How to Game Google

Since today is the 11th anniversary of first-day trading in Google shares after its initial public offering, I wanted to bring to your...

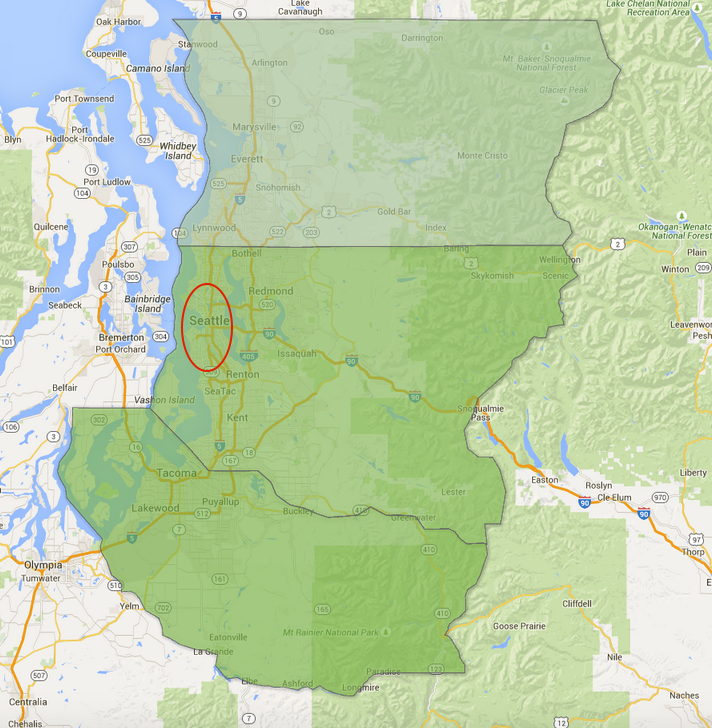

@TBPInvictus here: As I recently highlighted, Mark Perry – an AEI scholar and professor of economics – is playing very fast...

@TBPInvictus here: As I recently highlighted, Mark Perry – an AEI scholar and professor of economics – is playing very fast...

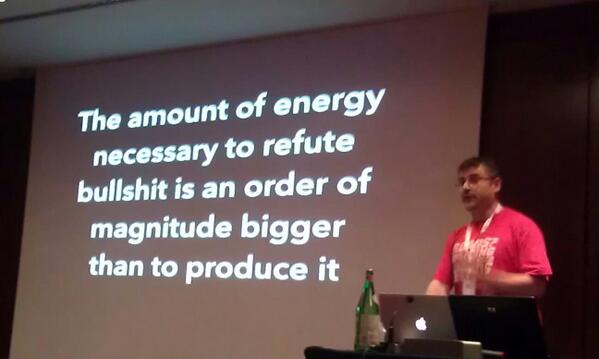

@TBPInvictus I am reminded of the above law each and every day. And a law it is. Inviolable. No sooner had I posted the other day...

@TBPInvictus I am reminded of the above law each and every day. And a law it is. Inviolable. No sooner had I posted the other day...

