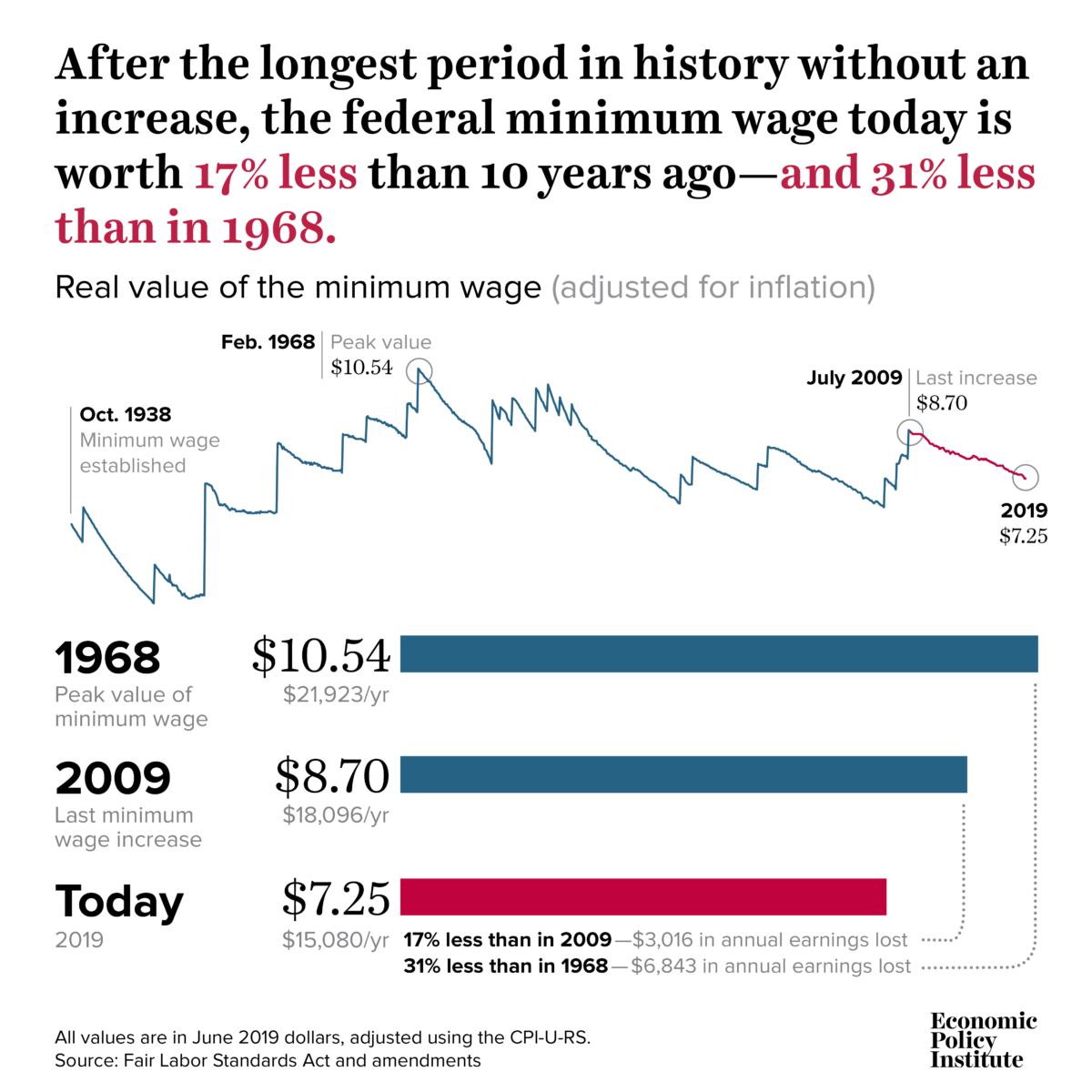

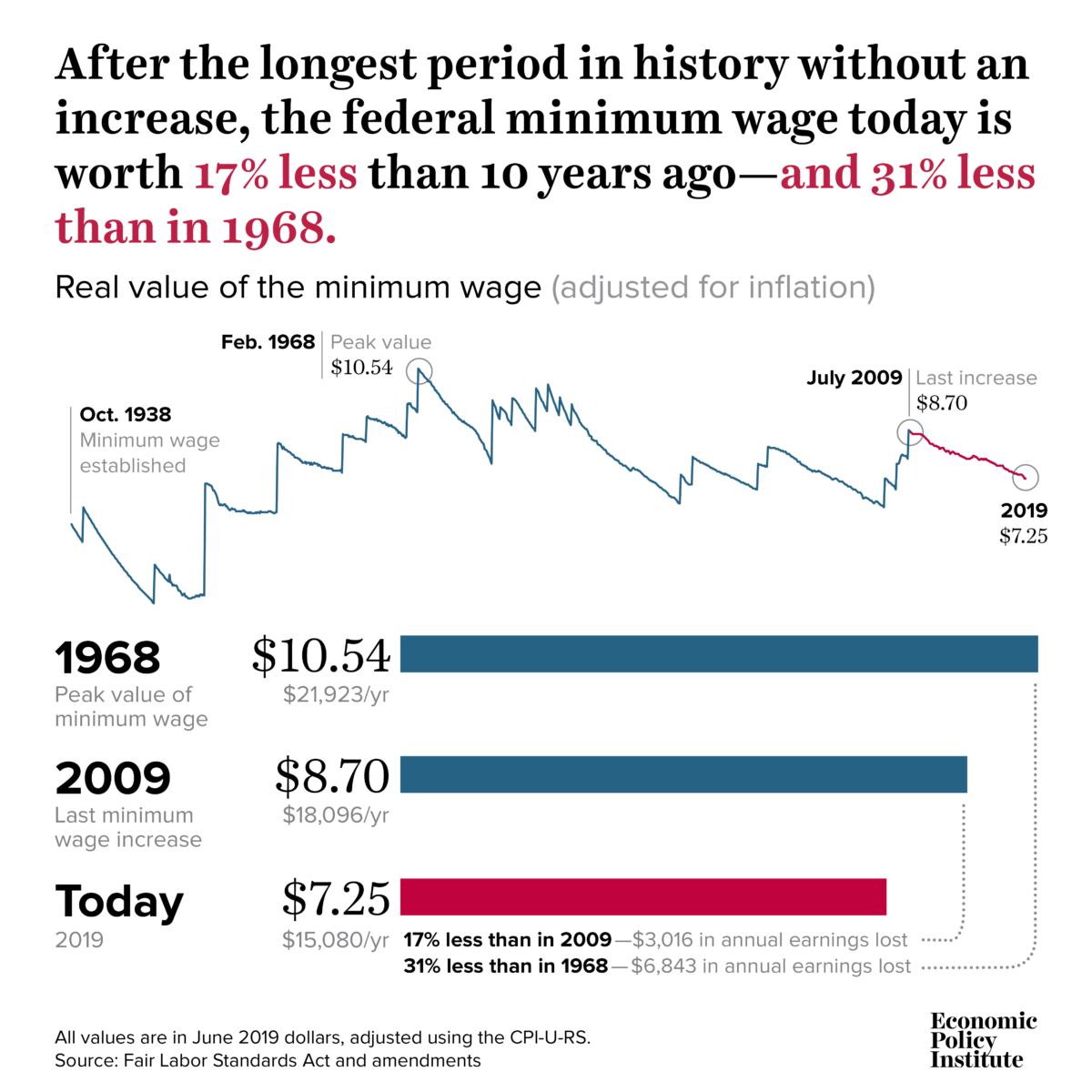

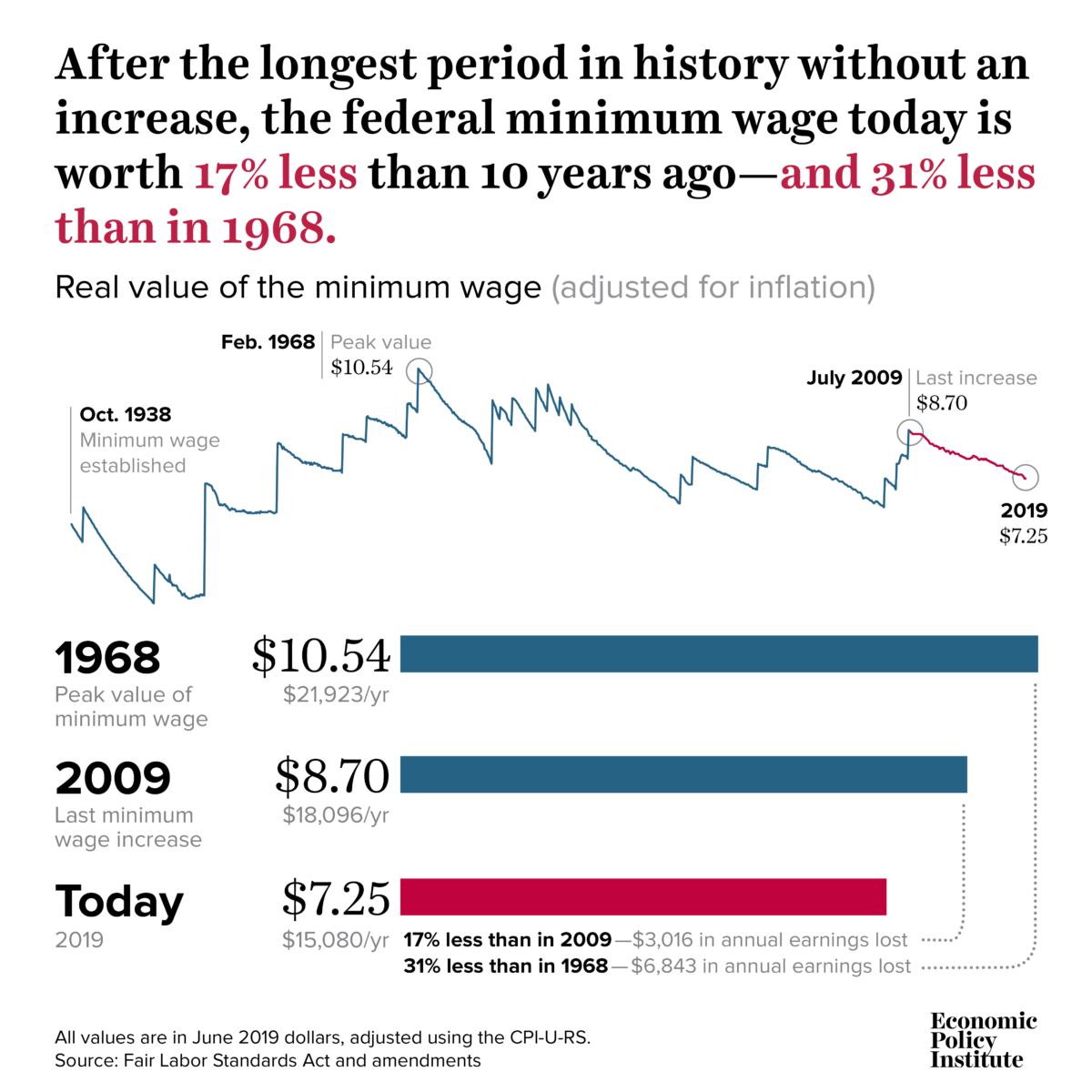

Congress has never let the federal minimum wage erode for this long Source: Economic Policy Institute We are now deep into record...

