Source: Know More

Source: Know More

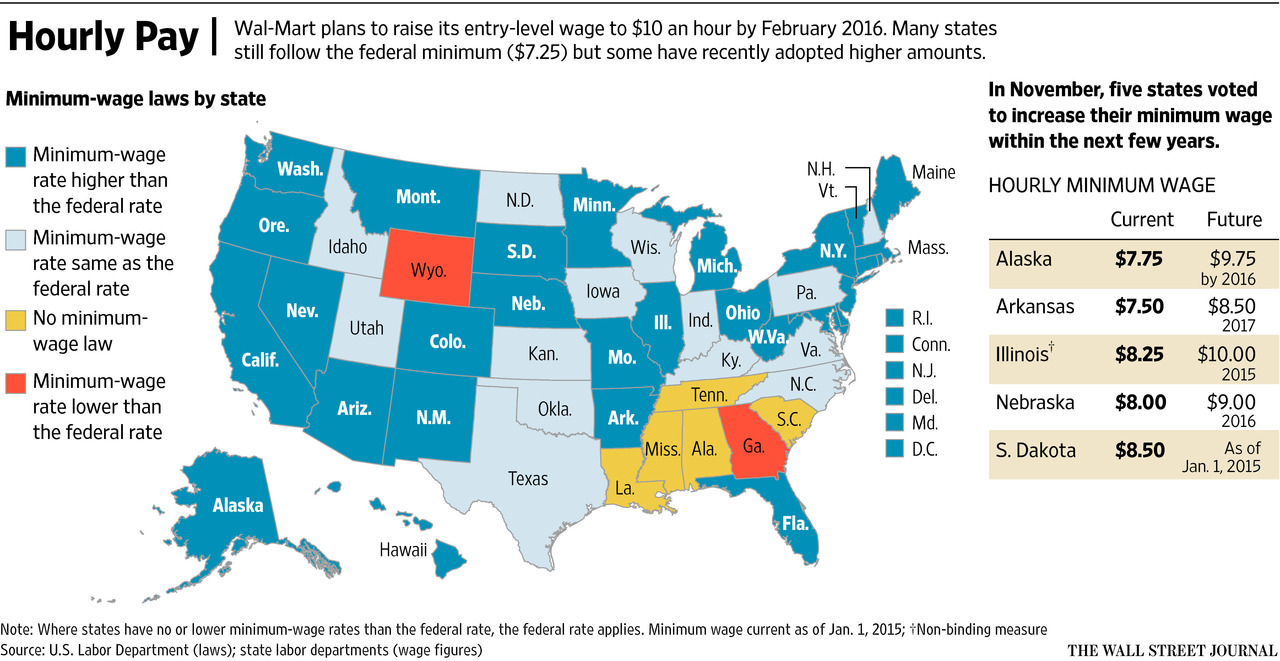

Wal-Mart’s Plan to Boost Pay, State by State

Regarding yesterday’s discussion on Wal-Mart’s pay raise, check out this informative map from the WSJ: Source: WSJ

Regarding yesterday’s discussion on Wal-Mart’s pay raise, check out this informative map from the WSJ: Source: WSJ

Wal-Mart’s Crash Course in Labor Economics

Wal-Mart’s Minimum Wage Breakdown Wal-Mart plans to raise the wages of hourly workers because it didn’t have much choice as...

