Today! MIT Sloane Investment Conference

Very interesting line up today at the MIT Sloan Investment Conference. I will be moderating two very fascinating panels:...

Very interesting line up today at the MIT Sloan Investment Conference. I will be moderating two very fascinating panels:...

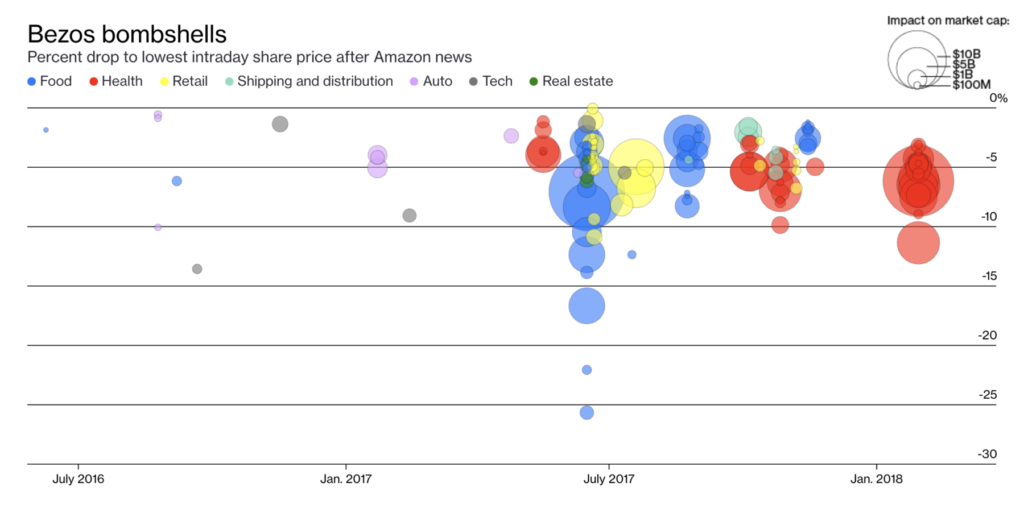

Impact of Amazon on Competitors

This is amazing: “The company has grown so large and difficult to comprehend that it’s worth taking stock of why and how it’s...

This is amazing: “The company has grown so large and difficult to comprehend that it’s worth taking stock of why and how it’s...

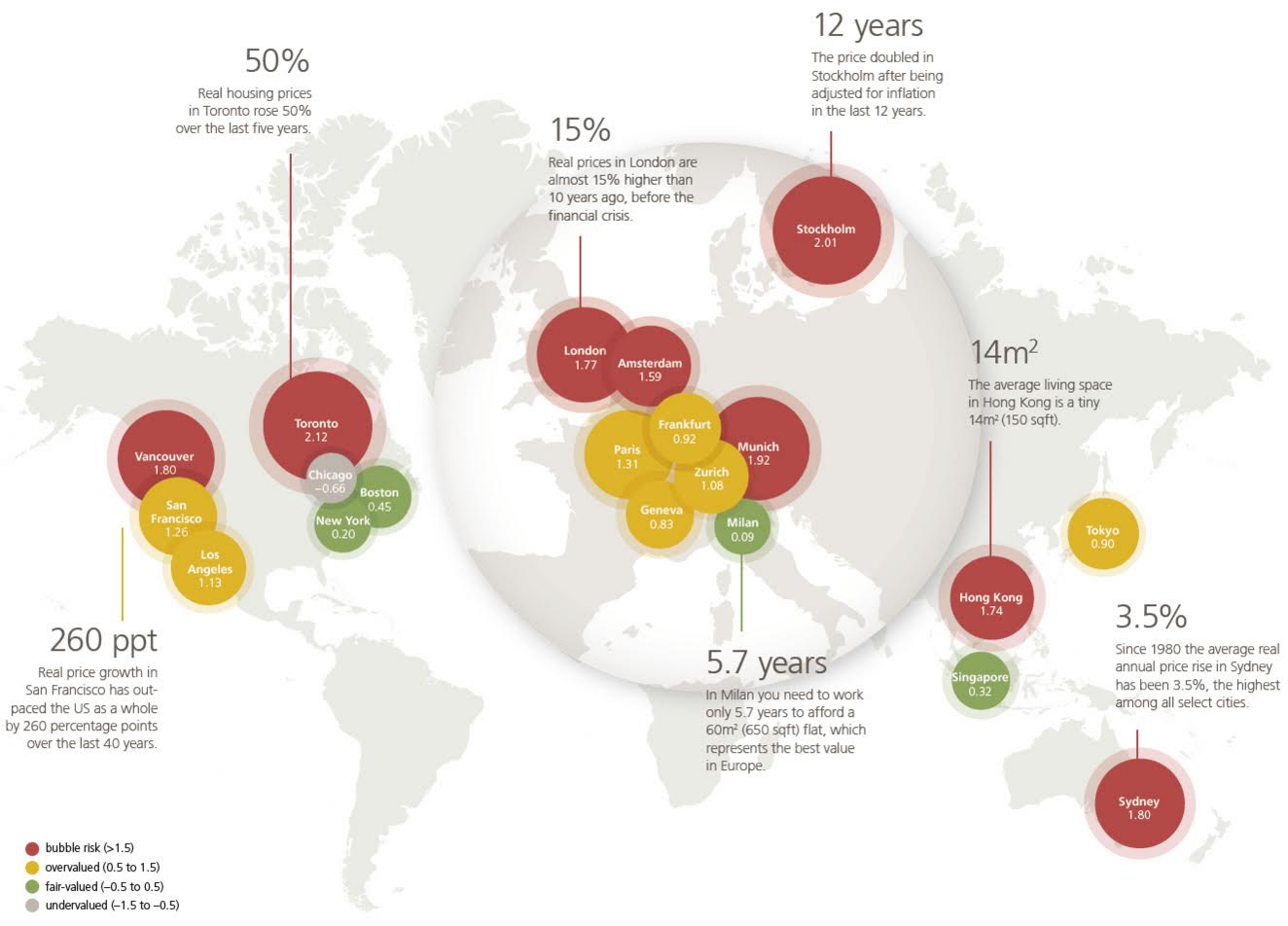

Global Cities on the Bubblicious Scale

click for ginormous graphic Source: Visual Capitalist Toronto and Vancouver at the high end of the scale, Chicago and Milan as...

click for ginormous graphic Source: Visual Capitalist Toronto and Vancouver at the high end of the scale, Chicago and Milan as...

Apple’s Cash Hoard Keeps Growing

Three Ideas for How Apple Should Use All That Cash The company is great, yes, but it can’t let so much money sit idle. Bloomberg,...

Valuation Ratios for Households and Businesses

Valuation Ratios for Households and Businesses Thomas Mertens, Patrick Shultz, and Michael Tubbs FRBSF Economic Letter, January 8, 2018...

Valuation Ratios for Households and Businesses Thomas Mertens, Patrick Shultz, and Michael Tubbs FRBSF Economic Letter, January 8, 2018...

Investing in an Overpriced World

“What should an investor do when all asset classes appear overpriced? The 10-year U.S. Treasury bond currently yields about...

Joel Greenblatt: Fundamentals of Value Investing

Interesting conversation with Joel Greenblatt on the Fundamentals of Value Investing. He is the author of the book You Can Be a Stock...

MiB: Brooke Lampley, Sotheby’s Vice Chair of Fine Art

This week I sit down with Brooke Lampley, vice chairman of the fine art division at Sotheby’s. Lampley is a specialist in...