Source: JP Morgan

Source: JP Morgan

10 Sunday Reads

Easy like my Sunday morning reads: • Wall Street Attracts Chop Shops 20 Years After ‘Wolf’ (Bloomberg) • Retiring on Your Own...

Easy like my Sunday morning reads: • Wall Street Attracts Chop Shops 20 Years After ‘Wolf’ (Bloomberg) • Retiring on Your Own...

Baumgartner’s 24 Mile Freefall in HiDef

October 14, 2012, Felix Baumgartner ascended more than 24 miles above Earth’s surface to the edge of space in a stratospheric...

How accurate is the groundhog?

Not so good – less than chance, in fact. Approximately 90% of the time, Phil sees his shadow. Records indicate he’s right...

Howard Stern: The Birthday Bash

What kind of crazy f____d up world do we live in where Howard Stern gets a better tribute than the Beatles? One in which Adam Levine does...

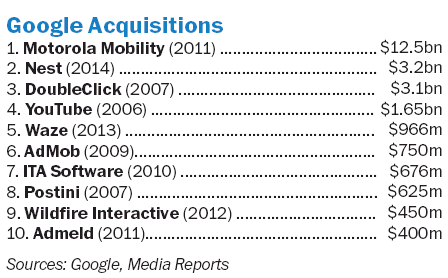

Google’s Nest Labs Acquisition is a Smart Move

Defense! Google’s Nest Labs acquisition is a smart move Barry Ritholtz Washington Post, January 26 2014 With the Super...

Defense! Google’s Nest Labs acquisition is a smart move Barry Ritholtz Washington Post, January 26 2014 With the Super...

10 Weekend Reads

Pour yourself a cup of Joe, and settle in for some of our longer form weekend reading: • Michael Steinhardt, Wall Street’s...

Pour yourself a cup of Joe, and settle in for some of our longer form weekend reading: • Michael Steinhardt, Wall Street’s...

2014 BMW i8

From Automobile Magazine: It came with a really clumsy name — Vision EfficientDynamics — and a very complicated surface...

From Automobile Magazine: It came with a really clumsy name — Vision EfficientDynamics — and a very complicated surface...