Congress has never let the federal minimum wage erode for this long Source: Economic Policy Institute We are now deep into record...

Read More

Money Doesn’t Deserve the Bad Rap It’s Getting More of it won’t necessarily make you happier day-to-day, but it does raise life...

Read More

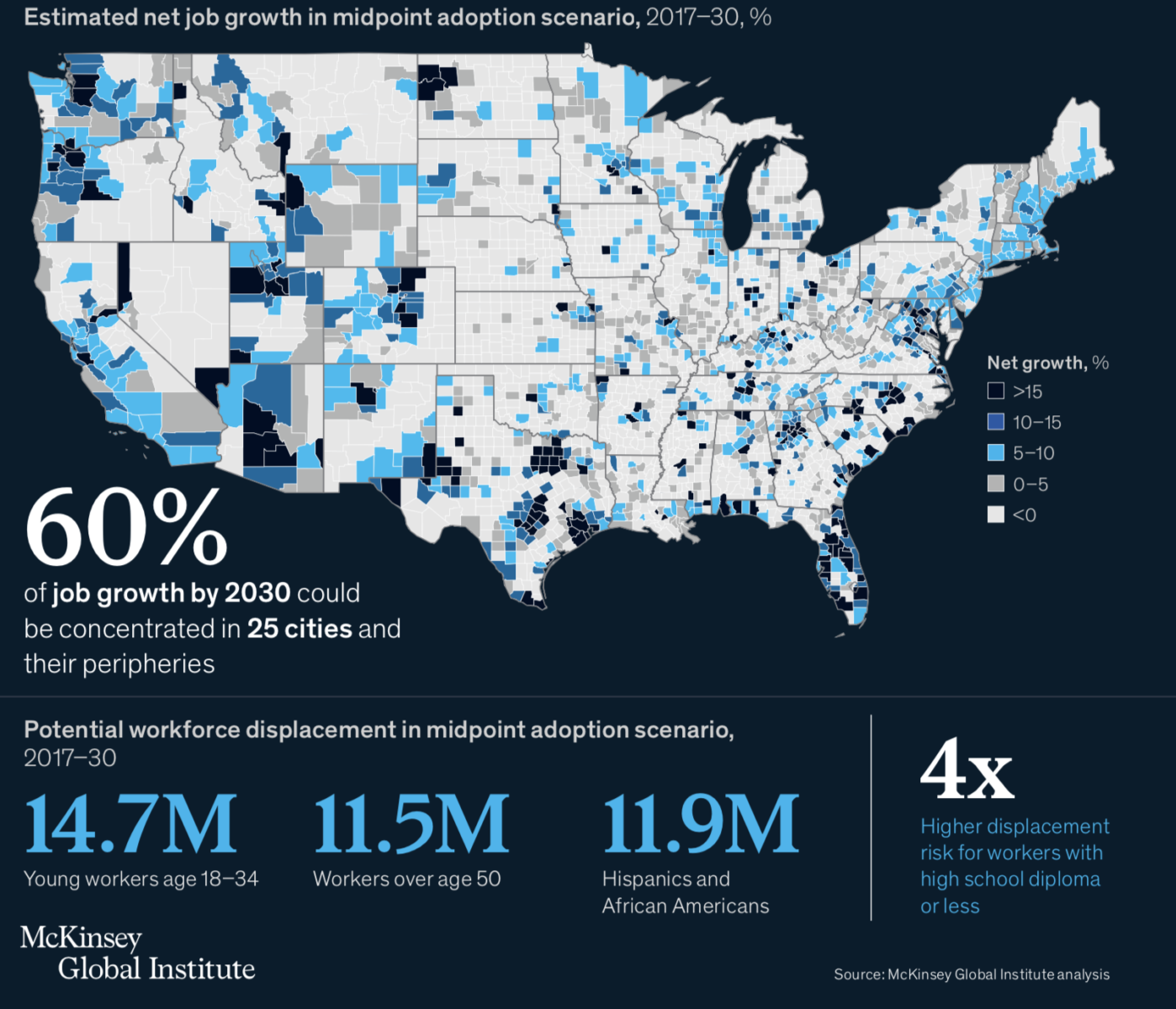

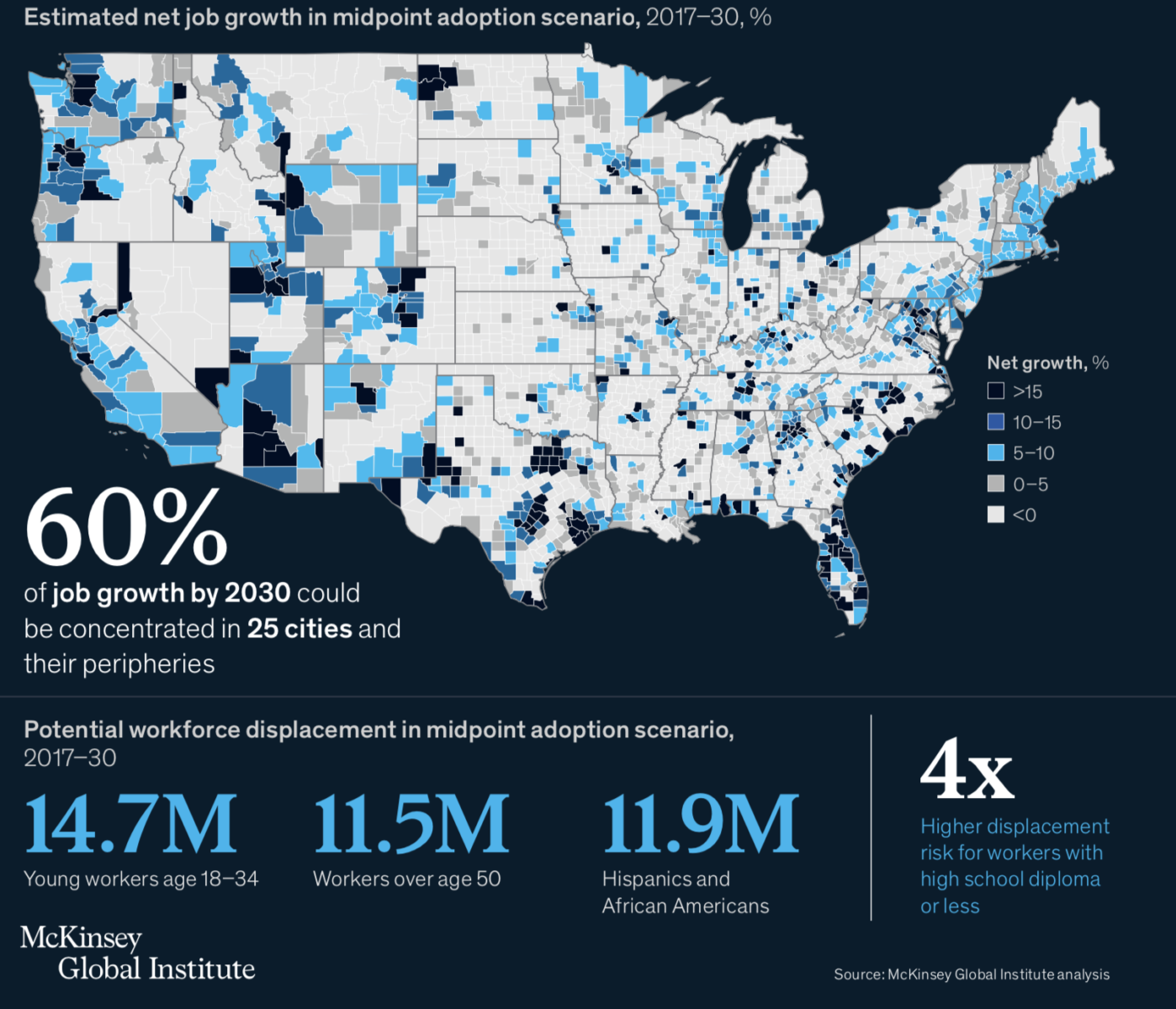

Source: McKinsey Where is the future economic growth coming from in the United States? Just 25 urban areas have accounted...

Source: McKinsey Where is the future economic growth coming from in the United States? Just 25 urban areas have accounted...

Read More

Money Doesn’t Deserve the Bad Rap It’s Getting More of it won’t necessarily make you happier day-to-day, but it does raise life...

