Last year, I took issue with the general idea that there is a lack of innovation in finance. This is not merely me...

Last year, I took issue with the general idea that there is a lack of innovation in finance. This is not merely me...

Read More

“And I know I’m fakin’ it, I’m not really makin’ it.” –Simon & Garfunkle...

Read More

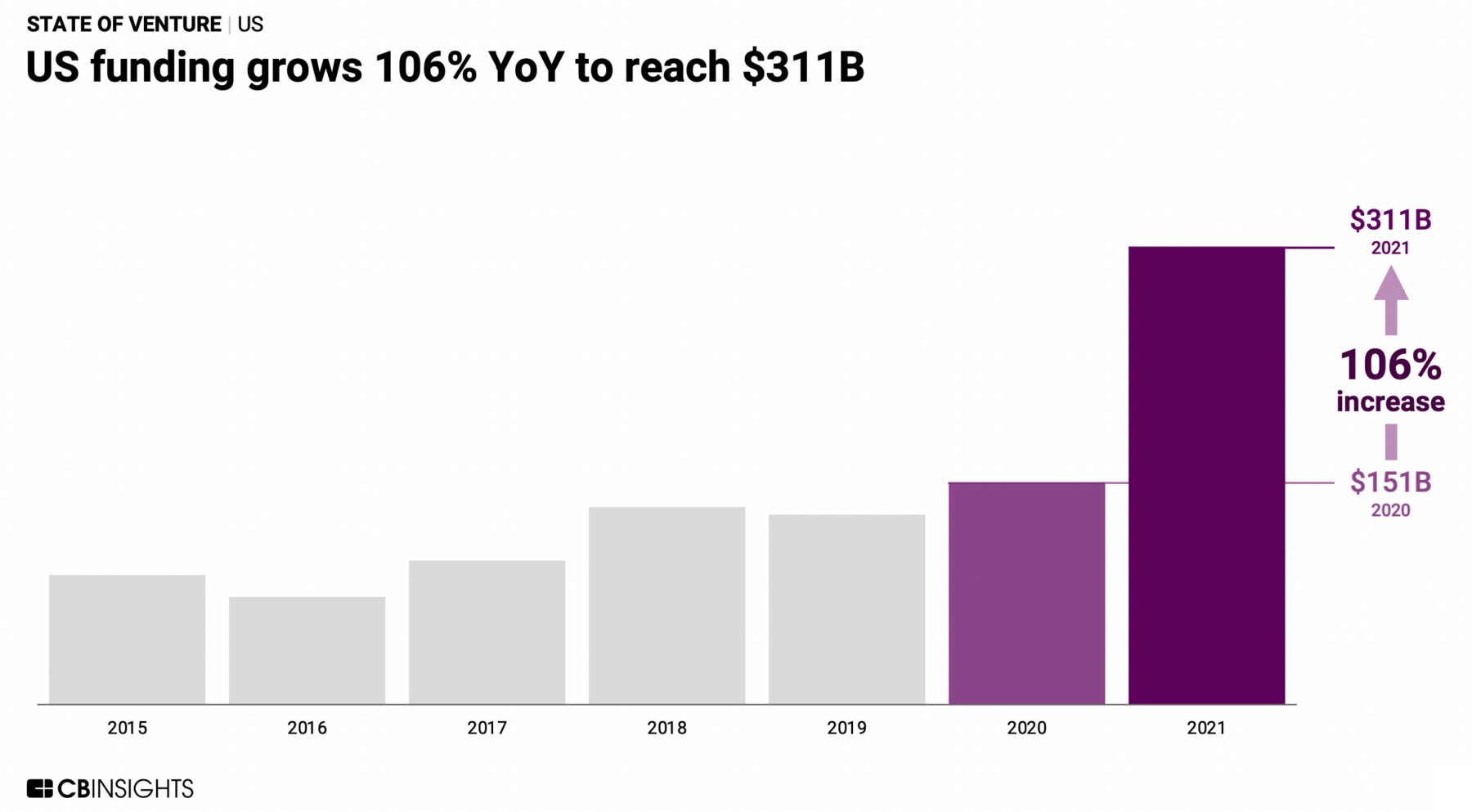

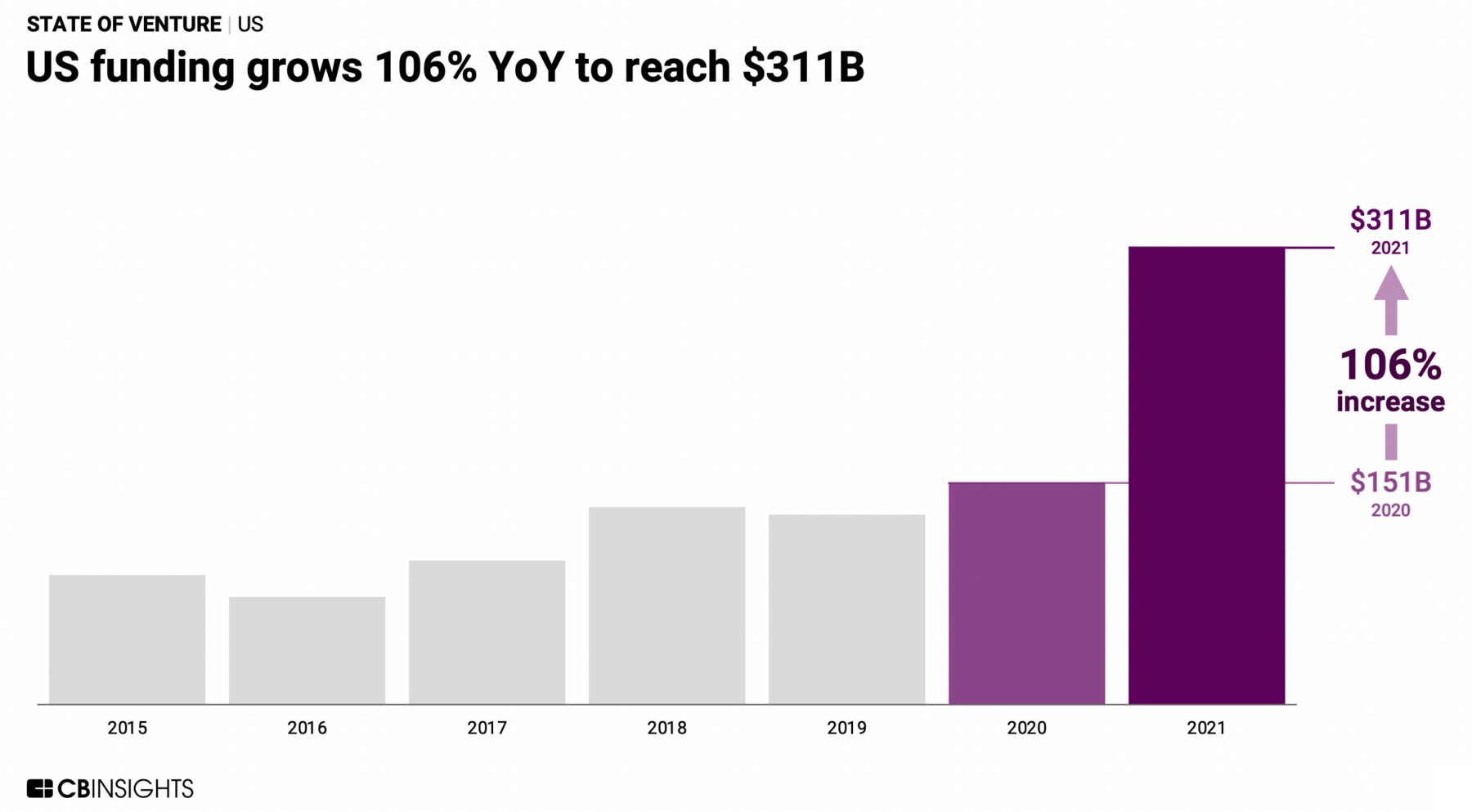

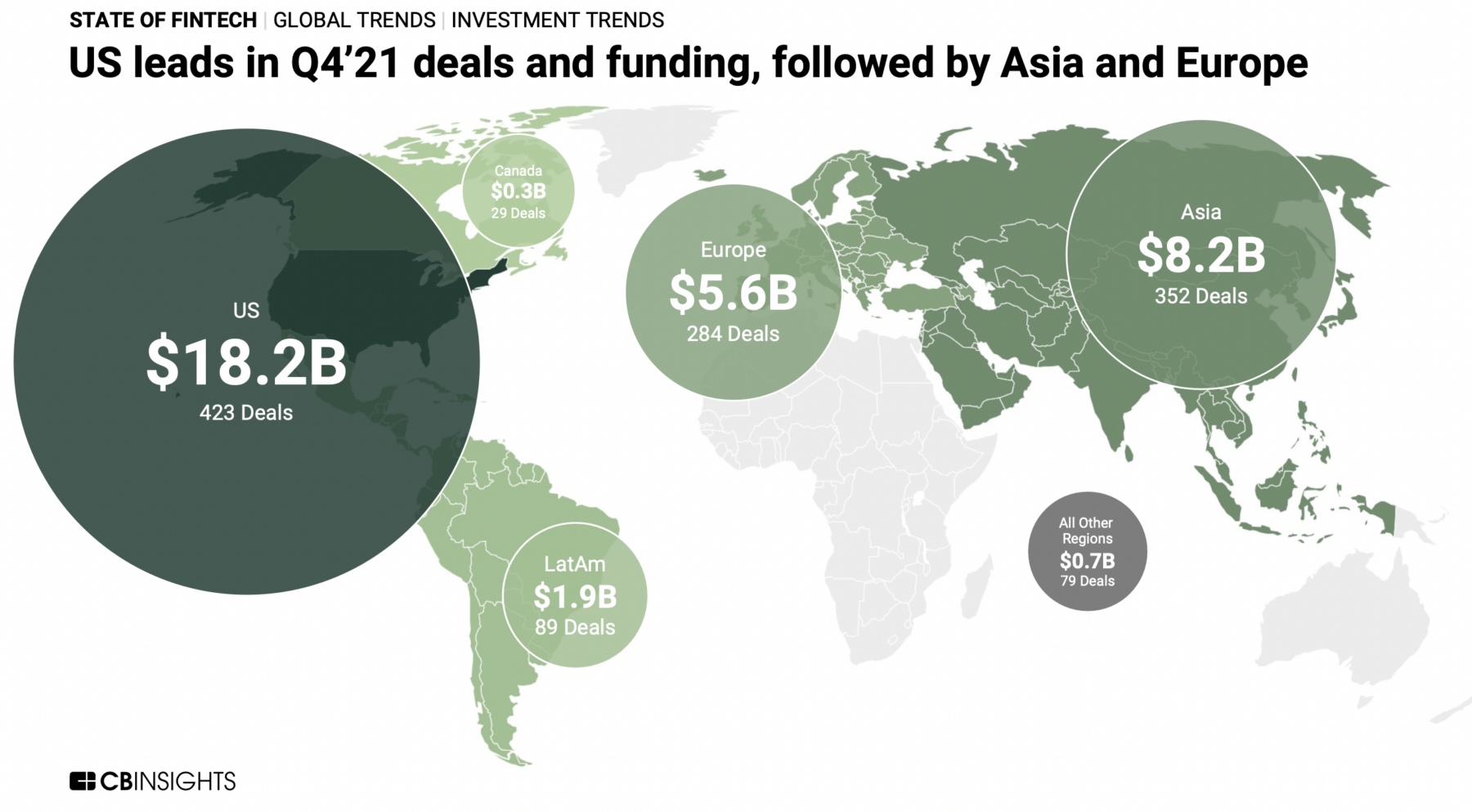

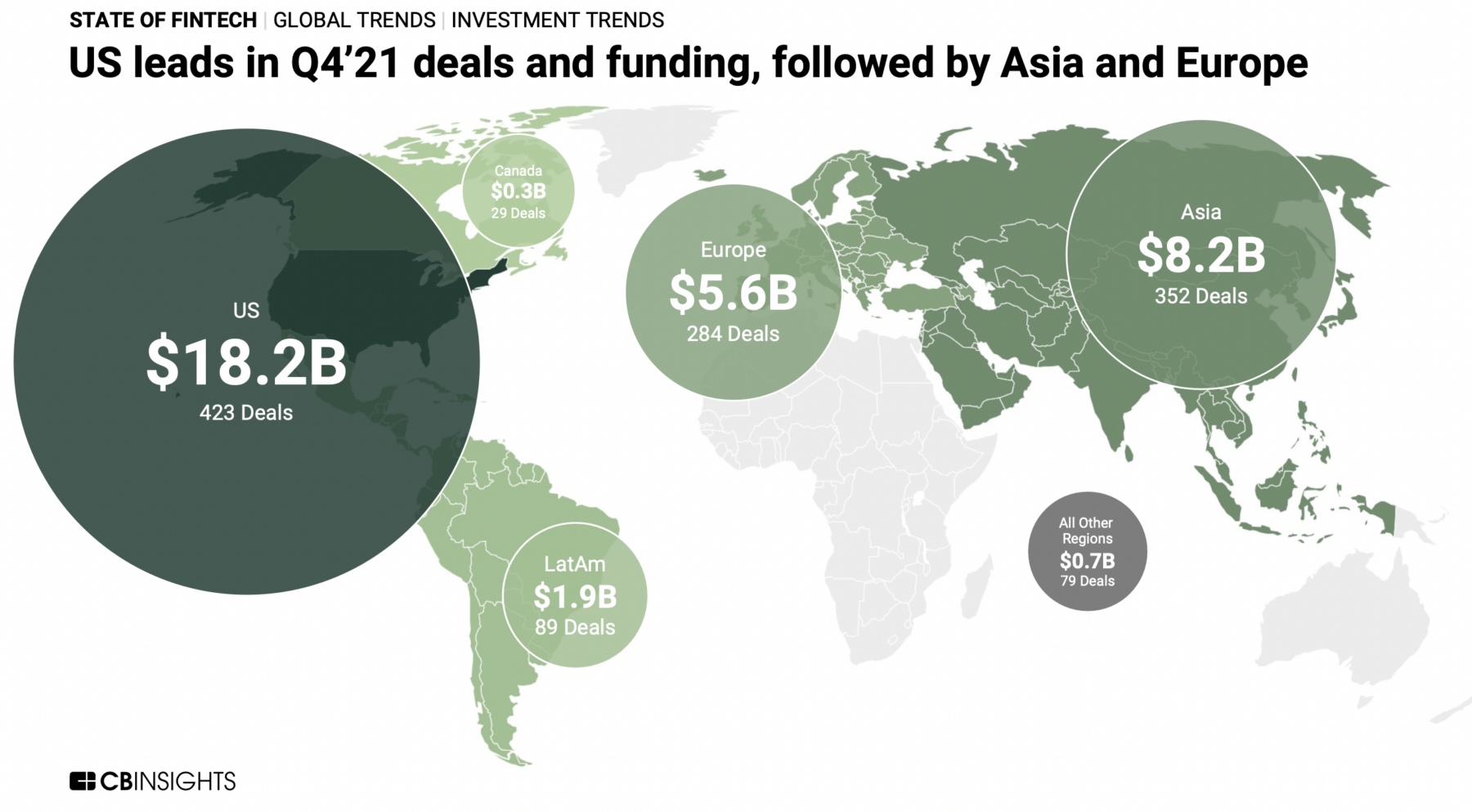

I have noted that it seemed like VC money was everywhere, and now we have the data to confirm that. According to...

I have noted that it seemed like VC money was everywhere, and now we have the data to confirm that. According to...

Read More

The transcript from this week’s, MiB: Maureen Farrell on the Cult of We is below. You can stream and download our...

Read More

This week, we speak with New York Times business reporter Maureen Farrell, who co-authored the 2021 book “The Cult of...

Read More

The transcript from this week’s, MiB: John Doerr, Kleiner Perkins, is below. You can stream and download our full...

Read More

This week, we speak with legendary venture capitalist John Doerr, chairman of Kleiner Perkins. His latest book is “Speed...

