The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • The...

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • The...

Read More

This week, we speak with Shomik Dutta, founder and managing partner at Overture, a venture capital firm...

Read More

My end-of-week morning train WFH reads: • Americans are actually pretty happy with their finances: By the numbers: 63% of Americans...

My end-of-week morning train WFH reads: • Americans are actually pretty happy with their finances: By the numbers: 63% of Americans...

Read More

Hey, this is a really nice surprise: Masters in Business was the winner in the Best Business-to-Business Podcast. It is...

Hey, this is a really nice surprise: Masters in Business was the winner in the Best Business-to-Business Podcast. It is...

Read More

At The Money: Meir Statman on What Investors Really Want, (January 17, 2024) What do investors really want?...

Read More

My back-to-work morning train WFH reads: • The Stock Market is Our Mona Lisa: Apple is our Colosseum. Microsoft is our Taj Mahal....

My back-to-work morning train WFH reads: • The Stock Market is Our Mona Lisa: Apple is our Colosseum. Microsoft is our Taj Mahal....

Read More

The transcript from this week’s, MiB: Cathy Marcus, co-CEO, global COO of PGIM Real Estate, is below. You can stream and...

Read More

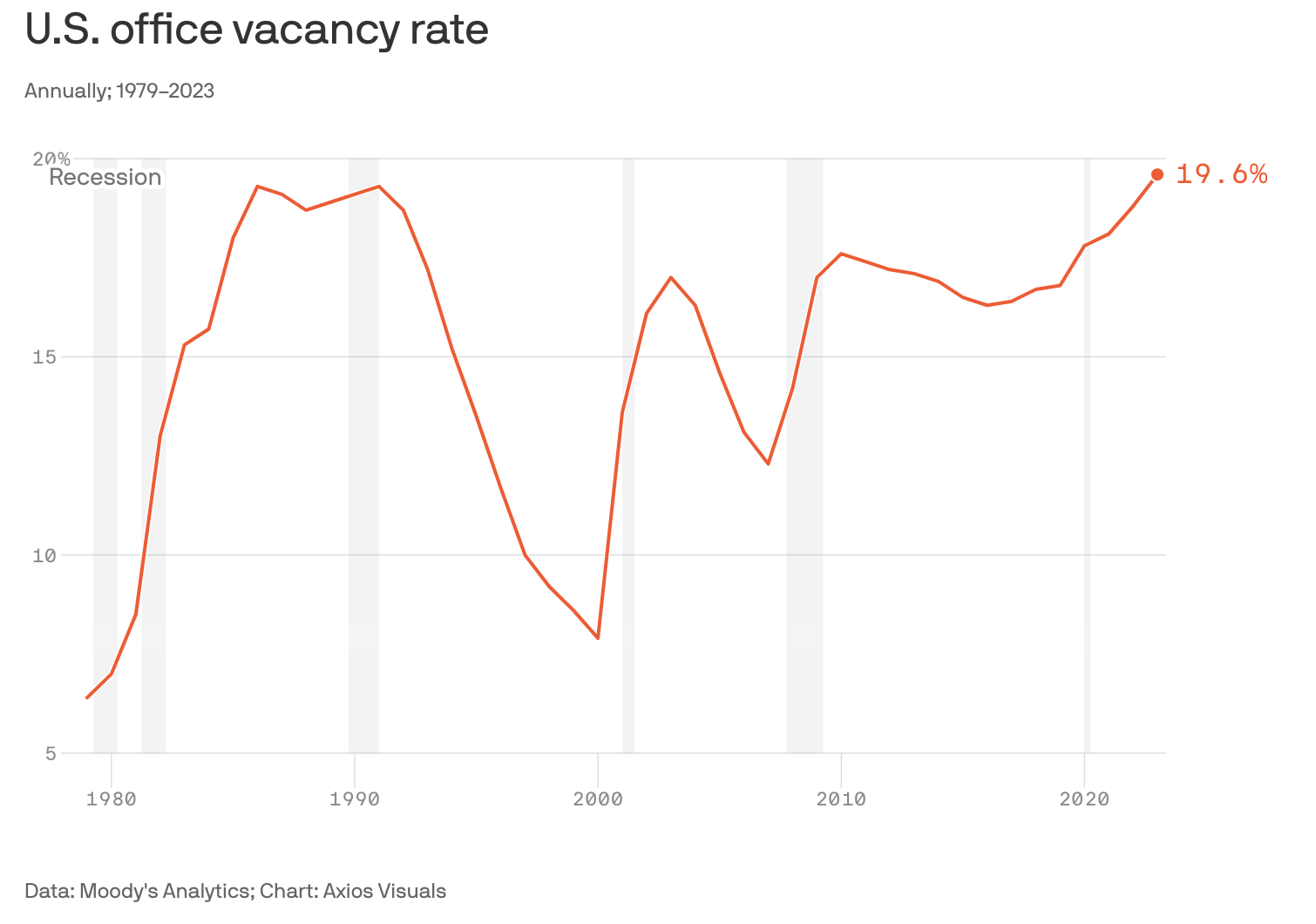

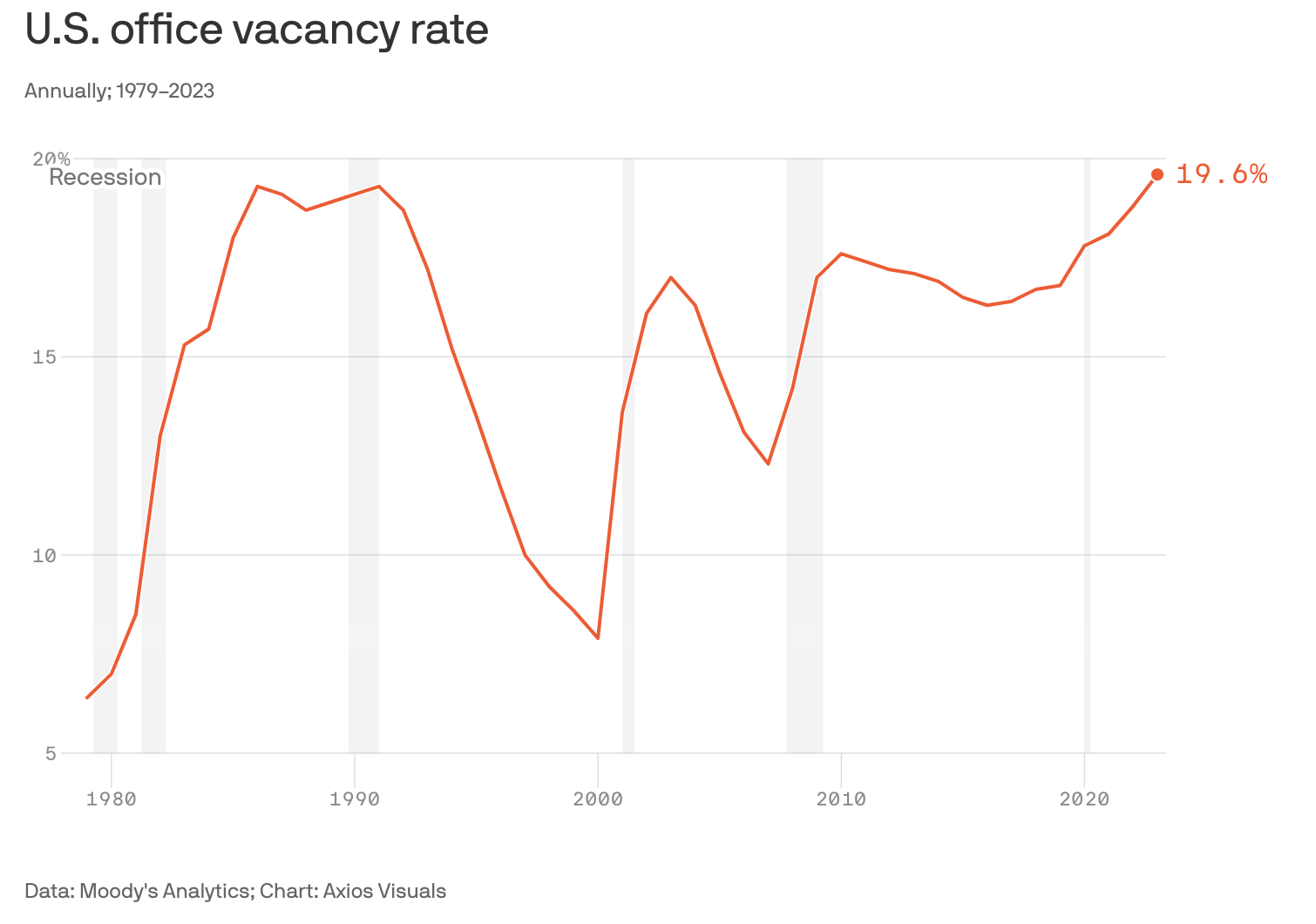

On Monday, I discussed reasons to be bullish or bearish in 2024. #2 in the bearish list is CRE/WFH: “The...

Read More

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • What We Lost When Twitter Became X As a...

Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures: • What We Lost When Twitter Became X As a...

Read More

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • Two...

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • Two...

Read More

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • The...

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • The...

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • The...

The weekend is here! Pour yourself a mug of coffee, grab a seat by the fire, and get ready for our longer-form weekend reads: • The...