Read More

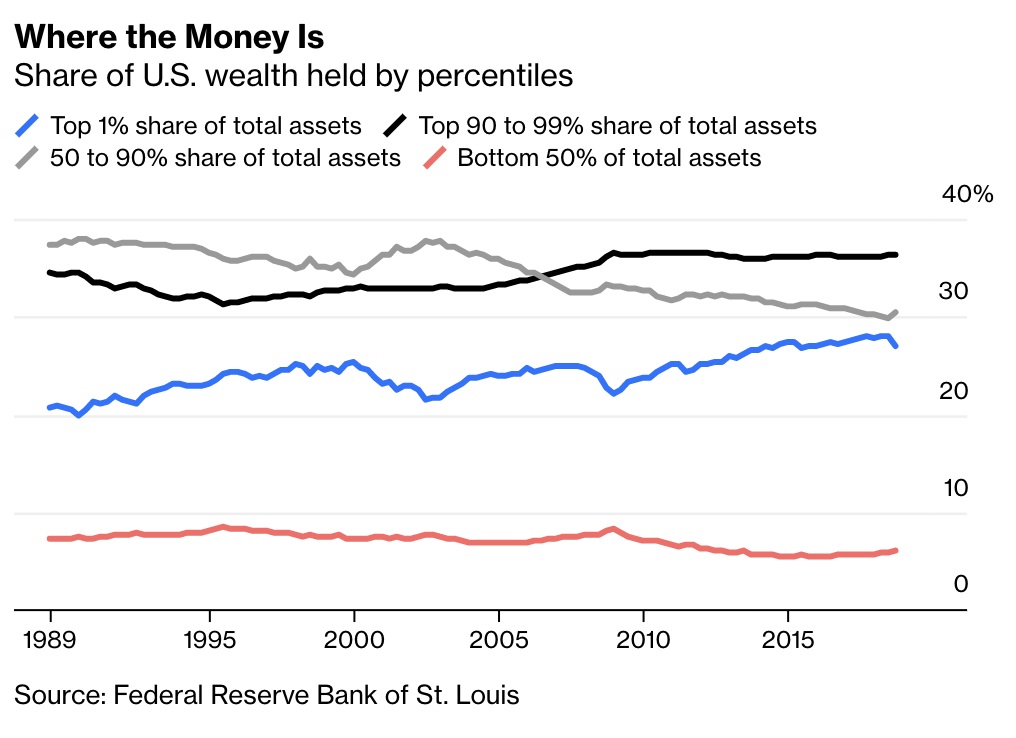

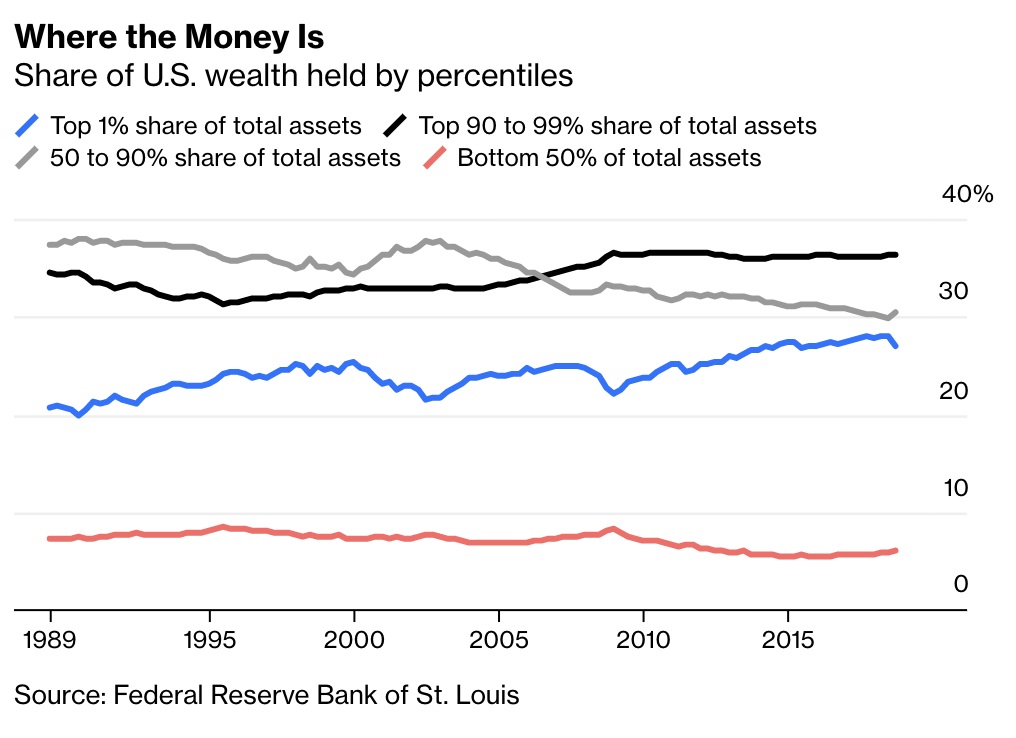

New Inequality Data Is a Gift to Campaign Sloganeers The Fed developed a data set that throws wealth disparities into high relief....

New Inequality Data Is a Gift to Campaign Sloganeers The Fed developed a data set that throws wealth disparities into high relief....

Read More

New Inequality Data Is a Gift to Campaign Sloganeers The Fed developed a data set that throws wealth disparities into high relief....

