MIB: Rex Sorgatz and the Encyclopedia of Misinformation

This week on our Masters in Business radio podcast, I speak with Rex Sorgatz, who writes about the intersection of technology and...

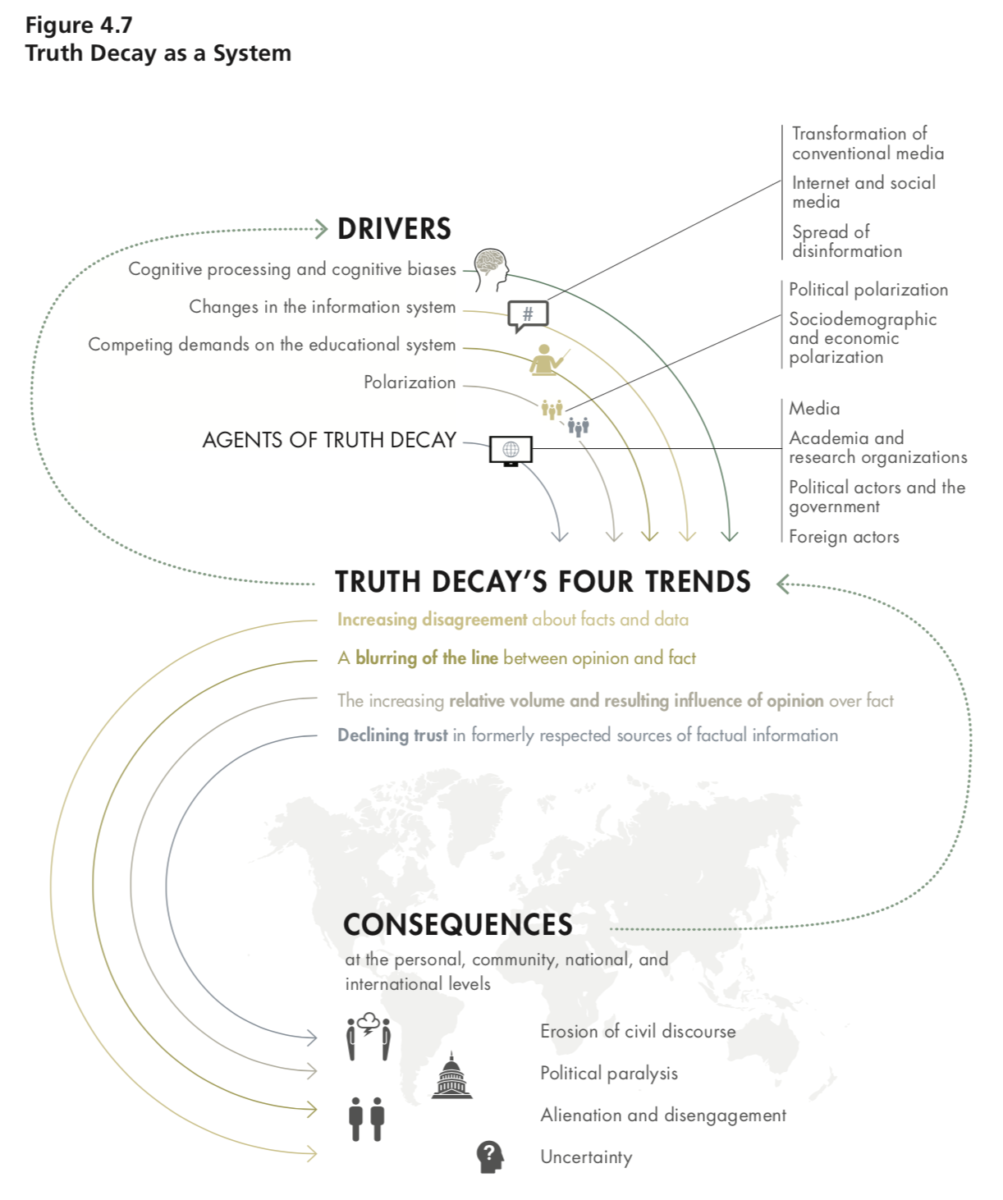

An Initial Exploration of the Diminishing Role of Facts and Analysis in American Public Life Source: RAND Corporation Why is...

An Initial Exploration of the Diminishing Role of Facts and Analysis in American Public Life Source: RAND Corporation Why is...

Source: RIA Last week, turned 5 years old. We got a very lovely anniversary gift from CityWire RIA magazine, whom we had...

Source: RIA Last week, turned 5 years old. We got a very lovely anniversary gift from CityWire RIA magazine, whom we had...

Facebook Inc. has a fake news problem. Its founder and Chief Executive Officer Mark Zuckerberg doesn’t seem to understand...

Facebook Inc. has a fake news problem. Its founder and Chief Executive Officer Mark Zuckerberg doesn’t seem to understand...

Nice showing from our team in Become a Better Investors review of best investment blogs with Josh, Mike and Ben all landing...

Nice showing from our team in Become a Better Investors review of best investment blogs with Josh, Mike and Ben all landing...

Get subscriber-only insights and news delivered by Barry every two weeks.