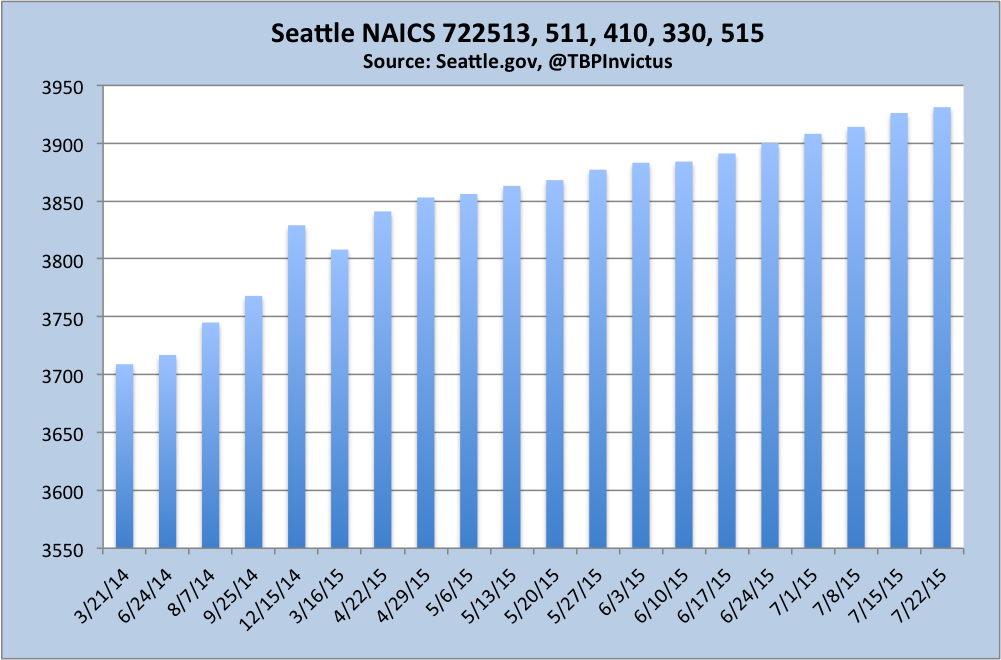

@TBPInvictus “He who knows nothing is closer to the truth than he whose mind is full of falsehoods and errors.” –...

@TBPInvictus “He who knows nothing is closer to the truth than he whose mind is full of falsehoods and errors.” –...

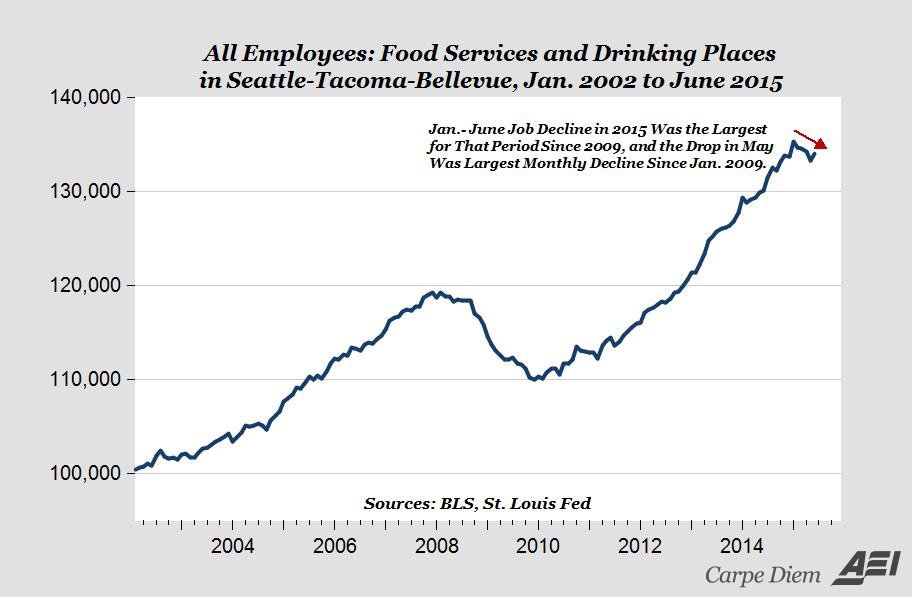

@TBPInvictus If you’re just joining us, here’s our story thus far: Some on the right took a fairly benign article out of a...

@TBPInvictus If you’re just joining us, here’s our story thus far: Some on the right took a fairly benign article out of a...

We seem to really enjoy contemplating the money and lifestyles of the top 0.01 percent. The wealthiest Americans garner immense...

We seem to really enjoy contemplating the money and lifestyles of the top 0.01 percent. The wealthiest Americans garner immense...

Get subscriber-only insights and news delivered by Barry every two weeks.