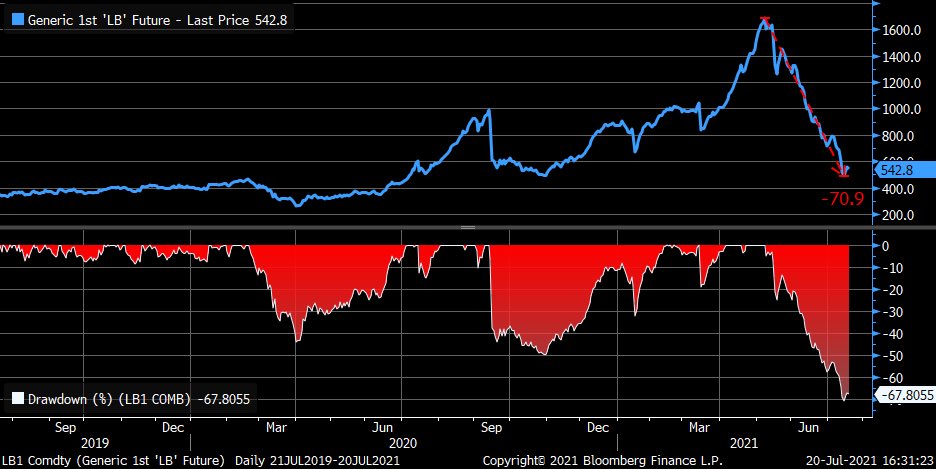

Lumber Back to Pre-Pandemic levels Source: Liz Ann Sonders, Schwab The inflation debate seems to be conflating a variety of...

Lumber Back to Pre-Pandemic levels Source: Liz Ann Sonders, Schwab The inflation debate seems to be conflating a variety of...

Read More

An endless series of articles have been discussing America’s Labor shortages, especially in foodservice and...

An endless series of articles have been discussing America’s Labor shortages, especially in foodservice and...

Read More

Fun conversation with “Marketplace” host Kai Ryssdal on the shifting balance of power between employers and employees. ...

