Today’s column might anger some people on the right AND the left. Try not to react emotionally. Instead consider this as a way to...

Today’s column might anger some people on the right AND the left. Try not to react emotionally. Instead consider this as a way to...

Read More

Jamie Dimon Reduces Income Inequality Does better technology mean we’re all better off? Don’t count on it. Bloomberg,...

Read More

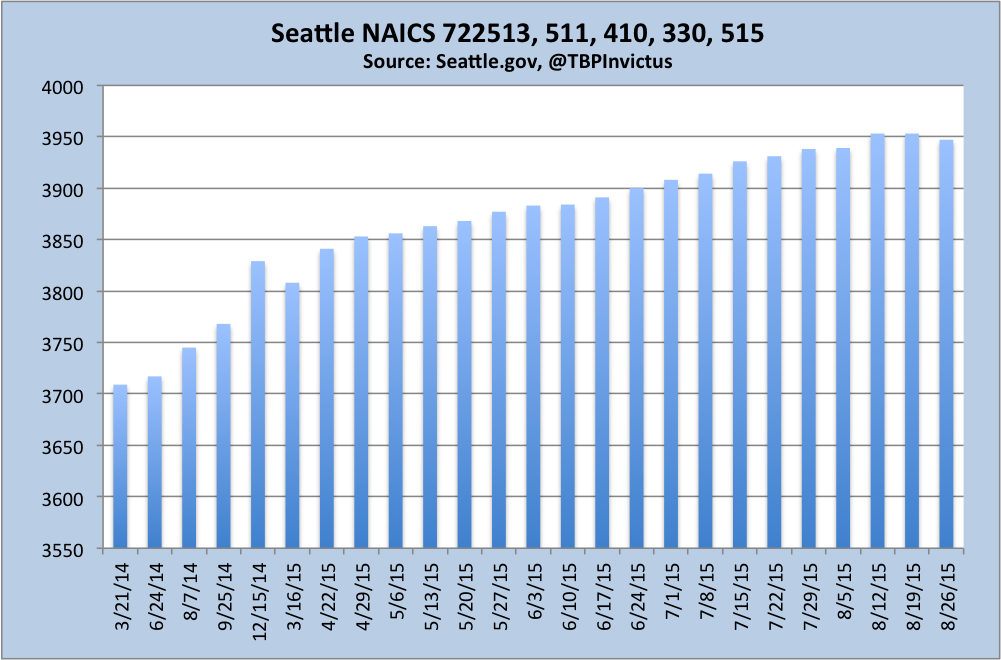

@TBPInvictus The opening paragraph of this CNNMoney piece (over one year ago) perfectly captures a growing sentiment that I’ve seen...

@TBPInvictus The opening paragraph of this CNNMoney piece (over one year ago) perfectly captures a growing sentiment that I’ve seen...

