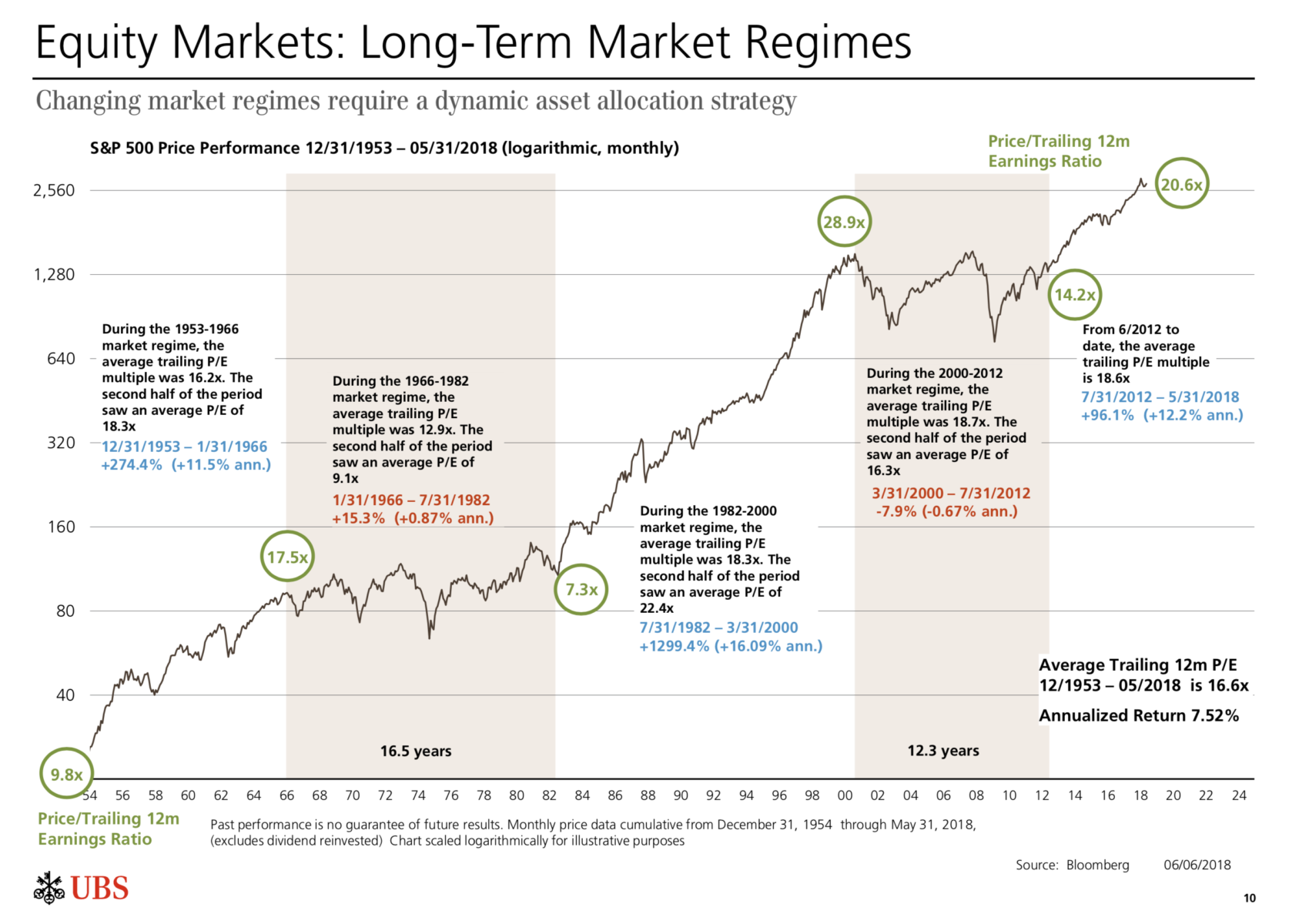

To Be, or Not to Be: Bullish click for ginormous graphic Source: MARKet Perspectives May 2018, Mark A. Lehmann, Global Strategist...

To Be, or Not to Be: Bullish click for ginormous graphic Source: MARKet Perspectives May 2018, Mark A. Lehmann, Global Strategist...