Read More

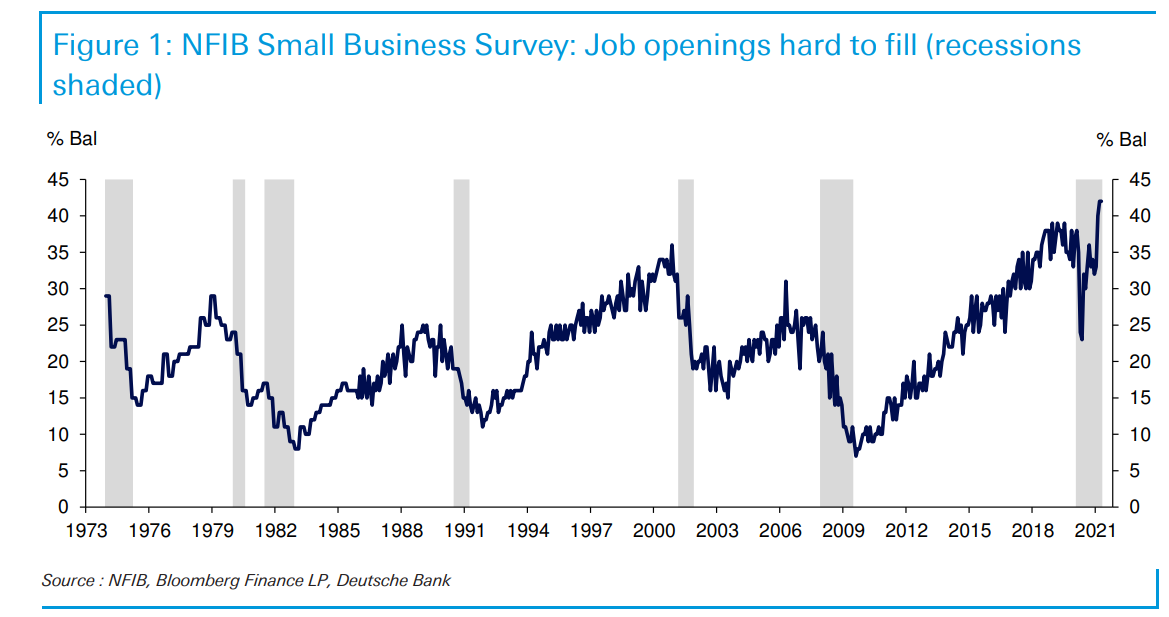

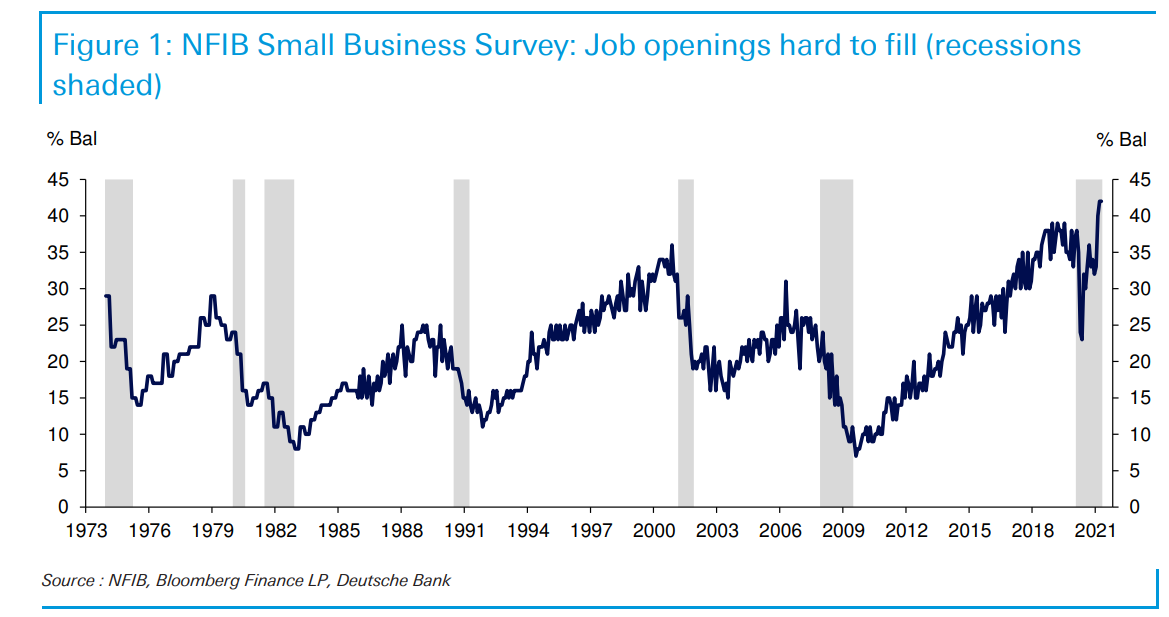

Listen to the audio version of this post here I have troubles with this question: “Why are Job Openings so...

Listen to the audio version of this post here I have troubles with this question: “Why are Job Openings so...

Read More

In the midst of a deep dive into employment data, I happened across some off-the-beaten-path analysis of the Teen Labor...

In the midst of a deep dive into employment data, I happened across some off-the-beaten-path analysis of the Teen Labor...

Read More

Every now and again, several different ideas and stories collide in a grand moment of serendipitous good fortune, resulting...

Every now and again, several different ideas and stories collide in a grand moment of serendipitous good fortune, resulting...

Read More

A massive shift is occurring in the labor market today, one that has been misinterpreted by economists of all stripes: On...

A massive shift is occurring in the labor market today, one that has been misinterpreted by economists of all stripes: On...

