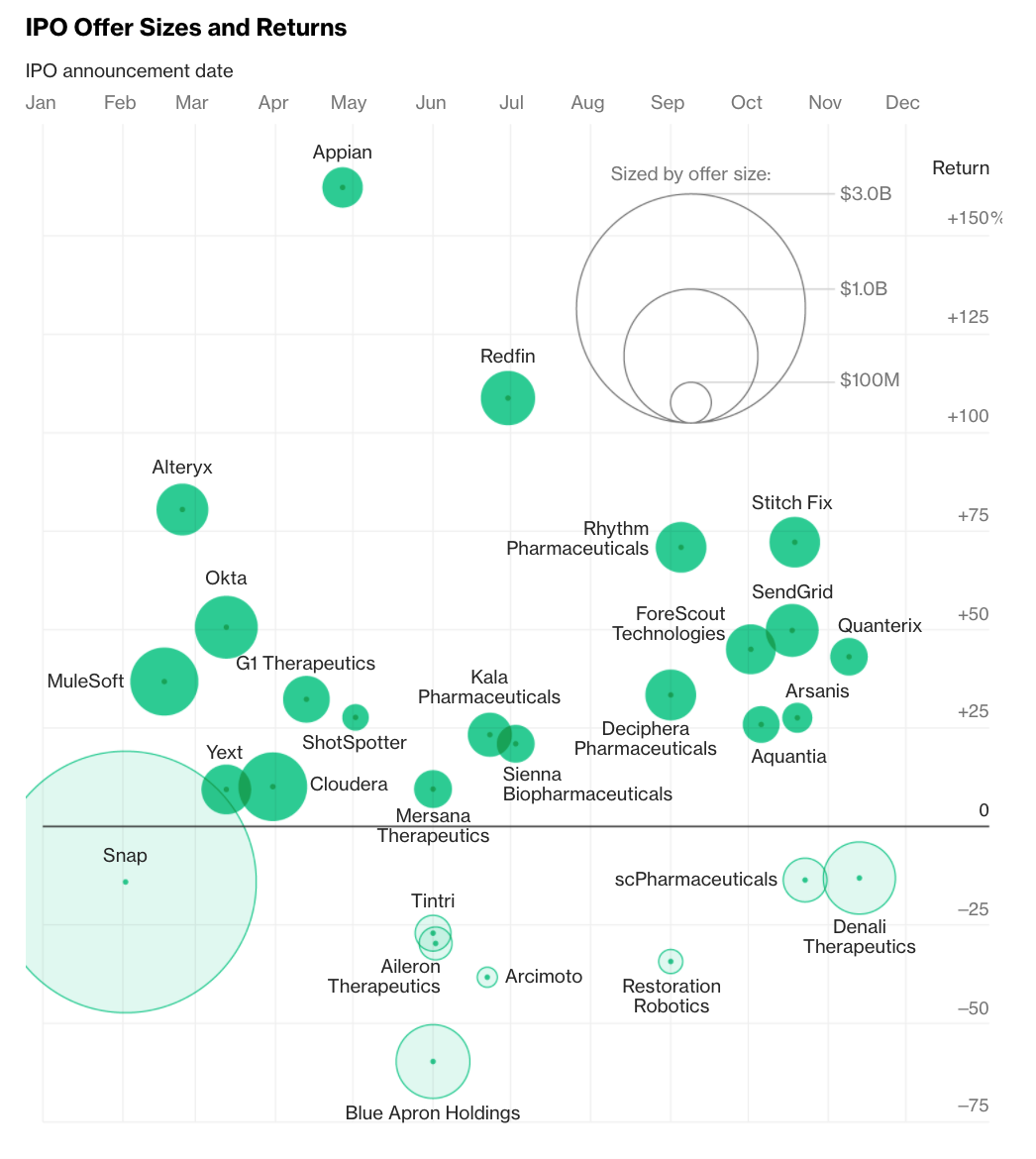

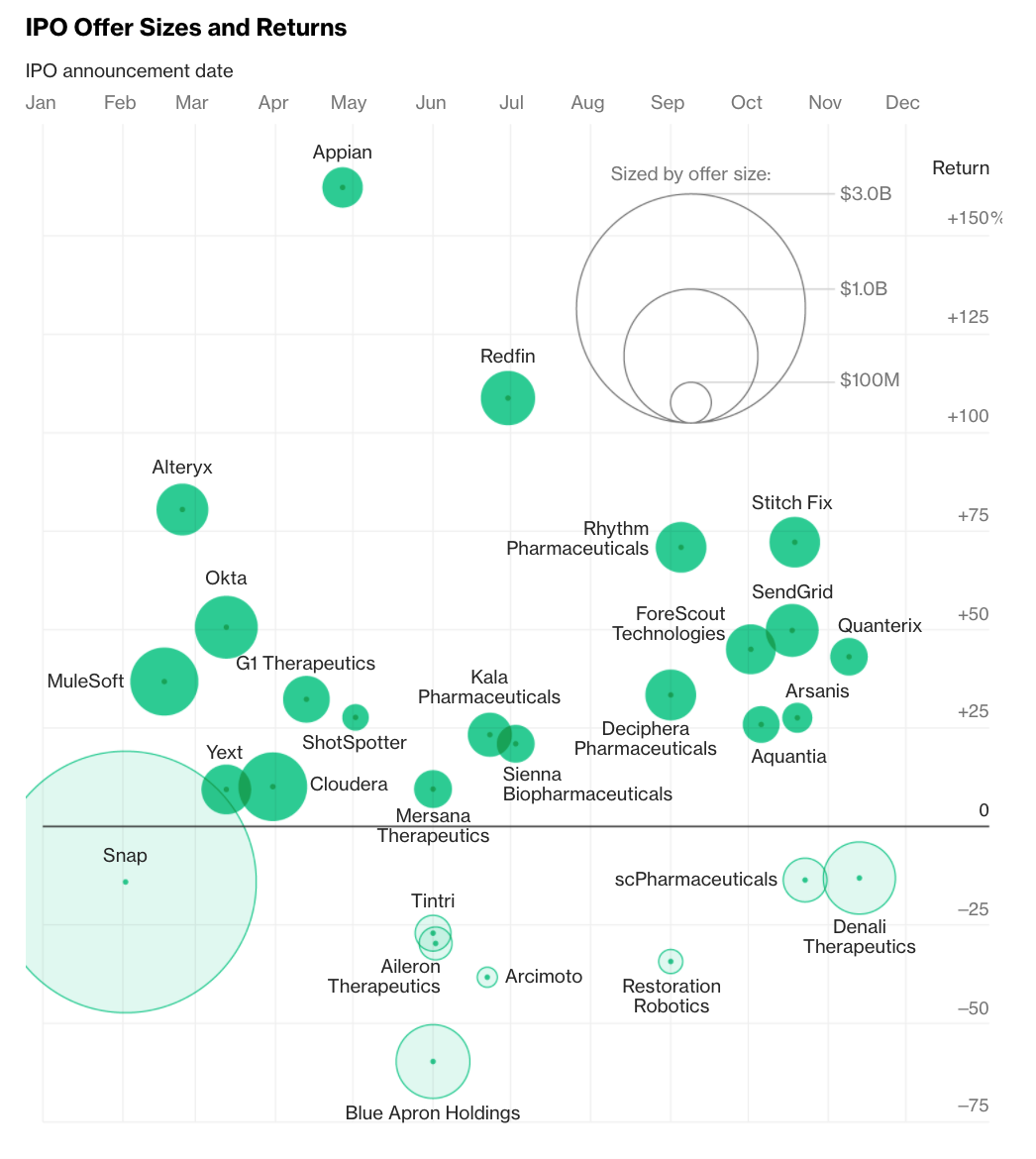

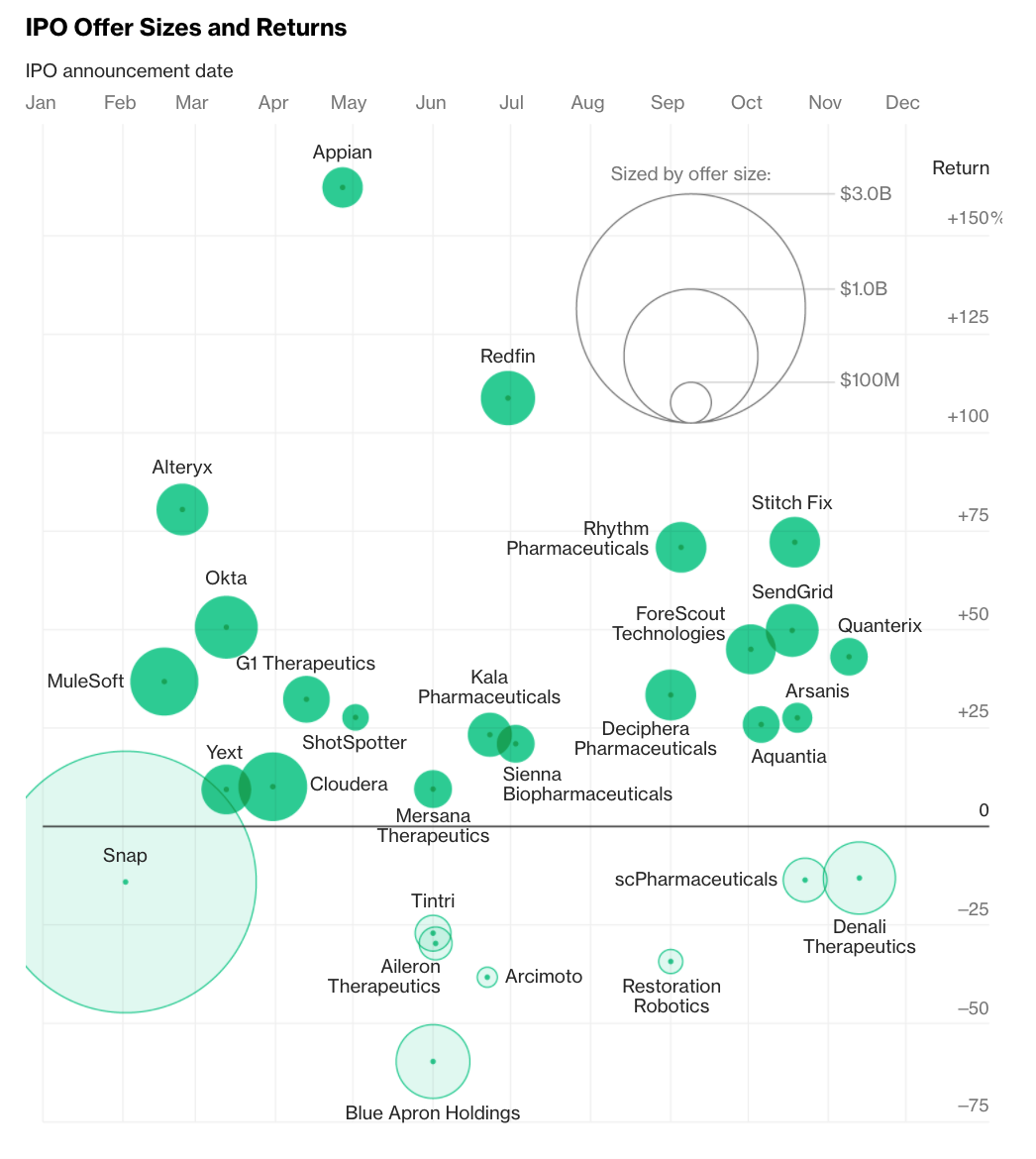

Interesting set of charts: The three largest offerings in 2017 had negative returns. Snap, the biggest offering of the year and...

Interesting set of charts: The three largest offerings in 2017 had negative returns. Snap, the biggest offering of the year and...

Read More

Uber’s crises have come so fast that they’ve piled on top of one another. Here are some of the companies most infamous...

Read More

Greg Sands, founder of Costanoa Ventures, has a deep background in technology. Sands was the first product manager at Netscape...

Read More

Our conversation this weekend is with Greg Sands, founder of Costanoa Ventures. Sands was the first product manager at Netscape...

Read More

Matt Wallaert is on a mission to create a ‘Chief Behavioral Officer’ officer as a standard C-Suite position within corporate America....

Read More

This week, we chat with Matt Wallaert, a behavioral psychologist and entrepreneur who was formerly a director at Microsoft Ventures....

