Theranos’ Fatal Flaws Were in Plain Sight With this many red flags, it’s a wonder the collapse didn’t come sooner. Bloomberg, May...

Read More

How a company with a blood-testing machine that could never perform as touted went from billion-dollar baby to complete bust: Elizabeth...

Read More

The new Supreme Court decision on sports gambling (New Jersey vs NCAA) will lead to a Cambrian explosion of new companies, software and...

Read More

The transcript from this week’s MIB: Steve Murray, Revolution Growth is below. You can stream/download the full conversation,...

Read More

This week we sit down with Steve Murray, a managing partner at Revolution Growth, founded by Steve Case (AOL), Ted Leonsis (Washington...

Read More

Joel Greenblatt know the challenges of running portfolios intended to outperform their benchmarks as well as anyone. When he was...

Read More

This week, we have a bonus interview: a special online only edition of MIB for the 3 day weekend with perhaps the greatest tennis...

Read More

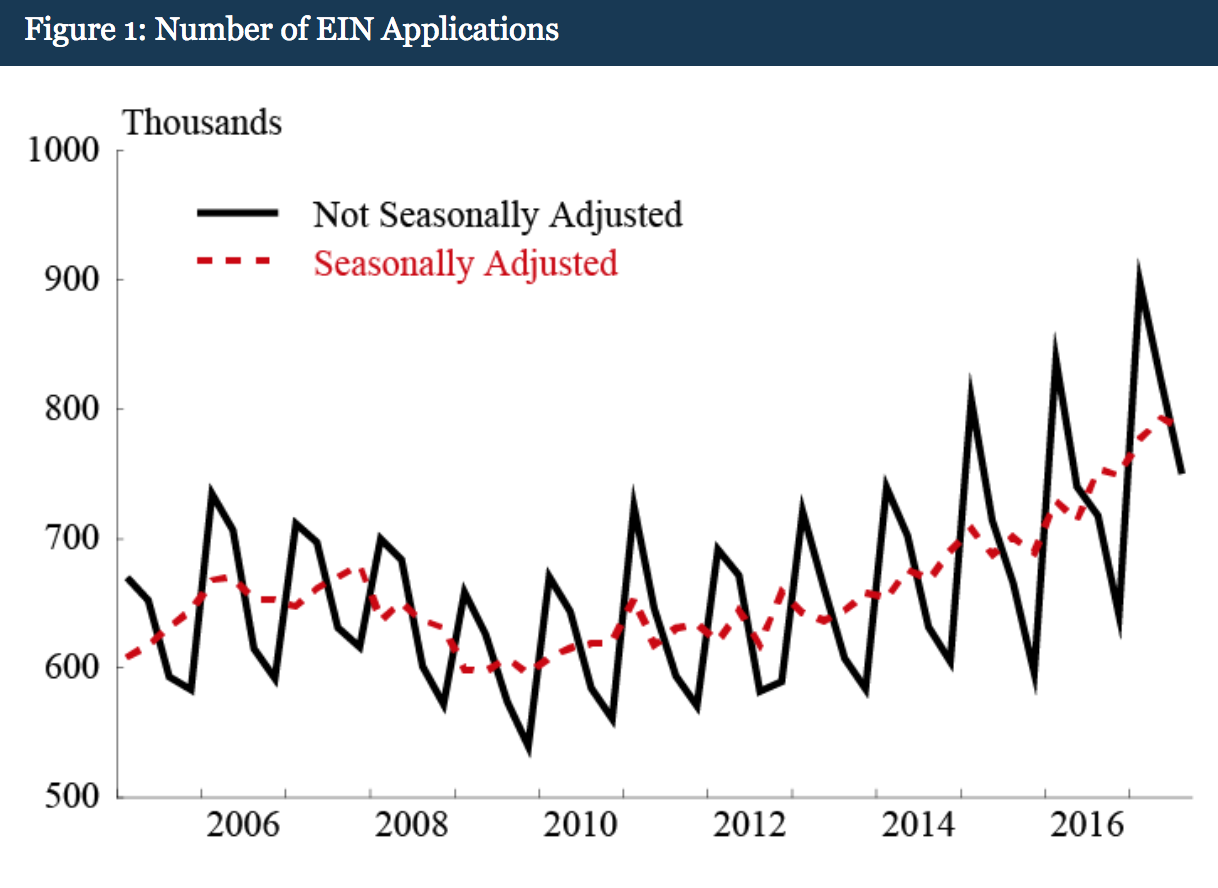

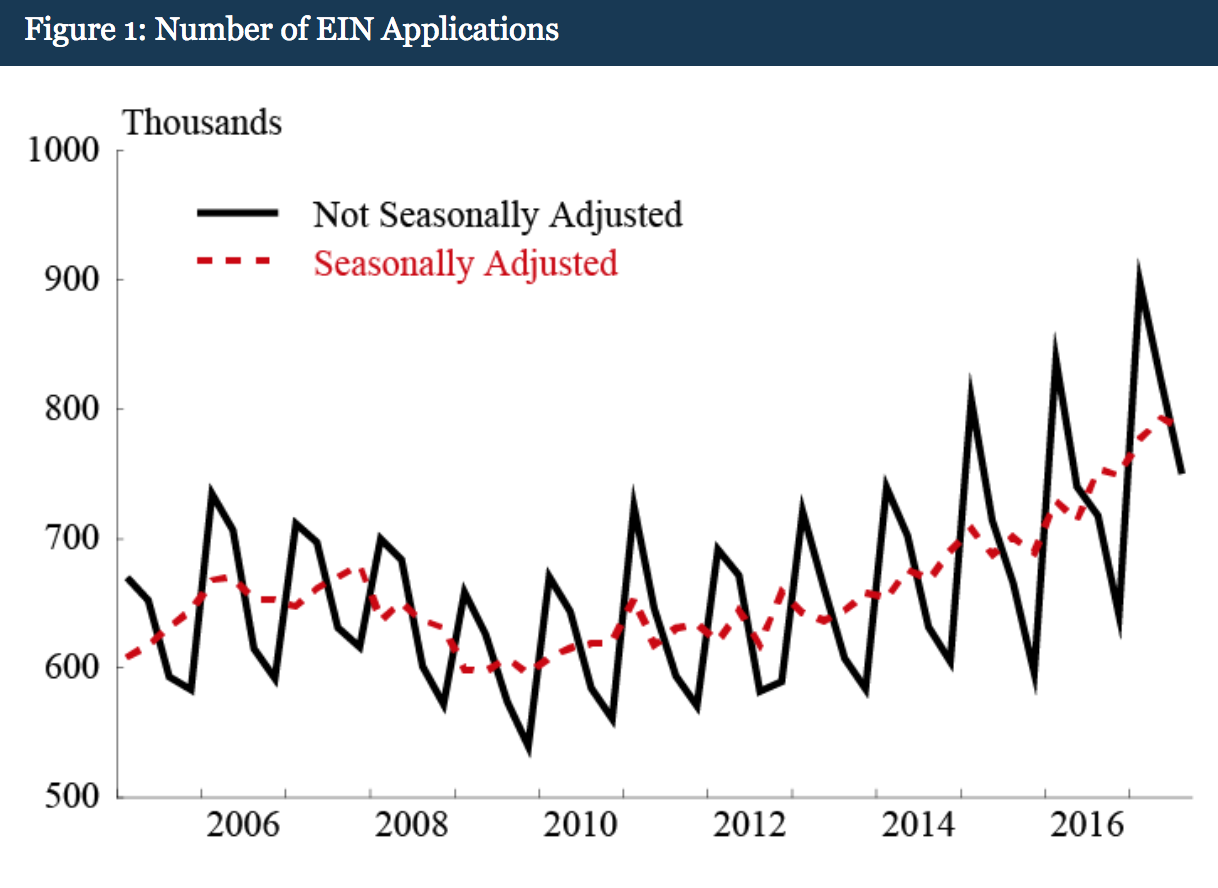

Kimberly Bayard, Emin Dinlersoz (U.S. Census Bureau), Timothy Dunne (University of Notre Dame), John Haltiwanger (University of...

Kimberly Bayard, Emin Dinlersoz (U.S. Census Bureau), Timothy Dunne (University of Notre Dame), John Haltiwanger (University of...

Read More

How to Know When a Company Represents a Paradigm Shift Think of the difference between evolution and revolution. Bloomberg, March 14,...

Read More

Kimberly Bayard, Emin Dinlersoz (U.S. Census Bureau), Timothy Dunne (University of Notre Dame), John Haltiwanger (University of...

Kimberly Bayard, Emin Dinlersoz (U.S. Census Bureau), Timothy Dunne (University of Notre Dame), John Haltiwanger (University of...