Read More

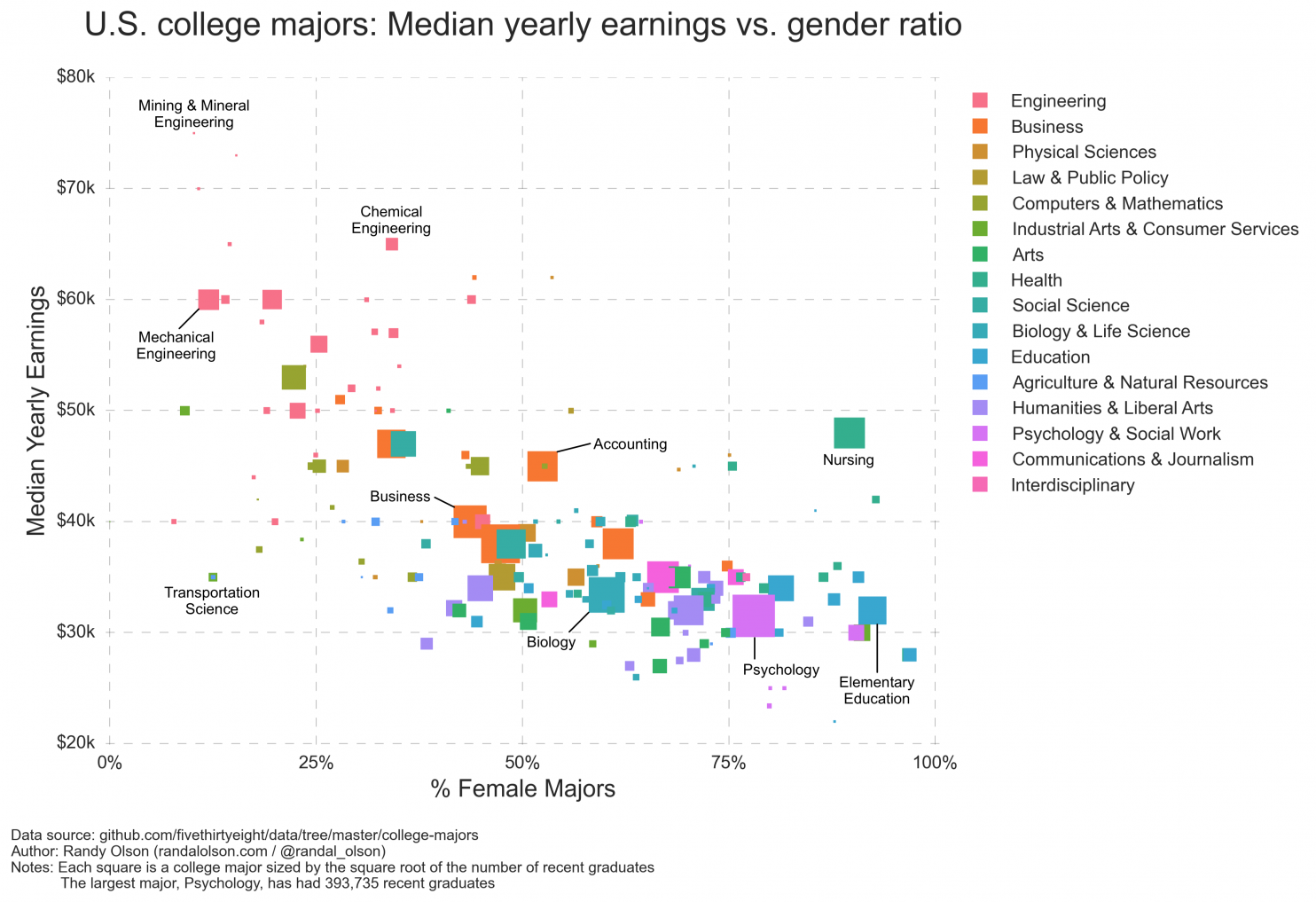

Intern season is over and all the college students are back at school. Seems like a good time to remind those of you about to assume a...

Intern season is over and all the college students are back at school. Seems like a good time to remind those of you about to assume a...

Read More

Searching for Higher Wages Luis Armona, Samuel Kapon, Laura Pilossoph, Ayşegül Şahin, and Giorgio Topa Liberty Street Economics,...

Searching for Higher Wages Luis Armona, Samuel Kapon, Laura Pilossoph, Ayşegül Şahin, and Giorgio Topa Liberty Street Economics,...

Read More

@TBPInvictus (Pun intended in the title) There are myriad factors that typically go into determining the success or failure of any...

@TBPInvictus (Pun intended in the title) There are myriad factors that typically go into determining the success or failure of any...