Read More

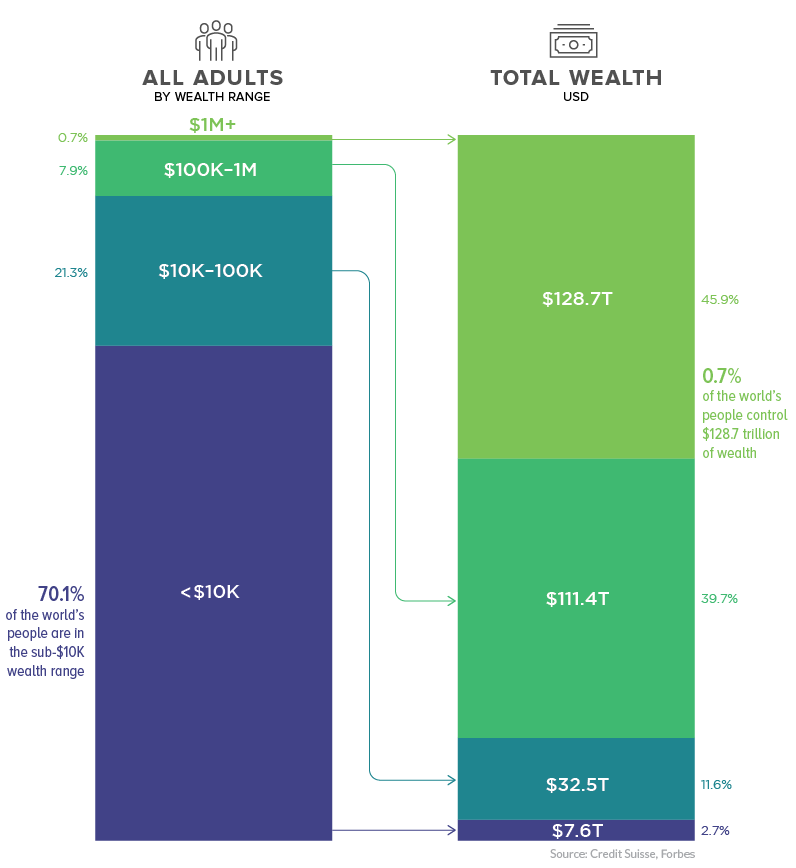

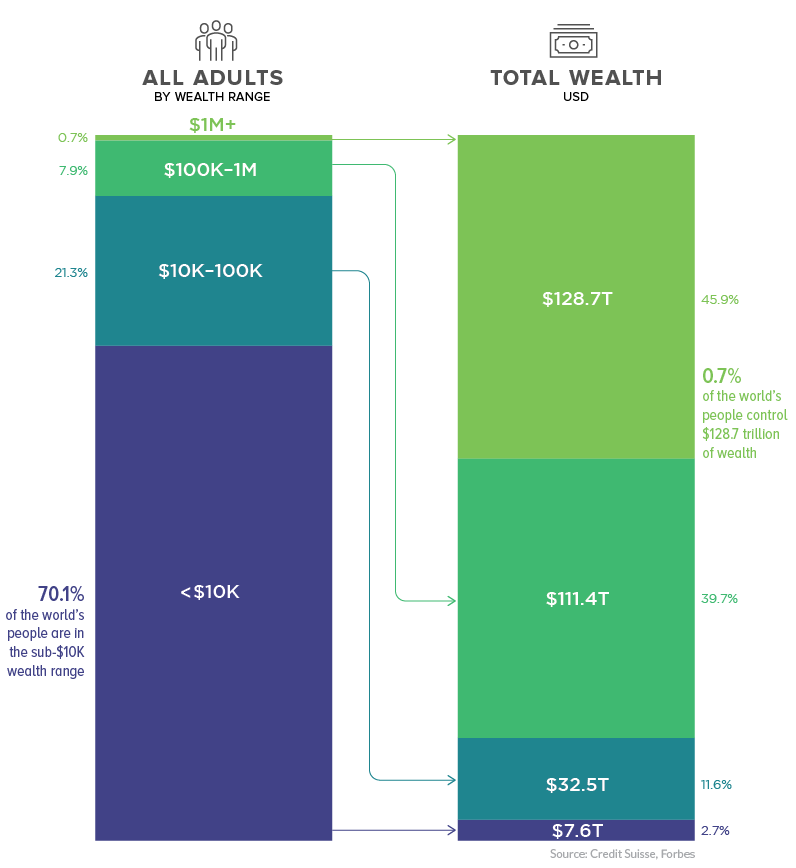

Source: Visual Capitalist The data on wealth inequality continues to surprise: Less than 1% of the world’s adult population...

Source: Visual Capitalist The data on wealth inequality continues to surprise: Less than 1% of the world’s adult population...

