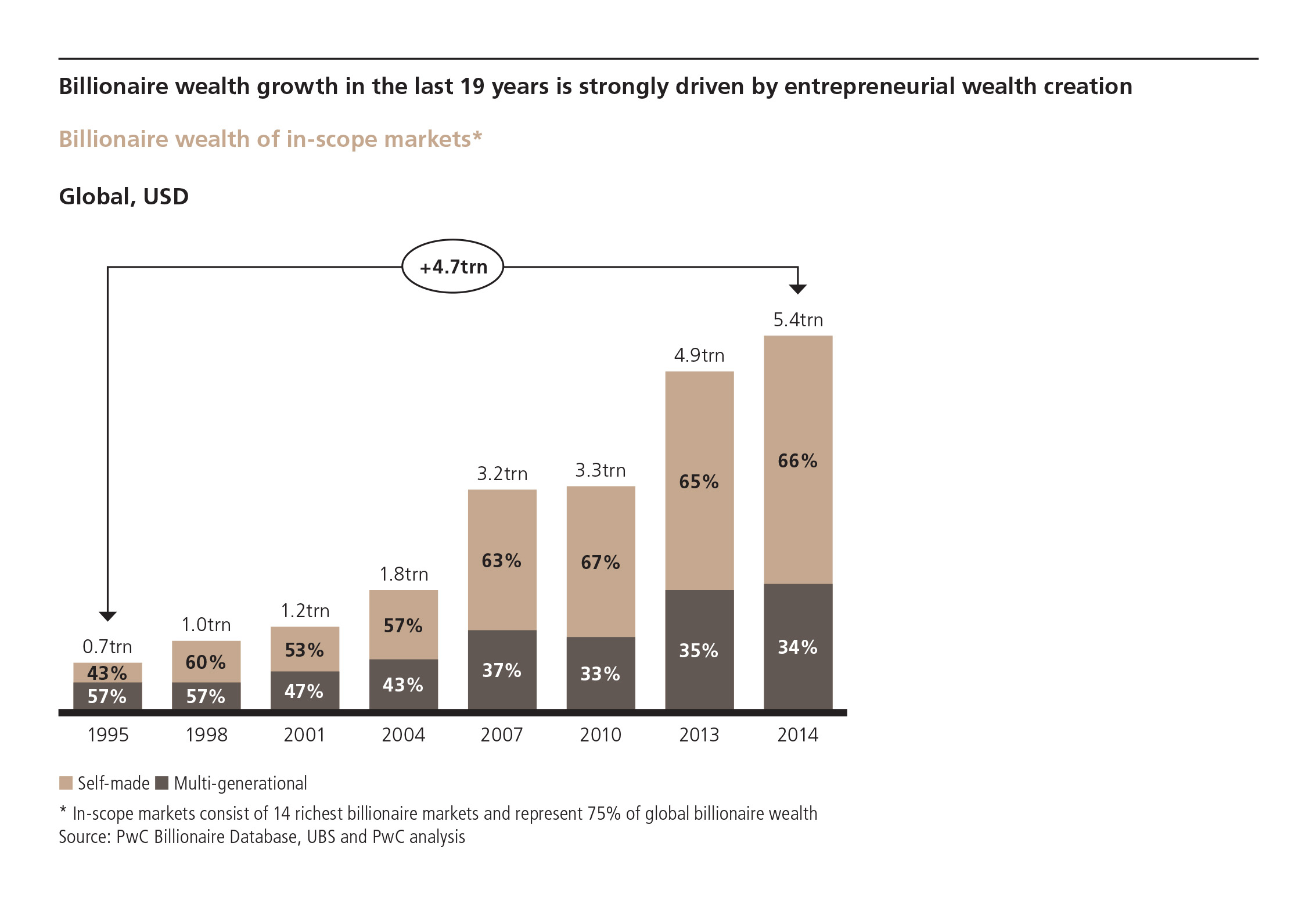

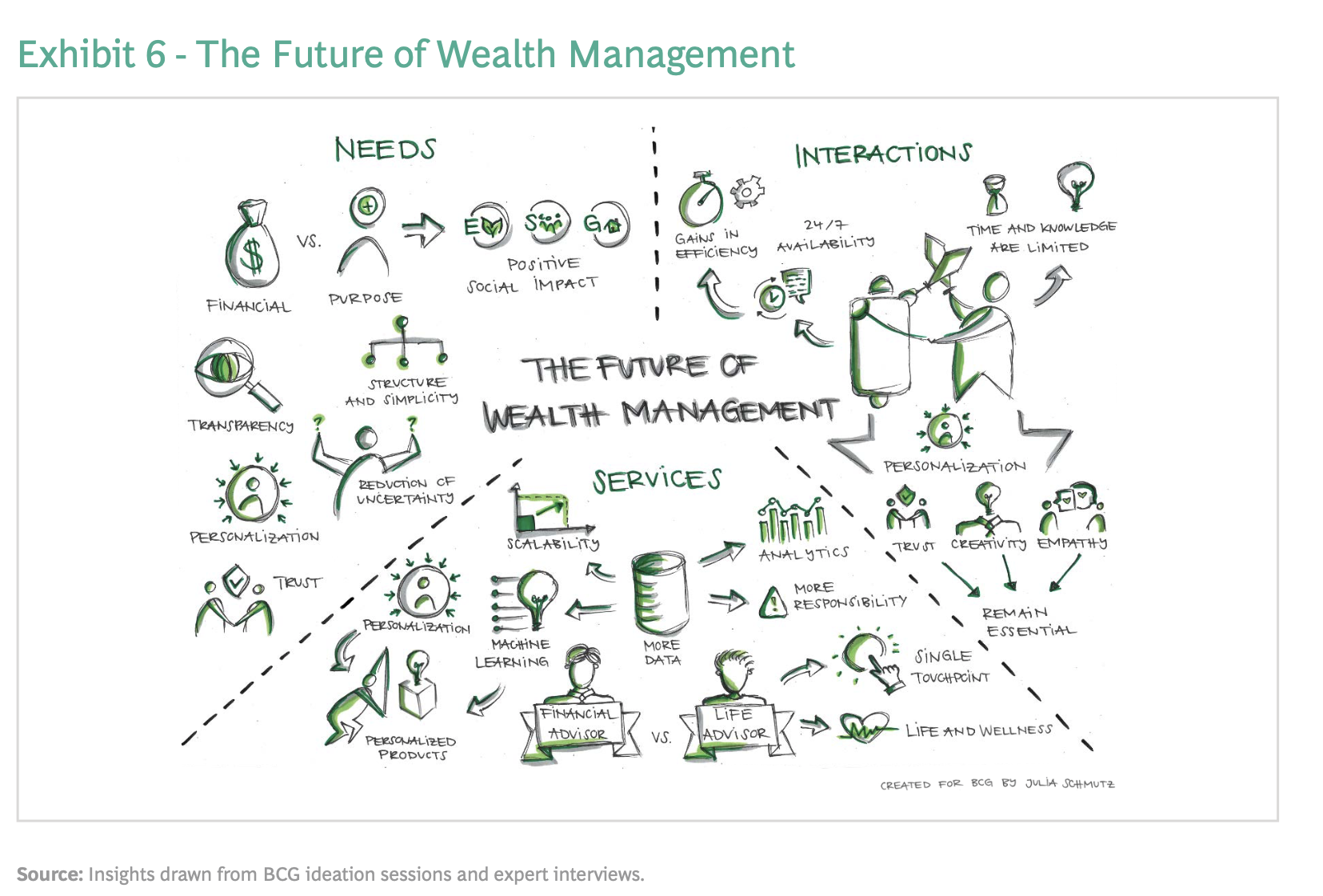

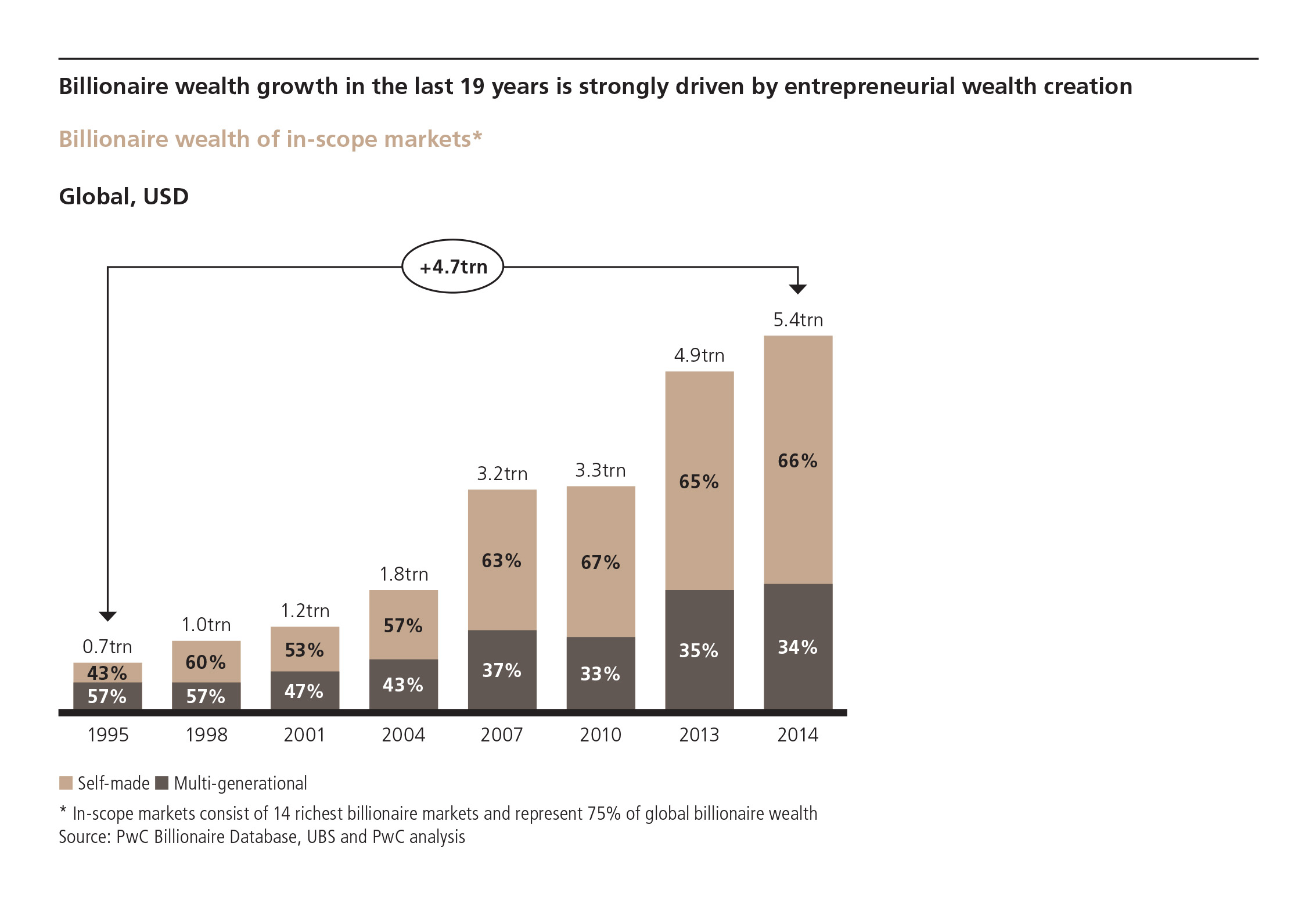

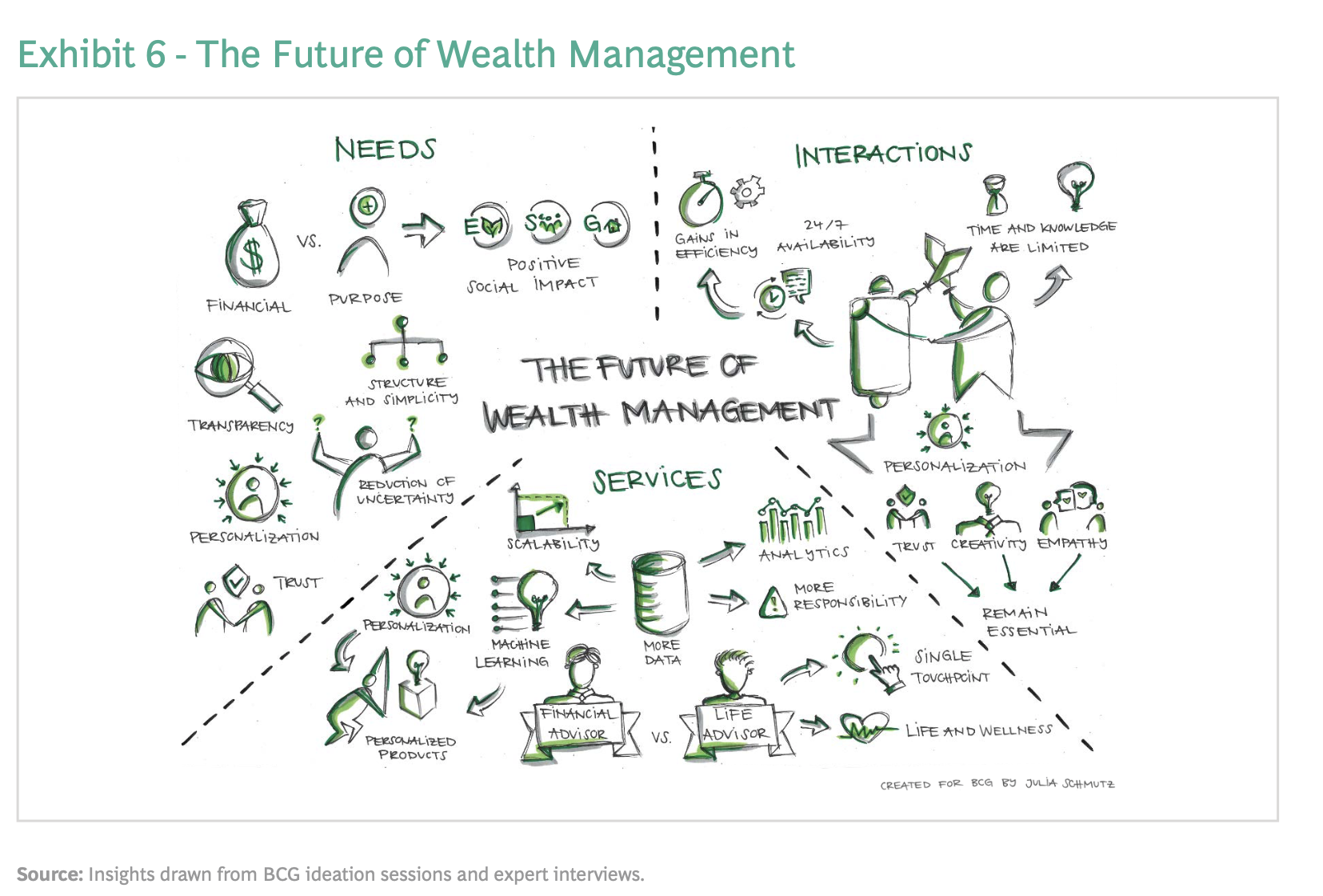

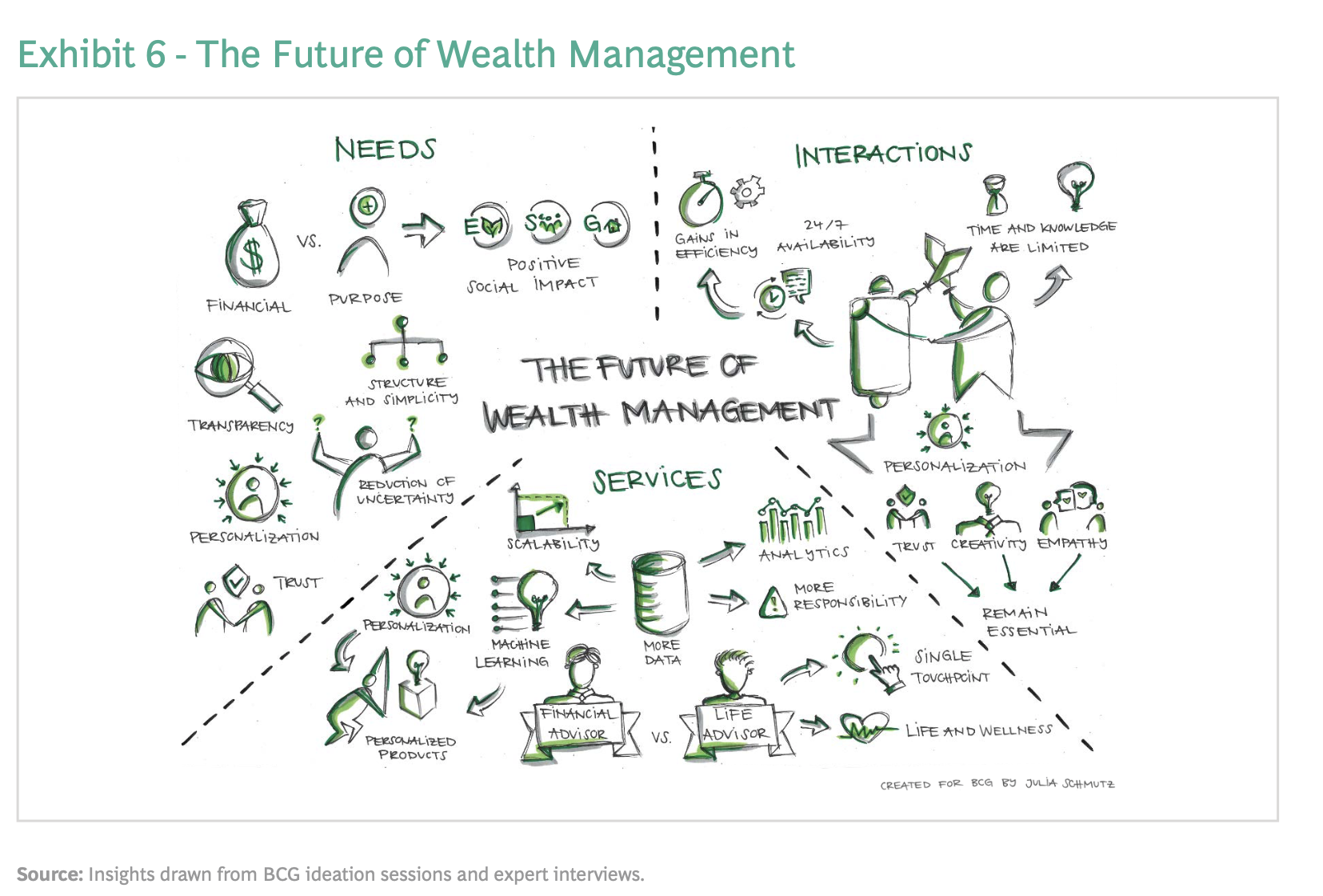

Source: BCG (PDF) Boston Consulting Group’s annual wealth management review is now in its 20th year. For its...

Source: BCG (PDF) Boston Consulting Group’s annual wealth management review is now in its 20th year. For its...