Read More

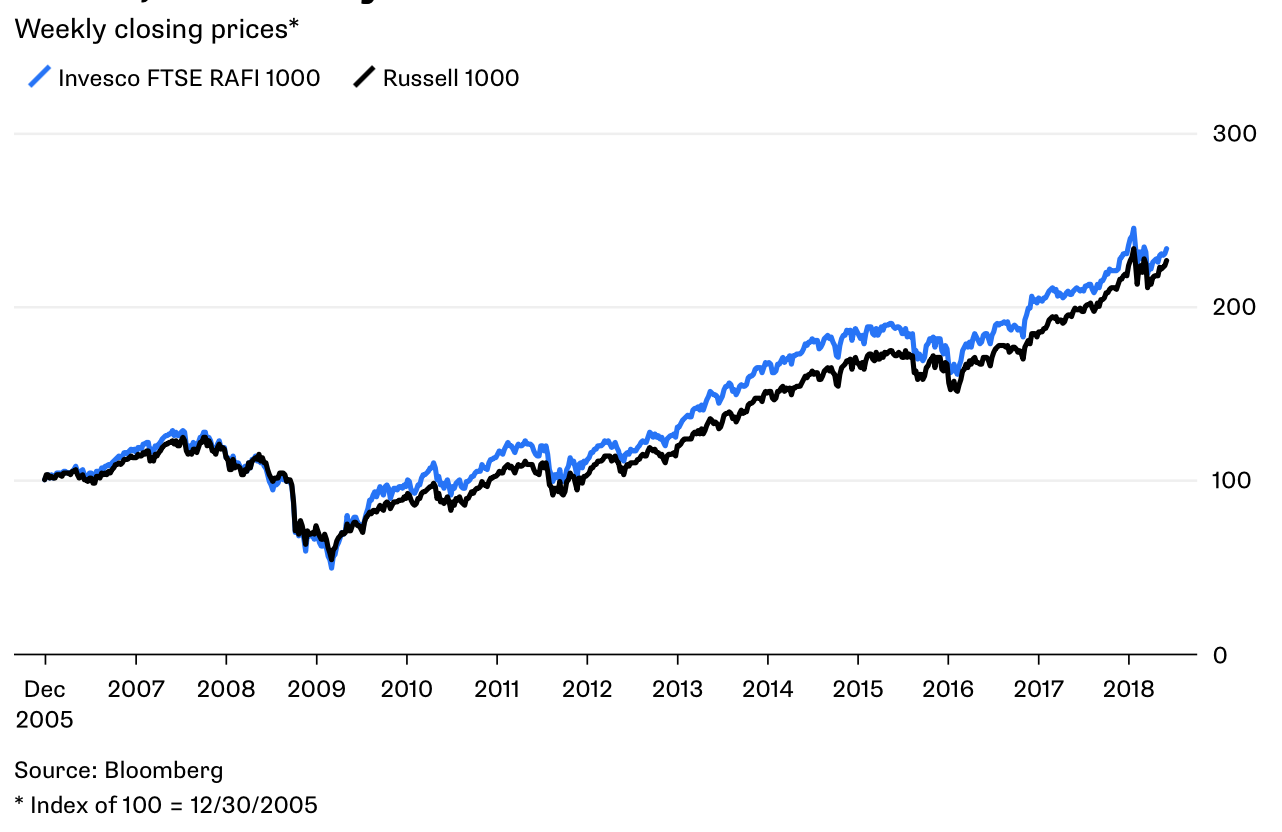

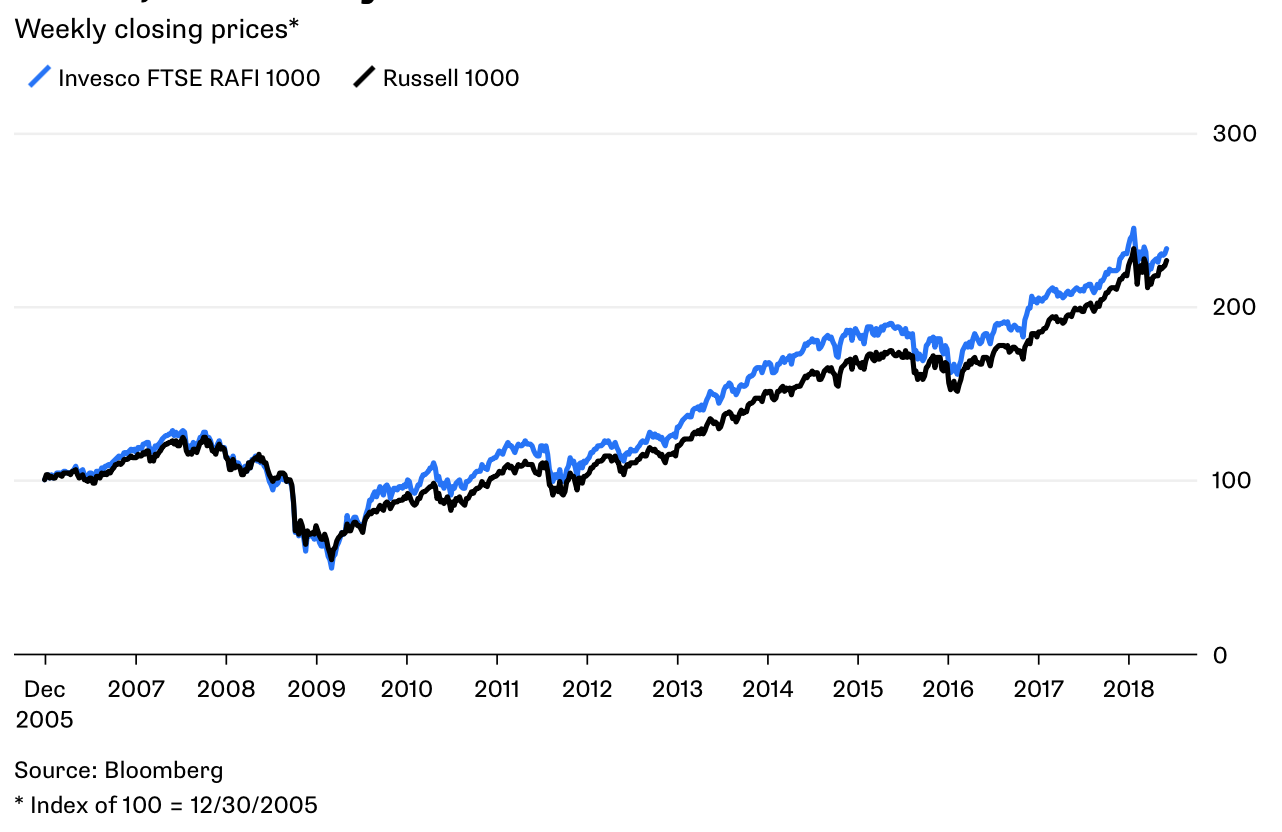

Smart Beta Performance Isn’t Worth the Cost The higher fees offset sporadically better returns. Bloomberg, June 8, 2018 ...

Smart Beta Performance Isn’t Worth the Cost The higher fees offset sporadically better returns. Bloomberg, June 8, 2018 ...

Read More

This week, we speak with Joel Greenblatt, co-founder of Formula Investing LLC and managing principal, co-chief investment officer and...

Read More

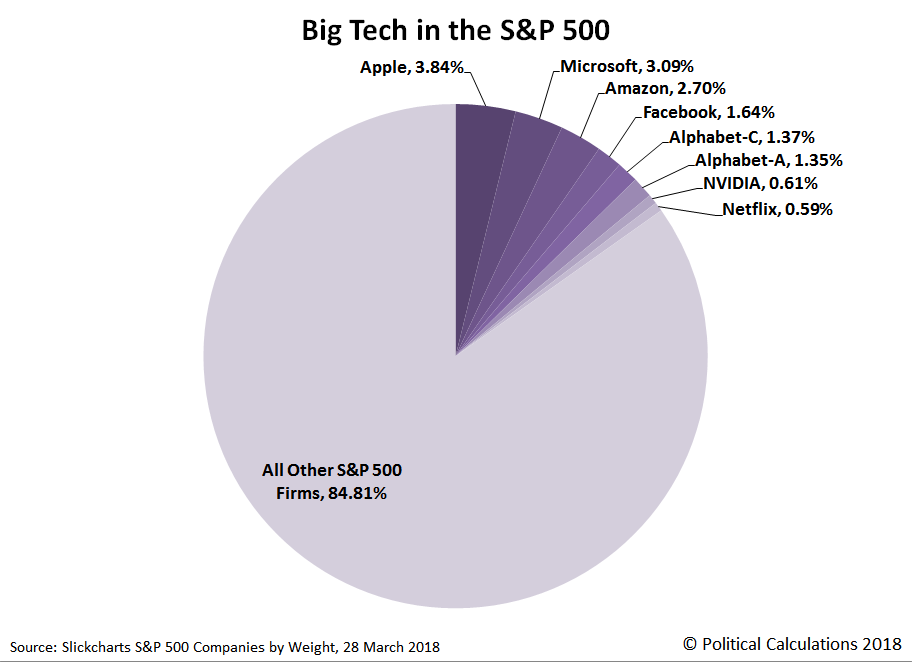

For some reason, the small cap premium keeps coming up. It is one of the original Fame-French Factors and continues to persist, even...

Read More

The Financial Times is raising the possibility that Manhattan RE has peaked: The number of new homes sold in Manhattan in the year to...

The Financial Times is raising the possibility that Manhattan RE has peaked: The number of new homes sold in Manhattan in the year to...

The Financial Times is raising the possibility that Manhattan RE has peaked: The number of new homes sold in Manhattan in the year to...

The Financial Times is raising the possibility that Manhattan RE has peaked: The number of new homes sold in Manhattan in the year to...