Read More

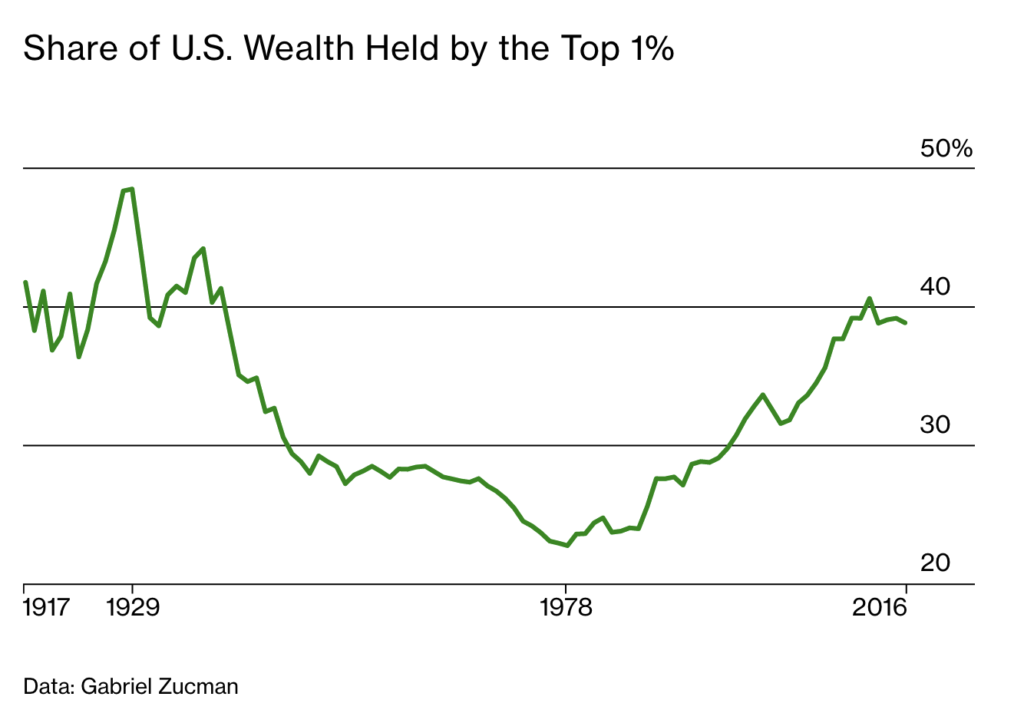

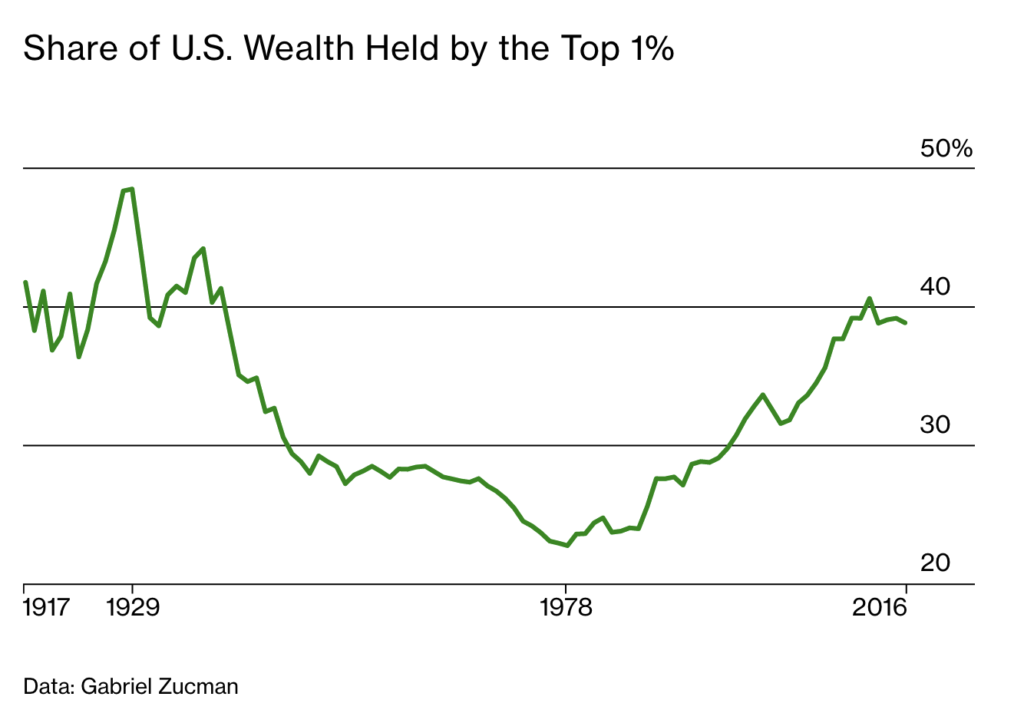

This data series is simply astonishing: The top 0.1% of taxpayers (170,000 families) control 20% of American wealth, the highest share...

This data series is simply astonishing: The top 0.1% of taxpayers (170,000 families) control 20% of American wealth, the highest share...

