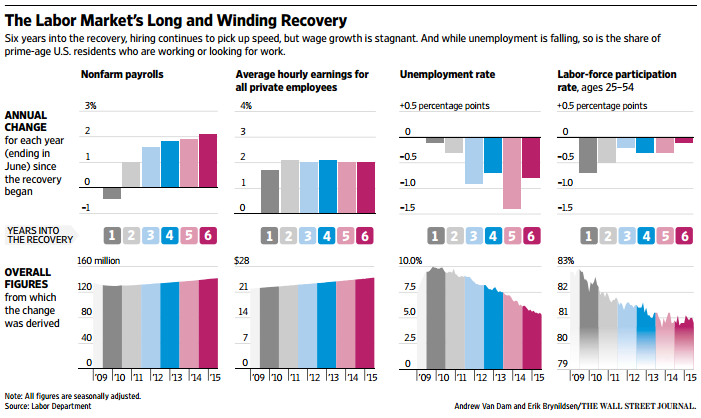

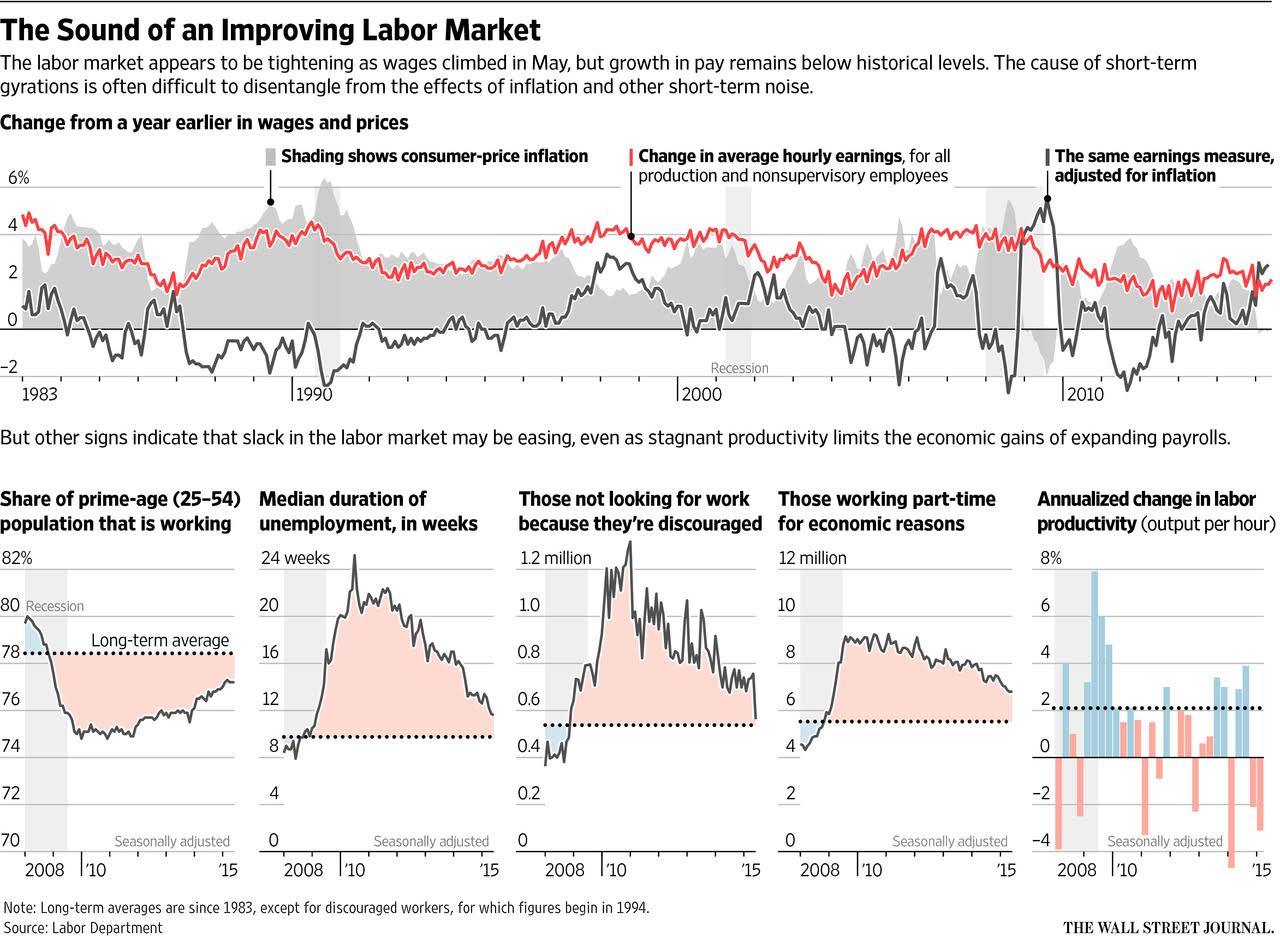

Despite continued progress in the labor market, wages have been rising slowly. In 2014, total nonfarm payroll employment rose by 3.1...

Despite continued progress in the labor market, wages have been rising slowly. In 2014, total nonfarm payroll employment rose by 3.1...