Read More

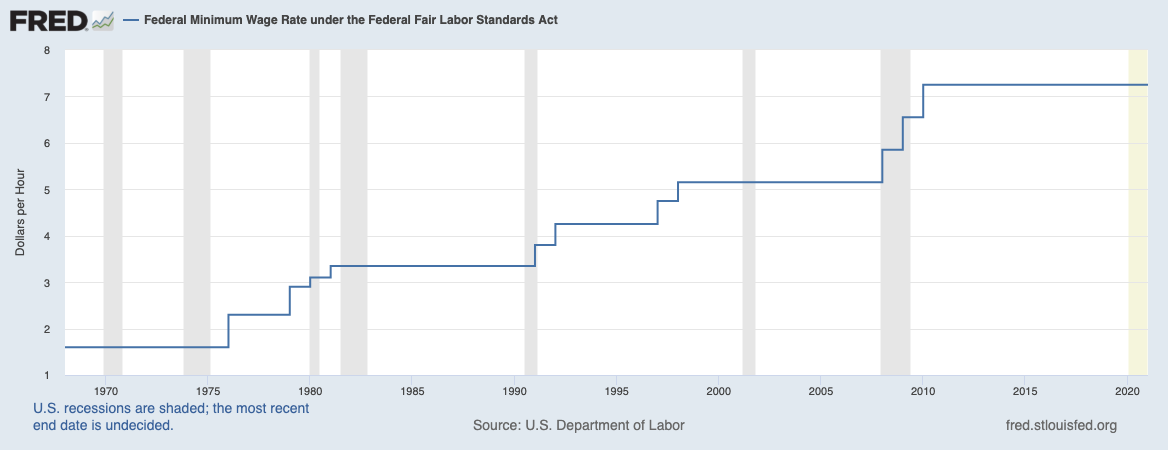

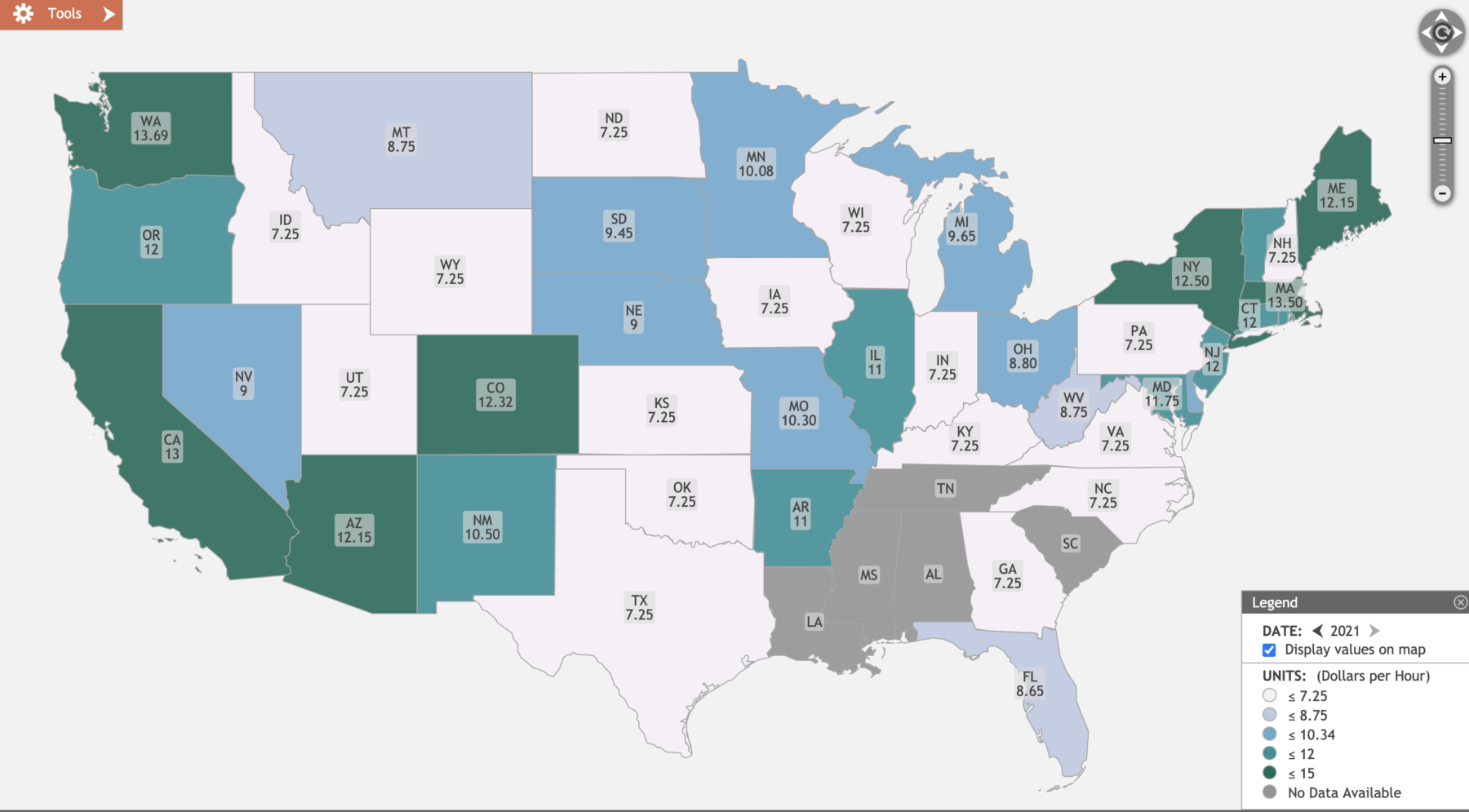

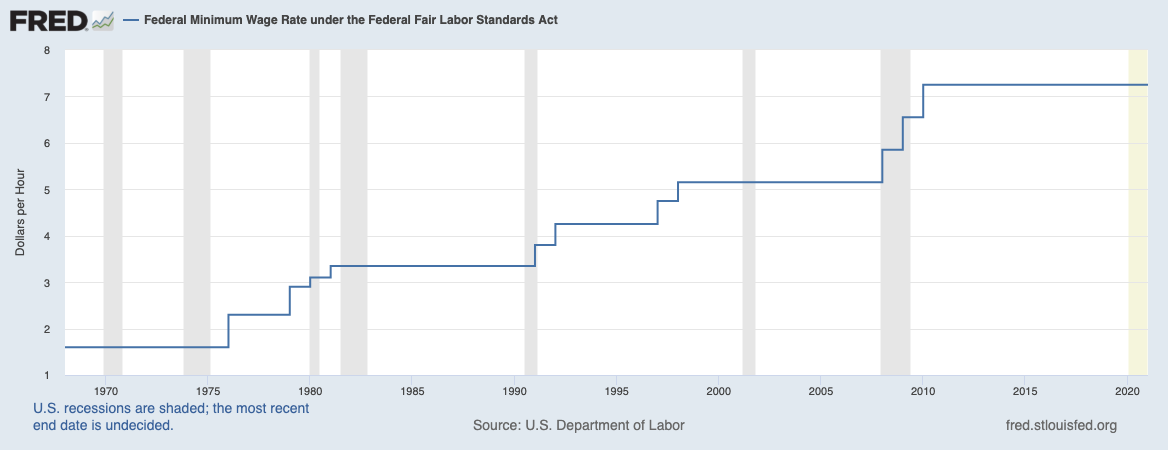

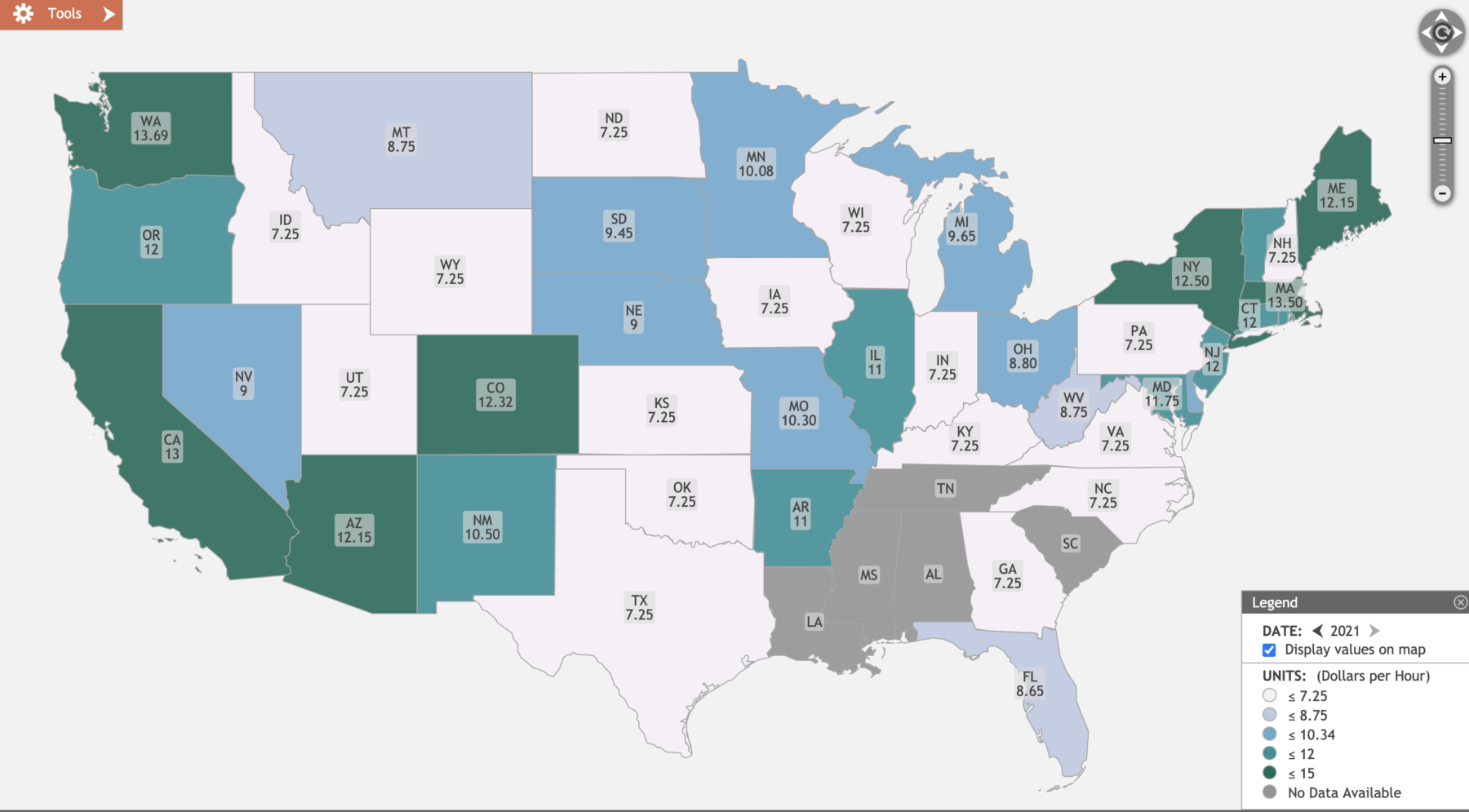

Source: GeoFRED Today’s (yawn!) NFP numbers are a good a time to take a quick look at the ongoing minimum wage...

Source: GeoFRED Today’s (yawn!) NFP numbers are a good a time to take a quick look at the ongoing minimum wage...

