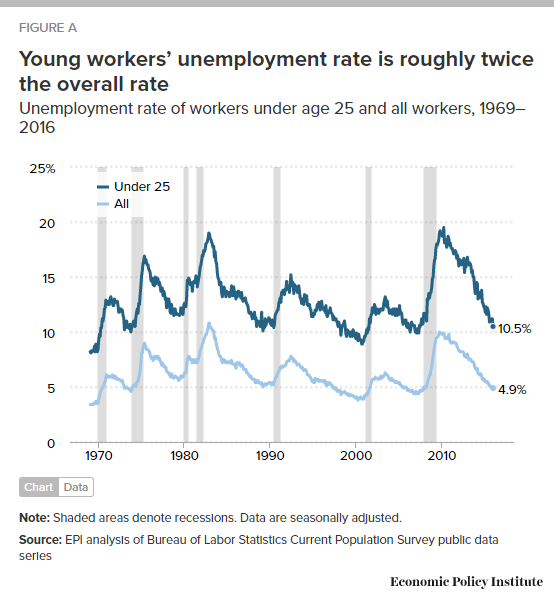

Interesting look at millenial employment via EPI: Source: Economic Policy Institute

Interesting look at millenial employment via EPI: Source: Economic Policy Institute

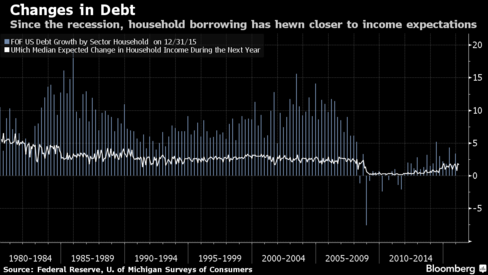

Deleveraging & Spending

Source: Bloomberg Between 2000 and 2007, borrowed money was adding about $330 billion a year to Americans’ purchasing...

Source: Bloomberg Between 2000 and 2007, borrowed money was adding about $330 billion a year to Americans’ purchasing...

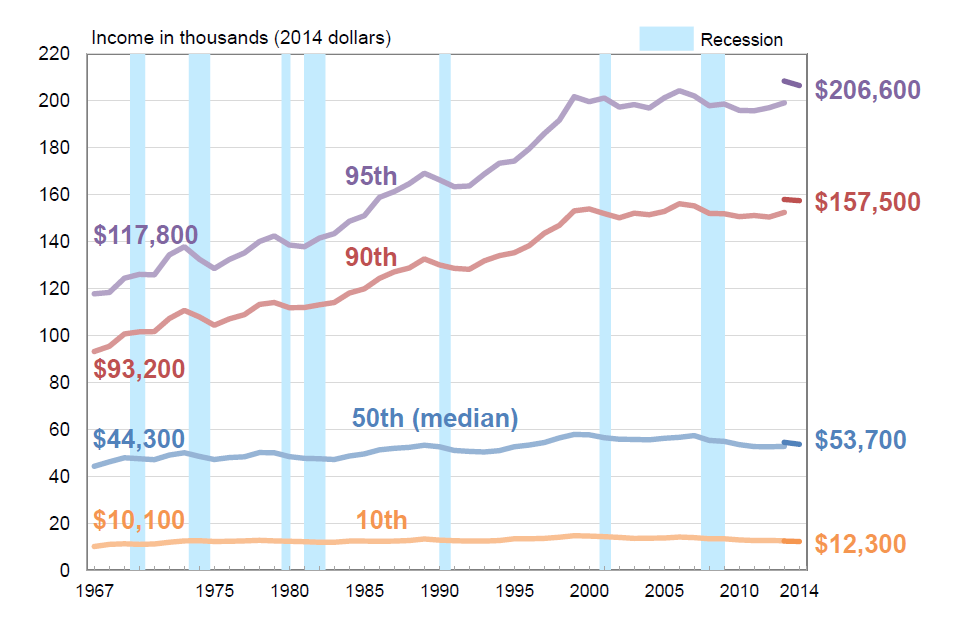

Lack of Household Income Gain Explains Trump & Sanders Appeal

Today is the New York state primary. Regardless of the outcome, the election offers an opportunity to explore why two...

Today is the New York state primary. Regardless of the outcome, the election offers an opportunity to explore why two...

What’s Up with Wage Growth?

What’s Up with Wage Growth? Mary C. Daly, Bart Hobijn, and Benjamin Pyle 2016-07 | March 7, 2016 While most...

What’s Up with Wage Growth? Mary C. Daly, Bart Hobijn, and Benjamin Pyle 2016-07 | March 7, 2016 While most...

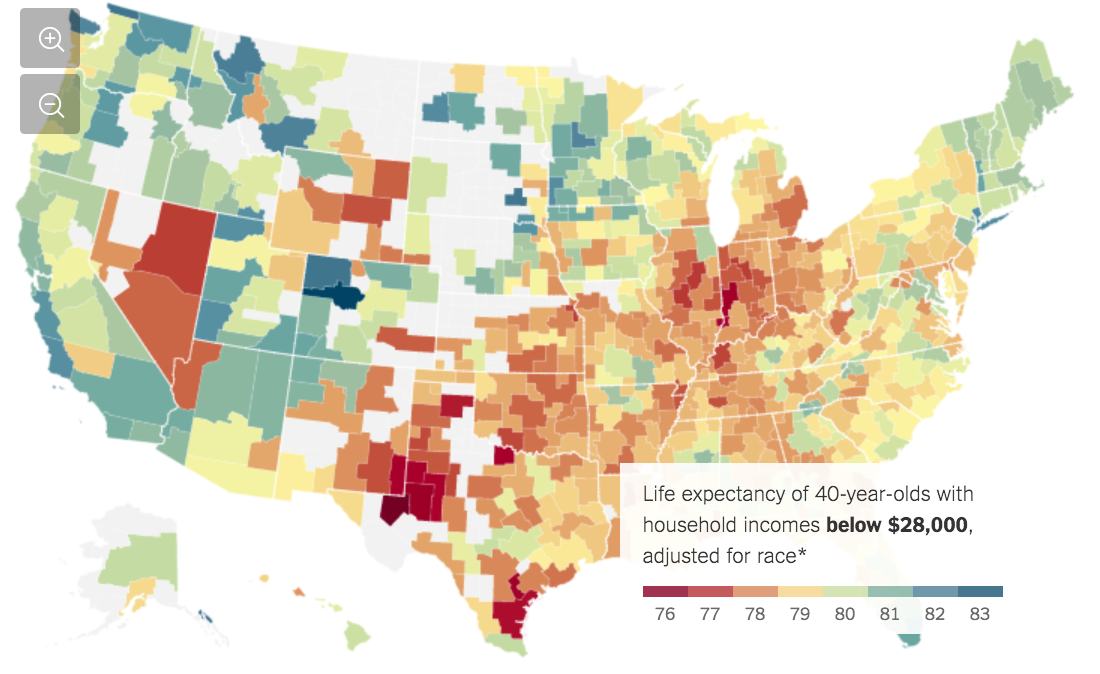

U.S. Life Expectancy Depends on Income, Location

Fascinating analysis on US life expectancies from Neil Irwin and Quoctrung Bui at the NYT on the various factors that impact life...

Fascinating analysis on US life expectancies from Neil Irwin and Quoctrung Bui at the NYT on the various factors that impact life...

Busted: The Sad Data Manipulation of Prof Mark Perry

@TBPInvictus here: It was exactly one year ago – here – that I penned my first piece on Seattle’s then-new (just going...