Three quarters of all venture-funded startups are in Silicon Valley, New York City or Boston (or within those cities’ states)....

Read More

The transcript from this week’s MIB David Hall, Revolution’s Rise of the Rest Fund, is below. You can stream/download the full...

Read More

This week, we speak with David Hall, partner at Revolution‘s Rise of the Rest Seed Fund, where he is responsible for investment...

Read More

An interview and Q&A with billionaire venture capitalist and co-founder Valar Ventures, Peter Thiel. In this interview, Peter...

Read More

Bill Janeway is known as a “key creator of modern venture capital.” helped to created BEA Systems, which connected software...

Read More

This week, Bill Janeway returns to MIB to update us his work as a venture capitalist. He is also a former Warburg Pincus banker. He...

Read More

Not everyone who reads a glowing write up about a young and feted entrepreneur gets their “Spidey-sense” tingling. But John...

Read More

The transcript from this week’s MiB: John Carreyrou on Theranos & Bad Blood is below. You can stream/download the full...

Read More

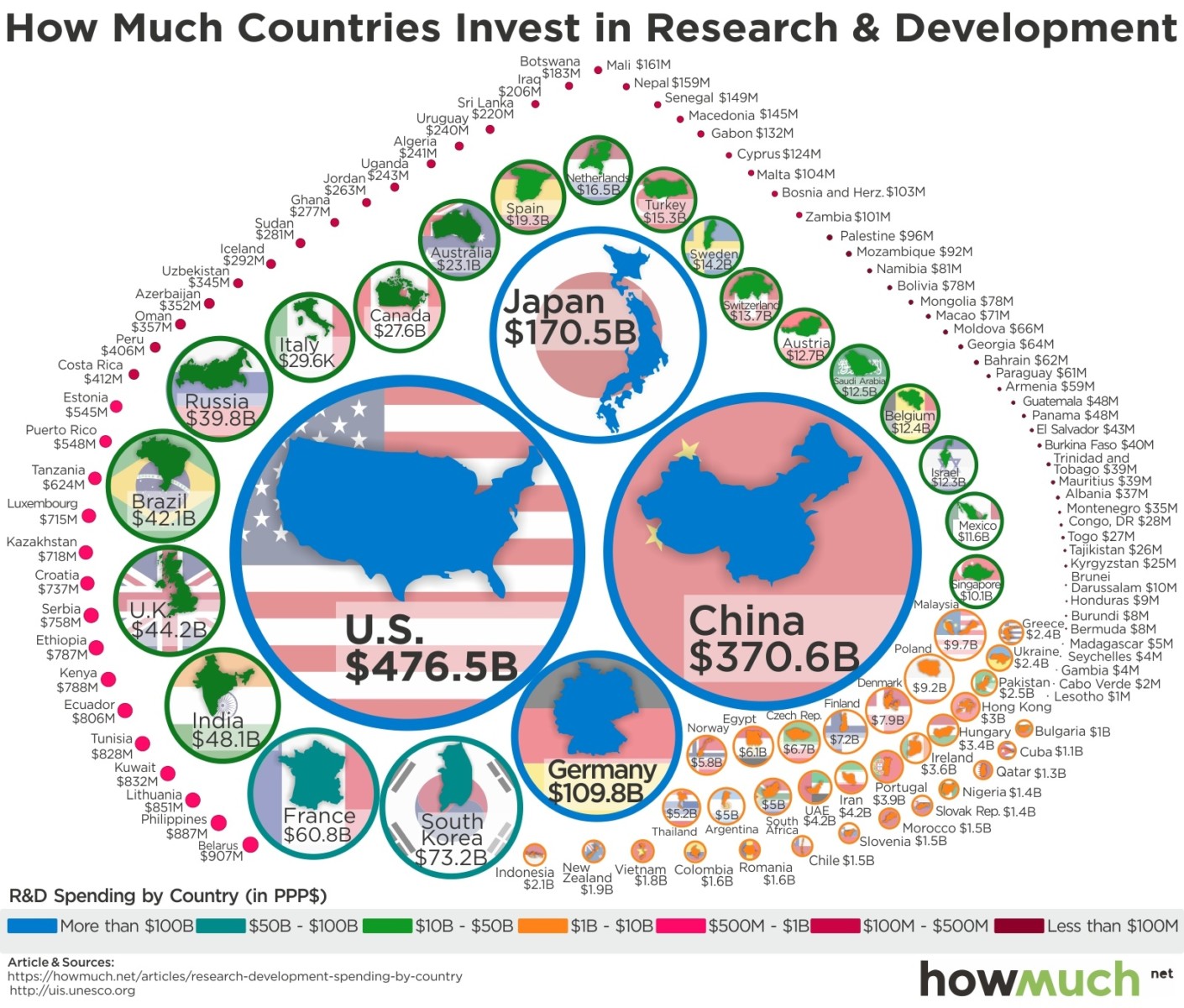

Source: UNESCO Institute for Statistics, via How Much

Source: UNESCO Institute for Statistics, via How Much

Read More