Read More

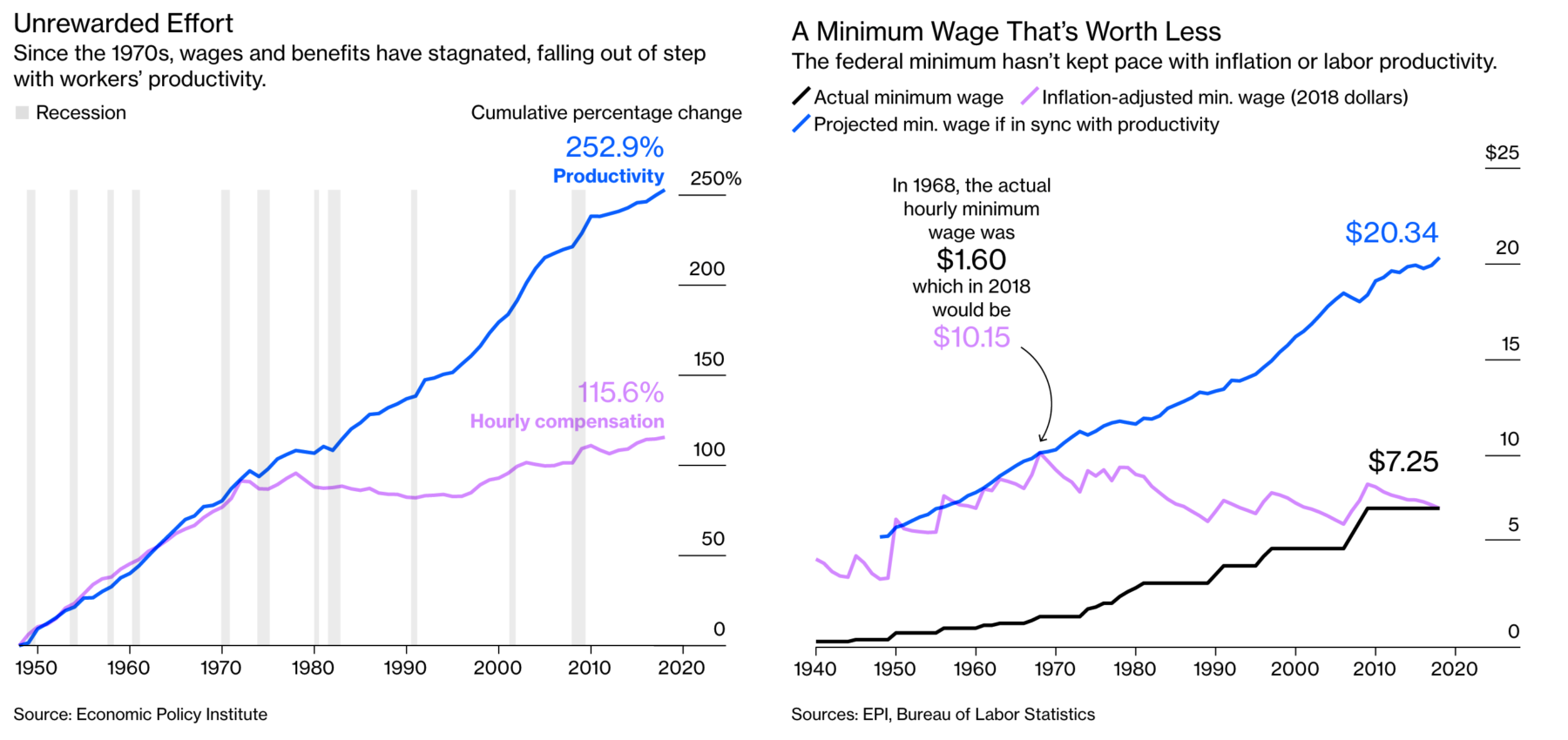

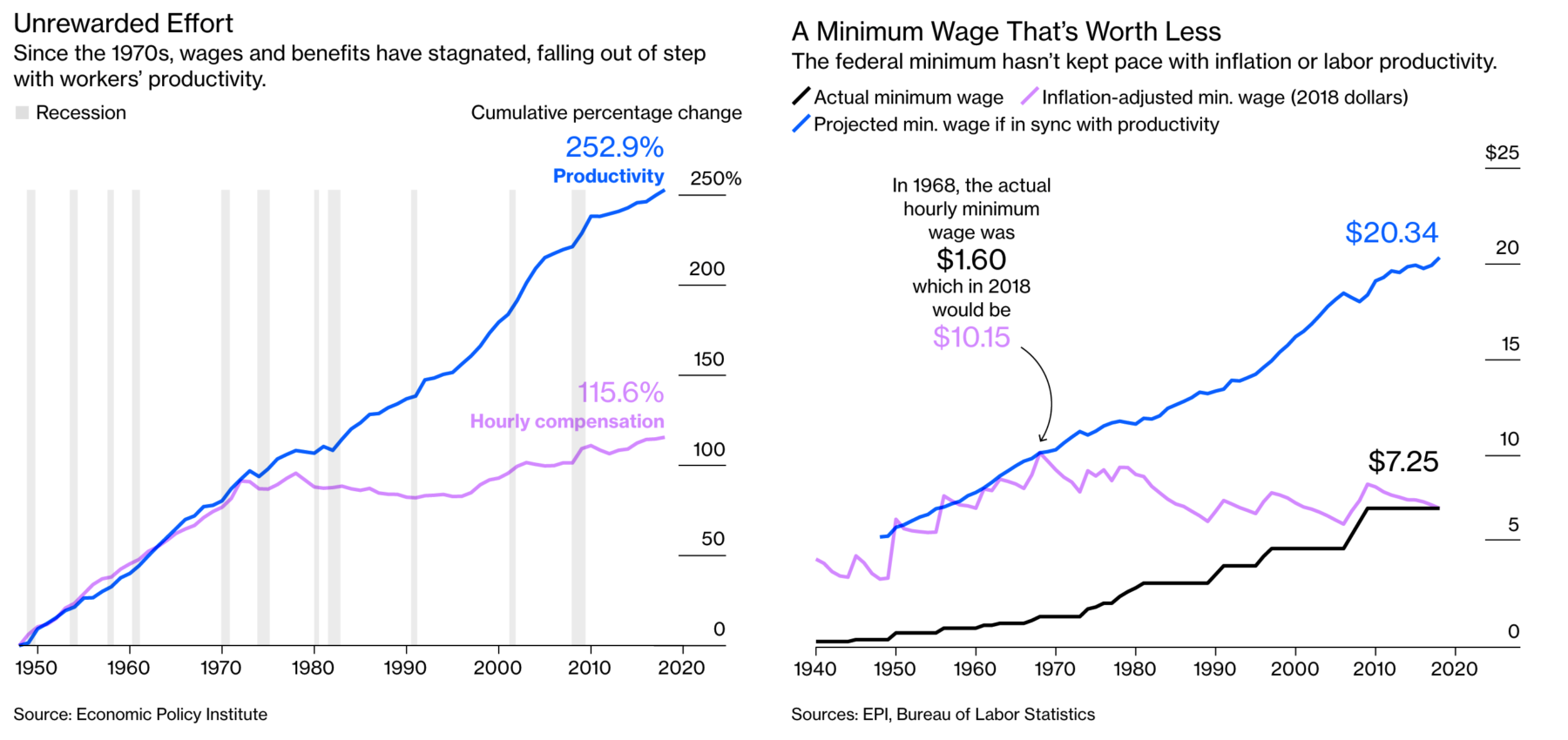

Source: Businessweek The debate about the $15 national minimum-wage has been generating more heat than light. It is an area...