Read More

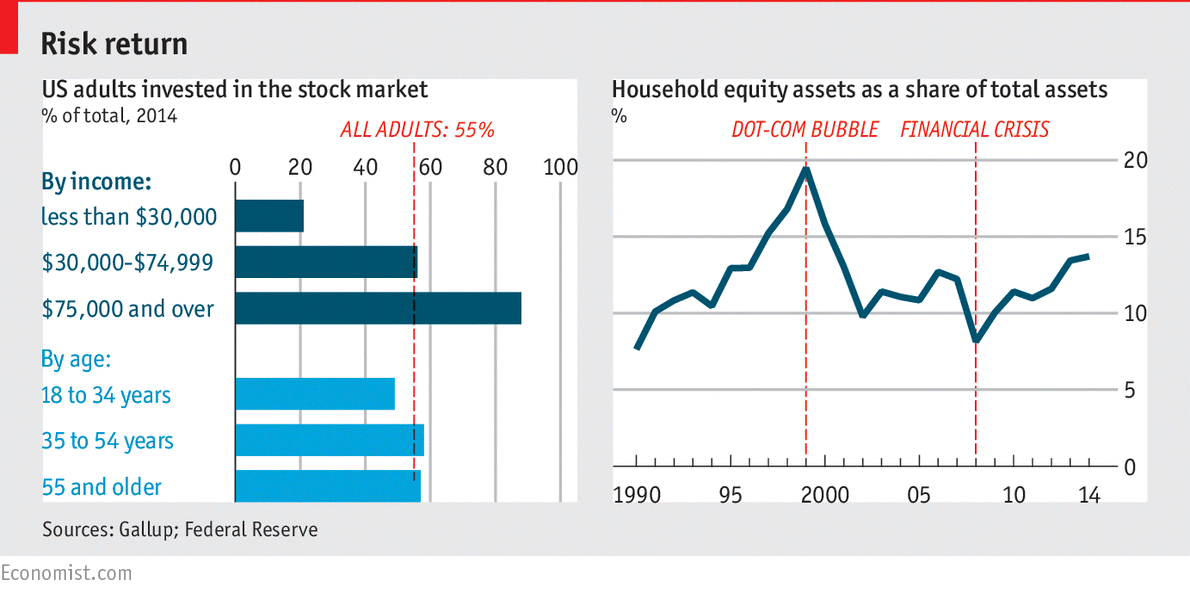

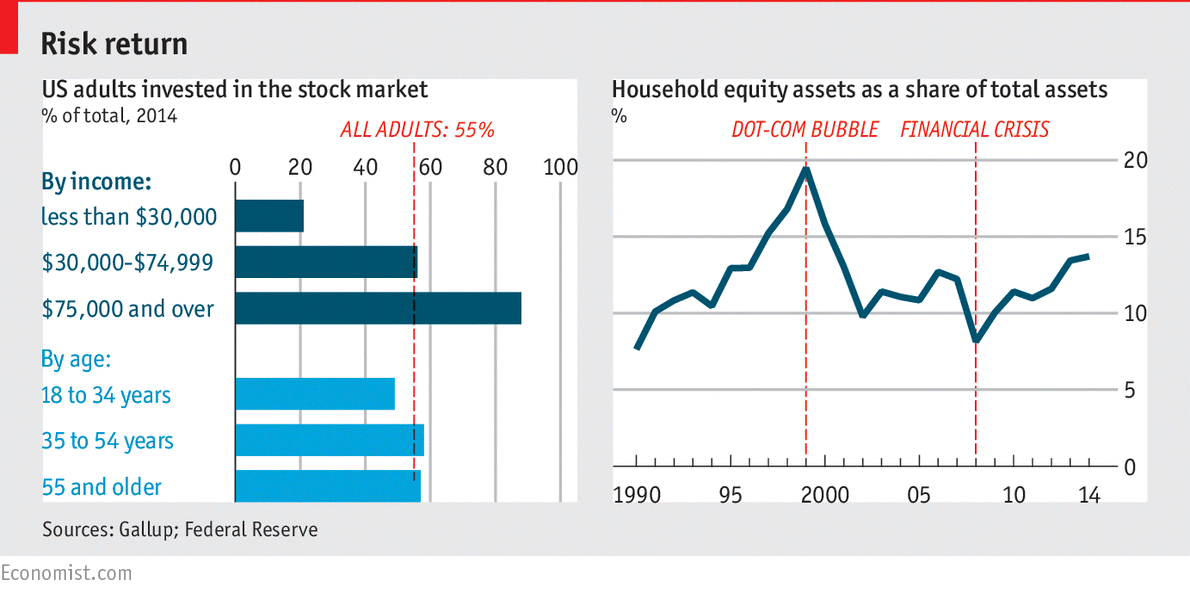

This is fascinating look at how exposed the average American household is to the equity markets. On average, about 55% of adults have...

This is fascinating look at how exposed the average American household is to the equity markets. On average, about 55% of adults have...