Read More

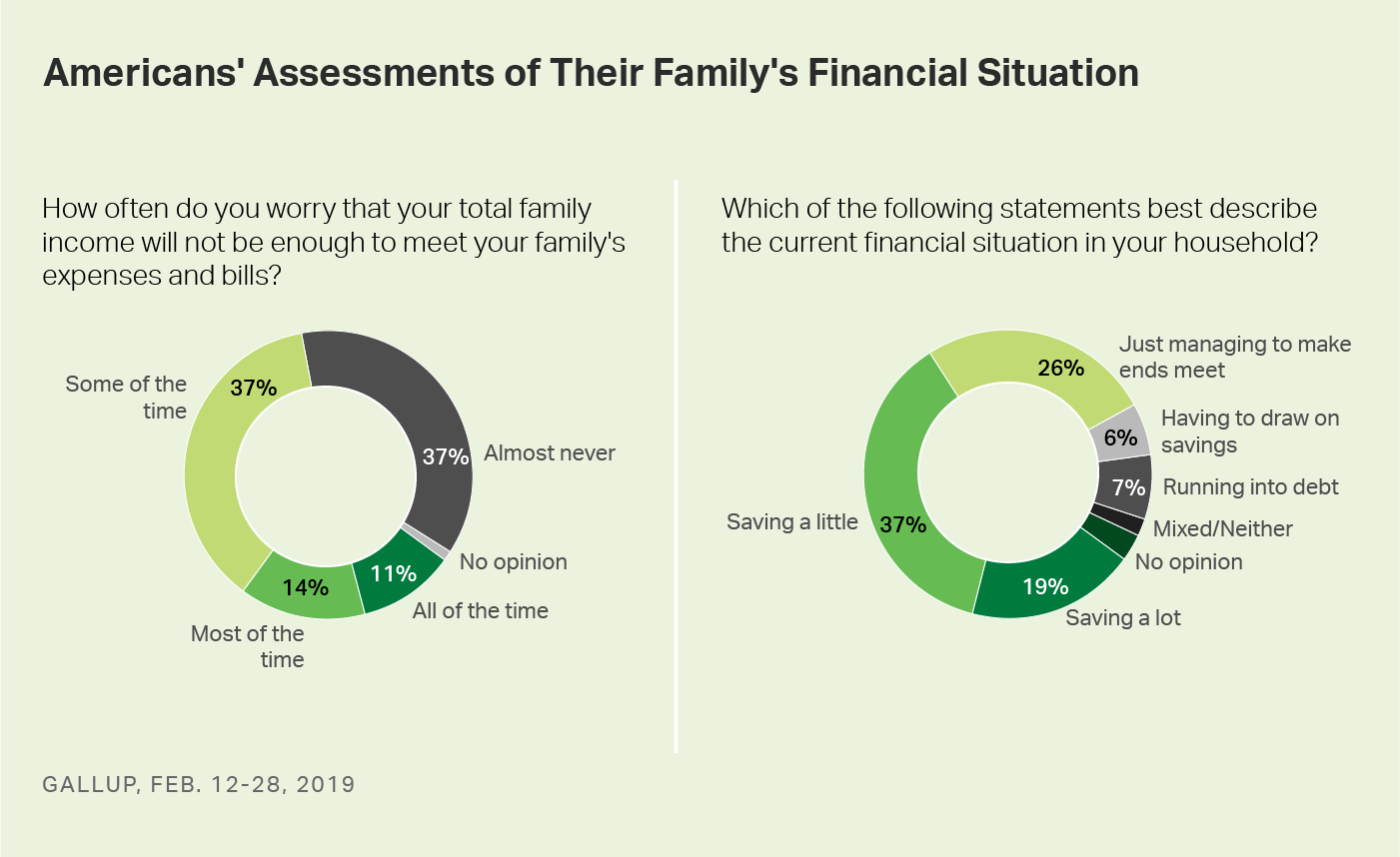

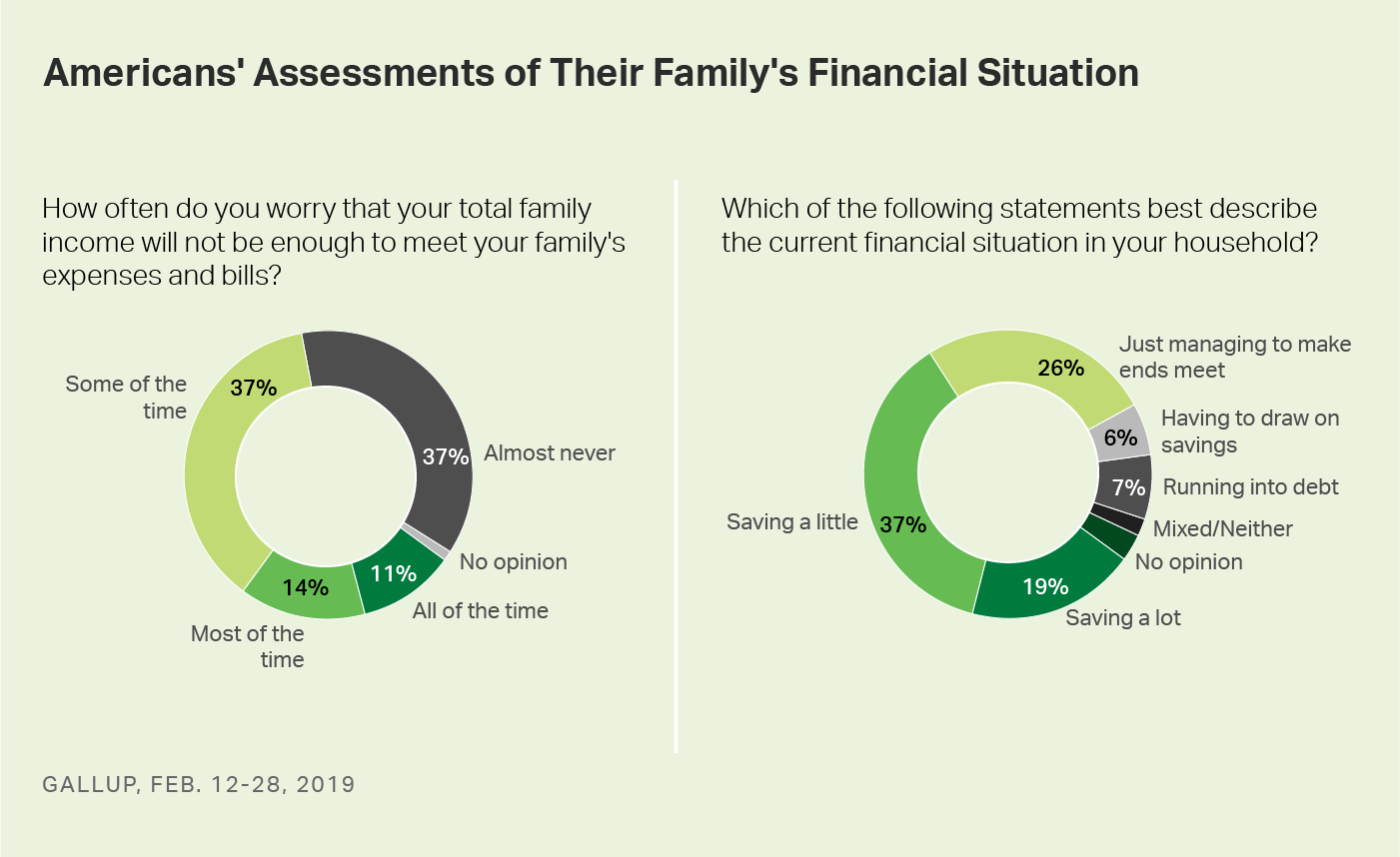

There was a fascinating Gallup survey last month about Americans’ optimism about their personal finances. Go read the whole thing;...

There was a fascinating Gallup survey last month about Americans’ optimism about their personal finances. Go read the whole thing;...

Read More

Congress has never let the federal minimum wage erode for this long Source: Economic Policy Institute We are now deep into record...

Congress has never let the federal minimum wage erode for this long Source: Economic Policy Institute We are now deep into record...

Congress has never let the federal minimum wage erode for this long Source: Economic Policy Institute We are now deep into record...

Congress has never let the federal minimum wage erode for this long Source: Economic Policy Institute We are now deep into record...