Source: Businessweek The debate about the $15 national minimum-wage has been generating more heat than light. It is an area...

Read More

Bloomberg has historically been an institutional data and content provider. The terminals pricing starts at $2000 per...

Bloomberg has historically been an institutional data and content provider. The terminals pricing starts at $2000 per...

Read More

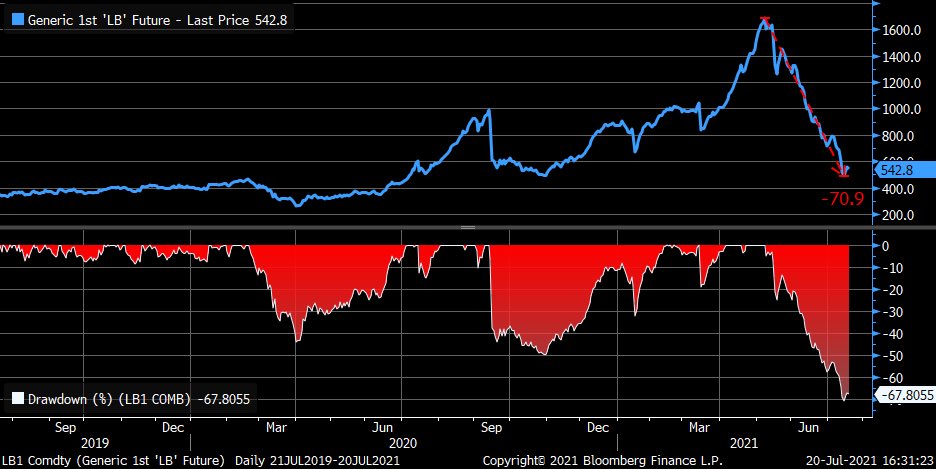

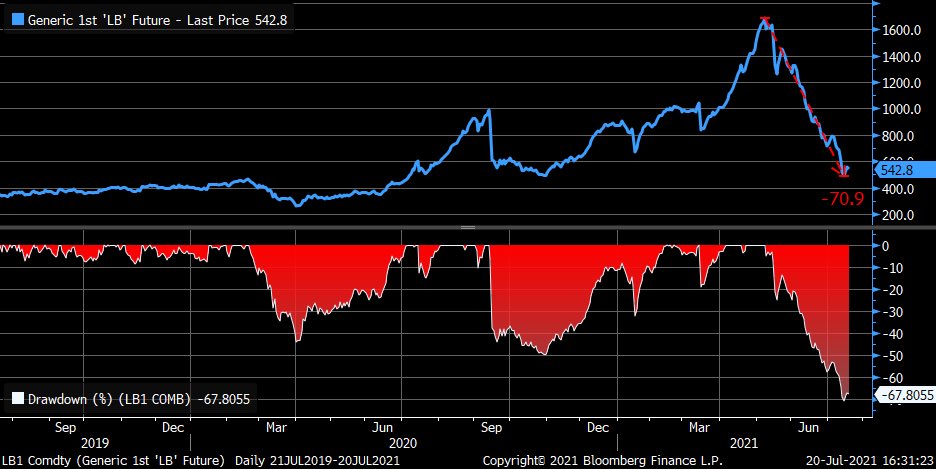

Lumber Back to Pre-Pandemic levels Source: Liz Ann Sonders, Schwab The inflation debate seems to be conflating a variety of...

Lumber Back to Pre-Pandemic levels Source: Liz Ann Sonders, Schwab The inflation debate seems to be conflating a variety of...

Lumber Back to Pre-Pandemic levels Source: Liz Ann Sonders, Schwab The inflation debate seems to be conflating a variety of...

Lumber Back to Pre-Pandemic levels Source: Liz Ann Sonders, Schwab The inflation debate seems to be conflating a variety of...