It is bottom of the ninth inning for unicorn madness. All that capital chasing too few quality deals leads to valuations getting...

It is bottom of the ninth inning for unicorn madness. All that capital chasing too few quality deals leads to valuations getting...

Read More

Venture Capitalists seem to be focused mostly on software, apps, and technology. This dearth of entrepreneurship into the basic sciences...

Read More

The transcript from this week’s MIB: Josh Wolfe, Lux Capital, is below. You can stream/download the full conversation,...

Read More

This week, we speak with Josh Wolfe, co-founder of Lux Capital. The venture firm was set up to support scientists and entrepreneurs who...

Read More

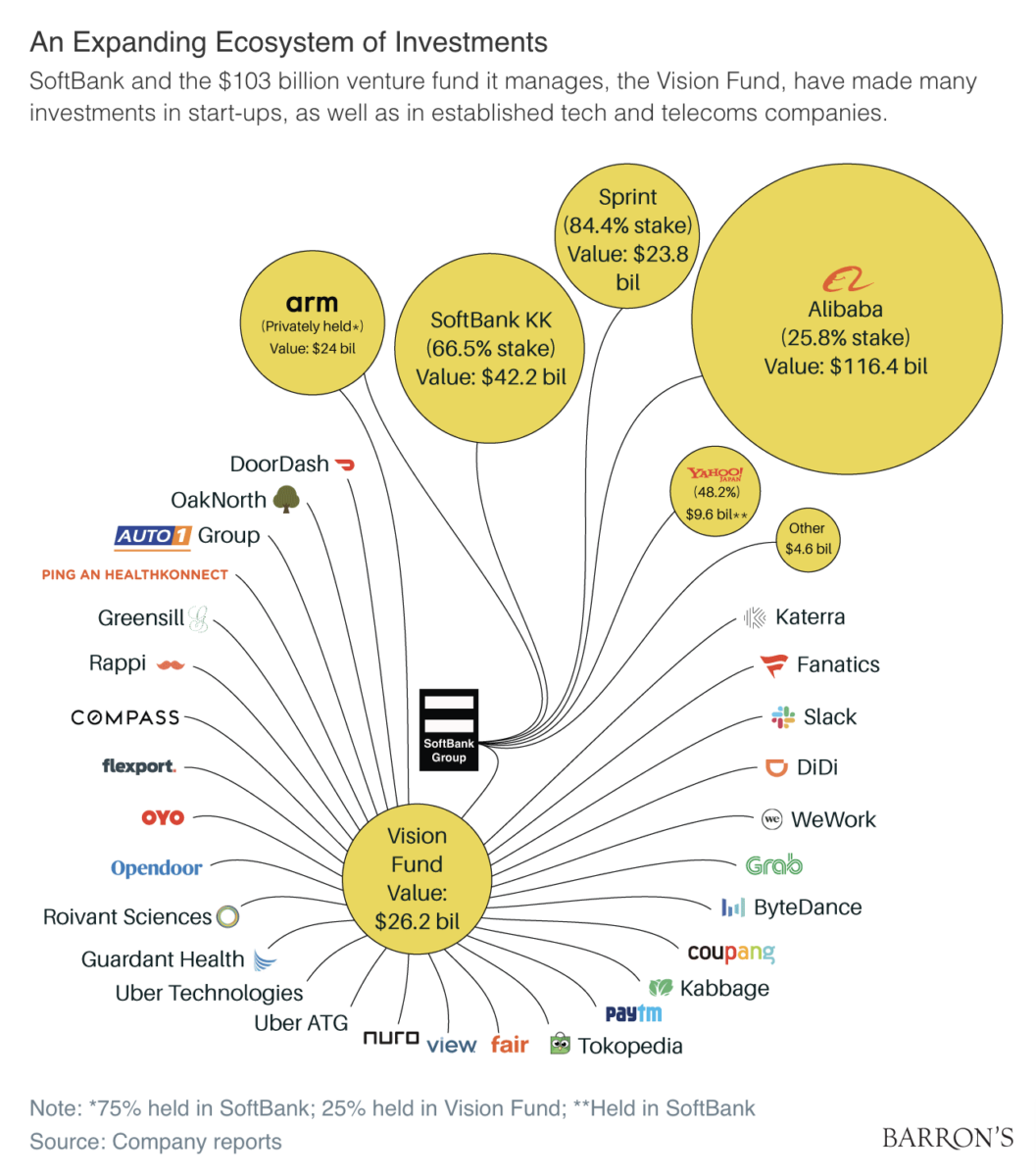

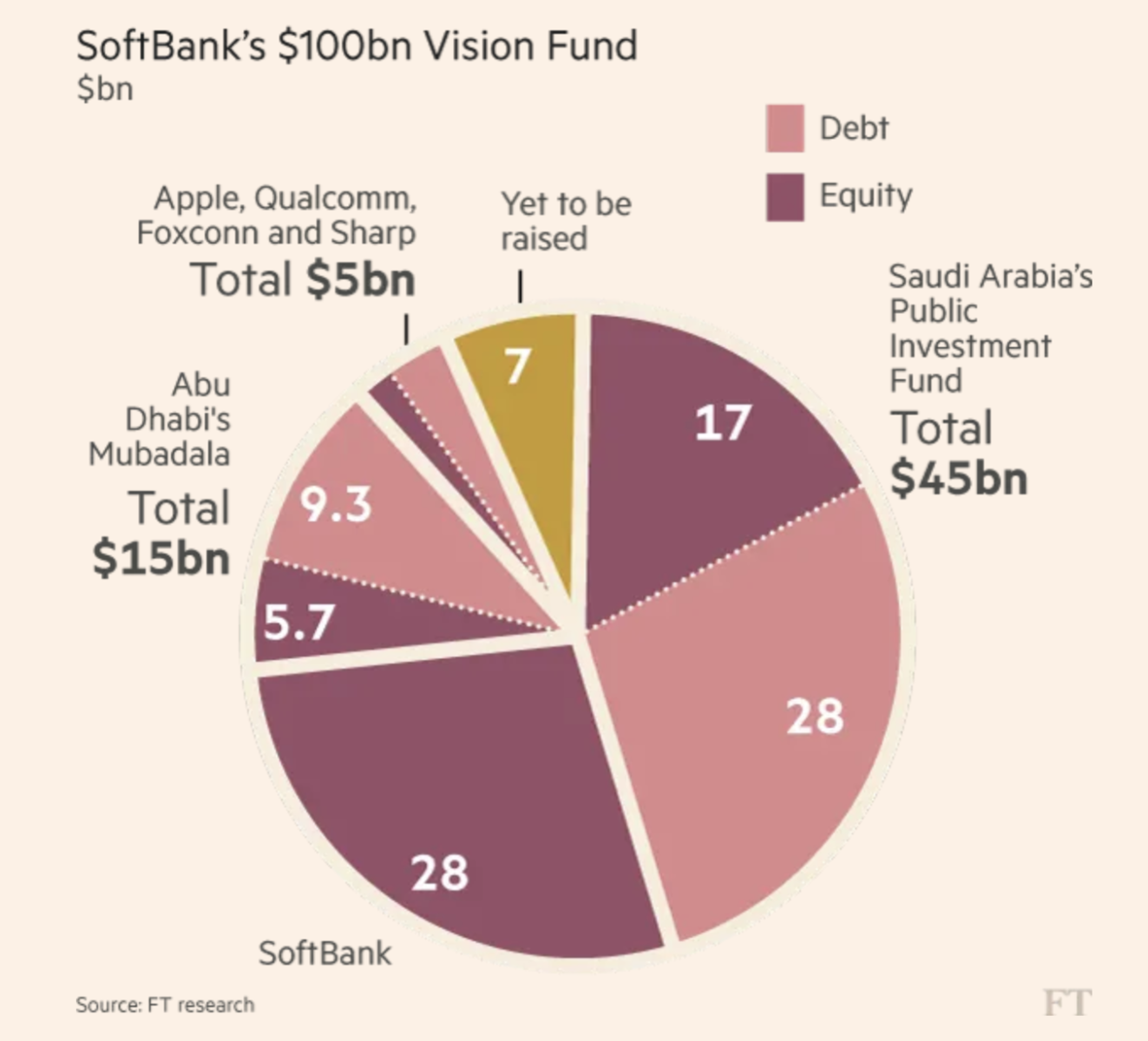

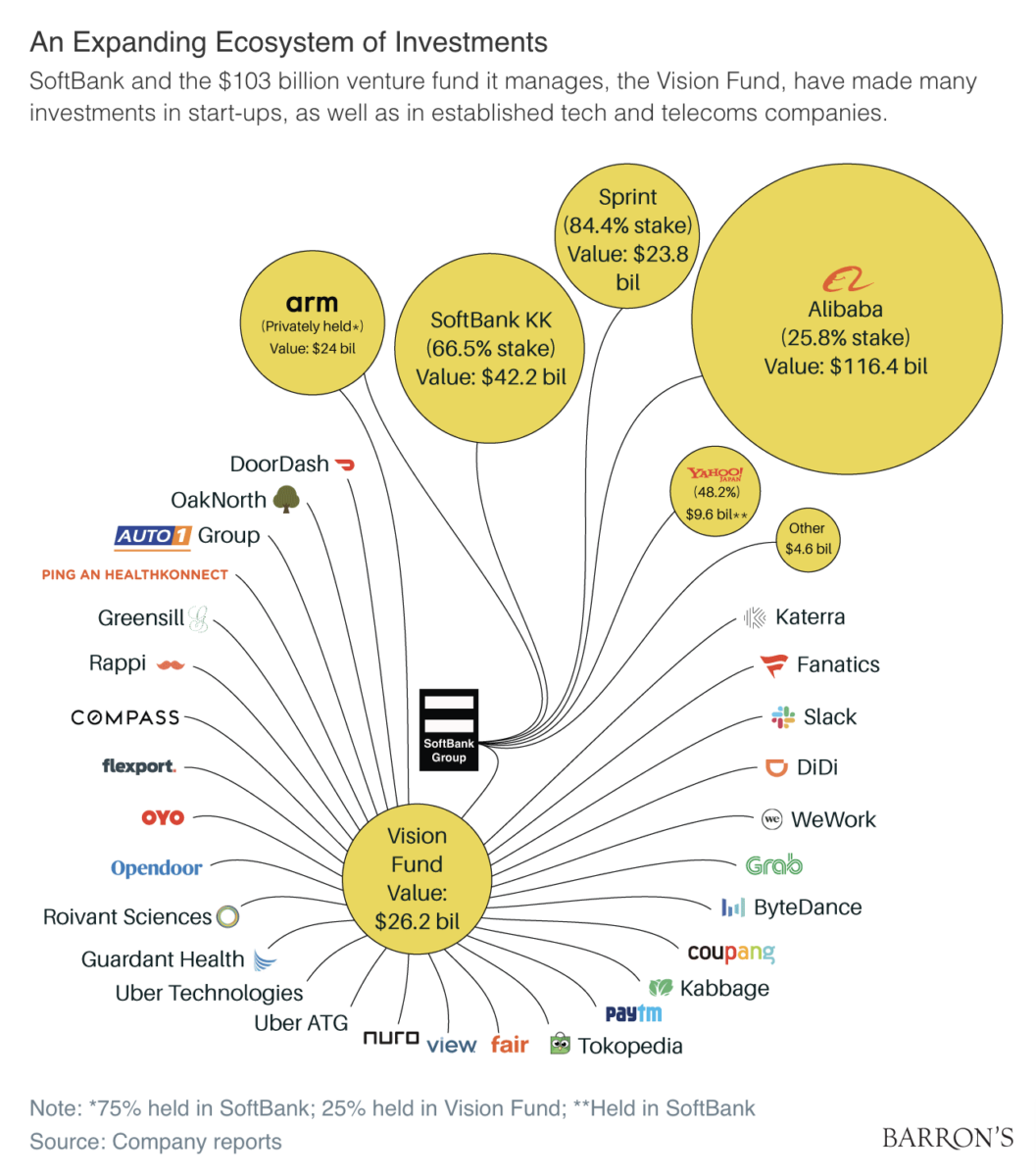

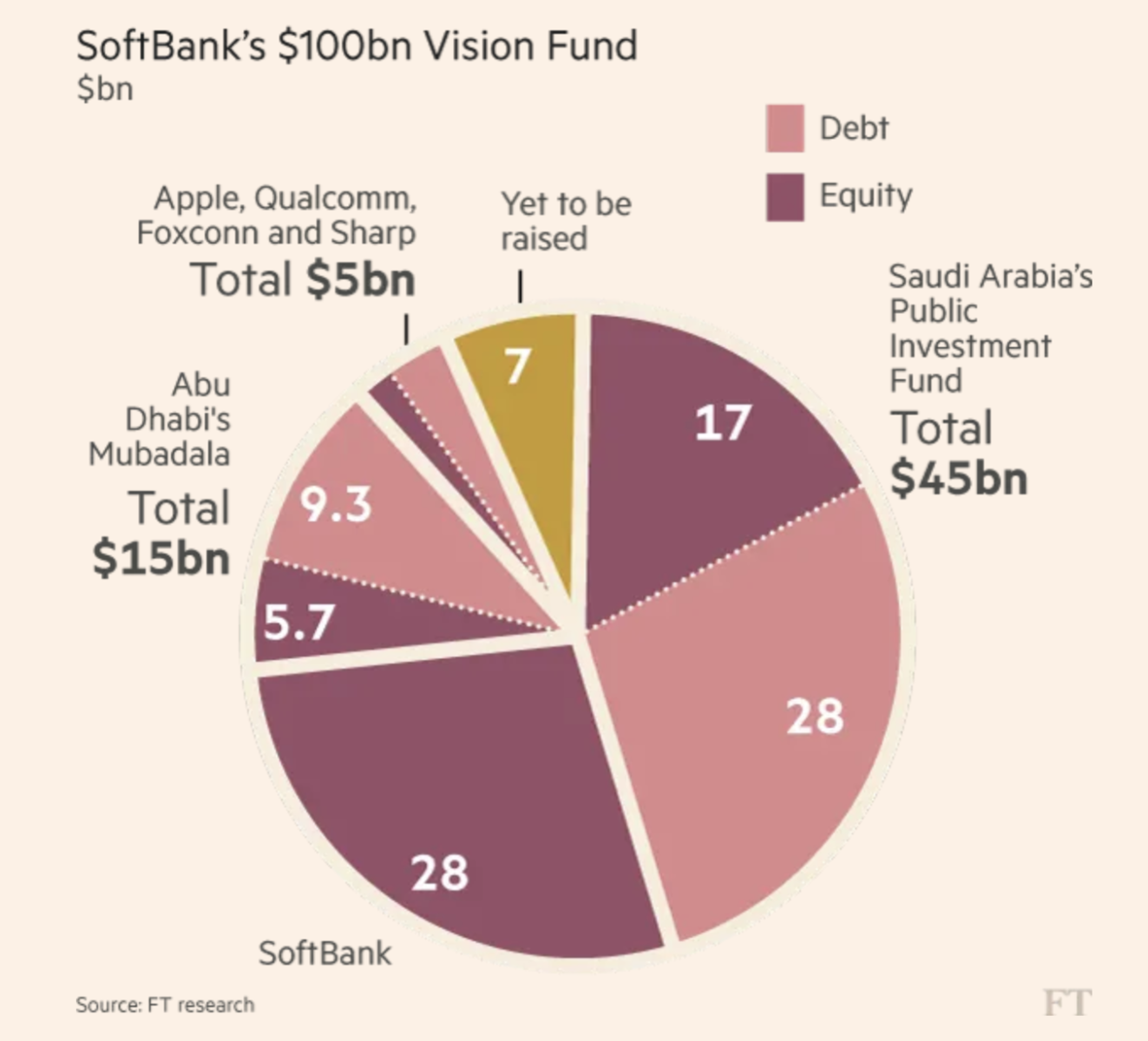

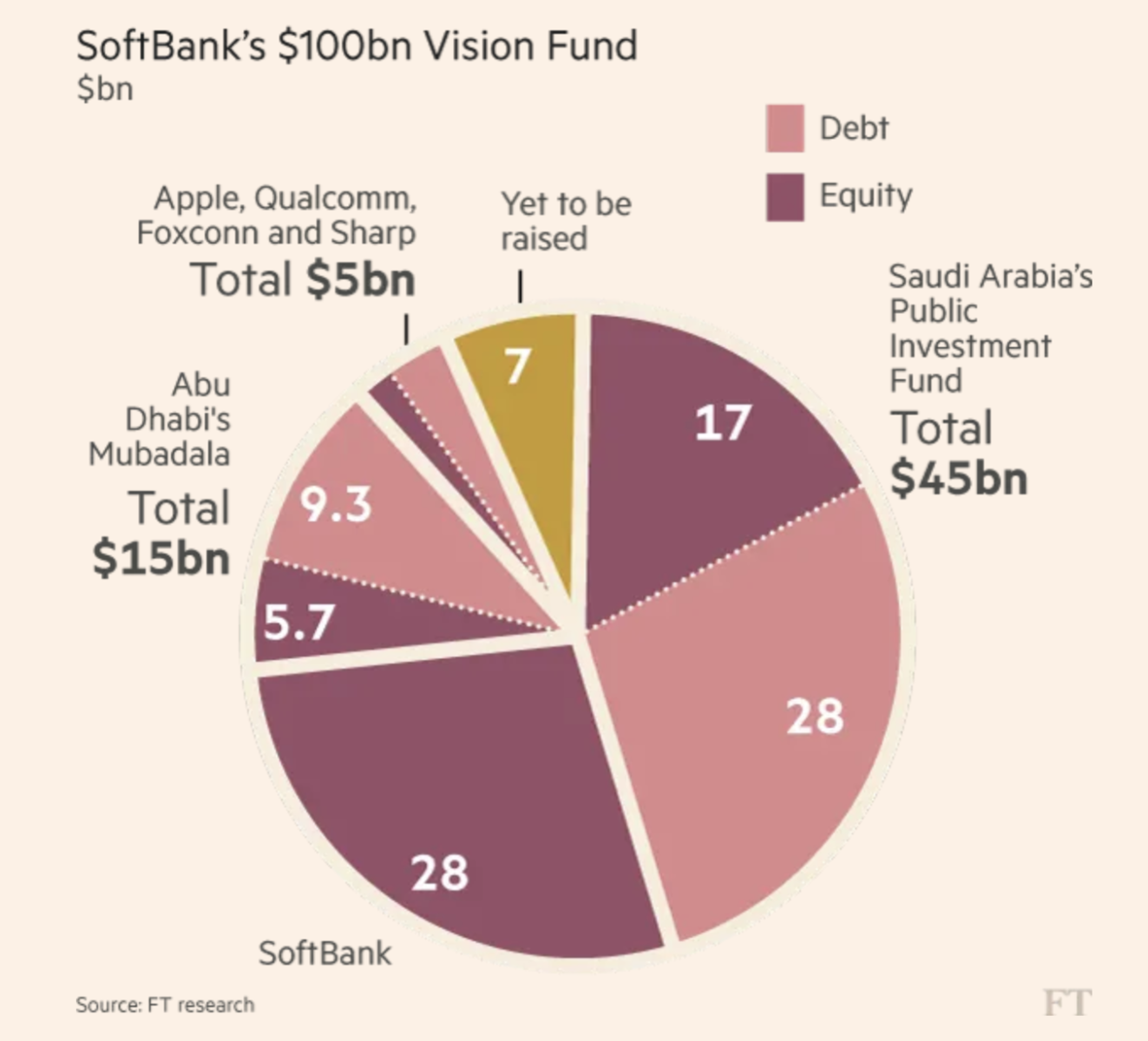

“SoftBank Group owns a dizzying array of assets, from Japan’s reigning baseball champions to a $116 billion stake in Alibaba...

“SoftBank Group owns a dizzying array of assets, from Japan’s reigning baseball champions to a $116 billion stake in Alibaba...

Read More

The average VC has done 100s if not 1000s of deals; the typical entrepreneur is on his first or second start up. This creates an...

Read More

I mentioned last week that Masters in Business just turned 5, and I am rolling out a few new changes. One of the ideas is to...

I mentioned last week that Masters in Business just turned 5, and I am rolling out a few new changes. One of the ideas is to...

Read More

The transcript from this week’s MIB: Scott Kupor, Andreessen Horowitz, is below. You can stream/download the full...

Read More

This week, we speak with Scott Kupor, managing partner at Andreessen Horowitz, where he was employee #1 at the firm. Previously he was at...

Read More

Theranos – Silicon Valley’s Greatest Disaster

Read More

It is bottom of the ninth inning for unicorn madness. All that capital chasing too few quality deals leads to valuations getting...

It is bottom of the ninth inning for unicorn madness. All that capital chasing too few quality deals leads to valuations getting...

It is bottom of the ninth inning for unicorn madness. All that capital chasing too few quality deals leads to valuations getting...

It is bottom of the ninth inning for unicorn madness. All that capital chasing too few quality deals leads to valuations getting...