Read More

Interesting: click for complete graphic Source: Bloomberg

Interesting: click for complete graphic Source: Bloomberg

Read More

Rich Barton was a senior Microsoft engineer working for Bill Gates and Steve Ballmer in the 1990s. His job required a good amount of...

Read More

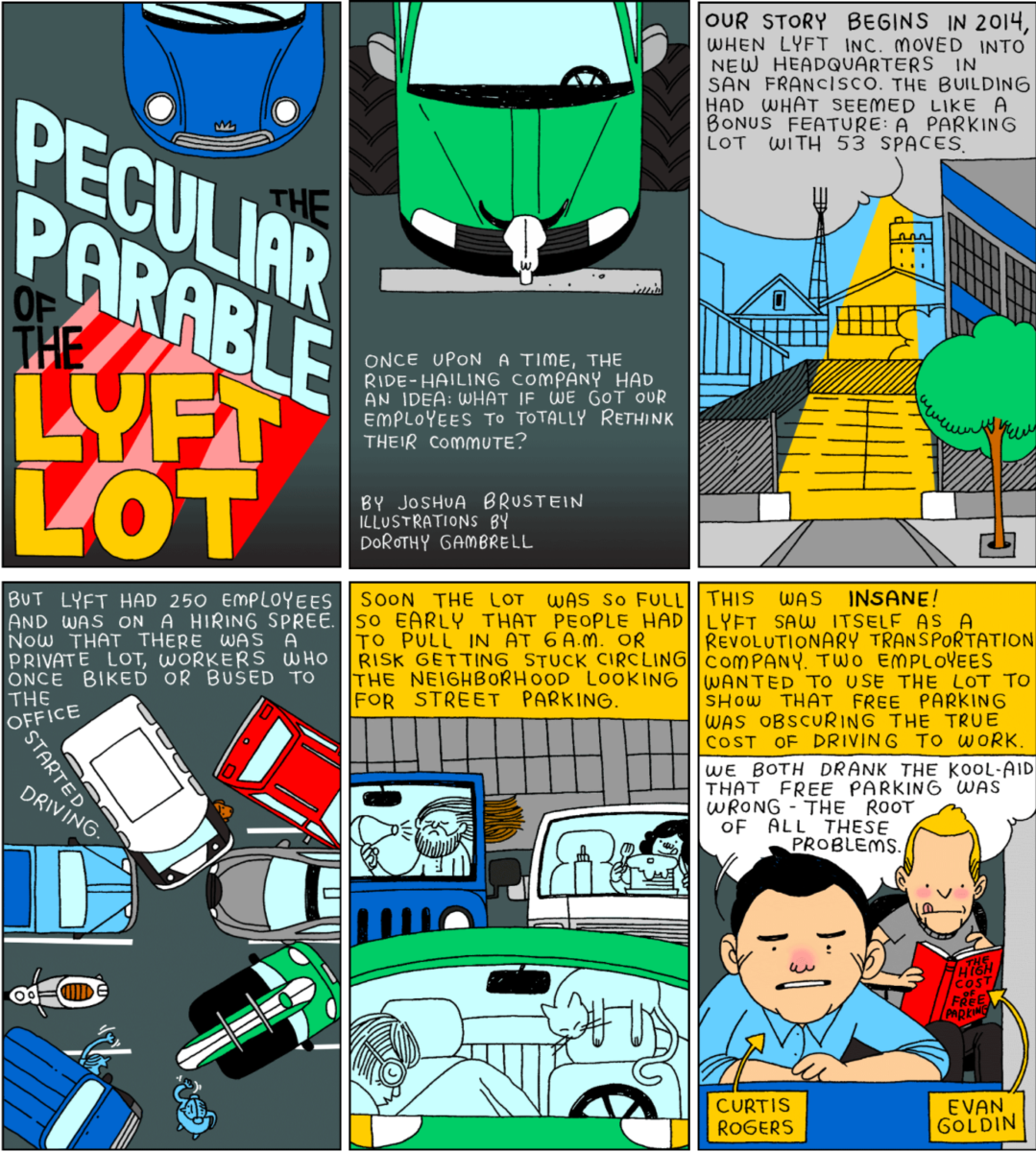

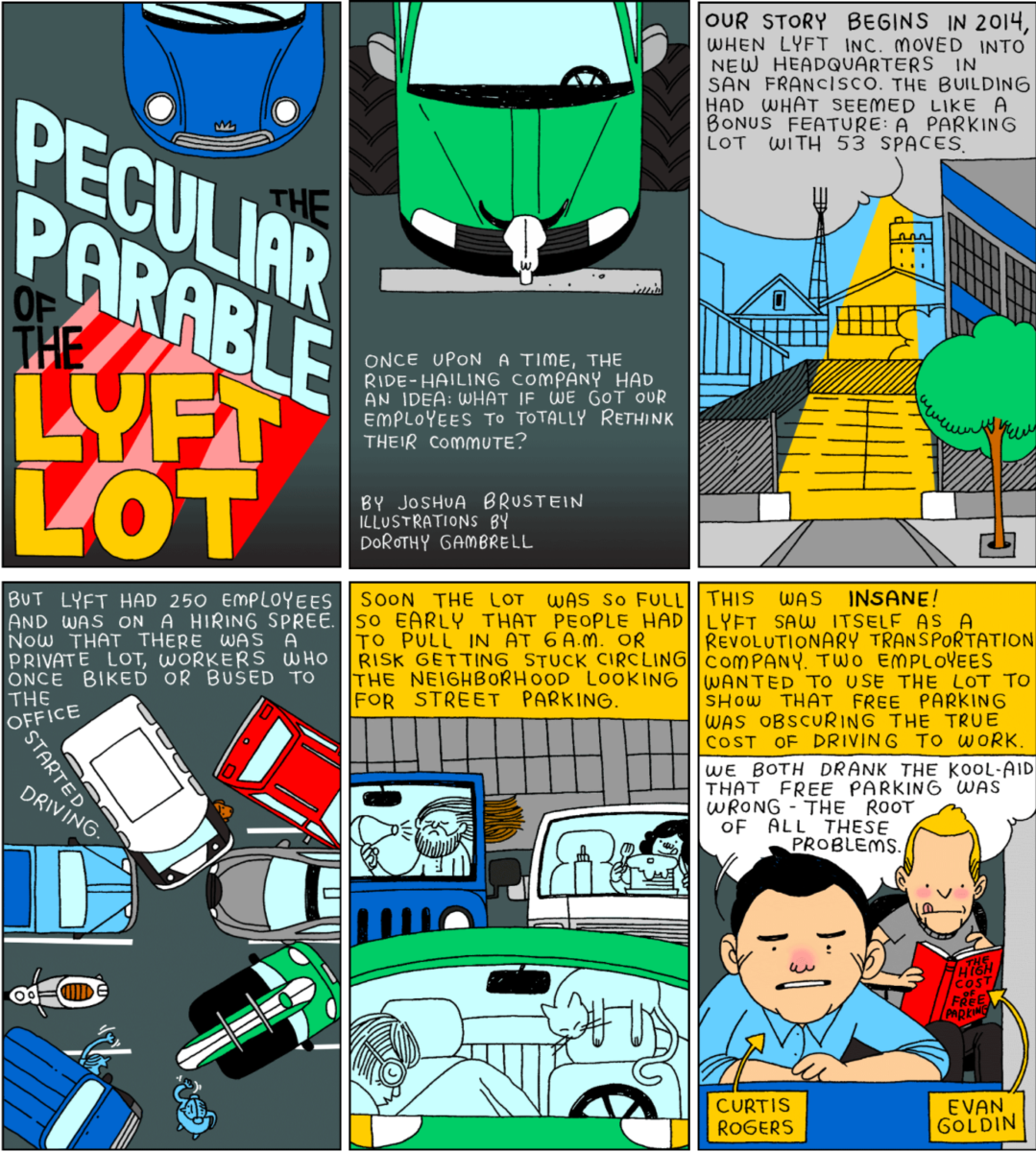

So much awesome: Source: bOingboing

Read More

Interesting set of charts: The three largest offerings in 2017 had negative returns. Snap, the biggest offering of the year and...

Interesting set of charts: The three largest offerings in 2017 had negative returns. Snap, the biggest offering of the year and...

Interesting set of charts: The three largest offerings in 2017 had negative returns. Snap, the biggest offering of the year and...

Interesting set of charts: The three largest offerings in 2017 had negative returns. Snap, the biggest offering of the year and...