Read More

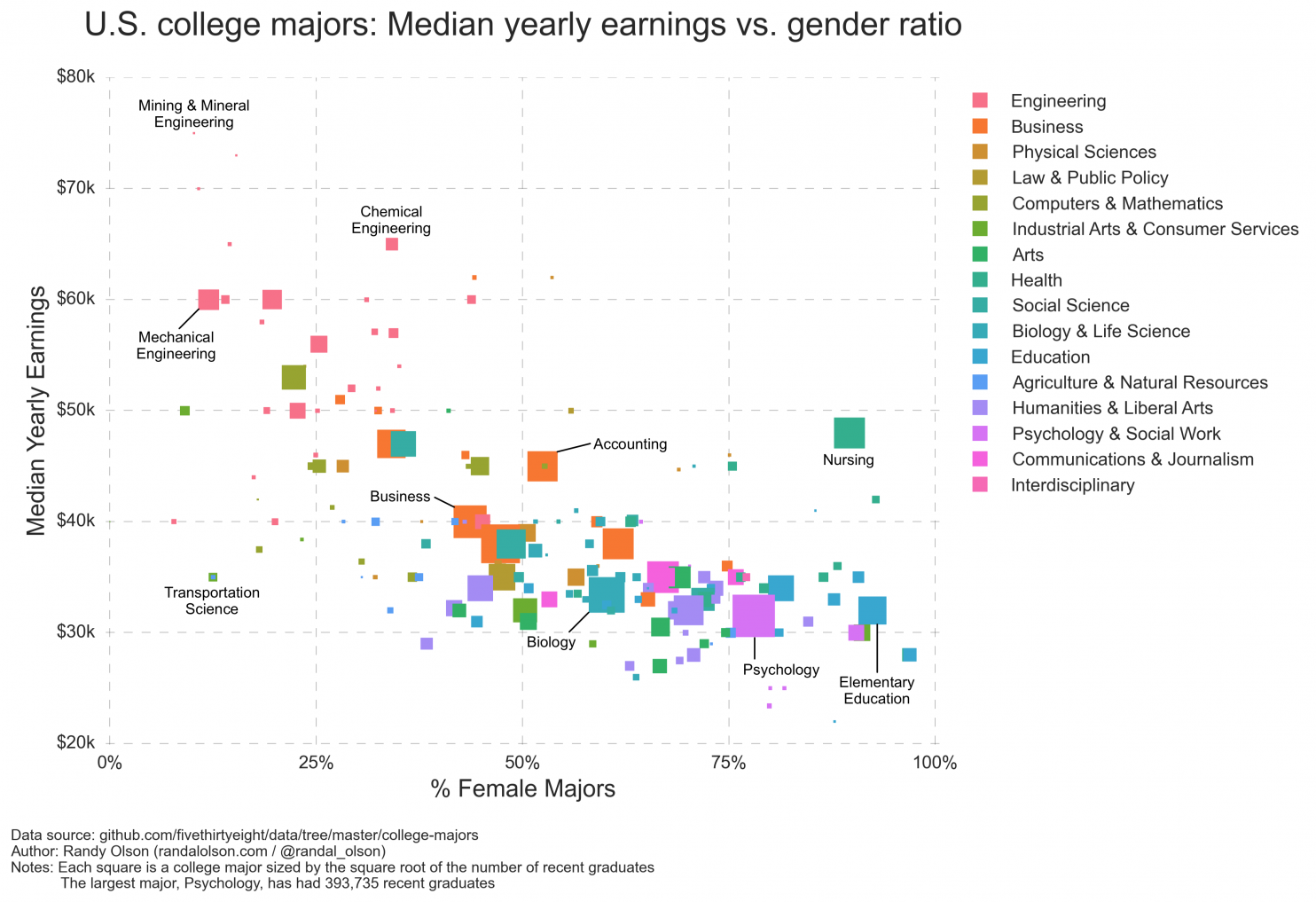

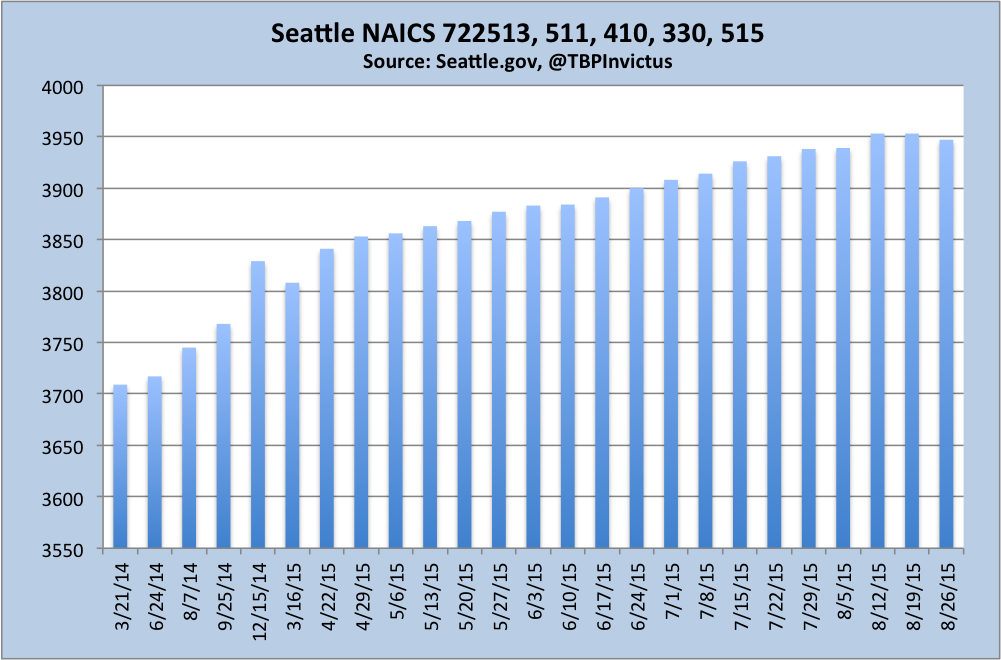

@TBPInvictus here. [File under: Petard, hoist on one’s own] Earlier this month, AEI “scholar” Mark Perry was spotted...

@TBPInvictus here. [File under: Petard, hoist on one’s own] Earlier this month, AEI “scholar” Mark Perry was spotted...

Read More

Today’s column might anger some people on the right AND the left. Try not to react emotionally. Instead consider this as a way to...

Today’s column might anger some people on the right AND the left. Try not to react emotionally. Instead consider this as a way to...

Today’s column might anger some people on the right AND the left. Try not to react emotionally. Instead consider this as a way to...

Today’s column might anger some people on the right AND the left. Try not to react emotionally. Instead consider this as a way to...