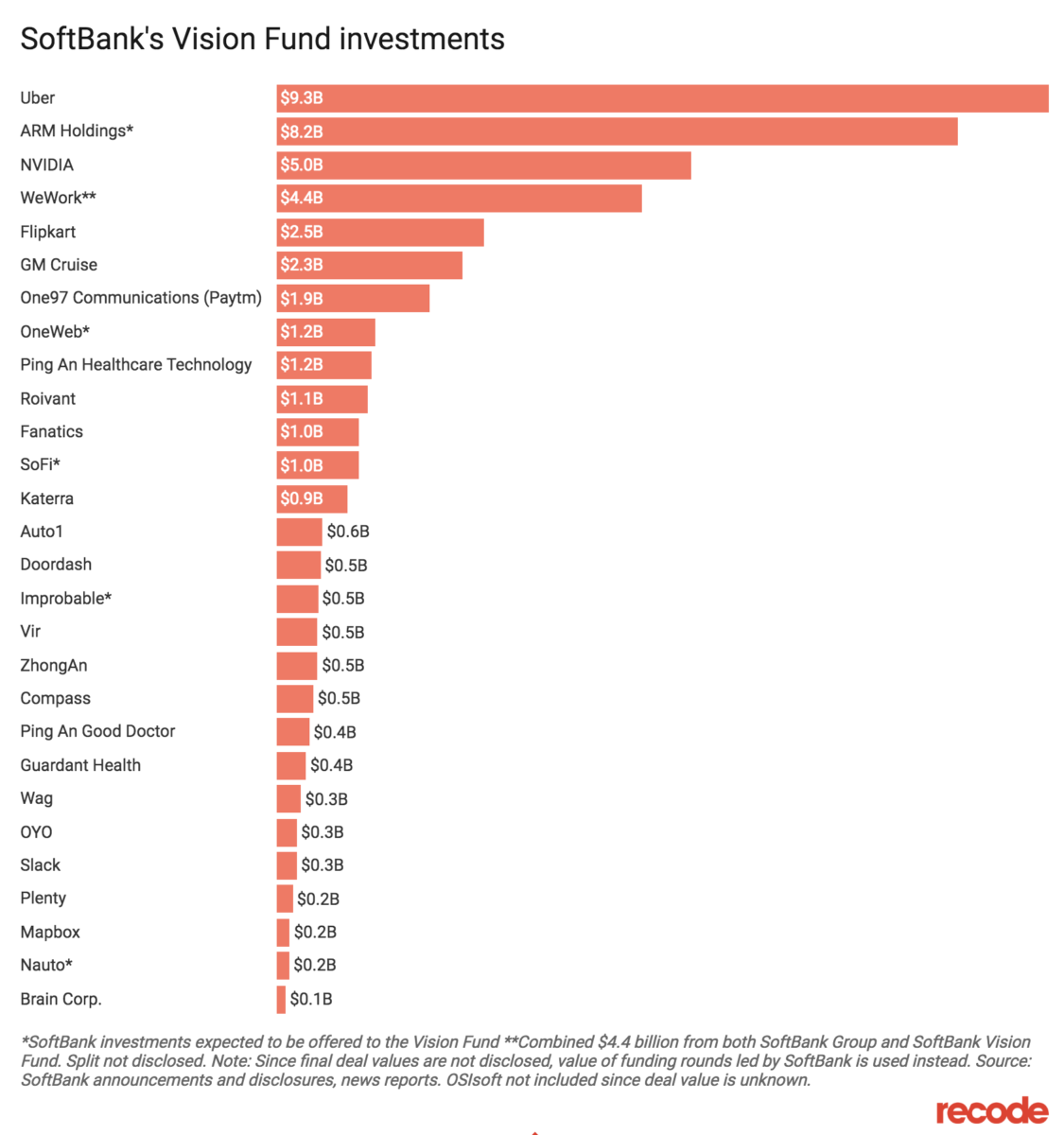

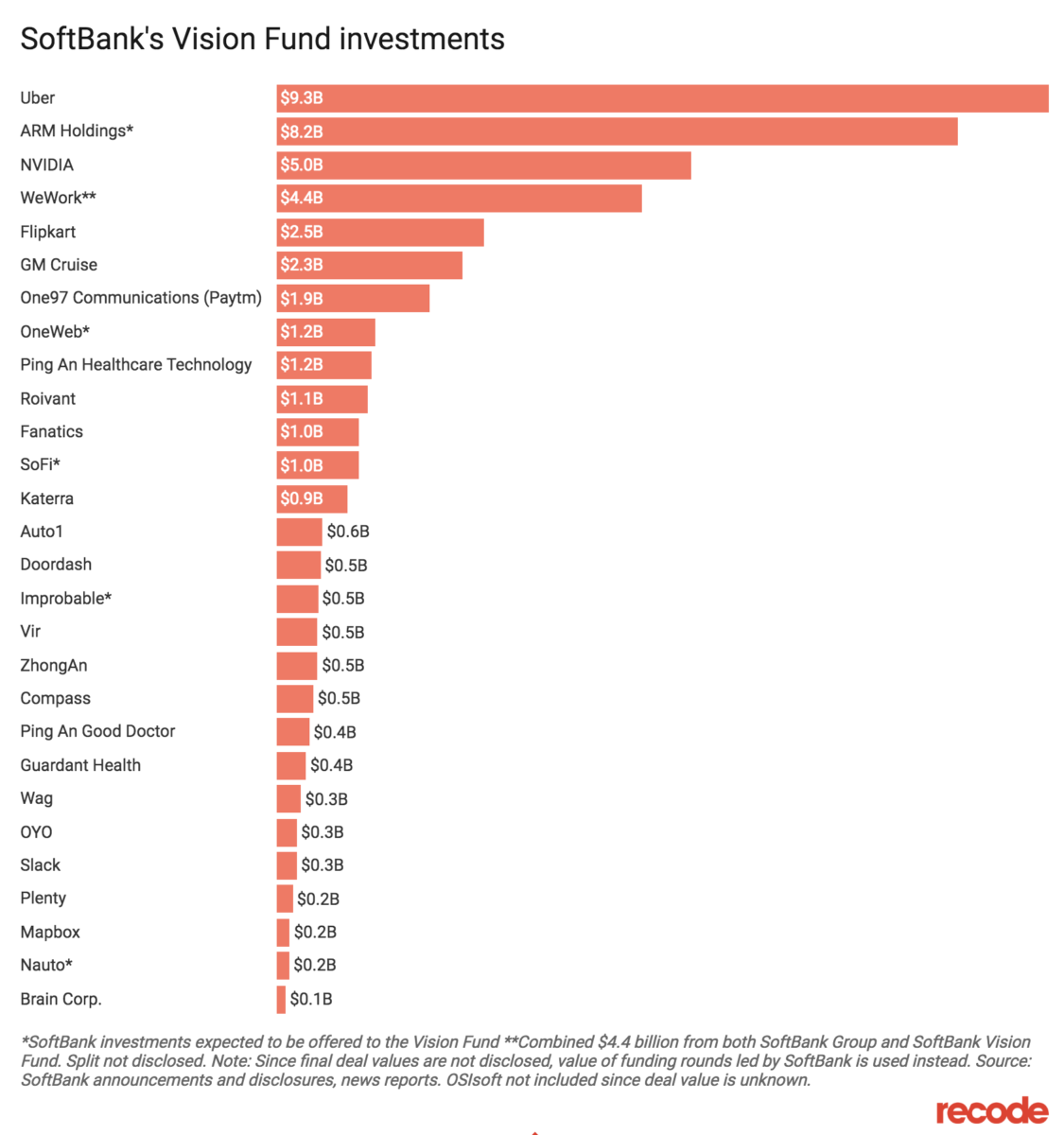

A few weeks ago, SoftBank’s mammoth Vision Fund came up in my MIB conversation with Steve Murray of Revolution Growth. At $100 billion...

A few weeks ago, SoftBank’s mammoth Vision Fund came up in my MIB conversation with Steve Murray of Revolution Growth. At $100 billion...

Read More

A few weeks ago, SoftBank’s mammoth Vision Fund came up in my MIB conversation with Steve Murray of Revolution Growth. At $100 billion...

A few weeks ago, SoftBank’s mammoth Vision Fund came up in my MIB conversation with Steve Murray of Revolution Growth. At $100 billion...