Read More

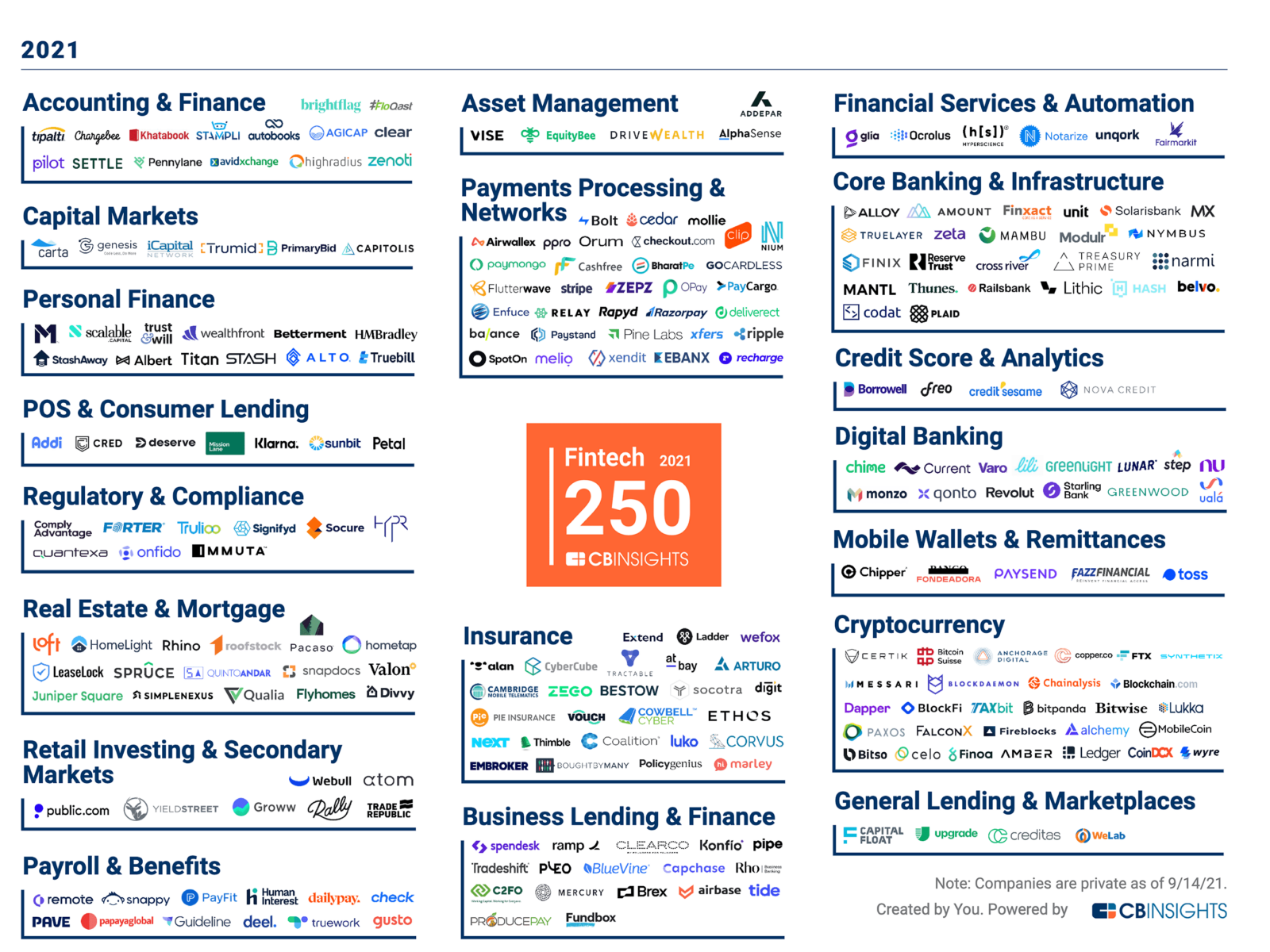

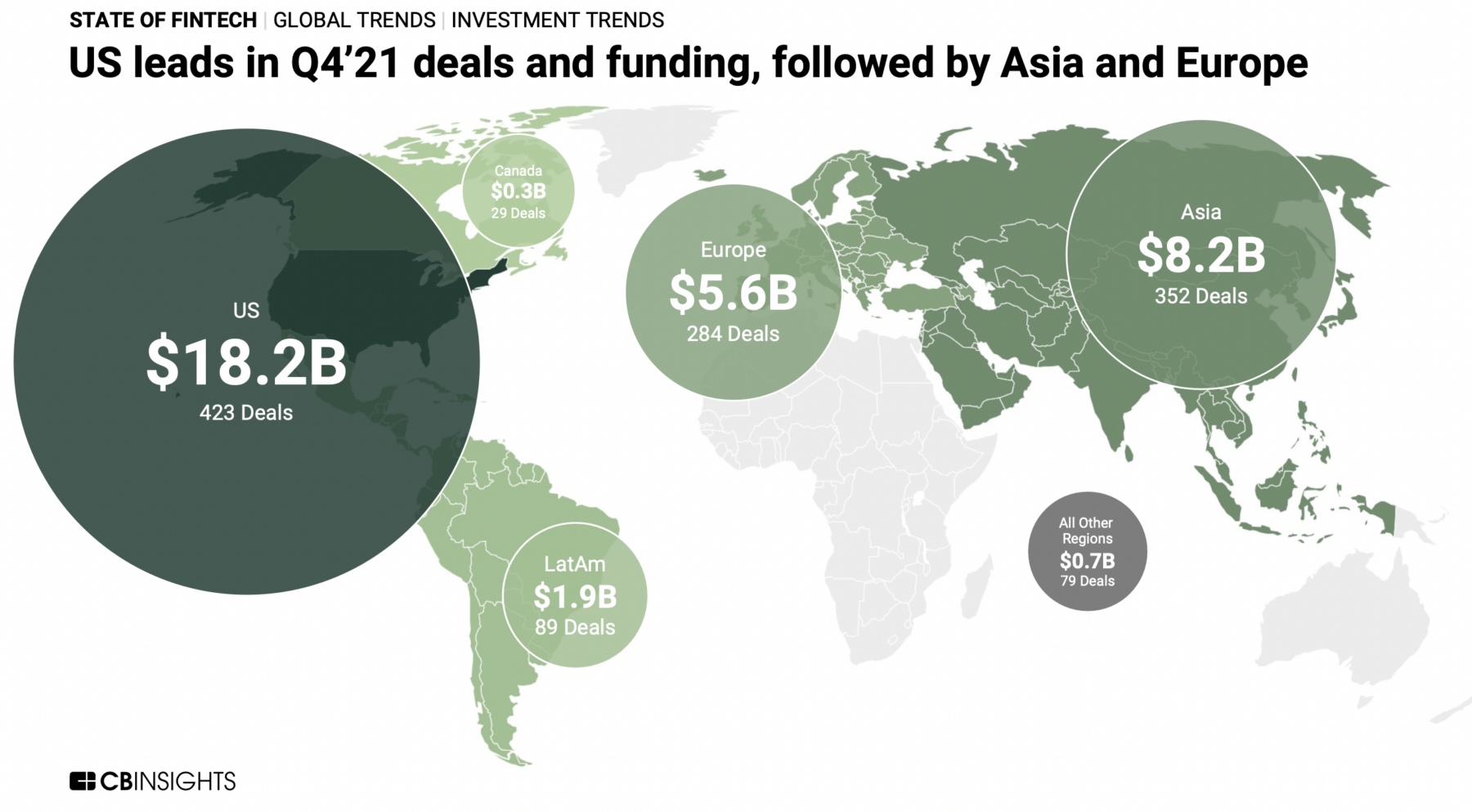

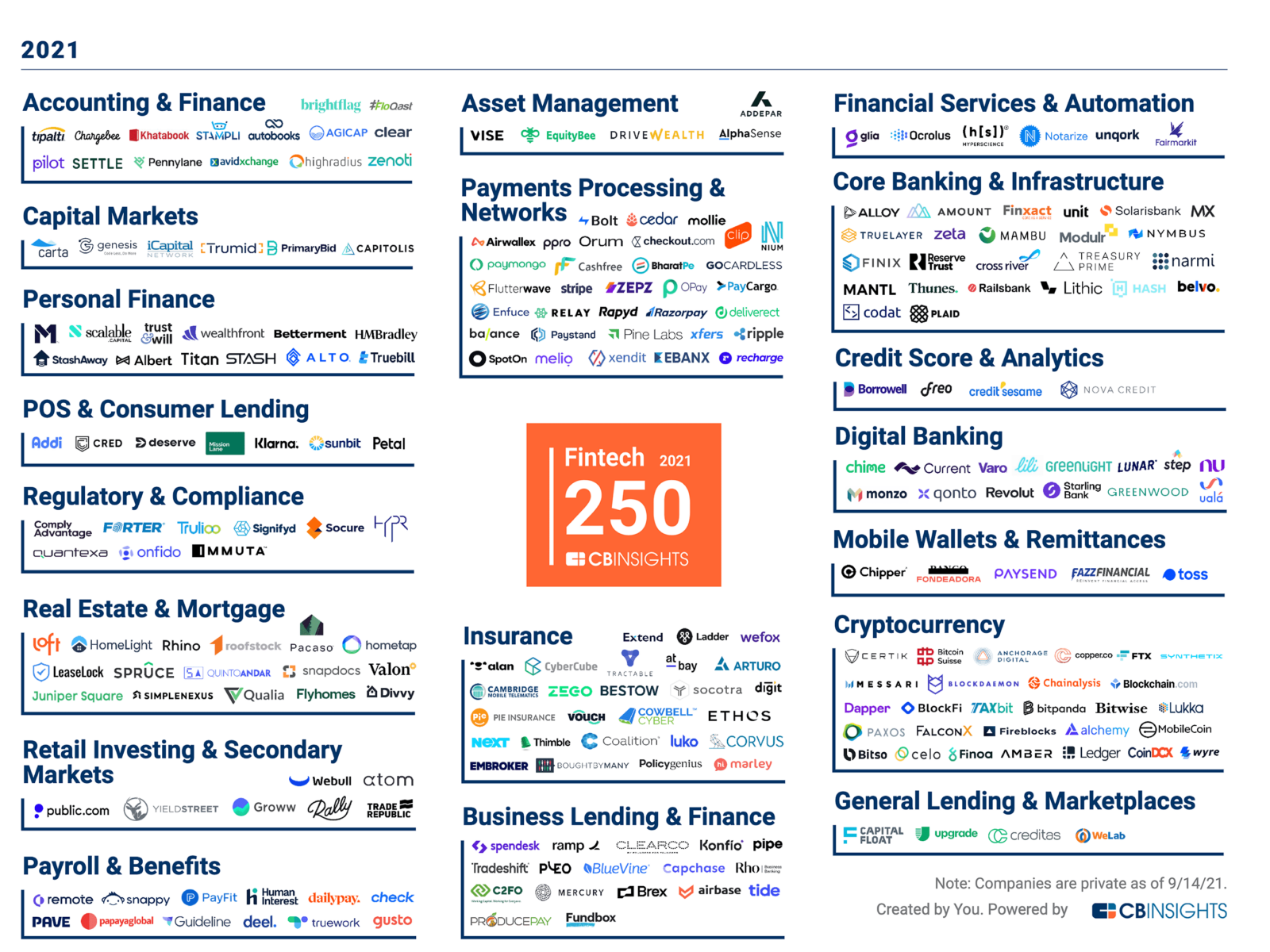

Source: CB Insights I have been discussing technology-driven productivity gains a lot lately (see this, this, or this). And...

Source: CB Insights I have been discussing technology-driven productivity gains a lot lately (see this, this, or this). And...

Read More

The transcript from this week’s, MiB: Soraya Darabi, TMV, is below. You can stream and download our full...

Read More

This week, we speak with Soraya Darabi, who is co-founder and general partner at TMV, an early-stage venture firm...

Read More

Last year, I took issue with the general idea that there is a lack of innovation in finance. This is not merely me...

Last year, I took issue with the general idea that there is a lack of innovation in finance. This is not merely me...

Last year, I took issue with the general idea that there is a lack of innovation in finance. This is not merely me...

Last year, I took issue with the general idea that there is a lack of innovation in finance. This is not merely me...