Read More

If you missed the big Barron’s article (How Much Do Silicon Valley Firms Really Earn?) story this past weekend on Silicon...

If you missed the big Barron’s article (How Much Do Silicon Valley Firms Really Earn?) story this past weekend on Silicon...

Read More

@TBPInvictus here It’s been a few months since the first increase in the Seattle minimum wage (see here for the schedule of bump...

Read More

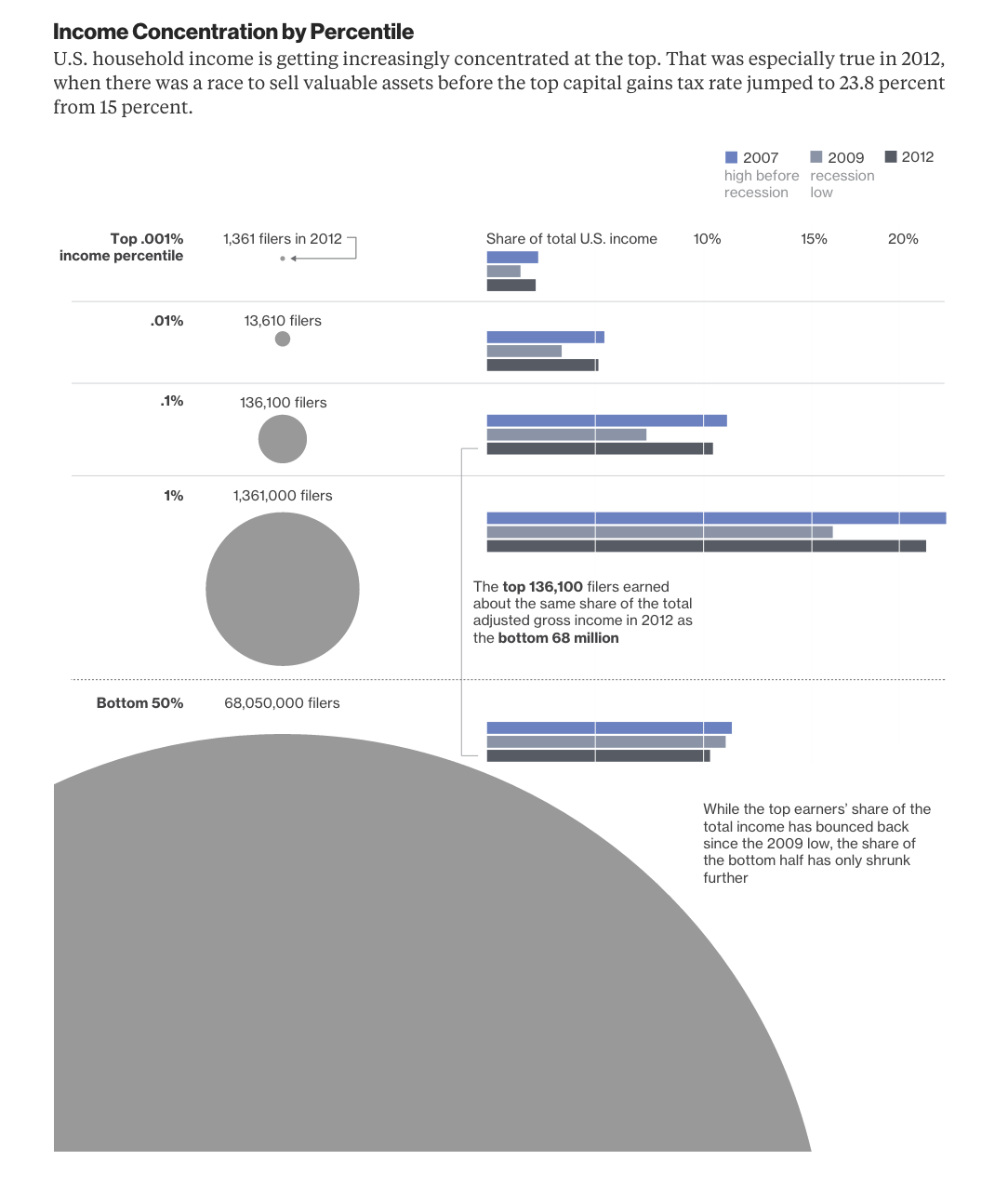

Fascinating data set assembled by the crack team at Bloomberg: Source: Bloomberg

Fascinating data set assembled by the crack team at Bloomberg: Source: Bloomberg

Read More

Wal-Mart Learns to Live Without Everyday Poverty Wages Employee turnover is down, but will profits rise? Bloomberg, June 11, 2015 ...

Read More

This has to be the strangest headline relative to the content I have seen in a very long time: Source: Wealth Management

This has to be the strangest headline relative to the content I have seen in a very long time: Source: Wealth Management

Read More

Despite continued progress in the labor market, wages have been rising slowly. In 2014, total nonfarm payroll employment rose by 3.1...

Despite continued progress in the labor market, wages have been rising slowly. In 2014, total nonfarm payroll employment rose by 3.1...

Despite continued progress in the labor market, wages have been rising slowly. In 2014, total nonfarm payroll employment rose by 3.1...

Despite continued progress in the labor market, wages have been rising slowly. In 2014, total nonfarm payroll employment rose by 3.1...