Read More

Bill Sweet is CFO of RWM. He is a triple threat: CFO, with an expertise in tax planning and financial planning. He is invaluable to our...

Read More

This week, we speak with Peter Mallouk, CEO of Creative Planning, and author of The 5 Mistakes Every Investor Makes and How to Avoid...

Read More

No Jacket Required: Inside the World of New School Wealth Management Source: Bloomberg Bloomberg: “On this episode of...

Read More

We are all super-excited about this September’s Wealth/Stack conference. We took a completely different approach to...

We are all super-excited about this September’s Wealth/Stack conference. We took a completely different approach to...

Read More

I spend an hour discussing all sorts of really fascinating topics with Pete Dominick; its satellite, so there is the occasionally NSFW...

Read More

This has to be the strangest headline relative to the content I have seen in a very long time: Source: Wealth Management

This has to be the strangest headline relative to the content I have seen in a very long time: Source: Wealth Management

Read More

“The Plutonomy is here, is going to get stronger, its membership swelling. Toys for the wealthy have pricing power, and staying...

Read More

Source: BCG (PDF) Boston Consulting Group’s annual wealth management review is now in its 20th year. For its...

Source: BCG (PDF) Boston Consulting Group’s annual wealth management review is now in its 20th year. For its...

Source: BCG (PDF) Boston Consulting Group’s annual wealth management review is now in its 20th year. For its...

Source: BCG (PDF) Boston Consulting Group’s annual wealth management review is now in its 20th year. For its...