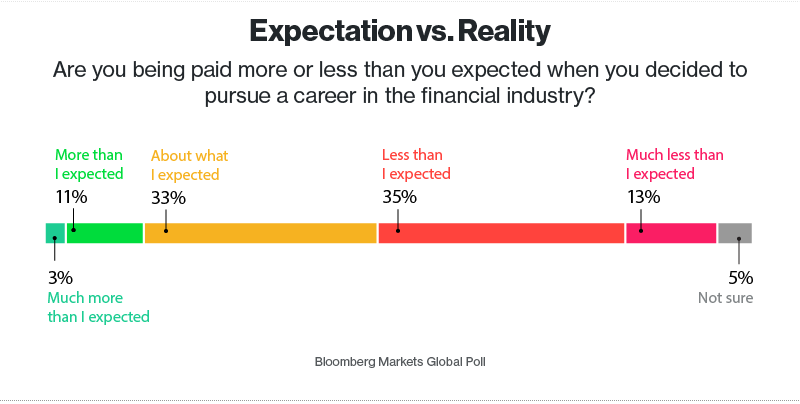

This is some amazing stuff: Source: Bloomberg

This is some amazing stuff: Source: Bloomberg

1.4% Price Rise Gets Wal-Mart Off Welfare

Te question I keep asking (here, here and here) is why are taxpayers subsidizing a giant, private, profitable company? The video goes...

Behind the Slow Pace of Wage Growth

Behind the Slow Pace of Wage Growth Filippo Occhino Federal Reserve Bank of Cleveland, 04.09.2015 Despite continued progress in the labor...

Behind the Slow Pace of Wage Growth Filippo Occhino Federal Reserve Bank of Cleveland, 04.09.2015 Despite continued progress in the labor...

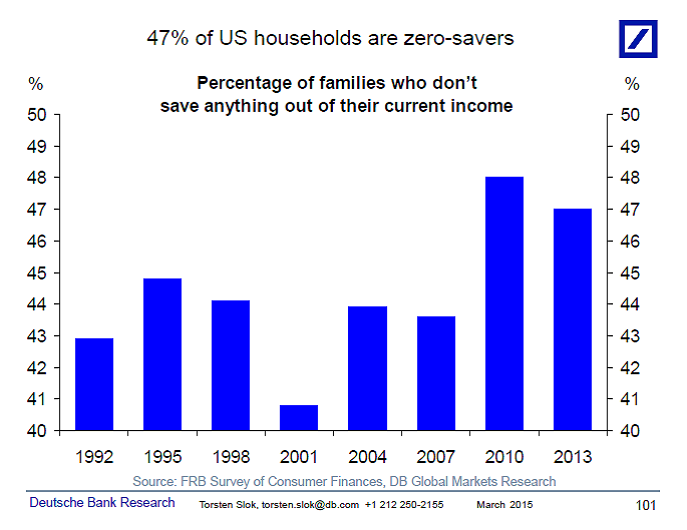

High Number of Zero-Savers

47% of households have a 0% personal savings rate, see chart below. Source: Torsten Sløk, Ph.D., Deutsche Bank Securities

47% of households have a 0% personal savings rate, see chart below. Source: Torsten Sløk, Ph.D., Deutsche Bank Securities

Millenials, Social Media + Competition for Employees Are Behind...

There has been surprising news across minimum-wage land: Paychecks are beginning to rise. Earlier this year, Wal-Mart raised its minimum...

Are Wages Flat or Falling? Decomposing Recent Changes in the...

Are Wages Flat or Falling? Decomposing Recent Changes in the Average Wage Provides an Answer Joel Elvery and Christopher Vecchio...

Are Wages Flat or Falling? Decomposing Recent Changes in the Average Wage Provides an Answer Joel Elvery and Christopher Vecchio...

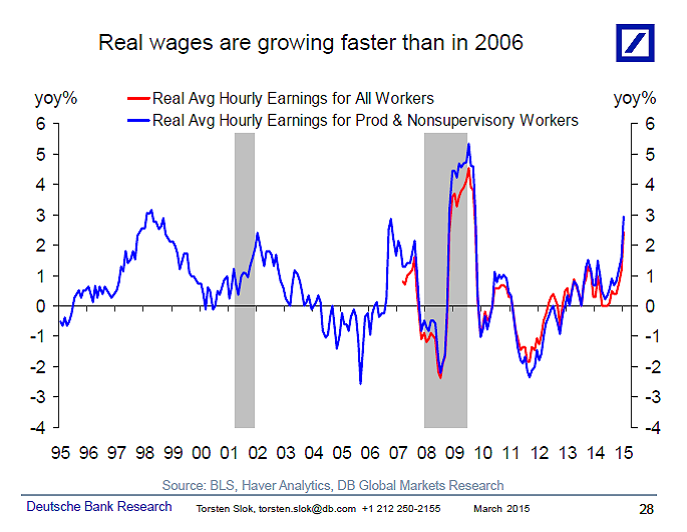

More Signs of Wage Inflation

From Torsten Sløk of Deutsche Bank: The first chart below shows that over the past year employer costs have risen significantly. The...

From Torsten Sløk of Deutsche Bank: The first chart below shows that over the past year employer costs have risen significantly. The...

“I come not to bury bonuses, but to praise them”

I come not to bury bonuses, but to praise them. Yesterday the New York State Office of the Comptroller released itsannual report. The...