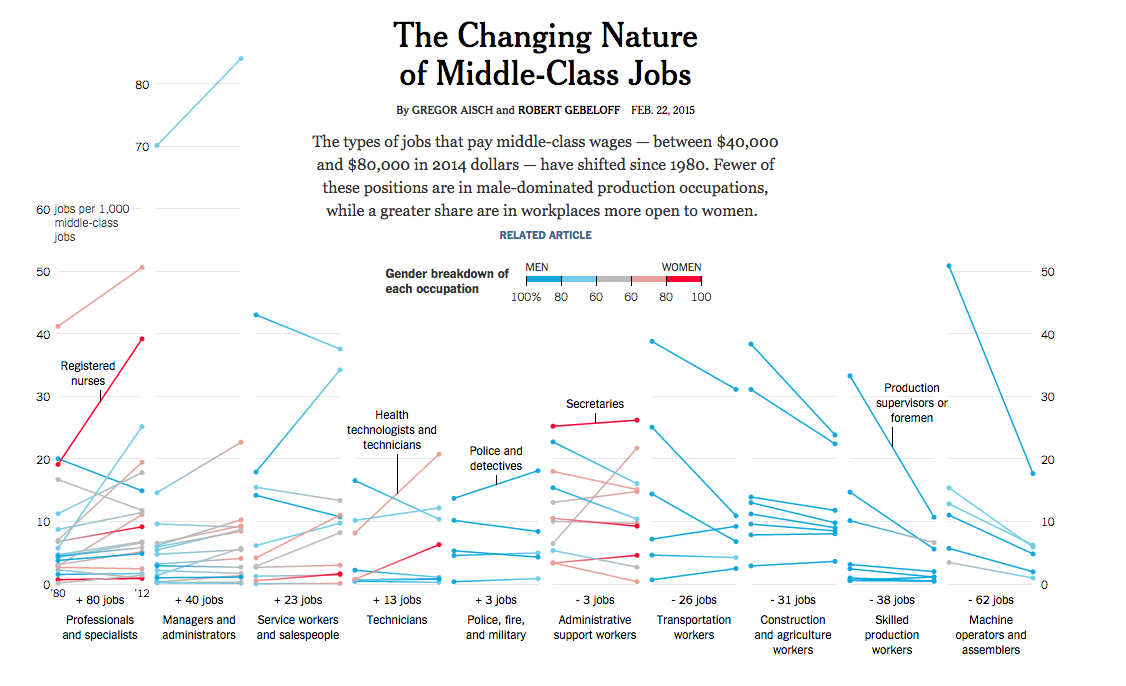

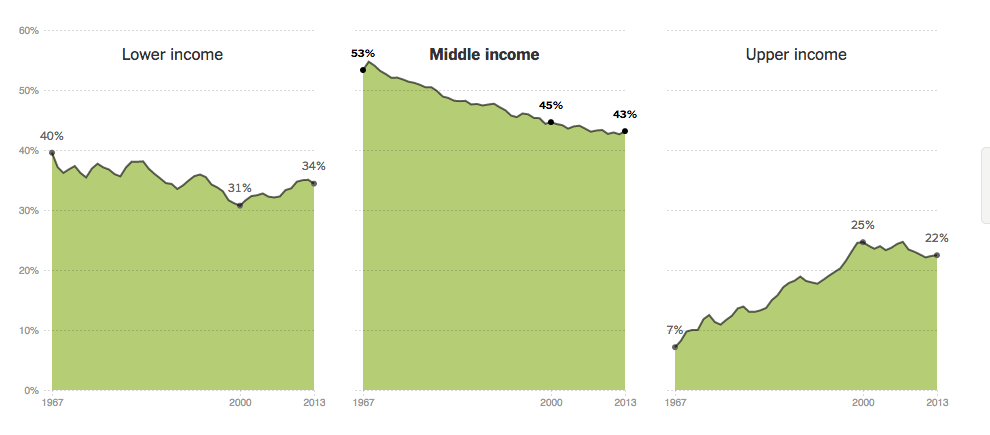

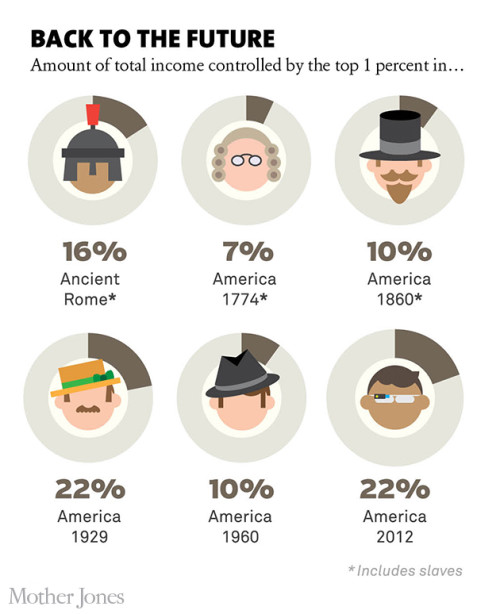

Higher Education, Wages, and Polarization

Higher Education, Wages, and Polarization Rob Valletta FRBSF, January 12, 2015 The earnings gap between people with a...

Higher Education, Wages, and Polarization Rob Valletta FRBSF, January 12, 2015 The earnings gap between people with a...

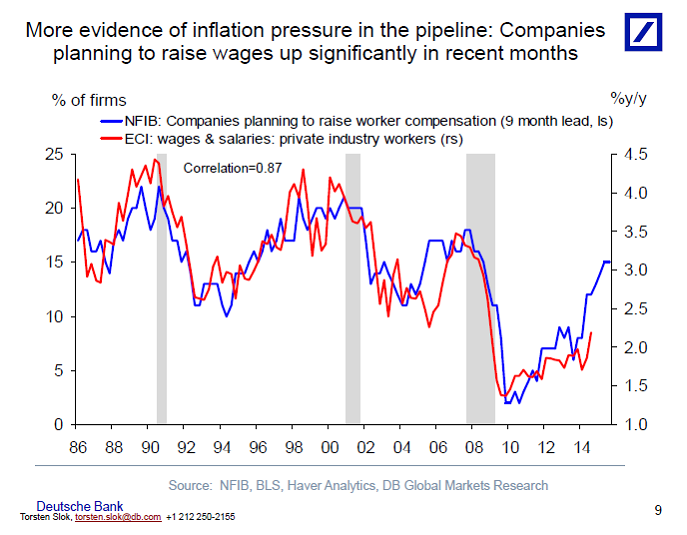

NFIB points to upward pressure on wages

From Torsten Slok, Deutsche Bank: The next ECI will be released on Jan 30 and the NFIB data that just came out points to more upward...

From Torsten Slok, Deutsche Bank: The next ECI will be released on Jan 30 and the NFIB data that just came out points to more upward...