Genetic Engineering INCREASES Pesticide Use, DECREASES Crop Yield

Genetic Engineering Companies Promised Reduced Pesticide Use … But GE Crops Have Led to a 25% Increase In Herbicide Use One of the main...

10 Thursday PM Reads

My afternoon train reading: • Why the leaders of the two largest developed economies are begging companies to raise pay (Quartz) but...

My afternoon train reading: • Why the leaders of the two largest developed economies are begging companies to raise pay (Quartz) but...

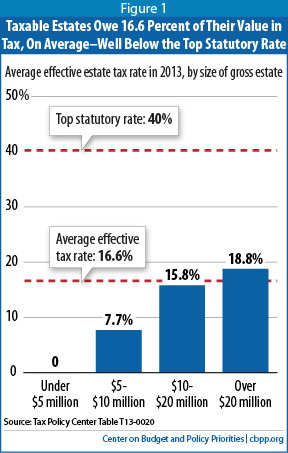

Who Pays a 45% Estate Tax? Idiots Do.

Only the Foolish Pay the 45% Estate Tax Nobody pays the 45 percent estate tax unless they want to or they’re not too bright....

Only the Foolish Pay the 45% Estate Tax Nobody pays the 45 percent estate tax unless they want to or they’re not too bright....

10 Thursday AM Reads

My morning-train reading: • What to expect: The Yellen Fed (Fidelity), see also In Parting Gift to Bernanke, First Unanimous Fed...